-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR/GBP Testing Downtrendline

MNI China Daily Summary: Monday, March 10

MNI US Employment Insight: Dovish Details vs Dovish Pricing

MNI ASIA MARKETS ANALYSIS - All About Inflation

HIGHLIGHTS:

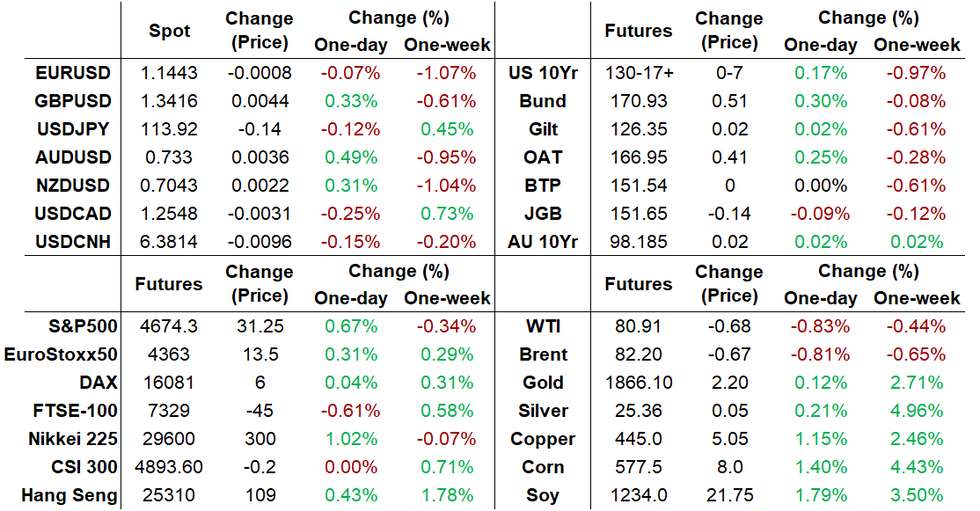

- Yields fell and the dollar retreated from near multi-month highs after a weak UMichigan consumer sentiment survey.

- But the moves retraced over the rest of the session as breakeven inflation headed to fresh highs.

- 5Yr US Tsy Yields confirmed their biggest weekly rise since 2019 as Fed rate hike expectations ramped up.

US TSYS: Belly, Breakevens Finish Week With A Bang

A busy week highlighted by a surprise acceleration in October CPI and the worst 30Y bond auction in a decade ended as perhaps should be expected: with inflation expectations continuing to rise, and further weakness in 30Y Tsys.

- 5 Year nominal yields posted their biggest weekly rise since August 2019, rising over 15bp on the week, touching the highest levels of the pandemic cycle.

- The move came on the back of a big rise in breakevens: 5Y TIPS-implied hit a fresh all-time high of 3.1766% (up nearly 25bp on the week), with 10Y hitting highest since 2006.

- A very weak UMichigan consumer sentiment figure led US Tsys to day's highs. The 2 to 5 year segment of the curve initially rallied as the data implied consumer weakness potentially denting the case for Fed hikes, but both then retraced their steps.

- Notably, the poor Michigan figure reflected high inflation denting consumer confidence.

- Overall the curve steepened, with 30Ys underperforming coming back from Thursday's cash holiday: the 2-Yr yield is up 0.5bps at 0.5175%, 5-Yr is up 1.8bps at 1.2341%, 10-Yr is up 2.9bps at 1.5784%, and 30-Yr is up 4.9bps at 1.9489%.

- Dec 10-Yr futures (TY) rose 7/32 at 130-17.5 (L: 130-10 / H: 130-26).

MNI Inflation Insight: Another Blow To “Transitory”

MNI has just published our latest Inflation Insight - "Another Blow To 'Transitory'".

- A well-above-consensus October U.S. core CPI reading struck yet another blow to the "transitory" inflation thesis.

- Arguably the "transitory" argument still has life yet, looking at market expectations for the long-term Fed funds rate and inflation.

- But the October reading increases the probability that the Fed will announce an acceleration in its taper pace at the December meeting.

