-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Atlanta Fed Bostic Walks it Back

US TSYS: Eurodollar/Treasury Roundup, Bumpy Ride

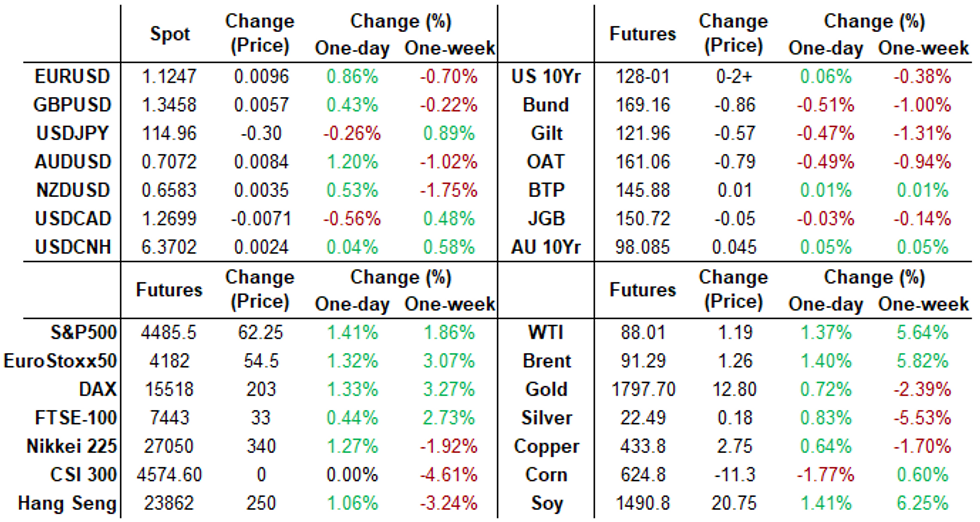

Rates had a bumpy ride Monday, rallying off early lows into the NY close, support evaporating late.- Tsy yield curves rebounding from year+ lows (2s10s taps 61.463 recently vs. 57.076 low) around midday with better fast and real$ buying in 2s-5s after domestic real$ selling 2s and separately buying 5s around late morning.

- Short end lead rebound early in second half, 30Y Bonds back to steady after Atlanta Fed Bostic headlines from Yahoo Finance interview: BOSTIC: 50-BP HIKE IS NOT MY PREFERRED POLICY ACTION FOR MARCH, Bbg

- Saturday FT interview Bostic said 50Bp hike in March possible. “Every option is on the table for every meeting. If the data say that things have evolved in a way that a 50-basis-point move is required or be appropriate, then I’m going to lean into that," Financial Times.

- US equity markets mostly gaining ground, SPX back to Jan 21 levels and north of 200DMA ESH2 topping 4489.0, DOW climbing 285.0 after trading weaker earlier. Contributing to modest risk-appetite, geopol-risk tied to Russia/Ukraine tension little cooler while US officials say diplomatic paths remain.

- Sector performance: Consumer discretionary (+2.05%) sees carry over support from Fri; Information technologies (+1.33%); Communication (+0.75%). flipside: Consumer staples (-0.45%) Financials (-0.40%) lead underperformers.

- Option volumes were fairly muted but continued to favor buying downside put insurance or skew plays: 15,000 short Sep 97.87/98.50 put over risk reversals, 7.5.

- After the bell, 2-Yr yield is up 0bps at 1.1627%, 5-Yr is unchanged at 1.6127%, 10-Yr is up 1.1bps at 1.7802%, and 30-Yr is up 2.7bps at 2.1002%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00114 at 0.07700% (+0.00343 total last wk)

- 1 Month +0.00057 to 0.10686% (-0.00142 total last wk)

- 3 Month -0.00771 to 0.30886% (+0.05886 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00957 to 0.54400% (+0.09000 total last wk)

- 1 Year +0.01443 to 0.96229% (+0.14929 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $82B

- Daily Overnight Bank Funding Rate: 0.07% volume: $281B

- Secured Overnight Financing Rate (SOFR): 0.04%, $908B

- Broad General Collateral Rate (BGCR): 0.05%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $332B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.401B accepted vs. $24.870B submitted

- Next scheduled purchases:

