-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Core CPI Miss Kicked Off Volatile Day

US TSY SUMMARY: Core CPI Miss Spurred Early Vol

Data-driven real-vol evaporated quickly early Wednesday, Tsys holding weaker levels on narrow range until an exceptionally strong 10Y Note auction stopped out just over 3bp spurred a sharp gap bid. Levels scaled back some post auction support to marginally mixed after the close.- Tsy futures surged after CPI Core miss (0.3% vs. 0.4% est), but just as quickly reverse (CPI MoM in-line with forecasted 0.5%) -- trading back near late overnight session lows. Volume surged on two-way flow, TYU >515k, yield curves bear steepened early.

- Tsys reversed losses/surged higher after particularly strong 10Y Note auction stopped through just over 3.0bp through WI at auction cutoff with 1.340% high yield. Tsy 10Y yields fell to session low of 1.3000% before late session bounce to 1.3202%. 2.65x bid-to-cover well above five auction avg: 2.43x while indirect take-up surged to 77.25% vs. 61.16% 5M avg.

- Fed speak was decidedly hawkish: Fed's George says 'Substantial Progress' already made; Dallas Fed Kaplan on CNBC (uber-hawk but non-voter) likes annc plan to taper at Sep FOMC, begin in October.

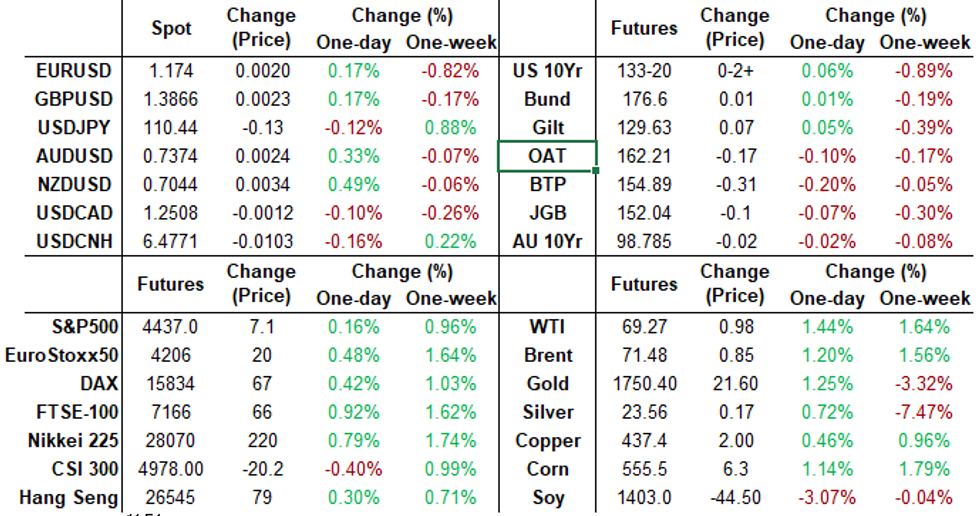

- The 2-Yr yield is down 2bps at 0.2186%, 5-Yr is down 1.4bps at 0.8115%, 10-Yr is down 0.9bps at 1.3405%, and 30-Yr is up 0.6bps at 2.0048%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00000 at 0.07863% (+0.00012/wk)

- 1 Month +0.00013 to 0.09663% (+0.00138/wk)

- 3 Month -0.00150 to 0.12125% (-0.00713/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00113 to 0.15738% (+0.00688/wk)

- 1 Year +0.00325 to 0.24288% (+0.00550/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $69B

- Daily Overnight Bank Funding Rate: 0.08% volume: $251B

- Secured Overnight Financing Rate (SOFR): 0.05%, $865B

- Broad General Collateral Rate (BGCR): 0.05%, $363B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $345B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $5.200B submission

- Next scheduled purchase

- Thu 8/12 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Thu 8/12 1500ET Update NY Fed Operational Purchase Schedule