US LIBOR FIX - 11/11/21

- US00 O/N 0.06538 -0.00550

- US000 1W 0.07388 -0.00062

- US000 1M 0.08950 0.00025

- US000 3M 0.15600 0.00162

- US000 6M 0.22788 0.00838

- US00 12M 0.38788 0.03413

STIR: Fed Funds Steady, Volume Dips To 2-Wk Low Ahead Of Holiday

| New York Fed EFFR for Nov 10 session (rate, chg from prev day): |

| * Daily Effective Fed Funds Rate: 0.08%, no change, volume: $72B |

| * Daily Overnight Bank Funding Rate: 0.07%, no change, volume: $277B |

US TSYS: Secured Rates Steady Prior To Holiday

| REPO REFERENCE RATES (rate on Nov 10, change from prev. day, volume): |

| * Secured Overnight Financing Rate (SOFR): 0.05%, no change, $871B |

| * Broad General Collateral Rate (BGCR): 0.05%, no change, $343B |

| * Tri-Party General Collateral Rate (TGCR): 0.05%, no change, $328B |

Eurodollar/ Treasury Options Flow

Friday's US rates / bond options flow included:

- EDU2 99.0625/98.0625ps, bought for 10 in 10k - flattener versus selling 3EM 97.75/97.25ps at7.5 in 5k vs 98.24 - net 6.5 debit.

- 0EZ1 99.25/99.37/99.5625 broken c fly, bought for 1 in 30k

- 0EZ1 99.33/97.11 ps ref 06 d.32, sold at 19 in 26k, done on block

- 0EZ1 99.37/99.00ps, sold at 25 in 35k on block

- FVZ1 121.00p, bought for 11 in 15k

EGBs-GILTS CASH CLOSE: Taking Off Risk Ahead Of The Weekend

Core European FI enjoyed a constructive session to end the week, with the short-end/belly of the German and UK curves outperforming in a flattening move. A few factors supported the risk-off core FI Friday, particularly in the afternoon.

- These included: the spectre of Covid restrictions returning (Netherlands expected to announce a 3-week lockdown after the close), geopolitical tensions (Ukraine/Russia and Belarus/E.U.), and a very weak UMichigan consumer sentiment figure led US Tsys to day's highs, dragging Europe.

- Meanwhile, periphery EGB spreads widened slightly, with Greece underperforming.

- After the close we get ratings reviews including Fitch on Portugal and S&P on the Netherlands.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.9bps at -0.742%, 5-Yr is down 4.9bps at -0.565%, 10-Yr is down 2.6bps at -0.257%, and 30-Yr is down 1.2bps at 0.061%.

- UK: The 2-Yr yield is down 3.9bps at 0.526%, 5-Yr is down 3.2bps at 0.673%, 10-Yr is down 0.7bps at 0.913%, and 30-Yr is up 1.1bps at 1.071%.

- Italian BTP spread up 1.8bps at 121.1bps / Greek up 3.9bps at 147.7bps

FOREX: Greenback Consolidates After Strong Weekly Gains

- G10 FX held narrow ranges on Friday, following the resumption of trade for US bond markets, following Thursday's Veteran's Day holiday. The dollar index traded either side of unchanged throughout the session, ending marginally in the red but consolidating its +1% gains for the week.

- AUD, NZD and GBP stemmed three days of losses to be the strongest performers in G10 on Friday, rising between 0.3-0.4% against the dollar.

- Similar dollar weakness prevailed against the Japanese Yen, with USDJPY gradually slipping from the overnight highs of 114.30 back below the 114 mark. Following a bullish engulfing reversal, the pattern signals scope for a stronger climb and has exposed key resistance at 114.70, Oct 20 high.

- The Swiss Franc continues to be supported on dips with underperformance in the Euro pinning EURCHF to the most recent lows below 1.0550. The move continues to garner market attention with focus on the key 1.0505 mark. The level provided crucial support following the onset of the pandemic in early 2020.

- In emerging markets, USDTRY made a push towards the psychological 10.00 level ahead of next week's CBRT meeting. The high print is currently 9.9969, however the pair trades close to these highs approaching the close. The Russian ruble came under particular pressure (down 2.06%) following geopolitical headlines regarding troop movement on the Ukraine border.

