-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - AUD/JPY Finds Bottom on China News

MNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI ASIA MARKETS ANALYSIS: Tsys Pressed on Weak Retail Sales?

US TSY SUMMARY: Buy Rumor/Sell Fact on Weaker Than Expected Retail Sales?

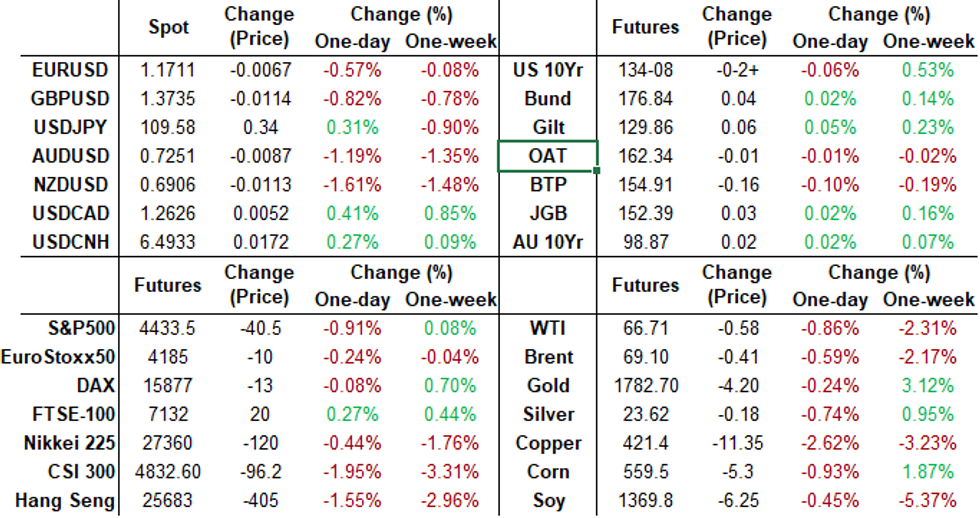

Rates trade weaker after the bell, off first half lows to near middle of session range. Decent overall volumes for a summer session (TYU1>1.2M), rates moved off lows as equities traded weaker in the second half (tech and autos weighing).- Early rates sell off after weaker than estimated Retail Sales (-1.1% vs. -0.3% est) had desks scrambling to come up with viable reasons for the move. Buy the rumor/sell the fact?

- Though retail sales prior month revised slightly higher (1.6% from 1.3%), unlikely driver given the broad miss on current read. Some desks posited market had anticipated an even greater miss due to effect of Delta-variant.

- Two-way swap tied flow amid better paying as spds forge directionally wider with Tsy yields. That said, corporate issuance has been lagging this week compared to last week's $40B in first three days. Some pre-auction short setting reported ahead Wed's $27B 20Y bond auction.

- Strong IP, Cap-U underscored first half weakness: Tsys extend sell-off through early evening levels following stronger than expected Industrial Production (+0.9% vs. 0.5% est; June uprev), Capacity Utilization (76.1% vs. 75.7% est). Latest 10YY 1.2717% high, 30YY 1.9352% high. * Additional flow includes option-tied hedging weighing on 5s-10s, dealer selling 10s-30s.

- The 2-Yr yield is up 0.2bps at 0.2113%, 5-Yr is up 0.2bps at 0.7635%, 10-Yr is down 0.7bps at 1.2583%, and 30-Yr is down 0.8bps at 1.9189%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00037 at 0.07788% (+0.00025/wk)

- 1 Month -0.00200 to 0.08650% (-0.00625/wk)

- 3 Month +0.00275 to 0.12725% (+0.00300/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00087 to 0.15625% (-0.00038/wk)

- 1 Year -0.00125 to 0.23550% (-0.00325/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $66B

- Daily Overnight Bank Funding Rate: 0.08% volume: $252B

- Secured Overnight Financing Rate (SOFR): 0.05%, $906B

- Broad General Collateral Rate (BGCR): 0.05%, $377B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $362B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $2.780B submission

- Next scheduled purchases

- Wed 8/18 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 8/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 8/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: REVERSE REPO OPERATION, Holding Above $1T

NY Fed reverse repo usage climbs to $1,053.454B from 70 counterparties vs. 1,036.418B on Monday. Record: $1,087.342B on Thursday, Aug 12.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, 10,000 Green Sep 99.12 straddle, 14.5

