-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: EU To Talk With US, Boost Industry Protection-Officials

MNI POLITICAL RISK- China Retaliates As Tariffs Go Into Effect

MNI US MARKETS ANALYSIS - On Headline Watch, China in Focus

MNI ASIA MARKETS ANALYSIS: 30Y Yld Back Over 2.0%

US TSYS: Yield Curves Bounce as 30YY Climbs Over 2.0%

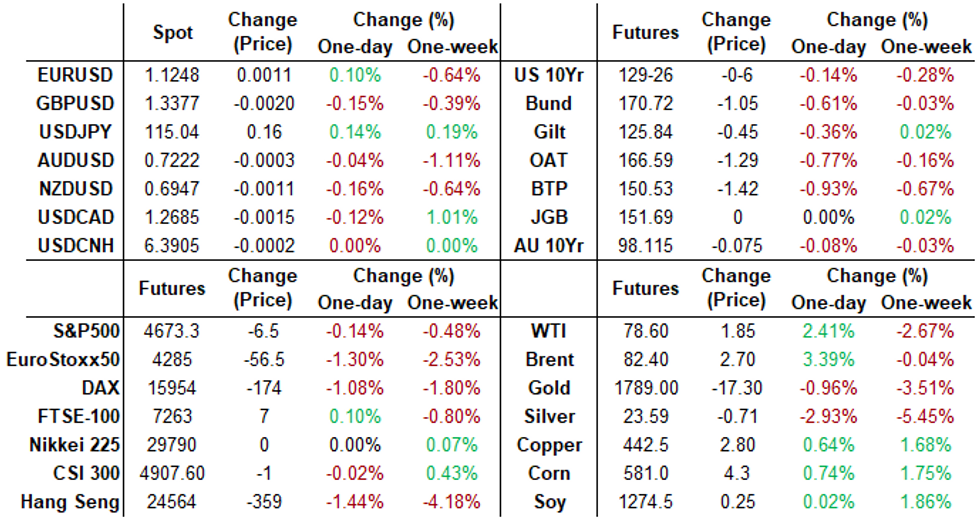

Tsys yields near late session highs after the bell (10YY 1.6686%; 30YY 2.0279%), futures just off late session lows, long end underperforming, yield curves steeper. Heavy volumes tied to ongoing Dec/Mar quarterly roll (Nov 30 first notice), TYZ1 >2.8M.- Coming into the session central banks remained active in short end, better sellers with some sporadic buying, fast- and real$ selling 10s, extension selling in intermediates. Two-way option-tied hedging ahead Dec expiry on Friday.

- Tsy futures bounced briefly off lows after $59B 7Y note auction (91282CDL2) stopped through: 1.588% high yield vs. 1.597% WI; 2.42x bid-to-cover 2021 high (five auction avg: 2.28x). Indirect take-up 59.29% vs. Oct's 63.89% (highest since Jan).

- Due to intermittent technical difficulties this morning, the NY Fed has decided to postpone today's purchase operation of app $1.075B 7.5Y-30Y TIPS at 1010-1030ET to Wednesday at 1100-1120ET.

