-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Curve Steeper Ahead of JOLTS

MNI US OPEN - Censure Motion Against France Gov't Due Today

MNI ASIA MARKETS ANALYSIS: Inflation Easing But Not Over

US TSYS: Inflation Easing But Not Over

Early session highs around the opening bell were short lived Wednesday -- support for Tsy futures in lead-up to import/export prices evaporated despite the weaker than forecasted August import price data:

- Prices for U.S. imports decreased 0.3 percent in August following a 0.4-percent advance in July, while Export prices rose 0.4 percent in August, after increasing 1.1 percent the previous month.

Current session trade included some flatteners:

- -9,767 FVZ1 123-20.25, post-time bid at 0930:00ET vs. +4,001 UXYZ1 148-13 post-time offer

- overnight/late Tuesday Block: 5s/ultra-bond flattener: -9,409 FVZ 123-21.25, sell through 123-21.5 post-time bid at 2339:11ET vs. +1,362 WNZ 200-00, nuy through 199-26 post time offer

- The 2-Yr yield is up 0.4bps at 0.2111%, 5-Yr is up 1.3bps at 0.7983%, 10-Yr is up 1.9bps at 1.3022%, and 30-Yr is up 0.7bps at 1.8659%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00025 at 0.07213% (+0.00050/wk)

- 1 Month -0.00050 to 0.08413% (+0.00025/wk)

- 3 Month +0.00200 to 0.12000% (+0.00425/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00050 to 0.14838% (-0.00100/wk)

- 1 Year -0.00087 to 0.22163% (-0.00087/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $258B

- Secured Overnight Financing Rate (SOFR): 0.05%, $893B

- Broad General Collateral Rate (BGCR): 0.05%, $380B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $357B

- (rate, volume levels reflect prior session)

- Tsy 0Y-12.25, $12.401B accepted vs. $38.125B submission

- Next scheduled purchases

- Thu 9/16 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 9/17 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

FED: Reverse Repo Operation

NY Fed reverse repo usage recedes to 1,081.342B from 75 counter-parties vs. $1,169.280B Tuesday. Record high holds at $1,189.616B set Tuesday, Aug 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Update +50,000 short Oct 99.50/99.56 2x1 put spds, 0.5

- 6,000 Dec 99.25/99.50 put spds

- Block, 10,000 short Mar 99.50/99.62/99.75 call flys, 3.0 vs. 99.45/0.10%

- 3,000 Blue Dec 98.25/98.50 put spds

- +4,000 long Green Dec 98.25 puts, 16.5

- Overnight trade

- 2,000 Jun 99.81/99.87 call spds

- 1,300 Green Jun 97.75/98.25 4x3 put spds

- 5,000 FVZ 122.5 puts, 10

- +10,000 FVV 123.25 puts, 4.5

- Overnight trade

- 5,200 TYX 132 puts, 12

- 3,000 TYV 135 calls, 1

- 3,400 FVX 124/124.5 call spds

EGBs-GILTS CASH CLOSE: Weak Afternoon

After some modest weakness in morning trade, Bunds and Gilts fell sharply Wednesday afternoon alongside US Treasuries.

- The bearish tone was set early with a pre-open beat on UK CPI, with some of Tuesday's post-US CPI global rally appearing to be reconsidered as the underlying inflation dynamics weren't particularly favourable for future Fed tightening prospects.

- The German curve steepened sharply; UK had more of a parallel shift. That said, no particular trigger for the moves.

- Italian spreads widened after 10Y/Bunds appeared to be establishing a hold below 100bp (low was 98.9, a little higher vs Tues low). Greece modestly outperformed.

- Upcoming supply potentially eyed by bears: Austria set to sell new 15Y RAGB via syndication Thursday, while Spain/France sells E14+B of Bonds.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.1bps at -0.701%, 5-Yr is up 2bps at -0.624%, 10-Yr is up 3.4bps at -0.306%, and 30-Yr is up 4bps at 0.192%.

- UK: The 2-Yr yield is up 3.4bps at 0.265%, 5-Yr is up 3.4bps at 0.453%, 10-Yr is up 3.9bps at 0.777%, and 30-Yr is up 3.4bps at 1.077%.

