-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

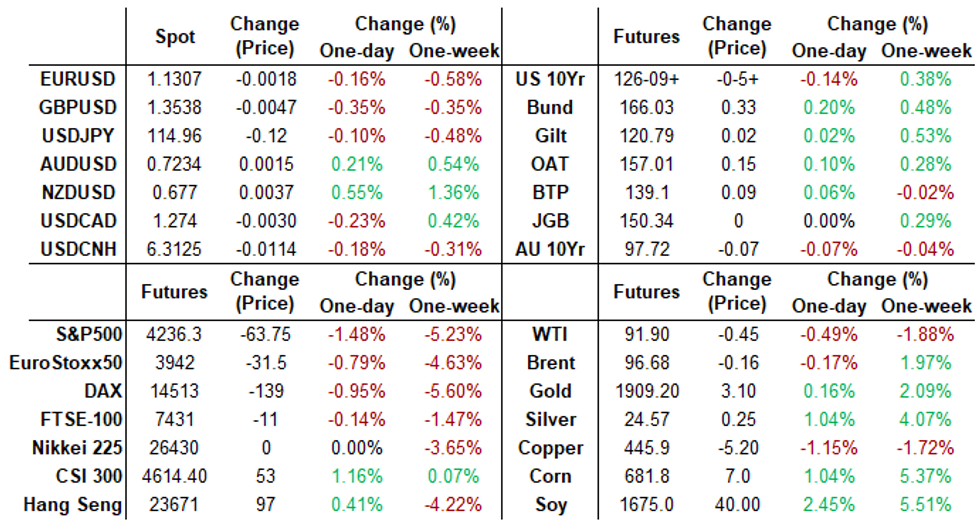

Free AccessMNI ASIA MARKETS ANALYSIS: Early Risk Appetite Sours

US TSYS: Risk Appetite Sours As Russia/Ukraine Tensions Heat Up

Tsys holding weaker across the board after the bell -- near the middle of the NY session range after some mid-morning whip-saw action. Yield curves mostly steeper, off early flatter levels w/ 5s30s just over 39.0 (+1.80). Heavy volumes driven by spike in Mar/Jun futures roll (Jun takes lead on Feb 28).- No market react to late SF Fed president Daly comments supporting liftoff in March absent "significant negative surprise" for economy, with as many as four hikes for the year.

- Session opened with a false risk-on tone despite building tensions over Russia threat to Ukraine, Tsys weaker vs. modest rally in stocks (ESH2 tapped 4345.5 high). Tsys sold off/extended session low midmorning (30YY 2.2927% high) with trading desks citing rate lock hedging vs. surge in corporate debt issuance (near $11B on day not exceptionally large however).

- Tsys reversed course, bouncing on headlines that Russia is within 48 hours of full-scale invasion of Ukraine. Equities sold off sharply into the close, SPX emini taps 4216.75 low.

- White House annc'd expanded sanctions on Russia elites and Nordstream 2 pipeline.

- Futures moderated through the second half holding modestly weaker after $53B 5Y note auction (91282CEC1) small stop: 1.880% high yield vs. 1.882% WI; 2.49x bid-to-cover vs. 2.50x last month.

- Limited option volumes focused on building downside (rate hike) put positions.

- The 2-Yr yield is up 4.7bps at 1.5956%, 5-Yr is up 2.4bps at 1.8864%, 10-Yr is up 3.1bps at 1.9703%, and 30-Yr is up 3bps at 2.2666%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 at 0.07743% (+0.00186/wk)

- 1 Month +0.01100 to 0.18686% (+0.01615/wk)

- 3 Month +0.00971 to 0.49757% (+0.01800/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.04486 to 0.82629% (+0.04500/wk)

- 1 Year +0.04829 to 1.33686% (+0.05100/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $257B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $930B

- Broad General Collateral Rate (BGCR): 0.05%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $332B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Next scheduled purchases:

- Thu 02/24 1010-1030ET: Tsy 0Y-22.5Y, appr $6.225B steady

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

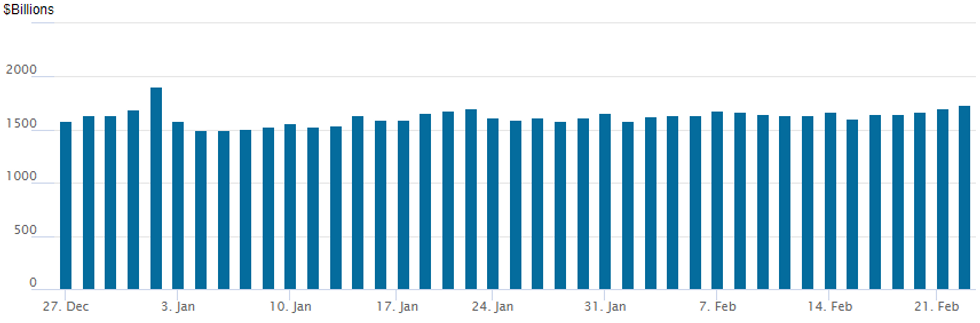

FED Reverse Repo Operation, Highest of Year

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,738.322B -- highest of year w/ 77 counterparties vs. $1,699.432B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 short Sep 97.25/97.50 put spds, 8.5 ref 97.655

