-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

MNI ASIA MARKETS ANALYSIS: Yields Top 6M Highs As Jobless Recede

Tsy Ylds Make Multi-Month Highs As Weekly Jobless Claims Recede

Tsys holding weaker levels after the closing bell, near middle narrow session range, yield curves see-sawing all day, finish mostly flatter (5s30s -5.9 at 90.8 after topping 98.0 earlier in session). US$ rebounded (DXY +214 at 93.771 late), equities held modest gains near all-time highs (ESZ1 +5.5 at 4533.50).- Tsys held weaker but off lows after weekly and continuing claims came out lower than est (290k vs. 297k est; 2.481M vs. 2.548M est), Philly Fed lower than exp at 23.8 vs. 25.0 est and mixed details (orders, shipments and employment solid).

- Tsys futures recede back to lower half relatively narrow session range after Sep existing home sales climbed 7% to 6.29M, better than 6.09M est.

- Swap curve flattened with short end widening on back of heavy (14k) Block/crosses in Eurodollar Red packs in the first half, likely payer/sale driven while AerCap issued $51B in debt over 9-tranches spanning 2-20Y generated rate lock selling as well. Spds should reverse/narrow as supply hedges unwound.

- Fed Chair Powell joins policy panel discussion hosted by South African Reserve Bank Friday at 1100ET -- probably last to speak before media Blackout late Friday (through Nov 4 -- FOMC on Nov 2-3).

- Late Tsy yields: 2-Yr yield is up 4.9bps at 0.4342%, 5-Yr is up 4.8bps at 1.2133%, 10-Yr is up 2.1bps at 1.678%, and 30-Yr is down 0.4bps at 2.1307%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00050 at 0.07275% (-0.00038/wk)

- 1 Month +0.00350 to 0.08925% (+0.00888/wk)

- 3 Month -0.00437 to 0.12388% (+0.00025/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00025 to 0.17025% (+0.00975/wk)

- 1 Year -0.00025 to 0.29650% (+0.01688/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $271B

- Secured Overnight Financing Rate (SOFR): 0.03%, $857B

- Broad General Collateral Rate (BGCR): 0.05%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $334B

- (rate, volume levels reflect prior session)

- Tsys 10Y-22.5Y, $1.401B accepted vs. $3.944B submission

- Next scheduled purchase

- Fri 10/22 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

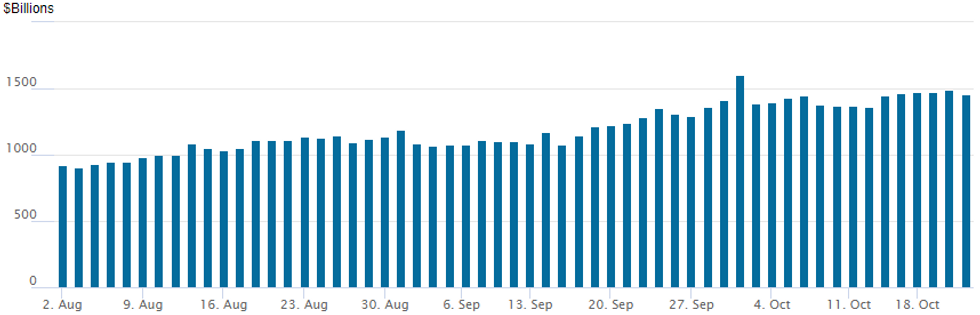

FED Reverse Repo Operation -- Lowest in a Week

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,458.605B from 78 counterparties from $1,493.961B on Wednesday. Record high remains at $1,604.881B from Thursday, September 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- total over 94,000 Green Dec 98.00 puts, 2.0

- -10,000 Jun 99.37/99.62 put spds, 5.0-5.25

- +6,000 short Jun 98.37 puts 0.0 over Green Jun 97.75 puts

- +4,000 Sep 99.25 puts, 10.5

- +10,000 short Nov 99.00 puts, 1.5

- -5,000 Green Dec 98.00/98.25 put spds, 2.5

- +15,000 short Sep 98.75/99.00 call spds 3.0 over 97.87 puts

- +10,000 Jun 99.62/99.75 put spds, 5.0

- +5,000 short Jun 99.50 calls, 2.5 vs. 98.90/0.10%

- Overnight trade

- Block, 5,000 Red Dec'22 99.00 puts, 13.0 vs. 99.315/0.30%

- 5,000 Red Dec 98.87/99.12 put spds

- 4,500 Jun 99.50/99.62/99.75 put flys

- 4,600 Jun 98.87/99.37 put spds

- 2,000 Dec 98.75 puts vs. short Dec 99.00/99.25 2x1 put spds

- 9,000 Dec 99.75/99.81 put spds

- +50,000 FVZ 121 puts, 13

- 11,127 USZ 158/161 1x2 call spds, 34

- Overnight trade

- 9,600 TYZ 128.5 puts, 12

- 9,700 TYX 130 puts, 2

- Block, total 20,000 TYZ 129.5 puts, 24-26

EGBs-GILTS CASH CLOSE: 10Y Gilts Touch Fresh Post-2019 High

Gilts significantly underperformed Bunds Thursday, with bear steepening in the curve. Supply and rate hike reconsiderations were the session's themes.

