-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Generally Upbeat Covid Headlines

US TSYS: Carry-Over Risk Appetite, Covid Headline Generally Upbeat

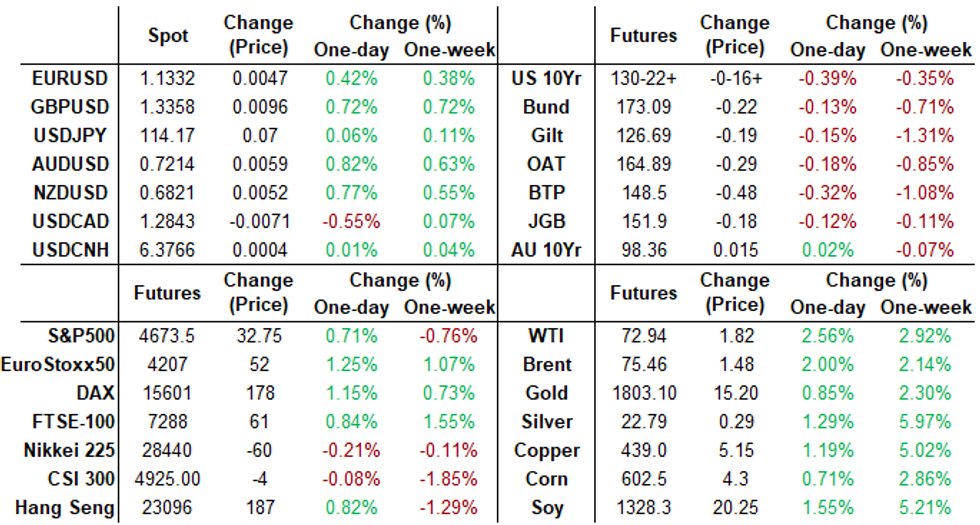

Yields finished mildly lower Wednesday, near the upper half of a narrow range, yield curves flatter with 5s30s just over 63.0 after breaching 70.0 on Tuesday.- Very light volumes on the last full session of the week (TYH2 <660k after the bell), early exit Thu, Fri closed for Christmas eve. (Next week, market closes early for New Years Eve Fri).

- Appetite for risk carried over from prior session with stock near highs in late trade (ESH2 +33.5 at 4674.0, 4678.5 high), West Texas crude gained 1.68 to 72.80 after an unexpected inventory drawdown.

- Limited react to data to positive data: US GDP Revised Up In Q3 (2.3% Q/Q SAAR), slightly lower savings; stronger than exp Consumer Conf unphased by Omicron variant (115.8; EST. 111.0). On tap Thu: wkly claims, PCE Durables, U-Mich and existing home sales. NY Fed buy-ops on hold, resume Jan 3.

- Wed focus more on upbeat Covid headlines: OMICRON HOSPITAL RISK TWO-THIRDS BELOW DELTA: SCOTTISH STUDY; PFIZER PILL CLEARED BY U.S. BECOMING FIRST AT-HOME COVID DRUG, Bbg. Meanwhile, US Pres Biden tested negative for virus after coming in close contact w/carrier earlier in wk.

- US Tsy $17B 5Y TIPS auction tailed 2bp w/-1.508% high yield.

- The 2-Yr yield is up 0bps at 0.6667%, 5-Yr is up 0.5bps at 1.2205%, 10-Yr is down 0.5bps at 1.4566%, and 30-Yr is down 0.9bps at 1.8538%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00238 at 0.07050% (-0.00375/wk)

- 1 Month -0.00150 to 0.10275% (+0.00025/wk)

- 3 Month -0.00462 to 0.21138% (-0.00125/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00088 to 0.32638% (+0.01363/wk)

- 1 Year +0.01138 to 0.55338% (+0.02375/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $249B

- Secured Overnight Financing Rate (SOFR): 0.04%, $896B

- Broad General Collateral Rate (BGCR): 0.05%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $329B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, appr $1.601B accepted vs. $4.062B submission

- NY Fed buy-operations pause for holidays, resume Jan 3:

- Mon 01/03 1010-1030ET: Tsy 2.25Y-4.5Y, appr $6.325B vs. $7.375B prior

- Tue 01/04 1100-1120ET: TIPS 1Y-7.5Y, appr $1.525B

- Wed 01/05 1010-1030ET: Tsy 7Y-10Y, appr $2.425B vs. $2.825B prior

- Wed 01/05 1100-1120ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 01/06 1100-1120ET: TIPS 7.5Y-30Y, appr $0.925B

