-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

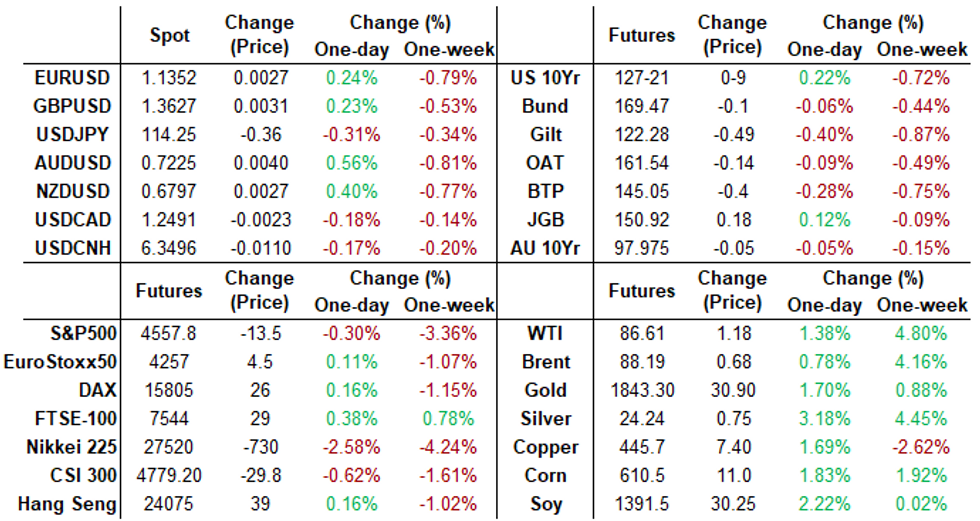

Free AccessMNI ASIA MARKETS ANALYSIS: Yield Surge Stalls, Geopol Risk Rises

US TSYS: FI Round-Up: Ylds Recede, Option Plays Fade Aggressive Hikes

Combination of technical support on the heels of Tuesday's sharp rout in rates and geopolitical tensions over Russia/Ukraine helped Treasury markets regain some ground Wednesday.- On the day, 10YY fell from 1.9006% high to 1.8199% low, 1.8306% after the bell; 30YY from 2.2134% high to 2.1352% low, 2.1426% after the bell.

- Contributing factors: 10Y German Bund yield went positive briefly amid growing concern over supply chain shortages weighing on German economy.

- With underlying futures rebound, accts looked to hedge cooling in tighter policy expectations priced into Whites (EDH2-EDZ2 with four .25bp quarterly hikes starting in March): +70,000 Jun 99.25/99.37/99.50 call flys, 2.25 with Jun'22 futures trading 99.225. In that vein: fading tighter policy move by the Fed via put condor sale: -10,000 Jun 99.06/99.18/99.31/99.43 put condors at 4.25.

- Limited react to data, Housing starts 1.4% vs. -1.7% est, Permits 9.1% vs. -0.8% est; Redbook JAN STORE SALES +14.8%. MNI's Chicago Business Barometer, was revised up to 64.3 in December from 63.1, as a result of the annual seasonal adjustment recalculation. Despite the upwards revision at the end of the year, in aggregate, the Barometer was revised down by -0.1 point in 2021 and revised up by +0.1 point in 2020.

- Tsy futures held near session highs following brief two-way following $20B 20Y note auction re-open (912810TC2) stop-through: 2.210% high yield vs. 2.220% WI; year high 2.48x bid-to-cover better than last month's 2.59x.

- The 2-Yr yield is down 2bps at 1.0225%, 5-Yr is down 4.7bps at 1.6113%, 10-Yr is down 4.6bps at 1.8271%, and 30-Yr is down 4.8bps at 2.1396%.

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N +0.00785 at 0.07814% (+0.00414/wk)

- 1 Month +0.00543 to 0.10914% (+0.00585/wk)

- 3 Month +0.00114 to 0.25514% (+0.01385/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01728 to 0.44714% (+0.05214/wk)

- 1 Year +0.01657 to 0.80357% (+0.07786/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $269B

- Secured Overnight Financing Rate (SOFR): 0.05%, $954B

- Broad General Collateral Rate (BGCR): 0.05%, $357B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $346B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $20.212B submission

- Next scheduled purchases:

- Thu 01/20 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Fri 01/21 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B vs. $9.325B prior

- Tue 01/25 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B vs. $1.525B prior

