-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

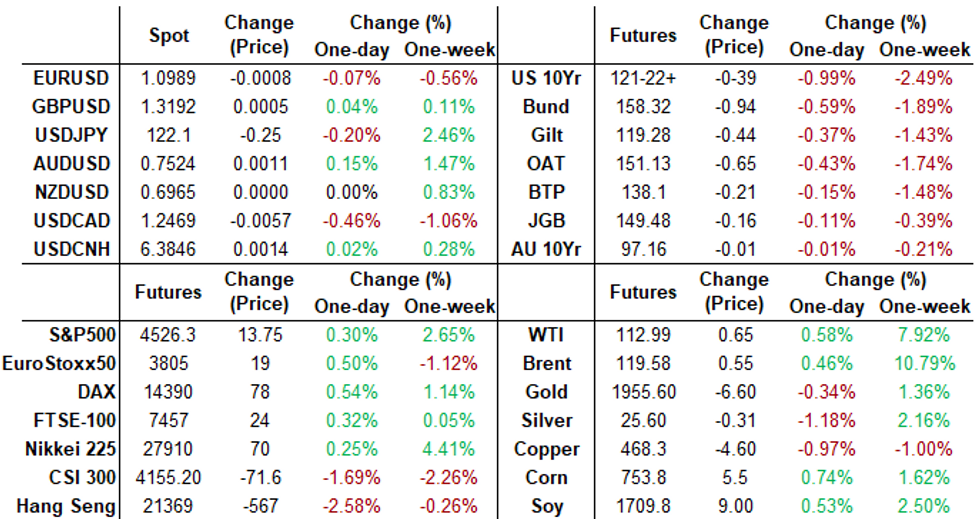

Free AccessMNI ASIA MARKETS ANALYSIS: Fed: Don't Worry About Inversion

US TSYS: Yield Curves Pancake

Tsy yield curves bear flattened in a hurry Friday as confidence in Fed managing a soft landing wavers. After starting off the session around +12.17, the 5s30s curve slipped below 2.0 recently to 1.317 low -- back near early 2006 levels now when pair inverted from Feb-March to low of -12.669 on Feb 27, 2006.- Meanwhile, 3s, 5s and 7s extending inversion vs. 10s, 5s10s at -8.125 vs. -9.094 low as Tsys held near session lows through the second half. See MNI Policy main wire Brief: Fed Paper Dismisses Yield Curve Inversion Signal at 1100ET. Link to Fed paper: (Don't Fear) The Yield Curve, Reprise.

- US FI markets gapped lower (30YY surged from appr 2.512% to 2.5767% over 20 minute period, making new highs at 2.641%). Timing of rate move occurred around the release of IFX headlines: RUSSIAN ARMY TO FOCUS ON TAKING FULL CONTROL OVER DONBAS, however: Open to interpretation on whether that is a positive development (potential for triggering rate sale) or NOT as equities trimmed gains over same period.

- On tap for next week:

- Advance Goods Trade Balance (-$107.6B, -$106.3B), 0830ET

- Wholesale Inventories MoM (1.0% rev, 0.8%), 0830ET

- Retail Inventories MoM (1.9%, 1.3%), 0830ET

- Dallas Fed Manf. Activity (14, 10), 1030ET

- Treasury auctions Monday:

- US Tsy $57B 13W, $48B 26W bill auctions at 1130ET

- US Tsy $50B 2Y Note auction (91282CEG2), 1130ET

- US Tsy $51B 5Y Note auction (91282CEF4), 1300ET

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00129 at 0.32657% (-0.00214/wk)

- 1 Month -0.00200 to 0.44514% (-0.00143/wk)

- 3 Month +0.01729 to 0.98286% (+0.04886/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.02528 to 1.45114% (+0.16357/wk)

- 1 Year +0.03085 to 2.08871% (+0.30228/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $74B

- Daily Overnight Bank Funding Rate: 0.32% volume: $246B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.27%, $900B

- Broad General Collateral Rate (BGCR): 0.30%, $351B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $339B

- (rate, volume levels reflect prior session)

