-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Monday, November 25

MNI ASIA MARKETS ANALYSIS: Yields Grind Higher, CPI Revisions

US TSYS: Eurodlr/Tsy Roundup, Hedging for Hot CPI, 50bp March Liftoff

Despite softer Tsys and late Tue stock bounce, risk appetite felt skittish ahead of Thu's CPI inflation data, (0.6% revised, vs. 0.5% prior).

- CPI seasonal revisions from BLS this morning, JP Morgan economists said the "underlying data (before seasonal adjustment) did not change, and the %oya price increases through December were unaffected and continue to look strong (headline: 7.0%, core: 5.5%)." JPM forecast for Thu's January CPI "is not meaningfully impacted by the revised seasonal factors, and we still look for 0.4% monthly increases in both the headline and core CPI measures, with the core change at 0.44% to two decimals."

- Treasury futures held weaker but holding inside range after $50B 3Y note auction (91282CDZ1) comes in on the screws: 1.592% high yield vs. 1.592% WI; 2.45x bid-to-cover vs. 2.47x last month.

- Indirect take-up surges to new year high of 68.55% vs. last month's high of 61.65%, while direct bidder take-up falls to 11.14% (15.511% Jan). Primary dealer take-up recedes to 20.31% vs. 22.84% in Jan, well under the 5M average of 28.06%.

- Eurodollar/Tsy option trade focus on buying rate hike insurance in March-Sep expiries in short end 5s and 10s, trading accts hedging for a hot CPI read to signal increased chances of a 50bps hike in March and June.

- The 2-Yr yield is up 4.9bps at 1.3394%, 5-Yr is up 4.2bps at 1.8067%, 10-Yr is up 3.8bps at 1.9541%, and 30-Yr is up 3.3bps at 2.2495%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00014 at 0.07700% (+0.00000/wk)

- 1 Month +0.00100 to 0.12571% (+0.01042/wk)

- 3 Month +0.00386 to 0.36629% (+0.02729/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01729 to 0.63986% (+0.08443/wk)

- 1 Year +0.00000 to 1.09171% (+0.09271/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $260B

- Secured Overnight Financing Rate (SOFR): 0.05%, $905B

- Broad General Collateral Rate (BGCR): 0.05%, $347B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $335B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, appr $1.801B accepted vs. $3.665B submitted

- Next scheduled purchase

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

- Next updated schedule will be released Friday, Feb 11 at 1500ET

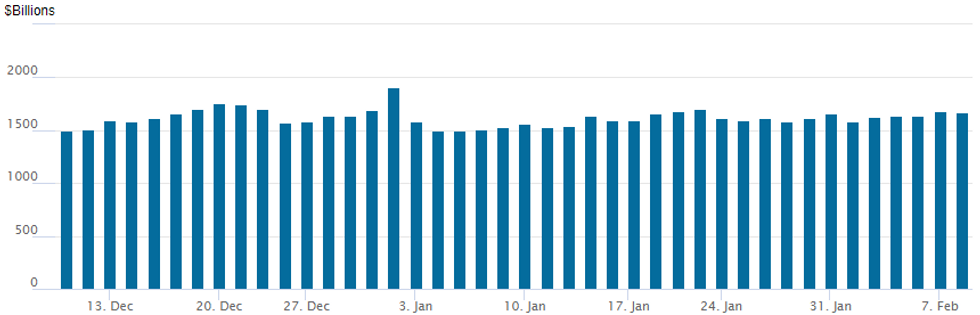

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,674.610B w/ 81 counterparties vs. second highest for year of $1,679.932B yesterday -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, 9,000 Dec 97.75/98.00 put spds, 6.0

- Block, 10,000 Green Jun 97.25/97.62 put spds, 9.5 ref: 97.84

- -3,000 Jun 99.50 puts, 11.0

- Overnight trade

- +18,000 short Sep 96.75/97.25 put spds, 7.5

- -5,000 Green Mar 97.62/98.00/98.25 broken put flys, 3.0

- Block, 10,000 97.50/97.75/98.12/98.37 put condors vs. 5,000 Dec 99.00 calls, 5.0 net on 2x1 package

- Block, 6,000 short Jun 97.43/97.75 3x2 put spds, 9.0

- 6,477 FVH 118/118.5 2x1 put spds, 2.5

- +4,000 FVH 117/117.5 put spds1

- Overnight trade

- +10,000 FVJ 119 calls, 13.5 vs. 118-10.75-10.25/0.24%

- 9,500 TYH 124/125 put spds

- Block, 2,500 wk2 FV 118.5 puts, 24

- +6,000 TYJ 123/125 put spds, 20

- +5,000 TYJ 123/124 put spds, 7

- +10,000 TYH 124/125 put spds, 2-3

- +5,000 TYJ 116.25/117.25 put spds, 15

EGBs-GILTS CASH CLOSE: Heavy Supply Weighs On Long End

European curves bear steepened Tuesday, with yield rises accelerating in the afternoon.

- Supply was a key factor in bear steepening, with long-ends pressured by a Spain 30Y mandate announcement, UK 50Y and NGEU issuance, and ahead of Germany auctioning a 30Y Wednesday.

- Gilts underperformed Bunds, with 10Y yields hitting 1.5% for the first time since 2018.

- BTP spreads underperformed; while GGBs performed, this appeared to be more of a retracement (5bp) of Monday's 20+bp widening.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.1bps at -0.298%, 5-Yr is up 2.6bps at 0.08%, 10-Yr is up 3.6bps at 0.264%, and 30-Yr is up 6bps at 0.453%.

- UK: The 2-Yr yield is up 5.3bps at 1.328%, 5-Yr is up 6.4bps at 1.373%, 10-Yr is up 8bps at 1.488%, and 30-Yr is up 8.9bps at 1.592%.