FED: Reverse Repo Operations, Over $1T Again, But No New High - Yet

NY Fed reverse repo usage climbs to $1,000.460B from 70 counterparties vs. $998.654B on Tuesday. Compares to record high of $1,039.394B on Friday, July 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 Blue Oct 99.00/99.25 call spds, 1.75

- +15,000 Blue Mar 99.50 calls, 2.0

- -15,000 Green Oct 98.93 puts, 11.5

- +3,000 Blue Dec 97.87/98.12 put spds, 3.25

- +5,000 Mar 100 calls, 1.0

- -4,000 Red Dec'22 99.25 puts, 9.0

- +10,000 Blue Sep 98.25/98.37/98.50/98.75 broken call condors, 2.0

- Overnight trade

- 6,500 Jun 100 calls, 1.0

- 2,500 Green Dec 98.75/99.00 put spds

- 4,500 Green Oct 99.12 puts

- +5,000 Blue Dec 97.87/98.12 put spds, 3.5

- +4,000 Blue Mar 99.50 calls, 2.0

- 10,000 TYU 133 puts, 14 last on wide range, total volume over 54,000

- +3,000 TYU 133.75/134.25 1x2 call spds, 1

- -9,000 TYV 131/134.5 strangles, 32

- Overnight trade

- -20,000 (10k blocked) FVU 123.25/123.75 put spds, 11

- 8,500 FVU 124.5 calls, 3-3.5

- 4,000 FVU 124.25 puts, 6

- +25,000 TYU 131.75/132.75 put spds, 13-15

- +10,000 TYV 130/132 put spds, 27-29

- Block, +7,500 TYV 130 puts, 11

EGBs-GILTS CASH CLOSE: Gilts Bull Steepen

Core European FI had a constructive session, reversing morning losses in the afternoon on a weaker-than-expected US core inflation print.

- Gilts outperformed, with the UK short end rallying sharply (2Y -3bp in a bull steepening move).

- Peripheries couldn't keep pace, with Italian spreads widening and underperforming peers.

- Very little in the way of market-moving data (CPI finals). UK sold GBP0.7bln of linkers, German E4bln of Bund.

- Bond supply is done for the week, and there are no scheduled central bank speakers. Thursday's highlight is set to be UK GDP, first thing.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is unchanged at -0.748%, 5-Yr is down 0.5bps at -0.728%, 10-Yr is down 0.7bps at -0.464%, and 30-Yr is up 0.1bps at -0.009%.

- UK: The 2-Yr yield is down 3bps at 0.123%, 5-Yr is down 2.2bps at 0.274%, 10-Yr is down 1.8bps at 0.571%, and 30-Yr is down 0.8bps at 0.946%.

- Italian BTP spread up 2.5bps at 103.1bps / Spanish up 1.5bps at 70.1bps

OPTIONS/Plenty Of Schatz And Bund Structures

Wednesday's European rate/bond options flow included:

- DUU1 112.30 put, bought for 3.5 in 8k

- DUU1 112.30/112.20/112.10p fly, sold at 2 in 1.5k

- RXU1 176/175/174p fly 1x1.5x0.5, bought for 11.5 in 8k

- RXU1 176.50/176/175/172.5p condor, bought for 6 in 2k

- RXU1 174.50 put, bought for 11 in 1.6k

- 3RZ1 100.25p vs 0RZ1 100.50^, bought the 3yr for half in 4k

FOREX: US Core CPI Miss Halts Greenback Momentum

- A small miss in monthly U.S. Core CPI weighed on the greenback on Wednesday. The dollar index looks set to end a three-day winning streak, after briefly matching the July highs at 93.19.

- EURUSD fell just two pips shy of key 1.1704 support before the data and ends the day a quarter of a percent higher around 1.1750. While less than 50 pips away, this level marks an important support and potential inflection point, bolstered by 1.1685 just below, which represents the 38.2% Fibonacci for the 2020 - 2021 rally. Importantly, little resistance is seen until the 1.19 highs, matching closely with the 50-day EMA at 1.1899.