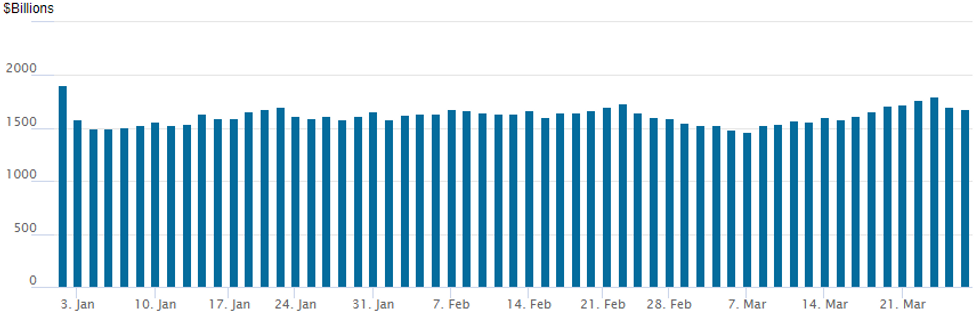

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,676.974B w/ 86 counterparties vs. prior session's $1,707.655B. Compares to Wednesday's year-to-date high of $1,803.186B and still well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Friday's Eurodollar, Treasury option flows were a bit more subdued than the prior session, perhaps wary of adding to positions after underlying rates sold off sharply in early trade -- taking a wait and see approach ahead of the weekend.- Note on underlying Treasury futures and yield curve in relation to recession concern -- or measure of confidence in Fed managing a soft landing. Tsy yield curves bear flatten sharply! After starting off the session around +12.17, the 5s30s curve slipped below 2.0 recently to 1.6632 low -- brings it back near early 2006 levels now when pair inverted from Feb-March to low of -12.669 on Feb 27, 2006. Meanwhile, 3s, 5s and 7s extending inversion vs. 10s, 5s10s at -8.125 vs. -9.094 low.

- Treasury options appeared to favor buying put structures across the curve with particular interest in 5s as the sector seems to be the most sensitive to hawkish Fed shifts.

- Over +67,000 FVK 114 puts, 26-26.5 and +10,000 FVM 112/113 put spds, 10.5 vs. 114-26.5/0.08%. in 10Y options:

- +7,000 TYK 121/122.5 put spds 7.0 over 124.5 calls vs. 122-25/0.46%; 30Y: +6,000 USK 147/147.5 put spds, 3

- Eurodollar option trade was more mixed on net, couple notable trades: buyer of +10,000 Jun 98.87/99.00 call spds, 1.25 followed by sale of -10,000 Sep 97.50/97.87 call over risk reversals, 3.0 vs. 97.72/0.80%. Late iron condor sale took in 28.5 on -4,000 Jun 96.25/96.75/97.87/98.8.37 iron condors.

- -10,000 Sep 97.50/97.87 call over risk reversals, 3.0 vs. 97.72/0.80%

- -4,000 Jun 96.25/96.75/97.87/98.8.37 iron condors, 28.5

- Seller Dec 97.00/97.37/97.87 put trees, 3.0

- +10,000 Jun 98.87/99.00 call spds, 1.25

- +2,000 Sep 98.00/98.25 call spds 0.0 over Sep 97.00 puts

- +5,000 Dec 97.00 puts, 25.5 vs. 97.405/0.32%

- +5,000 short Dec 97.00 puts, 25.5 vs. 97.405/0.32%

- Overnight trade

- +2,000 short Apr 97.37/97.50 call spds, 1.5 ref: 97.005

- -2,000 Dec 96.87/97.50 3x2 put spds, 31.0 ref 97.39

- 7,000 TYM 127 calls, 13

- 7,100 TYM 116.5/118.5 put spds, 4

- 2,500 TYK 120/122 put spds, 54

- 1,500 FVK 113/113.5/114 put flys

- 2,000 FVK 113.5 puts, 28.5

- Block, +10,000 FVK 114 puts, 31 ref 114-17.5

- +1,000 TYK 118/120/122 put flys, 20 vs. 122-23

- Overnight trade

- 1,500 TYM 118.5/120 put spds

- Block, +5,000 FVM 112/113 put spds, 10.5 vs. 114-26.5/0.08%

- +7,000 TYK 121/122.5 put spds 7.0 over 124.5 calls vs. 122-25/0.46%

- +6,000 USK 147/147.5 put spds, 3

- +5,000 FVK 114 puts, 26-26.5

EGBs-GILTS CASH CLOSE: Another Day, Another Selloff

Bond weakness saw little respite to end the week, with the short-end/bellies of the UK and German curves selling off sharply.

- Multiple potential factors weighed, including an increasingly hawkish sell-side outlook for near-term Fed hikes, and optimism that Russia may have limited its ambitions in the Ukraine conflict.

- Both the UK and German curves bear flattened. 10Y Bund yields hit highest since 2018 and closed on the highs.

- Periphery EGB spreads narrowed on core weakness: GGBs outperformed.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.4bps at -0.135%, 5-Yr is up 8.5bps at 0.355%, 10-Yr is up 5.5bps at 0.587%, and 30-Yr is up 3.5bps at 0.7%.