- France (E7.5bln) Spain (E5bln) and UK Green (GBP6bln) provided the supply, helping weigh on the space. Euribor and Short-Sterling futures weakened a few ticks after Wednesdays move higher.

- Further down the curve, 10Y Gilt yields touched a fresh post-2019 high. 10s30s flattening in Germany was notable (that segment now at the flattest since the pandemic started in March 2020).

- Periphery spreads saw little change.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.2bps at -0.646%, 5-Yr is up 4.1bps at -0.432%, 10-Yr is up 2.5bps at -0.101%, and 30-Yr is down 1.8bps at 0.273%.

- UK: The 2-Yr yield is up 2.5bps at 0.709%, 5-Yr is up 4.6bps at 0.864%, 10-Yr is up 5.4bps at 1.202%, and 30-Yr is up 5.6bps at 1.443%.

- Italian BTP spread up 0.3bps at 104.3bps / Spanish down 0.4bps at 62.6bps

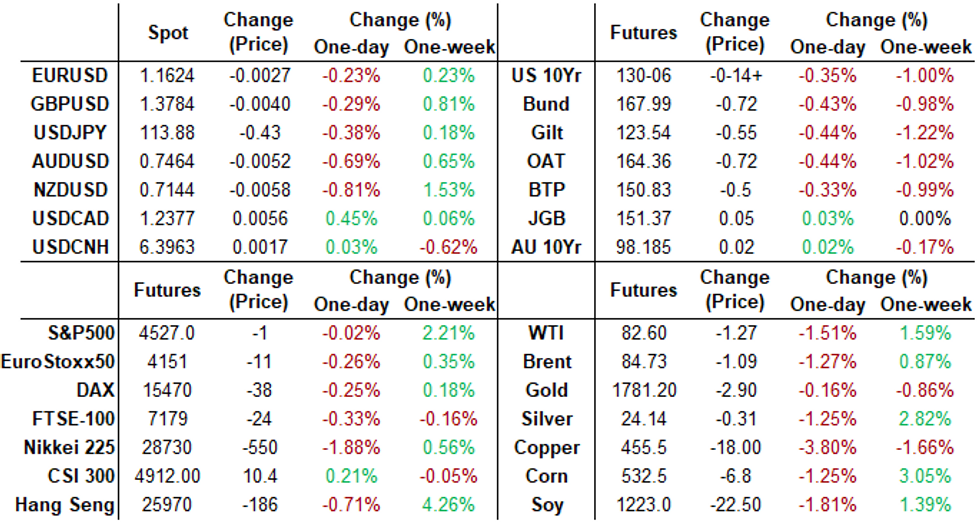

FOREX: Late Greenback Strength Halts USD Losing Streak

- The dollar strengthened in the latter half of the US session, in line with higher US yields and amid a slightly more cautious tone for risk. This will likely bring a six-day losing streak for the dollar index to a halt.

- Broad commodity weakness lent support to the greenback overall, causing risk-tied G10 currencies to halt their most recent trends higher.

- AUDUSD and NZDUSD suffered losses in the region of 0.75%, with Kiwi reversing the entirety of yesterday's gains and also putting an end to a run of six winning sessions. Additionally, with USDJPY dipping back below 114 and risk suffering, crossJPY was a notable laggard on Thursday.

- USDJPY matched the Oct 15 lows at 113.65 and any further yen strength may target the 113.00 low from Oct 12, although USDJPY dips are still considered technically corrective.

- Elsewhere the CHF also garnered some support, with EURCHF dipping back below 1.07 and to the lowest levels since November 2020. Some analysts have noted this may increase the likelihood of additional SNB intervention.

- In the EM space, the moves were more pronounced. A CBRT surprise 200bps rate cut prompted a near 3% sell off in TRY, closely followed by significant drops in high beta currencies such as ZAR and BRL.