- Block, +15,000 99.37/99.43/99.50/99.56 call condors, 1.75

- Overnight trade

- 2,000 short Mar 97.75/97.87 put spds vs. Blue Mar 97.75 puts

- +4,500 short May 97.12/97.37 2x1 put spds, 1 cr

- -15,000 short Apr 98.00/98.25 put spds, 20.0

- 3,000 short Jul 97.25/97.50 put spds vs. 98.25/98.37 call spd vs.

- 2,000 Green Mar 97.75/98.00 put spd

- +6,000 short Dec 96.62/96.87/97.62 broken put flys, 19.0 vs. 97.675/0.20%

- -5,000 short Apr 98.00/98.25 put spds, 20.0 ref 97.685

- +5,000 Apr 98.75/99.12 call spds

- -2,500 TYJ 125.75/126.75 strangles

- 7,000 TYJ 125 puts, 25

- 14,300 FVM 115.75 puts

- Block, 10,000 FVJ 117 puts, 28.5 w/another 5k at 28 on screen a minute later

EGBs-GILTS CASH CLOSE: Long-End German Rally Stands Out

UK short-end yields easily outperformed German counterparts Wednesday, though it was a different story further down the curve.

- BoE speakers in focus throughout the session, first with Treasury Committee hearing including Bailey which was taken as marginally dovish; in the afternoon the short-end saw a modest rally on Tenreyro (dove)'s call for a "small amount of policy tightening".

- Bund / Buxl stood out for afternoon outperformance of Gilts and Tsys. While Ukraine-Russia escalation headlines were at least partly responsible, the lack of movement in the short-end (and UK long-end) stood in stark relief.

- Periphery spreads widened on renewed geopolitical risk-off.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4bps at -0.359%, 5-Yr is up 0.7bps at 0.008%, 10-Yr is down 1.5bps at 0.228%, and 30-Yr is down 2.9bps at 0.467%.

- UK: The 2-Yr yield is down 4.2bps at 1.296%, 5-Yr is down 3.1bps at 1.331%, 10-Yr is up 0.8bps at 1.479%, and 30-Yr is up 1.6bps at 1.564%.

- Italian BTP spread up 3.2bps at 171.3bps / Spanish up 1.3bps at 103.3bps

EGB Options: Decent Bobl, Light Otherwise

Wednesday's Europe rates / bond options flow included:

- OEJ2 130.50/129.50ps 1x1.5, bought for 19.5 in 5k

- OEJ2 131.00/130.00ps 1x1.5, sold at 24.5 in 15k

- SFIH2 98.87/98.70ps vs 99.20c, sold the call at 1.25 in 2k

FOREX: FX Majors Exhibit Narrow Ranges Despite Weakness In Equities/Ruble

- The US dollar index is around 0.20% firmer as renewed weakness in equity indices has seen haven-tied FX be supported. With that said, major currency pairs are largely taking a back seat to the broader moves in global markets.

- EURUSD has traded on the backfoot, in line with the stronger dollar, however, still remains above the 1.1300 mark and has struggled to gather any momentum to the downside. Similarly, USDJPY has remained pegged to the 115.00 level, clocking just a 27-pip range on Wednesday.

- Slightly more in play with the risk-off dynamics has been the Swiss Franc, rising just over 0.5% against the Euro, outshone only by NZD which has retained a good portion of the RBNZ induced gains earlier on Wednesday.

- Naturally, the pain has been most evident in the Russian Ruble, declining 2.95% as of writing. USDRUB has extended above the November 2020 highs north of the 81.00 mark.

- Gains this week have resulted in a break of resistance at 80.4155, Jan 26 high. This confirmed a resumption of the underlying uptrend and signals scope for a climb towards 81.5675 and 82.3602, the 2.00 and 2.236 projection of the Feb 10 - 11 - 16 price swing.

- BoE Governor Bailey is due to deliver pre-recorded opening remarks at the BOE's First Annual BEAR Conference tomorrow at 1315GMT/0815ET. The US data docket is headlined by the second reading of Q4 US GDP. Also, potential comments from Fed’s Mester due to speak about economic outlook and monetary policy at an online event hosted by the University of Delaware. Q&A is expected.