- Italian BTP spread up 2.1bps at 100.8bps / Spanish up 0.4bps at 65bps

EGB Options: Sterling Downside, SONIA Call Fly Feature

Wednesday's European rates / bonds options flow included:

- RXV1 171.50/169.50 1x2 put spread vs RXX1 171.00/169.00 1x2 put spread sold in 5k (sold Oct, Bought Nov)

- RXV1 172/173/174c fly, bought for 22.5 in 2k

- DUX1 112.20/112.30 Risk Reversal, bought the call for flat and half in 7k total

- DUX1 112.30/112.40cs 1x2, bought for 1 in 1k

- 0LZ1 99.37/99.25ps 1x2, bought for 1 in 4k

- 3LZ1 99.25/99.375cs 1x2, bought for 0.75 in 8k

- SFIH2 99.80^, bought for 11 in 5k (ref 99.785)

- SFIH2 99.80/99.85/99.90/99.95 call condor, bought for 1 in 7k0LZ1 99.50/99.62cs vs 99.25p, bought cs for flat in 10k

- Buying 0LZ1 99.25/99.00 put spread vs Selling 99.75 call, net paid 2 in 30k

- SFIH2 99.90/99.95/100c fly, bought for 1 again in another 12.5k, now 16.25k total.

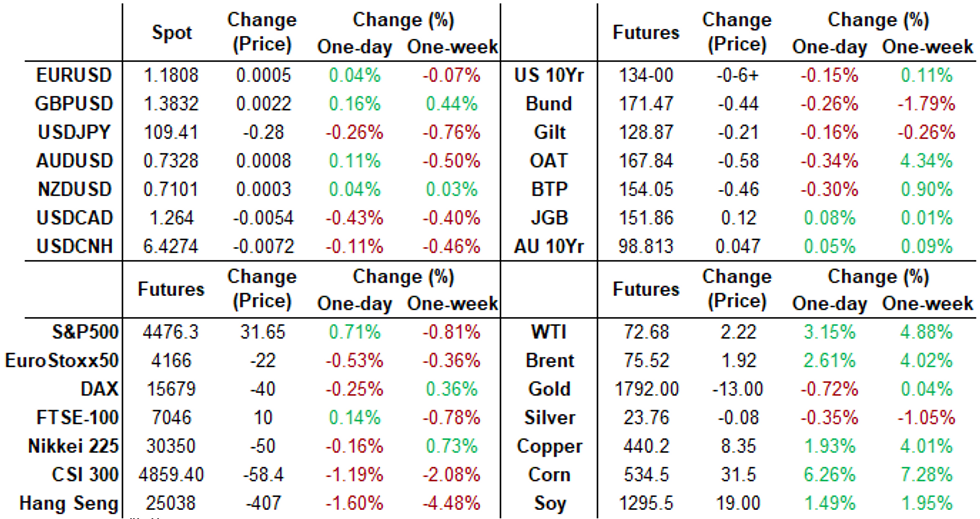

FOREX: CAD and NOK Boosted, USDJPY Holds Mid-August Lows

- A near three percent rally in crude futures lent support to both the Canadian dollar and the Norwegian Krone on Wednesday.

- NOK remained buoyant throughout the entirety of Wednesday's trade with USDNOK (-0.85%) marking its lowest point since early July around 8.57.

- USDCAD retreated just shy of 0.5%, reversing Tuesday's gains, however the selloff fell a way short of yesterday's low print at the 1.26 mark.

- USDJPY (-0.25%) continued a downward trajectory during European hours, however found support at the mid-August lows, bouncing from 109.11 back to the 109.40 area. Technically, a bearish risk is still present and key support lies at 108.72, Aug 4 low where a break would strengthen a bearish case and open 108.47, a Fibonacci retracement.

- Elsewhere, G10FX held narrow ranges with the dollar index just marginally softer on the day, down just 0.07%.