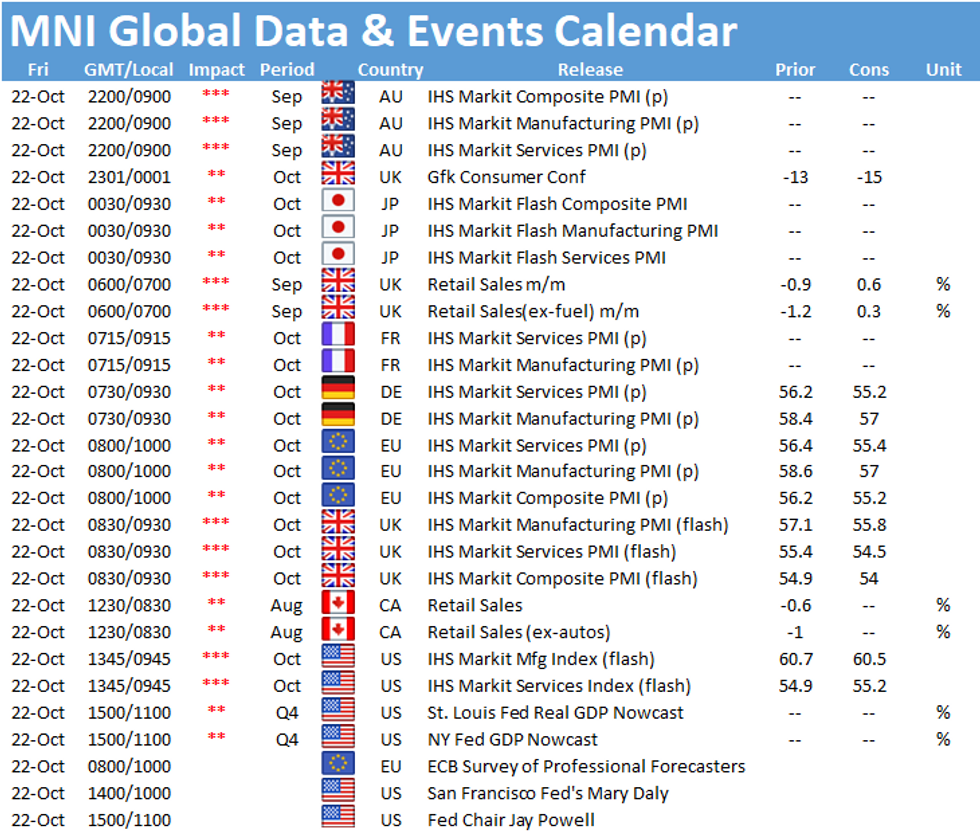

- A fairly busy European data docket on Friday, with UK retail sales preceding European Flash Manufacturing and Services PMIs. Canadian August retail sales are also due.

- Fed Chair Powell will feature in a policy panel discussion w/ SARB before going into media blackout through the November FOMC meeting.

FX: Expiries for Oct22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600(E788mln), $1.1650(E648mln)

- USD/JPY: Y113.50($500mln), Y114.25-45($1.6bln)

- GBP/USD: $1.3700(Gbp558mln)

PIPELINE: $21B AerCap 9-Tranche Jumbo Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/21 $21B #AerCap 9-tranche jumbo: $1.75B 2Y +70, $500M 2Y FRN/SOFR+68, $3.25B 3Y +90, $1B 3NC1 +100, $3.75B 5Y +125, $3.75B 7Y +150, $4B 10Y +165, $1.5B 12Y +175, $1.5B 20Y +175

- 10/21 $3B *CADES (Caisse d'Amortissement de la Dette Sociale) 5Y LIBOR+5

- 10/21 $500M #Santander Chile 10Y +150

EQUITIES: S&P500 On Track for Longest Winning Streak Since August

- Following the London close, the S&P 500 traded in positive territory, putting the index on track to secure a seventh consecutive session of gains - the longest winning streak since early August. Markets also traded above the record close on 4536.95, opening a move on the alltime intraday high of 4545.85 - both metrics were printed on Sept 2nd.

- A slip off the highs for WTI and Brent crude futures worked against energy names, putting the sector at the bottom of the G10 pile. Losses across energy names were countered by strength in consumer discretionary and utilities, with automakers also a source of strength. Tesla traded particularly well after a solid set of earnings after-market Wednesday.

- European markets were more patchy, with most headline indices slipping 0.2-0.3% at the bell. Spain's IBEX-35 and the UK's FTSE-100 were the poorest performers, dropping 0.6% and 0.4% respectively.

COMMODITIES: Further Global Lawmakers Take Action on Energy Ahead of the Winter

- The Dec-21 WTI future printed a new cycle high in Asia-Pac trade at $83.96/bbl, with strength stalling just ahead of the psychological $84/bbl handle. Both WTI and Brent crude futures have rolled off the overnight highs as the greenback reclaims some lost ground and recovers off the overnight lows.

- Weekly EIA NatGas storage change data came in ahead of expectations, with a build of 92BCF vs. Exp. 88BCF.

- Further signs of concern among global policymakers over high energy prices emerged from Paris, with the French PM Castex to appear on television this evening to announce measures to tackle rising domestic energy prices. Similarly, the Texas PUC voted on Thursday to adopt a winterization mandate - a measure that requires local power plants to prepare for cold weather.

- Gold traded toward the upper-end of the week's range, but still stopped shy of the 200- and 100-dmas of 1793.7/1. Attention though is on Friday's sharp sell-off that continues to highlight a potential bearish threat. Key short-term resistance has been defined at $1800.6, the Oct 14 high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.