- Fri 01/07 1010-1030ET: Tsy 0Y-2.25Y, appr $9.325B

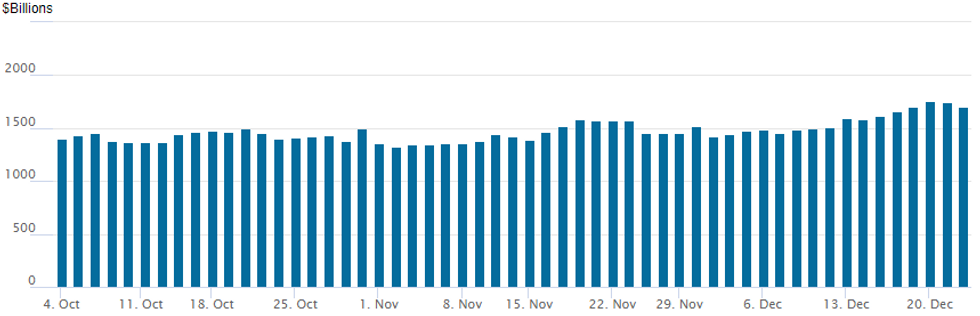

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,699.277B from 82 counterparties vs. Tuesday's $1,748.285B. New record high of $1,758.041B posted Monday, December 20.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -4,000 short Mar 98.62/98.81/99.00/99.31 call condors, 4.0 vs. 98.765/0.05%

- +5,000 Green Mar 98.00/98.75 strangles, 11.0

- +4,000 Mar 99.37/99.62 put spds, 4.5 vs. 99.65/0.37

- -10,000 FVH 120.75 puts, 35 vs. 120-31/0.44%

- +55,000 FVH 119.5/120 put spds, 7

- total 16,200 TYH 130.25 puts, 1

- 2,500 FVG 121/121.5 call spds

- 5,000 TYH 128.5/133 strangles

- 3,100 TYF 130.25/131 2x1 put spds, 23 earlier

FOREX: US Dollar Under Pressure, Cross-JPY Remains Supported

- Broad greenback weakness continued across markets as most G10 counterparts rose to their best levels of the week. The DXY is down 0.4% and completes its third consecutive daily decline, slowly eroding into last Friday’s advance.

- Outlier in this respect is the Japanese Yen which largely represents the extended bid for cross-JPY as equities extended their bounce with overall fears surrounding the Omicron variant waning. AUDJPY, NZDJPY and GBPJPY have all risen just shy of one percent.

- With the Aussie leading the charge in risk, it is worth highlighting the move away from 0.7090 short-term support, bolstering the medium-term outlook for a further recovery from a strong inflection point around 0.6995. Clearance of last week's high of 0.7224 on Dec 16 is needed to trigger a resumption of bullish activity.

- EURUSD broke a cluster of highs just above the 1.13 mark, rising to highs of 1.1342 and approaching last week’s peak at 1.1360. Key resistance, however, at 1.1383 is intact, Nov 30 high. A break of this hurdle is required to signal potential for a stronger recovery towards 1.1407 the 50-day EMA.

- Despite the looming holiday break – plenty of data for markets to assess tomorrow. Core PCE Price Index as well as durable goods headline the US calendar. In Canada, October GDP will be released.

FX: Expiries for Dec23 NY cut 1000ET (Source DTCC)

- EURUSD: 1.1225 (1.97bn), 1.1255 (774mln), 1.1270 (208mln), 1.1275 (230mln), 1.1300 (1.31bn), 1.1305 (233mln), 1.1315 (201mln), 1.1320 (364mln), 1.1330 (355mln), 1.1335 (466mln), 1.1340 (391mln), 1.1350 (782mln).

- USDJPY: 113.75 (733mln), 114.00 (320mln), 114.10 (527mln), 114.50 (276mln)

- USDCAD: 1.2880 (360mln), 1.2900 (230mln), 1.2925 (370mln)

- USDCNY: 6.35 (700mln)

EQUITIES

Key late session market levels:

- DJIA up 184.11 points (0.52%) at 35671.69

- S&P E-Mini Future up 31.75 points (0.68%) at 4672.25

- Nasdaq up 123.8 points (0.8%) at 15463.94

European bourses closing levels:

- EuroStoxx 50 up 42.07 points (1.01%) at 4217.06

- FTSE 100 up 44.25 points (0.61%) at 7341.66

- German DAX up 146.03 points (0.95%) at 15593.47

- French CAC 40 up 86.68 points (1.24%) at 7051.67

COMMODITIES: Oil Supported By Inventory Drawdown And Risk-On

- Oil futures are up 1-1.5% on growing risk-on sentiment, helped by a larger than expected drawdown in US crude oil inventories. They have consolidated these gains since Pfizer’s Covid pill was recently cleared by the FDA.

- WTI is +1.6% at $72.2, with resistance seen at $73.06 (50-day EMA) and initial support at $68.56 (Dec 21 low). Gains are however heavily skewed towards short-dated contracts.

- Brent +1.2% at $74.8, above the 20-day EMA of $74.61 as they next eye the 50-day EMA of $76.21 for resistance. Support is seen at $69.24 (Dec 3 low).

- Gold has been boosted on this backdrop, up +0.6% at $1799.2. It sits between the near-term bull trigger at $1815.6 (Nov 26 high) and the $1772.2 base of the bull channel.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.