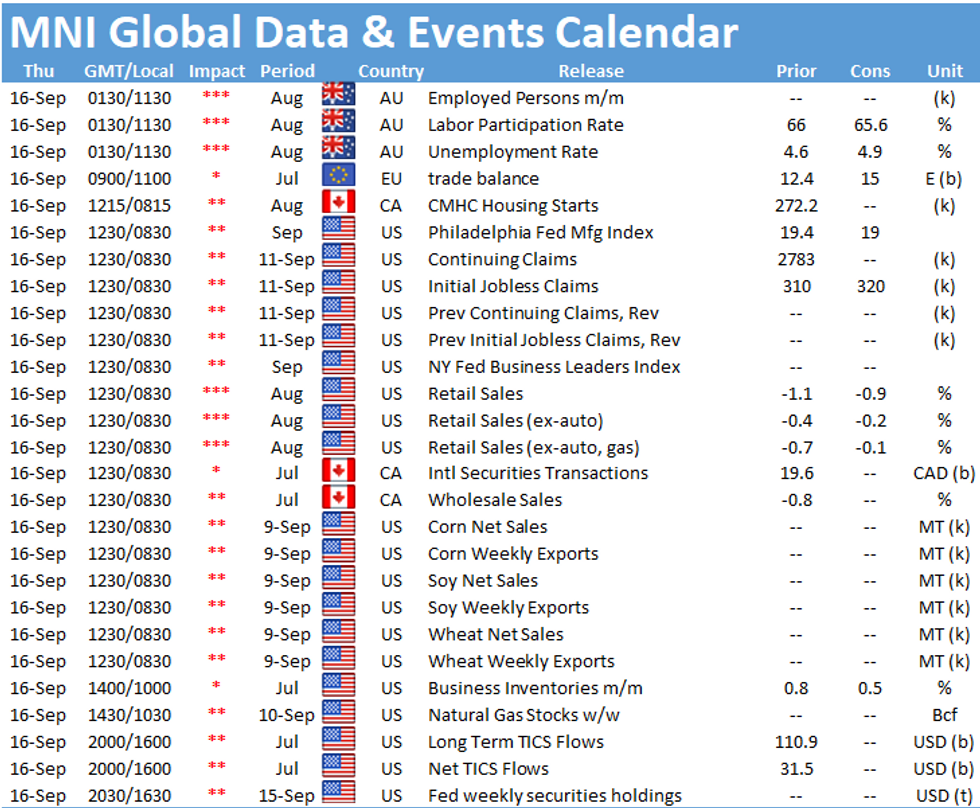

- New Zealand Q2 GDP data will be followed by Australian August Employment figures overnight.

- ECB President Lagarde is due to speak about the euro and the European economy at an online event where a Q+A is expected.

- Thursday's US data docket will be headlined by August retail sales and September Philly Fed.

FOREX: Expiries for Sep16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1720-25(E1.3bln), $1.1750(E635mln), $1.1850(E574mln)

- USD/JPY: Y109.30-40($673mln), Y109.70-80($1.3bln), Y110.50-65($1.7bln)

- EUR/GBP: Gbp0.8525-45(E580mln)

- AUD/USD: $0.7360(A$514mln)

- USD/CAD: C$1.2550-75($1.9bln)

- USD/CNY: Cny6.40($1bln), Cny6.45($995mln)

PIPELINE: $13.85B To Price Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 09/15 $3.5B *IADB 3Y SOFR+14

- 09/15 $3.25B #JP Morgan Chase $2.75B 6NC5 +67, $500M 6NV5 FRN/SOFR

- 09/15 $1.25B #Glencore $750M 10Y +135, $500M 30Y +160

- 09/15 $1.15B #F&G Global funding $750M 3Y +47, $400M 7Y +95

- 09/15 $1B *Council of Europe (COE) WNG 5Y -1

- 09/15 $1B *Bangkok Bank 15NC10 tier 2 +215

- 09/15 $850M #Boston Properties 12Y Green +115

- 09/15 $750M #Aviation Capital Grp 5Y +120

- 09/15 $600M #Florida Gas Trans WNG 10Y +100

- 09/15 $500M #Sealed Air 5Y +77

EQUITIES: US Just Above Unchanged, But Europe Continues Lower

- A solid oil price rally boosted margins for oil explorers and producers Wednesday, helping the energy sector buoy headline indices and put stocks into the green. The likes of Diamondback Energy and Marathon Oil rallied over 5% as WTI crude futures hit new weekly highs, helping the e-mini S&P off overnight lows of 4427.50.

- Despite the late support, equity indices failed to show through Tuesday's highs, keeping the outlook fragile for now. The contract has recently breached its 20-day EMA and this signals potential for a pullback towards and test of the key 50-day EMA at 4407.80.

- Continental markets saw more negative trade, with the benchmark EuroStoxx50 off over 1% at the close. Spain's IBEX-35 gave back some of the recent outperformance, finishing off by 1.7%.

COMMODITIES: DoE Data Supports WTI to New Weekly High

- A supportive set of DoE inventories numbers boosted oil prices further, with both WTI and Brent crude futures adding close to 3% apiece. Headline stockpiles saw a draw of near 6.5mln bbls across the week, over double market expectations. This was twinned with still sluggish refinery utilization, suggesting firm demand will continue to meet lacklustre supply.

- WTI crude futures topped the downtrendline drawn off the early July highs, opening further gains for the contract. Gains through $73.52 open $74.77, the Oct-21 high.

- Elsewhere, the usually placid UK gas market rallied sharply, extending September strength as the National Grid confirmed that the France-UK power cable is set to be halted until the end of March 2022. The outage was triggered by an onsite fire overnight, and has contributed to the sharp upside in UK natural gas prices today. Day Ahead forward prices for UK natural gas traded higher by as much as 20% Wednesday and are up 40% since the beginning of the month.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.