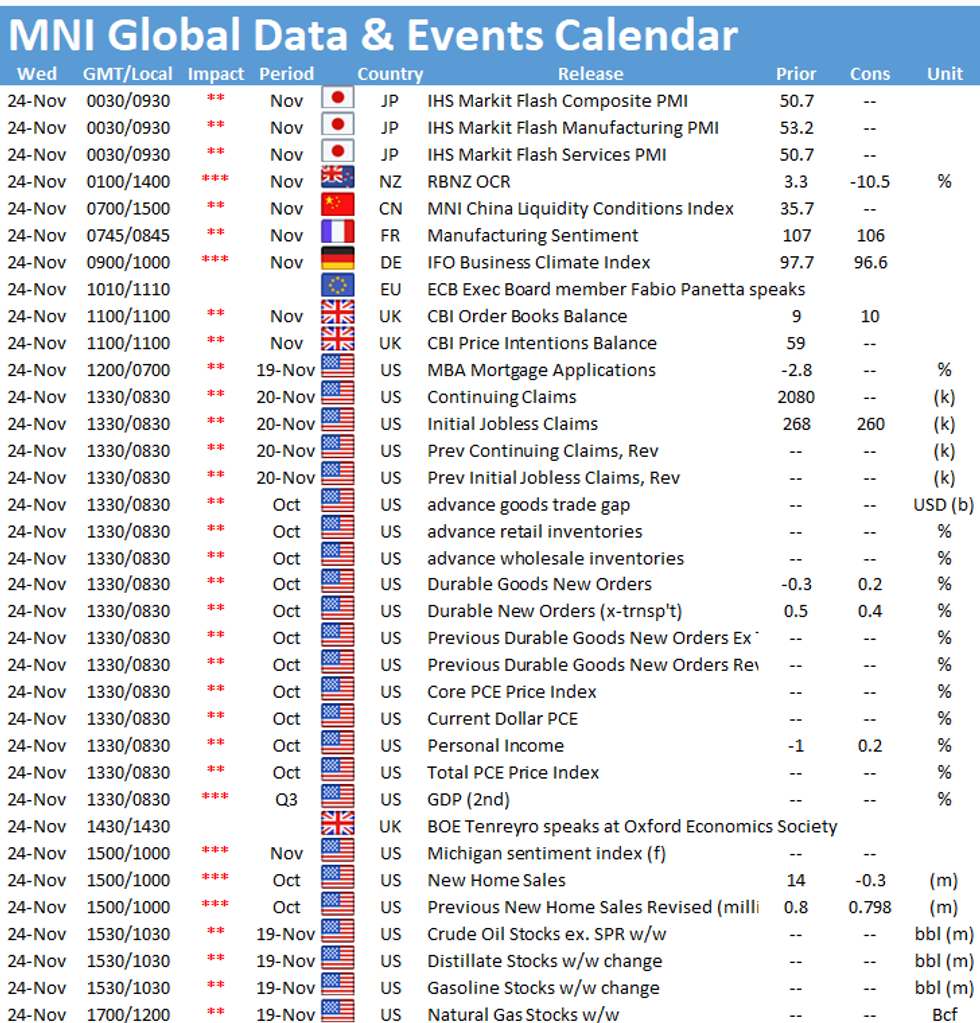

- Heavy slate of data Wednesday includes weekly claims (260k est vs. 268k prior) with Thursday closed for Thanksgiving holiday.

- The 2-Yr yield is up 2bps at 0.6043%, 5-Yr is up 1.1bps at 1.3278%, 10-Yr is up 3.5bps at 1.6582%, and 30-Yr is up 5.5bps at 2.0165%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00300 at 0.07250% (-0.00350/wk)

- 1 Month -0.00038 to 0.09200% (-0.00138/wk)

- 3 Month +0.00837 to 0.17800% (+0.01400/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00800 to 0.25188% (+0.02250/wk)

- 1 Year +0.02337 to 0.44900% (+0.05725/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $278B

- Secured Overnight Financing Rate (SOFR): 0.05%, $930B

- Broad General Collateral Rate (BGCR): 0.05%, $357B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $336B

- (rate, volume levels reflect prior session)

- Due to intermittent technical difficulties this morning, the NY Fed has decided to postpone today's purchase operation of app $1.075B 7.5Y-30Y TIPS at 1010-1030ET to Wednesday at 1100-1120ET.

- Operational purchases will resume Monday, Nov 29.

