-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Rates Of Lows As Equities Tumble

US TSYS: Tsys Pare Early Losses As Eqs Tumble

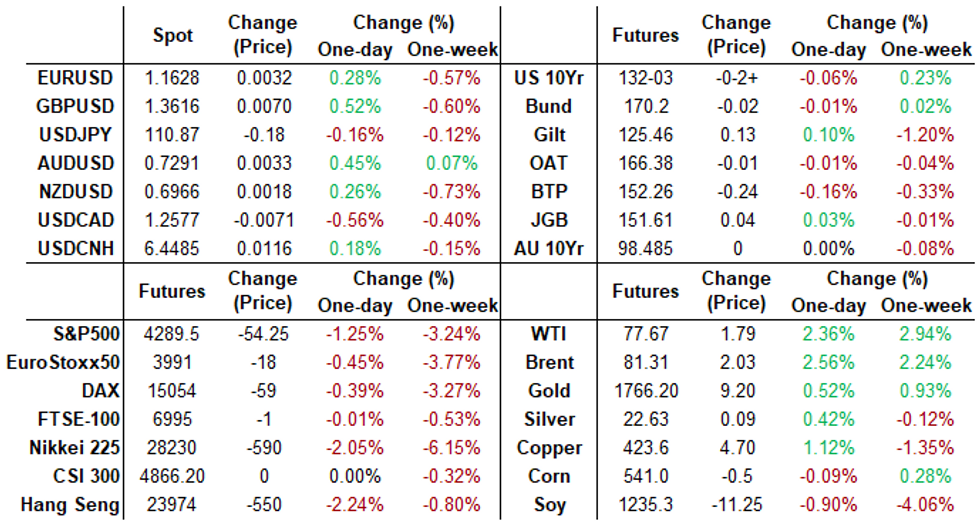

Tsys trading weaker by the close, off midmorning lows after a brief risk-off move as equities tumbled. Inside ranges for rates and equities while Oil and crude climbed, WTI tapped 78.38 high.

- No apparent headline driver, but underlying risk-off tone continues ahead Fri's Sep NFP data (+450k est vs. +243k prior). That's not to say there were no headlines that underscore the risk off tone, just nothing new to spur the midmorning moves.

- Headlines such as U.S. WILL ENFORCE COMMITMENTS CHINA MADE IN PHASE-ONE DEAL (Bbg), CHINA RUNNING ABOUT $5B SHORT ON AG BUYING. COMMITMENTS (and ongoing reports of China military jets flying through Taiwan defense zone either dropped over the weekend or are ongoing.

- Session rate flow included two-way in short end from fast$, real$ selling in 10s, swap-tied buying in 2s. Modest deal-tied hedging in 3s-5s.