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

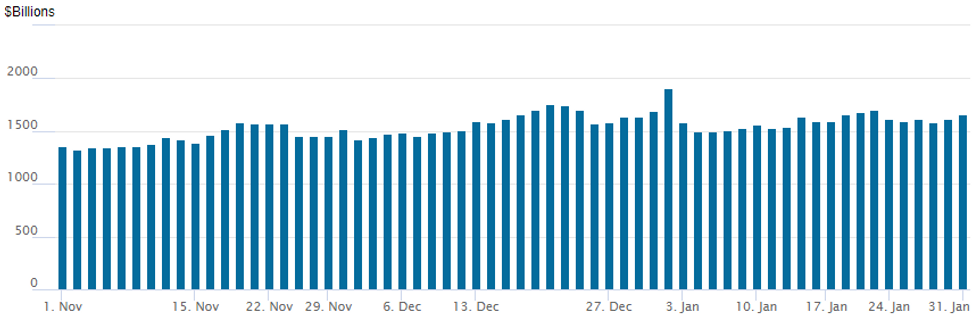

FED Reverse Repo Operation

NY Federal REeserve/MNI

NY Fed reverse repo usage inches higher at $1,654.850B w/88 counterparties vs. $1,615.021B last Friday -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -8,000 short Apr97.87/98.12 3x2 put spds, 28.5 vs. 98.25/0.78%

- +5,000 Sep 97.93/98.37/98.62 put flys, 2.5

- Update, total 15,000 short Sep 97.87/98.50 put over risk reversals, 7.5 ref 98.09

- Block, 42,105 Jun 99.50 puts, 44.0 vs. 99.075/0.85%

- 2,000 May 97.50/97.62 put spds

- 6,000 Apr 99.25/99.31 2x1 put spds

- 2,000 Dec'22/Mar'23 99.37 call spds

- Overnight trade

- 2,000 short Mar 98.37/98.62 put spds

- 3,000 Apr 99.25/99.31 2x1 put spds

- Block, 5,000 Green Jun 98.18/98.31 call spds, 5.0 vs.

- Block 10,000 Green Jun 97.00/97.50 put spds, 5.5

- 3,000 Green Feb 98.06/98.18/98.31 call flys

- Update, >9,000 TYH 125 puts

- 2,000 FVH 118 puts, 5

- Overnight trade

- 5,000 USH 164 calls, 3

- 5,000 TYH 126/127 put spds, 11

- 1,000 TYH 126/127.5 put spds vs. TYM 124.5/126 put spds

EGBs-GILTS CASH CLOSE: Bund Yields Close Above Zero

The week began with sharp rises in UK and German yields, with the short-end and belly bearing most of the brunt as markets eye rising rate hike risks.

- Several factors behind today's rise in yields, including: market-positive political developments in Italy and Portugal, higher than expected inflation readings in Spain / Germany, some continued central bank hike repricing post-Fed, and of course, the looming BoE/ECB meetings this Thursday.

- Multi-year high yields hit across multiple instruments, including Bund (first close above 0% since May 2019), Bobl (Nov 2018)

- Euribor and Short Sterling strips also suffered: 2022 rate hike pricing now roughly totals 25bps for the ECB and 125bps for the BoE.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.9bps at -0.528%, 5-Yr is up 8.5bps at -0.22%, 10-Yr is up 5.6bps at 0.011%, and 30-Yr is up 3.8bps at 0.277%.

- UK: The 2-Yr yield is up 7.7bps at 1.045%, 5-Yr is up 6.3bps at 1.133%, 10-Yr is up 5.8bps at 1.302%, and 30-Yr is up 7.8bps at 1.448%.

- Italian BTP spread down 4.5bps at 128.3bps / Portuguese down 1.1bps at 65.4bps

EGB Options: Some Downside, Some Short Cover

Monday's Europe bond/rate options flow included:

- DUH2 111.80/111.70 put spread bought for 2.25 in 3k

- OEH2 132.00/131.50 put spread bought for 12.5 in 5k

- RXH2 172.50 call bought for 12 to 16 in 20.7k. Hearing short cover

- IKJ2 146/143 put spread vs 147.5/148.5 call spread bought for 26 in 5k (bought p/s)

- 3RH2 99.875/99.625/99.375 put fly sold at 10 in 5.25k

FOREX: Greenback Continues To Lose Ground As Equities Grind Higher

- The US dollar has been in steady decline throughout the US trading session on Monday, showing a strong inverse relationship to recovering major equity benchmarks.

- Improved risk sentiment lent particular support to the Euro, with EURUSD appreciating around 0.7% to ~1.1230. Today's flash estimates of January inflation in Germany, Spain and Portugal were all substantial upside surprises, causing analysts to pre-empt pressure for Wednesday's Eurozone HICP reading and at the same time stoking some renewed optimism for the single currency. First resistance is at 1.1243 High Jan 27 before the more meaningful level of 1.1299 20-day EMA.