- +4,000 short Oct 99.31/99.43 2x1 put spds, 0.5 1-leg

- -5,000 Red Dec'22 99.00 puts, 5.0

- +10,000 Green Dec 98.75/99.25 put over risk reversals, 0.5 vs. 99.045/0.60%

- -15,000 Sep 99.75/99.88 put spds, 0.75 vs. 99.875/0.50%

- +2,000 Green Dec 99.50/99.62 call spds, 1.0

- Overnight trade

- +2.000 Green Sep 98.87/99.00/99.12 put trees, 3.0

- +2,000 short Dec 99.62/99.75 1x2 call spds, 2.5

- 4,000 TYU 133.5/134 2x1 put spds, 0.0

- -3,250 TYU 133 puts 3 vs. 134-11/0.11%

- +5,000 TYV 134 straddles, 131

- -10,000 TYV 135.5 calls, 9 around 133-23

- +10,000 FVV 123.25 puts, 16

- +9,000 FVU 123.75/124.5 call over risk reversals 4-5

- 1,175 TYU 134.5/135.5/136.5 call flys, 16

- Overnight trade

- +5,000 wk3 TY 133/133.5 put spds, 1 vs. 134-19 to -19.5/0.04%

- +1,500 wk1 TY 131.75/132.25 3x2 put spds, 2

- +1,000 TYZ 130/132 3x2 put spds, 28 vs. 133-26.5/0.10%

- 2,000 TYU 134 puts, 16

- 2,750 FVV 124.25 calls, 13

EGBs-GILTS CASH CLOSE: Afternoon Reversal

Yields reversed higher in afternoon trade, nullifying strength in the morning and leaving Gilts and Bunds largely unchanged Tuesday.

- European FI largely followed Treasuries in the afternoon - counterintuitively, weaker-than-expected US retail sales data saw Global core bonds sell off, with dollar strength.

- Gilts outperformed with bull flattening in the UK curve, while periphery spreads ended marginally wider.

- Strong auctions: UK sold GBP2.0bln of 25-year gilt, Germany E6bbln of Schatz.

- UK employment and Eurozone GDP data were in line with expectations.

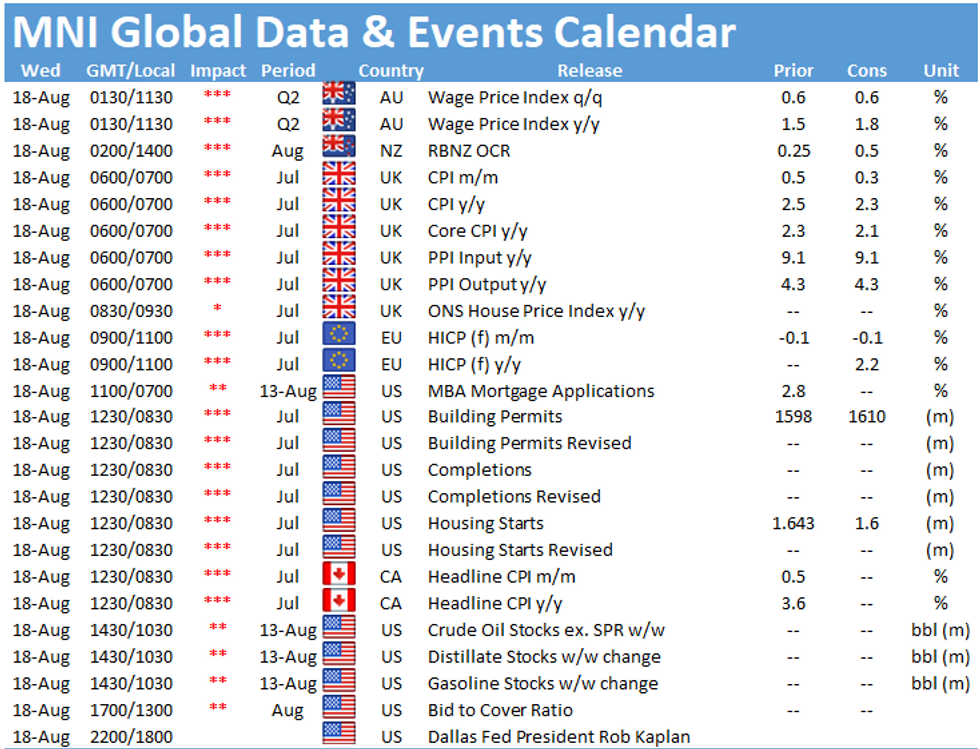

- Wednesday's highlights: UK July inflation data and 30Yr Bund supply.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.3bps at -0.736%, 5-Yr is down 0.2bps at -0.729%, 10-Yr is down 0.1bps at -0.47%, and 30-Yr is unchanged at -0.02%.

- UK: The 2-Yr yield is up 0.8bps at 0.152%, 5-Yr is unchanged at 0.302%, 10-Yr is down 0.8bps at 0.565%, and 30-Yr is down 1.5bps at 0.946%.