- Italian BTP spread up 2.9bps at 158.2bps / Greek down 5.1bps at 223.4bps

EGB Options: Big Bund Put Package (And Plenty Of Calls)

Tuesday's Europe rates / bond options flow included:

- OEJ2 130.50/131.75/132.50 call fly bought for 33 in 1.5k

- RXH2 165.5/166.5 call spread bought for 31 in 4k

- RXH2 166/167 call spread bought for 21.5 in 2.5k

- RXJ2 162/160.5/159/157.5 put condor, bought for 34/34.5 in 20k vs RXH2 166/164.5ps sold at 49 in 20k (done vs 4.2k futures at 1665.05)

- RXJ2 159/157ps 1x1.5, bought for 11 in 3k

- RXH2 166.50/168cs, bought for 26.5 in 4k

- DUH2 112/111.90/111.80/111.70p condor, sold at 1 in 3k

- ERM2 100.375/100.50cs vs ERU2 100.375c, bought the cs for 2 in 7.2k

- ERU2 100.25 call, bought for 9.5 in 30k

- ERU2 100.125/100.25/100.375c fly, bought for 2 and 2.25 in 14k on the day

- 0EM2 97.75/97.4375ps 1x1.5, bought for 4.5 in 12k

FOREX: Greenback Continues To Consolidate Ahead Of Inflation Data

- G10 currencies held narrow ranges on Tuesday amid a very light data calendar and markets remaining calm ahead of US inflation data on Thursday.

- The US dollar index is 0.2% higher for the day, however, the index remains broadly unchanged from the start of European trade. Continuing to edge off the recent lows, the DXY looks to be consolidating after last week’s consistent selling pressure.

- Underperformers of note are CAD (-0.39%), JPY (-0.36%) and NOK -0.7%), whereas the Australian dollar managed to post a win as EURAUD continued to erode recent gains.

- Of note in tomorrow’s session, we have Bank of Canada Governor Macklem due to speak at the Canadian Chamber of Commerce on the role of productivity in fostering non-inflationary growth. Having explicitly tied the rate path to productivity growth, his comments will be eagerly anticipated before the March meeting.

- The USDCAD outlook remains bullish despite yesterday’s bearish session. A positive theme follows the recovery from 1.2451, Jan 19 low. Price trading above the 50-day EMA reinforces a bullish theme and has opened 1.2843, a 76.4% retracement. Initial firm support lies at 1.2560, Jan 26 low with immediate support residing at 1.2650, Jan 27 and Feb 2 low.

- Overnight, quarterly inflation expectations for New Zealand will be in focus.

FX: Expiries for Feb09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1300-20(E1.0bln)

- USD/JPY: Y113.80-00($964mln), Y114.50-55($840mln), Y115.00($725mln), Y115.50-60($822mln), Y115.70-90($1.1bln)

- AUD/USD: $0.7150-70(A$1.0bln)

- USD/CAD: C$1.2720-30($740mln)

EQUITIES: Wall Street Turns Higher After Lacklustre Start

- Equity markets across the US opened flat, in a particularly subdued start to the session. Volumes crossing in the e-mini S&P were at their lowest since New Year's Eve, showing that traders look happy to sit on the sidelines ahead of Thursday's key CPI release.

- The beleaguered NASDAQ outperformed the S&P500 and DJIA Tuesday, although Monday's highs remained out of reach at 14,806.25, leaving prices closer to recent lows.

- Energy names were the laggard, slipping alongside WTI and Brent crude prices as markets read into reports that negotiations with Iran were advancing, and as France's Macron appeared to reassure markets that near-term tensions with Russia were more muted over Ukraine.

- Earnings season has begun to wind down, with 9% of the S&P 500 due to report across the week. Highlights include Amgen, Pfizer, Walt Disney, Coca-Cola and the ratings agencies Moody's and S&P Global.

- Healthcare and consumer staples make up the bulk of earnings, with Thursday the busiest session for the index.

- Full earnings schedule for the week here: https://marketnews.com/mni-us-earnings-schedule-qu...

COMMODITIES: Thawing Of Geopolitical Risks Plus Iran Progress

- Crude oil prices have fallen for a second day as Iran nuclear talks progressed (proposals are “on the finish line”) and Macron said he received assurances from Putin that we would not escalate the situation further, even if Moscow cast doubt on this.

- With oil already offered, there appeared to be little impact from White House Economic Adviser Bernstein saying that releasing more oil reserves is an option.

- WTI is -1.7% at $89.75, having cleared initial support of $90.07 (Feb 4 low) which next opens $86.34 (Jan 31 low). The most active strikes in the H2 contract have been $95/bbl calls.

- Brent is -1.7% at $91.09, also through first support at $91.2 (Feb 4 low) and opening $87.72 (Feb 1 low).

- Gold is up another 0.4% today at $1828.5 and currently sits between the bull trigger of $1853.9 (Jan 25 high) and the bear trigger of $1780.4 (Jan 28 low).

DATA CALENDAR for WEDNESDAY

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/02/2022 | 0700/0800 | ** |  | DE | trade balance |

| 09/02/2022 | 0900/1000 | * |  | IT | industrial production |

| 09/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/02/2022 | 1310/1310 |  | UK | BOE Pill at UK Monetary Policy outlook conference | |

| 09/02/2022 | 1500/1000 | ** |  | US | wholesale trade |

| 09/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 09/02/2022 | 1530/1030 |  | US | Fed Governor Michelle Bowman | |

| 09/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 09/02/2022 | 1700/1200 |  | CA | BOC Governor Macklem speaks to Chamber of Commerce | |

| 09/02/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/02/2022 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 09/02/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.