- With the European central bank’s baseline assumption facing increased pressure the ECB could opt to retain some optionality, at Thursday’s meeting, by stressing that inflation forecasts carry a high degree of uncertainty and that there are upside risks to inflation (perhaps citing the risk of persistent energy price pressures).

- Maintaining its position as the best performing G10 currency overnight, AUDUSD remains 1.15% higher to start the week, bolstered by a sharp retracement back above the key technical level at 0.6993/91, the Dec 3 2021 and Nov 2 2020 lows. While remaining technically vulnerable, firm short-term resistance will be in focus at 0.7130, the Jan 7 low ahead of the RBA’s decision overnight.

- Elsewhere the dollar lost ground across the board (DXY -0.66%), with relatively smaller gains (0.25-0.55%) being seen for the likes of JPY, CHF, GBP, NZD and CAD.

- EMFX surged amid the more positive backdrop with emerging market currency indices recording close to 1% gains. Between 1-1.5% advances were seen in MXN, ZAR, BRL and CLP.

- Canadian GDP and US ISM Manufacturing PMI data headline tomorrow’s data calendar.

FX: Expiries for Feb01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1150-70(E2.0bln), $1.1215-25(E2.9bln), $1.1300(E1.5bln), $1.1350-55(E1.2bln)

- USD/JPY: Y112.75($708mln), Y113.20-40($1.3bln), Y114.65($600mln), Y115.00-25($1.1bln), Y116.50-65($1.4bln), Y117.00($940mln)

- USD/CAD: C$1.2705($570mln)

- USD/CNY: Cny6.3600-15($1.2bln)

EQUITIES: Stocks Return Higher, Tech/Growth Leads Bounce

- During the final session of the month, equity markets across Wall Street traded higher, with tech and growth names leading the bounce, prompting outperformance in the NASDAQ relative to S&P 500 and Dow Jones Industrial Average.

- The NASDAQ 100 now trades close to 8% off last week's lows, and is again narrowing in on the 200-dma. This sentiment was echoed across the S&P 500, with consumer discretionary and tech sectors ripping higher. The gains were led by some of the most oversold stocks of recent weeks, with Tesla, Netflix, AMD and NVIDIA all sharply higher.

- The risk-on appetite was reflected in the underperformance for value stocks and defensive sectors, leading healthcare and consumer staples to underperform - sitting at the bottom of the pile in the S&P 500.

- The progression of earnings season remains a focus, with Meta (Facebook), Alphabet (Google) and Amazon all due in the coming days. Full earnings schedule including expectations and timings here: https://marketnews.com/mni-us-earnings-schedule-sp...

COMMODITIES: Oil Higher On Further Supply Worries

- Crude oil prices are up 1.3-1.5% today on Russia-Ukraine fears whilst an intercepted Houthi rocket attack showed potential for further re-escalation elsewhere.

- OPEC+ is set to increase production quotas by a scheduled 400kbpd tomorrow though many of its members are struggling to boost output, leaving production below target. OPEC+ is set to meet on Feb 2 to approve a March increase.

- WTI is +1.5% at $88.14, closing on first resistance at $88.84 (Jan 28 high) after which it opens a psychological $90. Support is seen at $85.01 (Jan 26 low).

- Reflecting supply concerns, price increases have been concentrated in front-dated contracts.

- The most active strikes today in the H2 contract have been $90/bbl and $95/bbl calls.

- Brent closed +1.3% at $91.2, also close to resistance at $91.7 (Jan 28 high).

- Gold meanwhile has edged up 0.3% to $1797.3 after last week’s post-Fed slide, sitting comfortably between resistance of $1822.2 (Jan 27 high) and support of $1780.4 (Jan 28 low).

Data Calendar for Tuesday

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/02/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 01/02/2022 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 01/02/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/02/2022 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 01/02/2022 | 0700/0700 | * |  | UK | Nationwide House Price Index |

| 01/02/2022 | 0730/0830 | ** |  | SE | Manufacturing PMI |

| 01/02/2022 | 0730/0830 | ** |  | SE | Services PMI |

| 01/02/2022 | 0730/0830 | ** |  | CH | retail sales |

| 01/02/2022 | 0730/0830 | *** |  | FR | HICP (p) |

| 01/02/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0855/0955 | ** |  | DE | unemployment |

| 01/02/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 01/02/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/02/2022 | 1000/1100 | ** |  | EU | unemployment |

| 01/02/2022 | - | *** |  | US | domestic made vehicle sales |

| 01/02/2022 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 01/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/02/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2022 | 1500/1000 | * |  | US | construction spending |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 01/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.