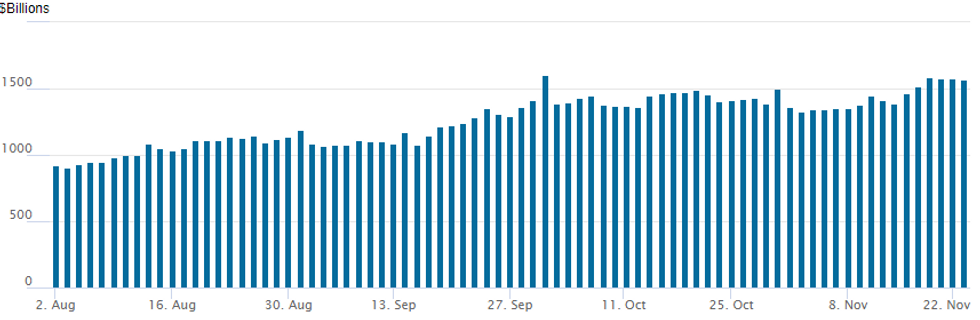

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage continues to inch lower: $1,571.980B from 79 counterparties vs. $1,573.796B on Monday. Record high remains at 1,604.881B from Thursday, September 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- 3,500 short Mar 98.37/98.62 put spds, 6.5

- 4,500 Green Mar 97.75/98.00 put spds

- Overnight trade

- Block, total 26,000 short Dec 98.75/99.00 put spds, 8.5 vs.

- Block. total 52,000 Red Mar 97.50/97.75 put spds, 4.0

- 25,000 wk1 TY 128/128.5 put spds, 8

- 1,400 USF 155/157 put spds 16 over USZ 157 puts

- Overnight trade

- +12,650 TYF 127 puts, 14

- Block, 12,500 wk3 TY 127.5/128.5 put spds, 17 vs. 129-02/0.17%

- +3,500 FVH 119.5/120.75 call over risk reversals, 11

EGBs-GILTS CASH CLOSE: PMIs Set Bearish Tone

Another day, another large rise in yields Tuesday, with Italy again the underperformer. Both the UK and German curves saw most weakness in the 10-Yr segment.

- Generally stronger-than-expected European PMIs in the morning set a bearish tone, with the spectre of renewed COVID lockdowns (Germany's Merkel in crisis meetings with party leaders) and weaker equities once again failing to provide much of a safe-haven bid.

- ECB's Schnabel said inflation risks are "skewed to the upside".

- BoE's Bailey said he didn't think the bank would return to a "harder" forward guidance. Earlier, Haskel - a dove - was non-committal on rate hike timing.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.2bps at -0.729%, 5-Yr is up 5.2bps at -0.545%, 10-Yr is up 8.1bps at -0.22%, and 30-Yr is up 7.7bps at 0.105%.

- UK: The 2-Yr yield is up 6.3bps at 0.596%, 5-Yr is up 6.1bps at 0.745%, 10-Yr is up 6.4bps at 0.997%, and 30-Yr is up 1.3bps at 1.083%.

- Italian BTP spread up 2.4bps at 128.1bps / Spanish up 1.4bps at 73.2bps

EGB Options: All Downside, Including ECB Rate Hike Plays

Tuesday's Europe rate / bond options flow included:

- RXF2 170.5/173.5 RR sold the call from 5 down to 1 in 20k

- RXF2 160.00 put bought for 2 in 10k (ref 172.33)

- DUG2 112.20/112.00/111.80p fly, bought for 4.25 in 5k

- ERU3 100/99.75ps vs 100.37/100.50cs, bought the ps for flat in 4k

- 3RG2 99.75/99.50ps bought 4 on 50k

FOREX: Lira Crisis Takes Focus Away From G10 FX

- Tuesday's G10FX moves were a sideshow for the rapidly accelerating depreciation of the Turkish Lira. USDTRY was up over 18% at its peak where the currency pair printed a high of 13.4539.

- As of writing, USDTRY gains tally 11.5% as President Erdogan met with the central bank to discuss the Lira slide – bringing some momentary consolidation amid extremely thin liquidity conditions.

- Contagion risk amid higher US yields impacted other emerging market currencies with USDMXN rising well over 1% and narrowing the gap to the year's highs above the 21.00 mark.