FX: Expiries for Feb24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200-15(E1.8bln), $1.1225(E627mln), $1.1245-55(E1.5bln), $1.1265(E548mln), $1.1290-00(E3.4bln), $1.1315-35(E2.3bln), $1.1345-50(E752mln), $1.1385-00(E1.4bln), $1.1425-35(E1.0bln)

- USD/JPY: Y113.50($715mln), Y114.30-50($592mln), Y115.25-30($781mln), Y116.40($1.4bln)

- EUR/GBP: Gbp0.8335-55(E807mln)

- EUR/JPY: Y128.65-70(E591mln)

- AUD/USD: $0.7225-35(A$2.7bln), $0.7270(A$541mln)

- USD/CAD: C$1.2645-50($1.5bln), C$1.2695-10($827mln), C$1.2800-10($849mln)

- USD/CNY: Cny6.3700($675mln)

EQUITIES: Extending Losses

Stocks continue to sell off ahead the FI close, SPX eminis through first support of 4250.00 (yesterday's low) to 4234.25. Brief rebound into midday has reversed, round of program selling on headlines the US is considering release of oil reserves as prices rise on Ukraine/Russia tensions.

- Focus on second support year’s low of 4212.75 on Jan 24.

- SPX Eminis currently trading -61.75 points (-1.44%) at 4238.5; Dow Industrials -371.87 points (-1.11%) at 33223.5; NASDAQ -258.4 points (-1.9%) at 13123.16.

- SPX lagging sectors:

- Communication Discretionary -2.80%

- Information Technology -1.88%

- Industrials and Utilities -1.41%

- RES 4: 4739.50 High Jan 12

- RES 3: 4671.75 High Jan 18

- RES 2: 4586.00 High Feb 2 and a near-term bull trigger

- RES 1: 4484.50 High Feb 16

- PRICE: 4332.25 @ 14:04 GMT Feb 23

- SUP 1: 4250.00 Low Feb 22

- SUP 2: 4212.75 Low Jan 24 and the bear trigger

- SUP 3: 4186.57 23.6% of the Mar ‘20 - Jan ‘22 major rally

- SUP 4: 4131.04 0.764 proj of the Jan 4 - 24 - Feb 2 price swing

COMMODITIES: Oil Ending Mixed Day Softer On Potential US Reserve Release

- Oil prices are ending a mixed day softer after headlines that the US is eyeing releasing oil reserves in response to higher prices on Russia-Ukraine, whilst gold is once again boosted by its safe haven properties.

- Oil prices had sharply increased on earlier headlines on the potential of a full-scale Russian invasion of Ukraine within 48 hours and an concurrent cyber-attack on Ukraine before retracing.

- WTI is -0.6% at $91.4, further pulling back from yesterday’s high of $94.95, which now forms initial resistance, but above key short-term support defined at $87.46 (Feb 18 low).

- Within the Apr’22 contract, the most active calls are $100/bbl for the second day running whilst the most active puts have been $85/bbl.

- Brent is -0.6% at $96.3, sitting off new resistance of $99.5 from yesterday’s high whilst above support from the 20-day EMA of $91.99.

- Gold has bounced +0.5% to $1907.7 as its strong uptrend continues after dipping yesterday. Resistance remains yesterday’s high of $1914.3 as it approaches the medium-term upside target of $1916.6 (the Jun 1, 2021 high). Initial support is $1879.6 (Feb 15 high).

Thursday Data Roundup

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/02/2022 | 0030/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 24/02/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 24/02/2022 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 24/02/2022 | 0900/1000 | * |  | IT | industrial orders |

| 24/02/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 24/02/2022 | 1315/1315 |  | UK | BOE Bailey Intro at BEAR Research Conference | |

| 24/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 24/02/2022 | 1330/0830 | *** |  | US | GDP (2nd) |

| 24/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/02/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 24/02/2022 | 1500/1000 | *** |  | US | new home sales |

| 24/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 24/02/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 24/02/2022 | 1600/1700 |  | EU | ECB Schnabel panels BOE BEAR conference on Unwinding QE | |

| 24/02/2022 | 1600/1600 |  | UK | BOE Broadbent moderates panel at BEAR Conference on QE | |

| 24/02/2022 | 1600/1100 |  | US | San Francisco Fed's Mary Daly | |

| 24/02/2022 | 1610/1110 |  | US | Atlanta Fed's Raphael Bostic | |

| 24/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 24/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 24/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 24/02/2022 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 24/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 25/02/2022 | 2330/0830 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.