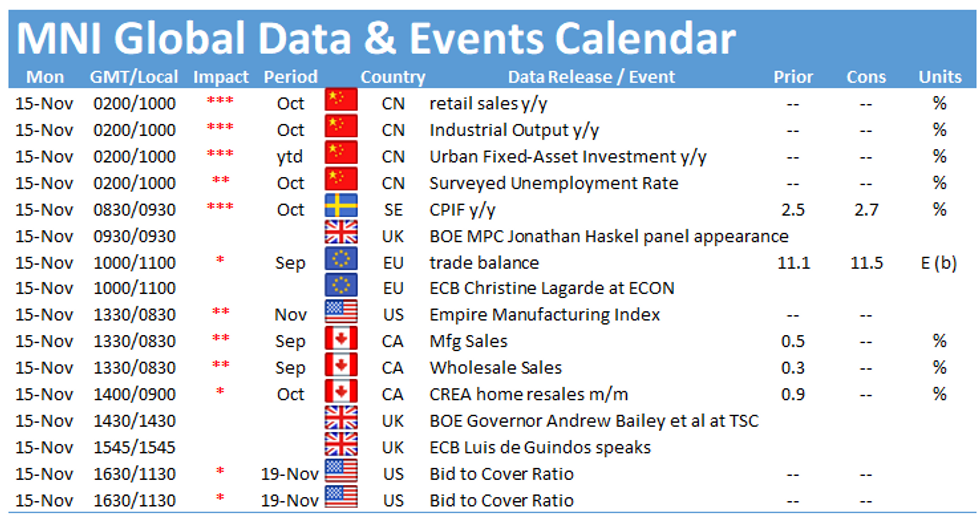

- Chinese retail sales and industrial production data kicks off next week's calendar before the US Empire State Manufacturing Index.

- The RBA will publish their minutes on Tuesday. UK and Canadian Inflation data is scheduled for Wednesday.

FX OPTIONS: Expiries for Nov15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1375(E553mln), $1.1580-00(E1.3bln)

- USD/JPY: Y113.95-00($519mln), Y114.75($570mln)

- AUD/USD: $0.7267-80(A$600mln)

EQUITIES: Wall Street Finishes Week on a High Note

- Equity markets traded solidly Friday, finishing the week on a high note as strength across communication services and tech names more than countered weakness in energy, financials and real estate. The e-mini S&P saw decent buying interest at the London close, with a flurry of volume that surmounted that seen at the opening bell.

- The move confirmed the corrective nature of week's pullback, reinforcing the underlying bullish theme. Another all-time high print on Nov 5 confirmed a resumption of the uptrend and the focus is on 4717.00 next, a Fibonacci projection. Trend signals such as moving average studies remain in a bull mode, reinforcing current conditions and market sentiment. The 50-day EMA at 4507.32 continues to represent the key support handle.

- European indices traded more mixed, with the EuroStoxx 50 gaining at the expense of the FTSE-100 and Spain's IBEX-35.

COMMODITIES: Crude Off as Markets Weigh Odds of White House Action

- WTI and Brent crude futures traded lower into the Friday close, with a combination of greenback strength and further speculation that the White House could move against high energy and gas prices weighing on sentiment. WTI oscillated either side of the $80/bbl handle, closing close to the week's lowest levels.

- WTI futures gains initially stalled on Wednesday. Recent gains have exposed key resistance and the bull trigger at $85.41, Oct 25 high. A break of this bull trigger would confirm a resumption of the uptrend and resume the bullish price sequence of higher highs and higher lows. This would open $87.45, a Fibonacci projection. On the downside, key short-term support has been defined at $78.25 Nov 4 low. A break would be bearish.

- Gold holds much of the post-CPI gains, resulting in a clear break of resistance at $1834.0, Sep 3 high. The breach of this hurdle reinforces current bullish conditions and paves the way for further upside. Note too that the yellow metal has also breached $1863.3, 76.4% of the Jun - Aug sell-off.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.