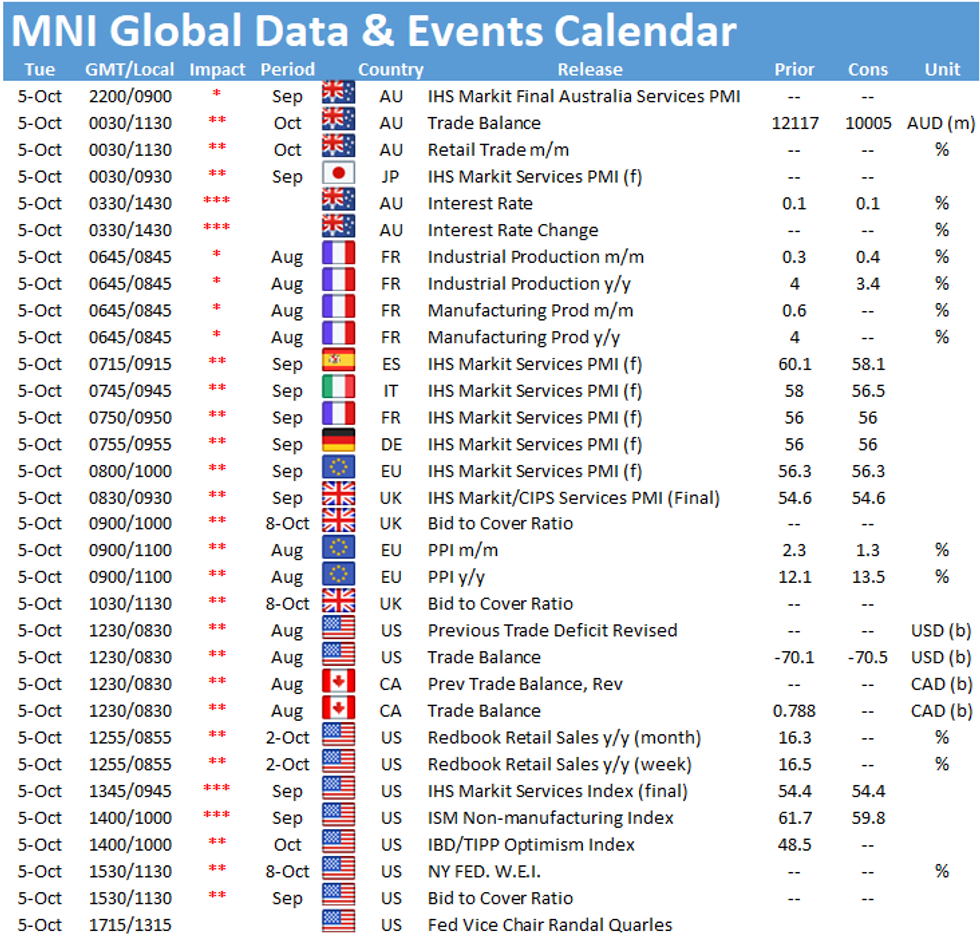

- Tsy Sec Yellen and Chicago Fed Evans will be interviewed on CNBC early Tuesday (0730ET and 0830ET respectively). Data on tap: Trade Balance (-$70.7B), Markit US Services and Composite PMIs, ISM Services Index (60.0).

- The 2-Yr yield is up 1.4bps at 0.2776%, 5-Yr is up 1.6bps at 0.9441%, 10-Yr is up 1.7bps at 1.4789%, and 30-Yr is up 1.8bps at 2.0463%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00188 at 0.07250% (-0.00238 total last wk)

- 1 Month +0.00263 to 0.07788% (-0.00988 total last wk)

- 3 Month -0.00650 to 0.12663% (+0.00088 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00150 to 0.15550% (+0.00162 total last wk)

- 1 Year -0.00288 to 0.23200% (+0.00525 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $68B

- Daily Overnight Bank Funding Rate: 0.07% volume: $257B

- Secured Overnight Financing Rate (SOFR): 0.05%, $928B

- Broad General Collateral Rate (BGCR): 0.05%, $371B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $372B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $1.999B accepted vs. $5.372B submission

- Next scheduled purchases

- Tue 10/05 1100-1120ET: Tsy 7Y-10Y, appr $3.225B

- Wed 10/06 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Thu 10/07 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 10/08 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

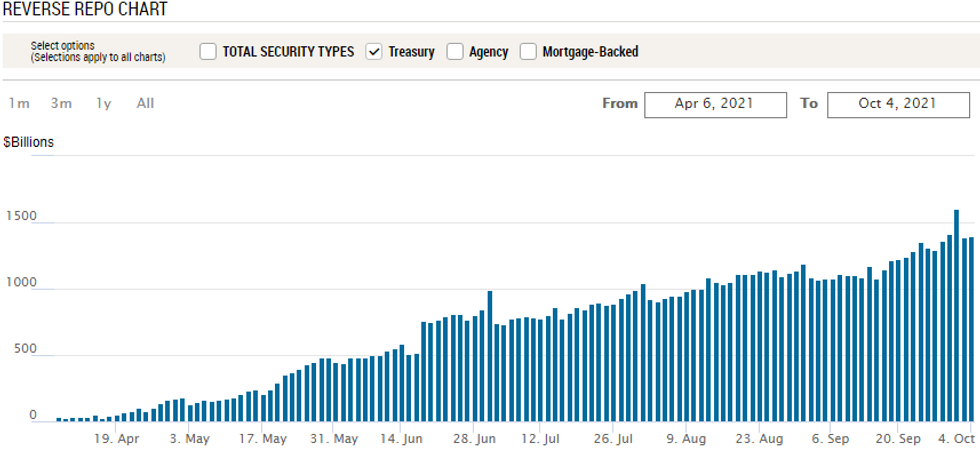

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,399.173B from 77 counterparties vs. $1.385.991B on Friday. Compares to Thursday, September 30 record high of $1,604.881B.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options- -2,500 short Nov 99.50/99.62 2x1 put spds, 4.25

- -1,000 short Dec 99.50 straddles, 11.5

- Overnight trade

- 4,000 Green Jun 99.50 calls, 2.0

- 4,000 short Nov 99.43/99.50 2x1 put spds

- 2,800 Blue Dec 97.75/98.12/98.25 broken put trees vs. 98.87 calls

- -10,000 FVX 123/123.25 call spds, 11.5

- +5,000 FVX 122.5 puts, 7.5 vs. 122-29.75/0.26%

- +3,000 wk2 FV 123.25/123.75 call spds, 4 vs. 122-31.75/0.10%

- +5,000 TYZ 129.5/131 put spds, 19

- Overnight trade

- +7,500 TYX 130.5 puts, 5 ref 132-05

- 2,200 wk2 TY 133/133.75 1x2 call spds

EGBs-GILTS CASH CLOSE: Steeper To Start The Week

European FI weakened in a bear-steepening move, with Gilts and Bunds trading largely in line with each other to start the week. Periphery spreads were a little wider.

- Weaker equities and continuing supply-side energy concerns did not translate into a safe-haven bid in core FI, though Gilts mounted a decent comeback in the afternoon with yields briefly turning lower on the session.

- Little data of note, and no market-moving commentary from today's central bank speakers. Most notable was ECB's de Guindos who stressed that while there were no signs of notable wage increases yet, the ECB will remain vigilant to second-round effects from recent price gains.

- The ESM completed its 2021 Funding with a E2bln no-grow tap sale of Dec-24 bonds.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is unchanged at -0.703%, 5-Yr is up 0.7bps at -0.574%, 10-Yr is up 1bps at -0.214%, and 30-Yr is up 1.2bps at 0.268%.