- Pause for FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

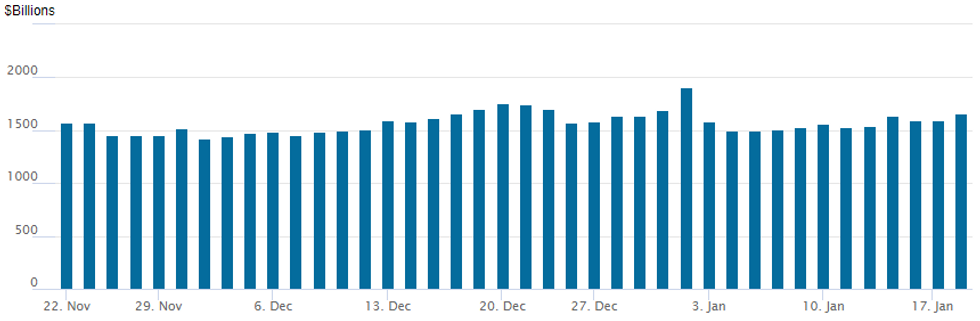

FED Reverse Repo Operation, Highest Usage in 2022 So Far

NY Federal Reserve/MNI

NY Fed reverse repo usage surged to $1,656.576B (highest for 2022 so far) w/83 counterparties today vs. $1,597.137B prior session -- still well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- 4,000 Apr 99.56/Jun 99.87 1x2 call spds

- 70,000 Jun 99.25/99.37/99.50 call flys, 2.25

- Block, 10,000 Mar 99.25/99.37 put spds, 1.0

- +12,000 Sep 98.62/98.87 put spds 1.0 over 99.25 calls vs. 98.91/0.42%

- Overnight trade

- Block, 9,500 Dec 98.87 calls, 16.0 vs. 98.63/0.35%

- Block, -10,000 Jun 99.37/99.50 put spds, 10.0 vs. 99.18

- Block, 2,000 short Mar 98.75/99.00 4x5 call spds, 24.0

- -10,000 short Feb 98.50/98.62/98.75 put trees, 5.5 vs. 98.41-40.5/0.50%

- -8,000 Blue Mar 97.25/97.50/97.75 put flys, 3.5 vs. 97.875/0.10%

- 5,000 TYH 127 puts, 31, total volume >54k part tied to 126.5 put spd

- -15,000 USH 152/153 put spds, 23 vs. 153-29 to -30/0.08%

- 1,800 USH 150/152/153/155 broken put condors

- 12,500 TYG 126/126.5 put spds, 1-2

- 15,000 FVH 119 calls

- Update, +30,000 TYH 126 puts, 24 vs. 127-06 to -06.5/0.28%

- Overnight trade

- +15,000 FVH 118/118.75 put spds, 16.5 ref 118-27

- 2,500 TYG 127.5/128.25 put spds

- 2,000 TYH 124.5/125.5 put spds

- 5,000 TYH 126.5/127 put spds

EGBs-GILTS CASH CLOSE: Intraday Reversal; GGBs Underperform

Gilts (and GGBs) underperformed as stronger-than-expected UK December CPI set a bearish tone for Wednesday's session, added to by a nascent stabilisation in equities.

- Greece's 10-Yr syndication was seen as having soft demand, with E3bln sold on books of >E15bln, about half the demand of last June's sale. GGB spreads widened ~10bp.

- GIlt yields ended sharply higher across the curve, but closing levels reflected an intraday move lower from multi-month highs.

- 10Y Bund yields crossed the 0.00% watermark at the open, but ended negative.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is unchanged at -0.57%, 5-Yr is up 0.3bps at -0.341%, 10-Yr is up 0.6bps at -0.012%, and 30-Yr is up 1.4bps at 0.293%.

- UK: The 2-Yr yield is up 4.1bps at 0.908%, 5-Yr is up 3.3bps at 1.057%, 10-Yr is up 3.9bps at 1.256%, and 30-Yr is up 4.3bps at 1.372%.

- Italian BTP spread up 1.6bps at 135.1bps / Greek up 9.6bps at 174.3bps

EGB Options: A Few Bobl, And OTM Bund Put Buying

Wednesday's Europe rates / bond options flow included:

- RXH2 157p, bought for 2 in ~9.3k

- OEH2 133.25/133.50cs, bought for 5 in 1k

- OEH2 132p, sold at 20 in 4.5k

- ERZ2 100.12/100ps, bought for 2.5 in 2.5k

FOREX: Greenback Off Best Levels, Consolidates Prior Day’s Rally

- The US dollar traded sideways for the majority of the US trading session following a small retrace of yesterday’s strong rally. While the Dollar Index is seen 0.2% lower on the day, the DXY remains above the 95.50 mark, a short-term pivot level of significance.