- UK: The 2-Yr yield is up 6.8bps at 1.416%, 5-Yr is up 5.8bps at 1.473%, 10-Yr is up 4.9bps at 1.695%, and 30-Yr is up 4bps at 1.881%.

- Italian BTP spread down 2.5bps at 149.6bps / Greek down 4.3bps at 222.8bps

EGB Options: Large Bobl Downside, Mixed Euribor

Friday's Europe rates / bond options flow included:

- OEK2 129.50/128.50 ps vs 130.25 c, bought the ps for -.7.5 up to -6 (receive) in 20k total

- ERZ2 99.37p, sold at 7.25 in 5k

- ERU2 100.125/100.25/100.50c fly, bought for 1 in 5.5k

FOREX: More Muted Friday After Volatile Week

- Currency markets were more muted Friday, consolidating after several sessions of acute volatility - mainly led by JPY crosses. Both USD/JPY and EUR/JPY this week printed fresh cycle and multi-year highs, sending upside targets north and prompting mild verbal intervention from Japanese ministers. Both currencies showed technical signs of being overbought, prompting a session of consolidation Friday in which the JPY regained a very small part of the recent lost ground.

- NOK was the strongest performer Friday, benefiting from both a higher oil price as well as the Norges Bank decision on Thursday, which showed a far sharper, steeper rate path projection relative to the past forecast round in December. USD/NOK and EUR/NOK hold close to recent YTD lows.

- The oil saw support into the Friday close, as an attack on a Saudi Aramco facility in Jeddah erased any downside pressure that followed reports that the US are considering another wave of oil reserve releases as gas prices remain sticky.

- Focus in the coming week turns to the latest US jobs release, with markets expecting job gains of 480k and another downtick in the unemployment rate to 3.7%. Personal income/spending data is also due, while markets will also contend with month-end flows.

FX: Expiries for Mar28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0950-60(E1.0bln), $1.1000(E532mln)

- USD/JPY: Y120.50-70($649mln)

- USD/CAD: C$1.2535-50($1.0bln)

Late Equity Roundup, SPX Firmer, Near Mid-Range

Equity indexes have had a rocky session are holding mostly/mildly higher after the FI close: SPX eminis near middle of the session range: +2.25 (0.05%) at 4515.5, Dow trades +6.91 (0.02%) at 34717.1, and Nasdaq -99.3 (-0.7%) at 14092.99.

- Earlier focus was on key resistance of 4578.5 (Feb 9 high), while morning sell-off turned focus to key support of 20-day EMA: well below at 4375.64.

- SPX leading/lagging sectors: Energy sector remains strong +2.02%, with Utilities +1.18. Laggers: Information Technology sector (-0.76%) after making strong gains Thu, and Consumer Discretionary -0.59% (durables: +0.17 weighed down by retailing -0.41%, consumer services -0.54 and autos -1.36%)

- Dow Industrials Leaders/Laggers: Travelers insurance (TRV) +2.78 at 187.00, Chevron (CVX) +2.59 at 168.89 (U.S AUTHORIZE CHEVRON TO OPERATE IN VENEZUELA, Bbg). Laggers: Home Depot (HD) continues to sell off -5.64 at 310.14.

COMMODITIES: Oil Finishing A Strong Week Nudging Higher

- Oil prices sit only slightly higher on the day having fallen through the day before rising sharply on a missile strike on a Saudi Aramco distribution plant.

- However, rather than simply being a short-term supply shock only effecting a few front-dated contracts, the increasingly frequency of attacks appears to have weighed on prices further out the curve.

- WTI is +0.6% at $113.0 and hasn’t troubled yesterday’s resistance of $116.64. Support is seen at the 20-day EMA of $103.74.

- After a mixed day, the most active strike for the May’22 contract has been $130/bbl calls followed by $126/bbl calls.

- Brent is +0.5% at $119.57, also below initial resistance of $123.74 (Mar 22 high) whilst comfortably above support at the 20-day EMA of $109.28.

- Gold is -0.16% at $1954.63, seeing a dip as rate hike expectations surged. Having cleared a similar level of resistance yesterday, it next eyes $1966.1 (Mar 24 high) whilst support is seen at the 50-day EMA of $1899.6.

- Weekly moves: WTI +7.6%, Brent +10.5%, Gold +1.7%, European Nat Gas -3.6 to -3.8%.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/03/2022 | 1100/1200 |  | UK | BOE Bailey in Conversation w. Guntram Wolff | |

| 28/03/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/03/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/03/2022 | 1430/1530 |  | UK | DMO Consultation Gilt Issuance 2022/23 | |

| 28/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 28/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/03/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 28/03/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.