- The greenback consolidated on Monday's gains and the dollar index remains at its best levels for 15 months. EURUSD lacked direction holding at the midpoint of its 50 pip range around 1.1250.

- Heavy equity indices prompted some initial Yen strength on Tuesday. USDJPY after breaking 115 overnight had a sharp reversal to 1.1449, however, markets remain in dollar dip-buying mode and the pair trades back above 115, approaching the US-APAC session crossover.

- The Swedish Krona was a notable underperformer as EURSEK rose 0.7%. This extends the currency pairs winning streak to four days following the break back above the 10 handle – an important pivot inflection point.

- The main event overnight will be the RBNZ decision/statement where the board may have a close decision between a 25 or 50bp hike.

- German IFO and the second reading of US GDP will precede US Core PCE data on Wednesday. The FOMC minutes will also be published before Thursday Thanksgiving Holiday.

FX: Expiries for Nov24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1195-00(E1.3bln), $1.1225-35(E775mln), $1.1300(E999mln), $1.1330(E799mln), $1.1400(E1.8bln), $1.1500(E4.2bln)

- USD/JPY: Y113.50($1bln), Y113.67-70($647mln), Y113.95-15($2.2bln), Y114.40-50($554mln), Y115.00-10($1.5bln), Y115.50-60($1.4bln)

- AUD/USD: $0.7200-15(A$568mln), $0.7270-75(A$819mln)

EQUITIES: US Energy Names Surge on SPR News

- The e-mini S&P sustained losses through the Asia-Pac session and largely consolidated through the London close. This puts prices around 80 points shy of the alltime highs posted yesterday, with the index posting a bearish candle formation in the pullback. This exposes support at 4625.25, the Nov 10 low. A break of this support would signal scope for a deeper pullback towards the 50-day EMA at 4551.59.

- Energy names surged across the US, with the sector comfortably at the top end of the table across the S&P 500 as explorers and refiners welcomed the rally in oil prices. The coordinated reserve release provided a decent catalyst for a rally in oil prices, raising the risk that OPEC+ could move to delay the easing of curbs to their production targets at next week's meeting.

- Furthermore, with the SPR release being wholly made up of sour crude, US refiners eye a solid pipeline of business when the supplies are released from mid-December.

- Resultingly, the likes of Occidental Petroleum and Devon Energy posted gains of as much as 6%.

- At the other end of the table, tech and consumer discretionary names suffered, with particular weakness noted in automakers. Ford, General Motors and Tesla all slipped, with Ford reversing off the 2021 high printed Monday.

COMMODITIES: Oil Up, Gold Down

- Oil prices up 1.9-2.8% on the day as underlying details of the release of state oil reserves across the US, China, India, Japan and the UK underwhelmed.

- The US SPR release was larger than expected (50mln bbl vs 35mln) but consisted of 18mln in pre-approved sales and 32mln as part of a swap arrangement, whilst the Indian release of 5mln was very small and Chinese intervention of 7mln no larger than what they've already been in the market for.

- This could prompt OPEC+ to reverse their planned easing of oil output curbs, tightening the market. OPEC+ next meets on Dec 2.

- WTI futures up 1.9% to $78.18, below the initial firm resistance point of $80.68 (Nov 16 high) required to ease the developing bearish theme.

- Brent futures up 2.8% to $81.90, a little stronger than WTI with an ease of the previously developing bearish theme having broken the initial firm resistance level of $80.68 (Nov 16 high). Next resistance at $83.83, the Oct 25 high and bull trigger.

- Gold prices meanwhile fell further, down another -1.1% on the day to $1784.28, comfortably through the 50-day EMA. The next key support level is $1759, the Nov 3 low.

- Biden speaking on economy/inflation later today plus US data risk tomorrow with durable goods and personal incomes/consumption due followed by Fed minutes before Thanksgiving.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.