- In line with greenback weakness, EUR, GBP, CAD, CHF and CNH were all supported.

- However, the outperformers were AUD (+0.56%) and NZD (+0.41%), largely down to an extension of positive price action in the commodity space, with both metals and oil prices providing tailwinds.

- NZDUSD remains well supported below the 0.6750 mark with firm technical support coming in at 0.6700. The Kiwi had caught a bid overnight as participants added hawkish RBNZ bets, with money markets now pricing ~31bp worth of tightening come the end of the Feb MPC meeting.

- A turn higher for AUDUSD and importantly a break of 0.7314, Jan 13 high would resume the recent upleg and cancel the developing bearish technical threat.

- Worth noting some interesting price action in the Canadian Dollar. Canadian CPI printed in line with median estimates, however, the BOC core indices were above expectations. Perhaps with a buy the rumour, sell the fact dynamic in play, USDCAD put in a fresh low at 1.2450, closely matching with Fibonacci support, and then sharply rose immediately after the data back to 1.2520. The pair’s squeeze quickly lost steam after that, consolidating around the 1.2490 level. A move through 1.2448 would open 1.2387, the Nov 10 low.

- Aussie Employment data headlines the overnight session before the Norges Bank rate decision in the early European session.

FX: Expiries for Jan20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1250-65(E997mln), $1.1280-90(E1.1bln), $1.1300-15(E3.8bln), $1.1345-58(E2.2bln), $1.1400-10(E635mln), $1.1450(E1.1bln)

- USD/JPY: Y114.00-20($1.4bln), Y114.65-75($674mln)

- GBP/USD: $1.3750-70Gbp632mln)

- AUD/USD: $0.7260-70(A$526mln)

EQUITIES: Sell-Off Abates, But Not Before NQ Comp Enters Correction

- Despite a dip in prices following the opening bell, Wall Street equity markets traded positively following the London close, but not before the NASDAQ Composite printed a fresh cycle low.

- The Wednesday low put prices at 10% off the November high - thereby entering correction territory, reminding markets of the underperformance in tech/growth names as both the S&P500 and the Dow Jones Industrial Average sit just 5% off the alltime highs printed earlier in January.

- Financials continue to underperform the broader market, with bank earnings generally underwhelming so far, with poor rates trading countering strength across investment banking and advisory services. Disappointing earnings from State Street and US Bancorp led the sector lower.

- The e-mini S&P rose back above the 100-dma support at 4564.2 on the intraday recovery rally, with the level remaining a focus headed into the closing bell. A finish below here would spell further losses for the contract, with 4520.25 and 4485.75 the next downside targets.

COMMODITIES: $100 WTI Calls Top Most Strikes Of the Day For Mar’22

- Crude oil prices have seen yet another day of strong gains on supply disruption, this time a temporary pipeline outage between Iraq and Turkey, along with continued geopolitical tension.

- WTI is +1.26% at $86.51 (having settled +1.8% at $86.96). With an earlier high of $87.85, it briefly tested second resistance at $87.86 (2.00 proj of the Dec 2-9-20 price swing) after which it would open the $90 psychological round number.

- Within the Mar’22 contract, the most active strikes have been $100/bbl calls.

- Brent is +0.75% at $88.17, having also broken the first resistance level of $89.05. This opens $90 and then $91.29 (2.00 proj of the same price swing).

- Gold meanwhile is up strongly, +1.6% at $1842.8 after earlier weakness in equity markets. It has cleared a key near-term resistance of $1831.9 (Jan 3 high) and next opens $1849.1 (Nov 22 high).

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/01/2022 | 0130/1230 | *** |  | AU | Labor force survey |

| 20/01/2022 | 0700/0800 | ** |  | DE | PPI |

| 20/01/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/01/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 20/01/2022 | 1000/1100 | *** |  | EU | HICP (f) |

| 20/01/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 20/01/2022 | 1230/1330 |  | EU | ECB publishes Dec meet accounts | |

| 20/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 20/01/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/01/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 20/01/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 20/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 21/01/2022 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.