- UK: The 2-Yr yield is up 0.7bps at 0.406%, 5-Yr is up 0.6bps at 0.629%, 10-Yr is up 0.9bps at 1.011%, and 30-Yr is up 1.2bps at 1.379%.

- Italian BTP spread up 0.8bps at 104.4bps / Spanish up 0.3bps at 65bps

EGB Options: Large Sterling Put Sales

Monday's European rates / bond options flow included:

- RXX1 170.50 call sold at 46.5 in 2k

- LU2 99.00p, traded paper to paper and look sold at 7.75 in 6k. There was a massive option build up at that strike ( bought for 2.75 in 100k in January for example), OI coming into Monday = 312k

- SFIH2 99.85/99.80ps vs 99.95c, sold the ps 3.5 in 8k

FOREX: Swiss Franc Outperforms As Risk Falters, Cad Rallies With Oil

- Since making fresh 12-month highs last week, the dollar index has retreated for a third consecutive session, losing roughly a quarter of a percent on Monday, boosting the Euro, Aussie and Kiwi in the process.

- The greenback was unable to catch a bid with higher US yields early in the session, however happily retreated as yields tracked lower during NY hours. With the focus firmly on September payrolls on Friday, pre-positioning/profit taking may be working against the dollar.

- CHF was a beneficiary to the risk-off tone and was the best performing G10 currency. USDCHF fell 0.7% with roughly a 100 pip move off the 0.9328 highs posted shortly after the open.

- GBPUSD was strongly supported on Monday, grinding from a 1.3530 base all the way to print a high at 1.3640. Despite the uptick, the pair maintains a bearish technical theme and initial resistance is seen at the 1.3662 zone.

- Fresh cycle highs in crude futures buoyed the Canadian Dollar and Norwegian Krone, both rising around half a percent and largely ignoring the waning sentiment across equity markets.

- Faltering equities did impact pockets of the EM FX space. EM currency indices fell around 0.4% with substantial declines noted in both ZAR (-1.15%) and BRL (-1.4%).

- The main risk event overnight will be the RBA rate decision and statement where consensus looks for the RBA to leave its monetary policy settings unchanged. ISM Services PMI will headline the US data calendar on Tuesday.

FOREX: Expiries for Oct05 NY cut 1000ET (Source DTCC)

- USD/JPY: Y110.80-00($1.1bln), Y112.00($823mln)

- AUD/NZD: N$1.0410(A$2.1bln)

- AUD/USD: $0.7450(A$728mln)

- USD/CAD: C$1.2615-25($2.0bln)

- USD/CNY: Cny6.4620($1.0bln)

PIPELINE: Royal Bank of Canada 4Pt Fix/FRN Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/04 $3.5B #Bank of Nova Scotia 5Y +17

- 10/04 $2.75B #Royal Bank of Canada $1B 3Y +30, $500M 3Y FRN/SOFR+34, $900M 5Y +48, $350M 5Y FRN/SOFR+59

- 10/04 $1.25B #FS KKR Capital $500M 3Y +120, $750M 7Y +190

- 10/04 $500M L-Bank 7Y LIBOR +10

- 10/04 $Benchmark Bain Capital investor call

- 10/04 $Benchmark General Mills investor call

- Expected this week:

- 10/05 $500M KFW 2024 tap FRN/SOFR+11a

E-Mini S&P Finds Support Ahead of Last Week's Lows

- Equity markets traded lower across both Europe and the US on Monday, with losses accelerating on the Wall Street opening bell. Cash indices in the US slipping as much as 2.2%, with weakness across tech and communication services names prompting the NASDAQ to underperform other benchmark indices.

- Stock weakness saw no key headline or data trigger, with markets clearly unsettled from the outset - evidenced by a slew of programmatic selling pressure pushing the e-mini S&P back toward last week's lows. Markets managed to find a modicum of support ahead of Friday's low at 4260.00, but the outlook remains fragile.

- A break through 4260 would reinforce the current bearish trend, opening Jul 20 low at 4243.50 initially ahead of key support at 4214.50. Around 4095 for the e-mini S&P marks a 10% pullback from the early September alltime high, official correction territory for the index.

COMMODITIES: Oil Rips to New Highs as OPEC+ Stick to Script

- WTI and Brent crude futures ripped higher Monday, with both oil benchmarks touching a fresh cycle best at $78.38/bbl for WTI and $82/bbl for Brent.

- The price action followed a much anticipated OPEC+ meeting, at which markets speculated that the group could front-load their planned output hikes to bring November production higher by 800,000bpd - double the previously agreed pace. This didn't come to pass, with OPEC+ sticking to the script and sending a message that the group will tolerate restrained output in exchange for high prices.

- This leaves the rally off the August lows intact, with WTI targeting $79.53 initially ahead of psychological resistance at the $80/bbl handle.

- Elsewhere, gold is firmer off the Sep29 low at $1721.7, with a firmer recovery needing to take out $1776.6 ahead of the 50-dma at $1783.7 to firm the outlook.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.