- Overall dollar weakness aided gains across the entire G10 space with notable gains for AUD and NZD, rising 0.4% and 0.6% respectively, following a second consecutive day of gains for broad commodity indices. For NZDUSD, multiple highs between 0.7090-7105 will prove the next resistance.

- The Norwegian Krone outperformed, rising 0.72% against the dollar, bolstered by a strong rebound in oil prices following the DOE inventories data.

- A strong US 10-yr auction precipitated some additional marginal dollar weakness, however G10 ranges overall remain unimpressive. The following sessions may be significant in determining the medium-term direction in which we will see PPI, jobless claims and sentiment data. Next week, retail sales and the FOMC minutes will be released.

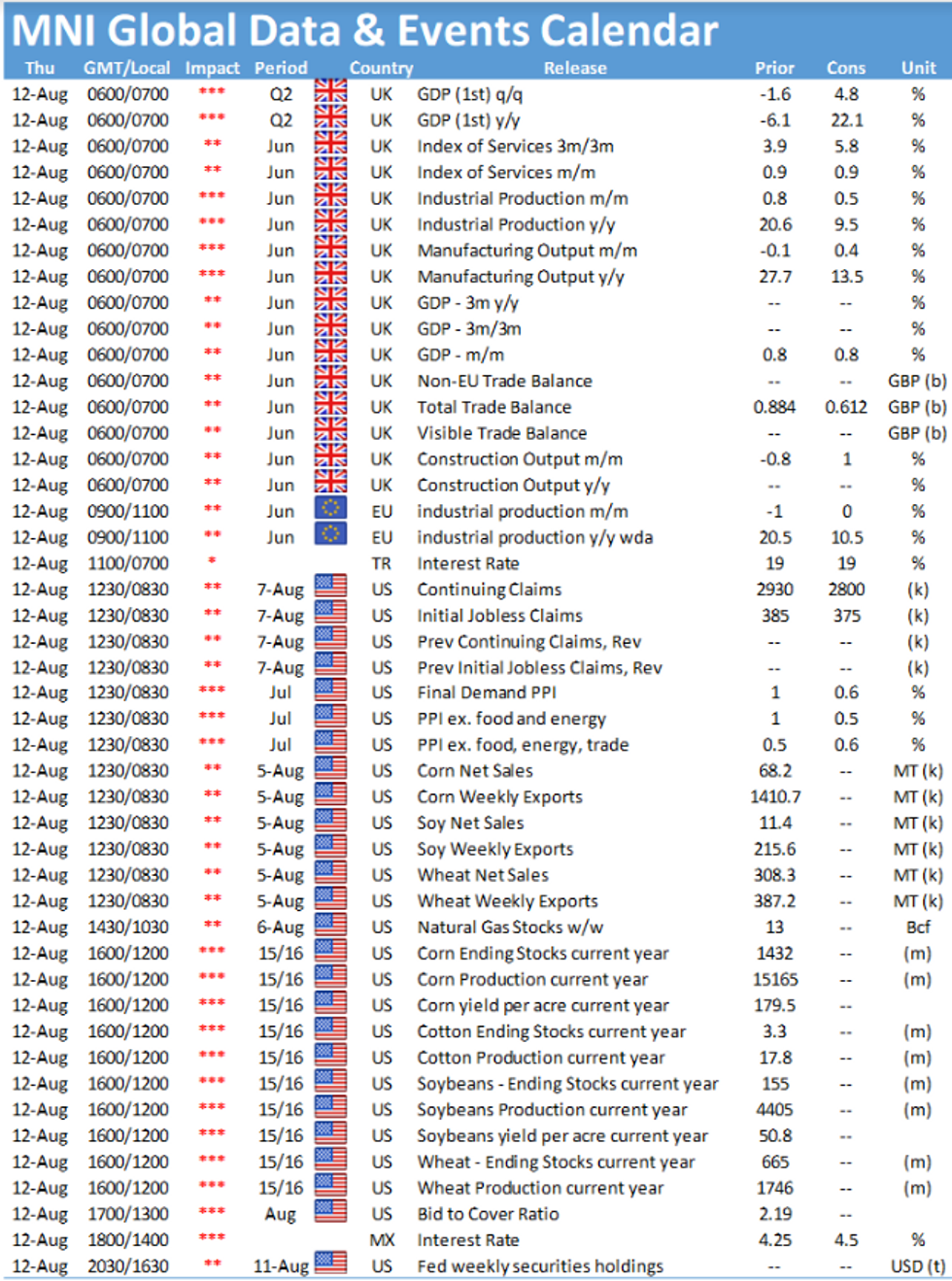

- Thursday will see the UK report their preliminary Q2 GDP data at 0700BST.

FX/Expiries for Aug12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650-60(E2.4bln), $1.1700-05(E1.7bln), $1.1785-00(E2.2bln), $1.1810-15(E1.6bln)

- USD/JPY: Y109.40-50($712mln), Y110.00-10($618mln), Y110.30-50($1.3bln), Y110.95-00($881mln)

- GBP/USD: $1.3840-60(Gbp906mln)

- EUR/GBP: Gbp0.8500(E570mln)

- AUD/USD: $0.7300(A$697mln), $0.7440(A$678mln)

- USD/CAD: C$1.2495-00($1.0bln), C$1.2540($585mln), C$1.2655($555mln)

- USD/CNY: Cny6.4620($960mln)

PIPELINE: Issuance Slows After $35B Issued Mon-Tue

$4.7B expected to price Wednesday:- Date $MM Issuer (Priced *, Launch #)

- 08/11 $1B #Air Lease Corp $500M 3Y +60, $500M 7Y +125

- 08/11 $1B Royal Caribbean 5NC 5.5%a

- 08/11 $1B #Equifax 10Y +105

- 08/11 $800M #Public Service Co Oklahoma $400M 10Y +90, $400M 30Y +115

- 08/11 $500M #Ventas Realty 10Y +120

- 08/11 $400M *Sichuan Development 5Y 2.8%

EQUITIES: Stocks Inch Higher Still, With Cyclicals Gaining Over Tech

- Wall Street was mixed after the slightly slower-than-expected core CPI release, with cyclicals outperforming tech, leading the e-mini S&P to trade at a new alltime high.