- Italian BTP spread up 0.9bps at 104.3bps / Spanish up 0.6bps at 69.9bps

OPTIONS: Another Series Of Sep / Oct Bunds

Tuesday's European bonds/rates options flow included:

- RXV1 171.00 put / 177.00 call strangle sold at 21.5 in 2k

- RXU1 177.00 call sold at 51 in 2.6k

- RXU1 176.00/175.00/174.00 put fly sold at 10 in 1.5k

- RXU1 175.00/174.00 put spread sold at 4 in 2k

- 0RU1 100.50 straddle bought for 2.5 in (just under) 5k

- 0LZ1 99.625/99.50/99.25 broken put ladder bought for 5.5 in 8.5k all day

FOREX: Sustained Weakness in Antipodean FX, EURUSD Approaching Key Support

- The New Zealand Dollar retreated aggressively on Tuesday, with markets swiftly paring rate hike expectations as New Zealand re-enters lockdown.

- With a fresh 3-day nationwide lockdown (and a 7-day lockdown in Auckland and surrounding areas), a number of sell-side analysts have revised their calls for a 25bps rate hike from the RBNZ. Their decision and statement will be published overnight.

- NZDUSD consolidated losses throughout US hours with the pair trading in close proximity to the 0.6900 lows. A break of key support and the bear trigger at 0.6881 would confirm a resumption of a bearish cycle that started late February with notable supports below: 0.6798 Sep 18, 2020 high and 0.6703, 38.2% of the Mar '20 - Feb bull run.

- Broad greenback strength helped AUDUSD play catch up to the move, extending weakness through the year's lows at 0.7290. Settling around the 0.7250 mark, the pair dipped 1.2% for the day.

- With global macro developments continuing to weigh on risk sentiment/equity indices, the US dollar garnered strong support overall. GBP and NOK were other notable losers, falling around 0.75% with other haven currencies such as JPY and CHF subsiding by a more modest 0.25%.

- With recent weak US data points unable to prompt a sustained bounce in EURUSD, major support at 1.1704/06 looks increasingly vulnerable.

- A break below would leave the single currency at the lowest levels since November 2020 and may target 1.1603, low Nov 4, 2020. Below here, the immediate post pandemic highs at 1.1495 would likely act as strong psychological and pivot support, matching closely with the 50% retracement of the March 2020-Jan 2021 price swing.

- Aside from the anticipated RBNZ meeting, Wednesday will see CPI prints for both the UK and Canada.

Expiries for Aug18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E707mln), $1.1850(E587mln)

- USD/JPY: $110.00-20($2.0bln)

- AUD/USD: $0.7405(A$712mln), $0.7480(A$2.6bln)

- USD/CNY: Cny6.55($561mln)

PIELINE: Baidu US$ Roadshow

Baidu US$ roadshow about the only thing of note Tuesday, issuers plying sidelines after much better placement last week: $40B from Mon-Wed.

- Date $MM Issuer (Priced *, Launch #)

- 04/17 $Benchmark Baidu roadshow

- $4.05B Priced Monday

- 04/16 $1.25B *Athene Global Funding $550M 3Y +50, $350M 3Y FRN/SOFR+56, $350M 7Y +95

- 04/16 $1.2B *Southwest Energy 8.5NC3.5 5.37

- 04/16 $1B *Pfizer 10Y +53

- 04/16 $600m *Norfolk Southern 30Y +103

- 04/16 $Benchmark HDFC Bank inaugural 5Y roadshow

EQUITIES: S&P Undone by Weak Autos & Earnings

- Equity markets slipped into the close, with the three main indices looking to finish lower by 1% or more. This opens a gap of around 50 points with the alltime highs printed earlier in the week for the e-mini S&P. Despite Tuesday's pullback, key support remains in tact at the 4334.8 50-dma on the continuation contract.

- Across Wall Street, the consumer discretionary sector was hardest hit. Autos firms suffered sharply, with the likes of Tesla, Ford and General Motors all off by 4% or more at some points of the session. The moves follow disclosures from Buffett's Berkshire Hathaway, who trimmed their General Motors position for a third consecutive quarter.

- Similar weakness was also seen in pandemic winner Home Depot after their quarterly earnings release. The company saw customer transactions decline markedly as consumers rotated back into hospitality segments as regional restrictions lifted.

- European trade was similarly negative, with Italy's FTSE-MIB the hardest hit. The index slipped 0.9% although the UK's FTSE-100 held onto gains of 0.4% or so into the closing bell.

COMMODITIES: Energy Offered as Retail Sales Falls Below Forecast

- WTI and Brent crude futures started the session poorly and deteriorated from then on, with a poorer-than-expected US retail sales reading adding to the downside pressure. Nonetheless, Monday's clarification from OPEC+ that they would not meet US calls for increased output appear to have underpinned a floor in markets, making $65.15 and $65.73 the key supports going forward.

- Gold and silver both traded heavy, with the yellow metal coming under pressure on dollar strength after the retail sales release. A bouncing greenback weighed on USD-denominated assets, preventing gold bulls from mounting any real test on 50-dma resistance at $1799.9.

- Despite weakness in the second half of the session, gold has printed six consecutive higher highs, which keeps momentum with the upside argument for now. A break and close above the 50-dma opens the $1800.0 handle as well as the pre-nonfarm payrolls high at $1804.95.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.