- Weakness across tech names resulted in the NASDAQ being the sole index to trade lower, with semiconductors particularly weak.

- The outlook for ES1 remains bullish as evidence of dip buying remains solid on intraday pullbacks. Recent gains have confirmed a resumption of the uptrend and signal scope for a continuation near-term. The sell-off Jul 14 - 19 resulted in a break of 4279.25, Jul 8 low. However the contract found support at the 50-day EMA - this EMA represents an important support and the bounce from it is bullish. The focus is on 4481.75 next, a Fibonacci projection. Key support is 4224.00, Jul 19 low.

- European indices finished uniformly higher, with Italy's FTSE-MIB the outperformer to close with gains of 1%. Germany's DAX lagged slightly, but still finished with upside of 0.4% or so. Europe's industrials and energy sectors outperformed, countering the losses across tech, reflecting a similar divergence in US indices.

COMMODITIES: Oil Caught Offguard as US Calls for OPEC+ to Open Taps

- Conflicting factors helped stabilise oil benchmarks into the Wednesday close, with early pressure hitting WTI and Brent futures after the US issued a statement appealing to OPEC+ to open the output taps and relieve oil prices in the face of a slowing post-COVID recovery. This pressured WTI futures to back below $67/bbl before prices bounced on the DoE inventories release.

- The weekly release saw an unexpected draw of 448,000 barrels against an forecast of a build, with implied demand data also proving supportive.

- To resume any incline in Brent futures, bulls need to again take out $74.47, the 76.4% retracement of the Jul 6 - 20 downleg. A break and close back above here opens key resistance at $76.80, Jul 6 high.

- Gold extended the recovery of the week's dramatic low, but to reinforce any upside argument, bulls need to regain $1834.1, Jul 15 high, ahead of $1853.3, a Fibonacci retracement.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.