-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: KC George on Faster Asset Draw Down

US TSYS: Waiting For Fri's March Jobs Data

FI markets traded higher by the closing bell, inside range on robust volumes (TYM2>1.5M). Yield curves gradually scaled back early steepening, mixed after the bell. After briefly inverting Tuesday, 5s30s hit +5.122 high and finished around 3.33 +3.28.- Aside from mixed geopol headlines re: Russia/Ukraine, KC Fed George generated some interest after midday after mentioning "FED BALANCE SHEET SIZE NEEDS TO DECLINE SIGNIFICANTLY ... while "ROLLING OFF FED ASSET HOLDINGS COULD HELP STEEPEN CURVE" Bbg.

- George said it's clear that removing accommodation is required and laid out a more cautions stance on raising the federal funds rate, paired with a desire to roll assets off of the central bank's balance sheet faster.

- "Given the state of the economy, with inflation at a 40-year high and the unemployment rate near record lows, moving expeditiously to a neutral stance of policy is appropriate," she said, characterizing recent inflation as a result of supply constraints in the face of strong demand.

- Little/no react to March ADP +455 vs. +450 est, +6.9%. Thursday data focus on weekly claims (+196k est), Personal income/spending at 0830ET; Chicago PMI (57.0 vs. 56.3 prior) at 0945ET.

- The 2-Yr yield is down 4.4bps at 2.3204%, 5-Yr is down 5.8bps at 2.4399%, 10-Yr is down 4.6bps at 2.3488%, and 30-Yr is down 2.8bps at 2.4735%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00057 at 0.32814% (+0.00157/wk)

- 1 Month -0.00229 to 0.45514% (+0.01000/wk)

- 3 Month -0.03914 to 0.96686% (-0.01600/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.02771 to 1.47200% (+0.02086/wk)

- 1 Year -0.07714 to 2.12586% (+0.03715/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $83B

- Daily Overnight Bank Funding Rate: 0.32% volume: $255B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.28%, $874B

- Broad General Collateral Rate (BGCR): 0.30%, $332B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $320B

- (rate, volume levels reflect prior session)

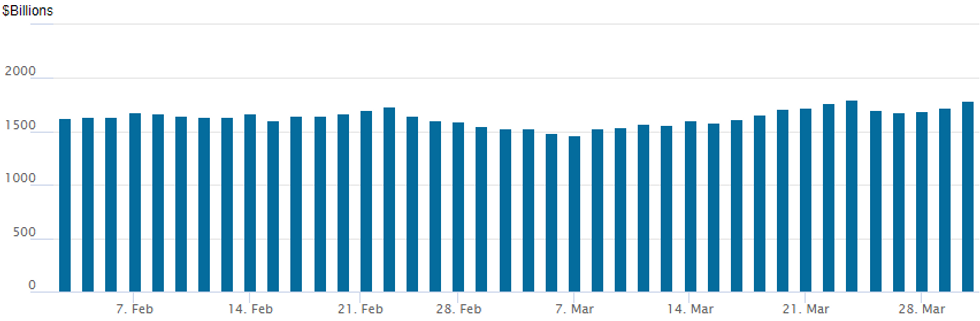

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,785.939B w/ 86 counterparties vs. prior session's $1,718.870B. Compares to Wed, March 23 year-to-date high of $1,803.186B and all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Wednesday's derivatives trade appeared mixed on moderate volumes. Early buyers of low delta calls and puts turned two way by midday as underlying FI futures reversed early losses, extended higher in second half. Call buying picked up midday, particular interest in 5Y calls with buy of 25,000 FVK 114.5 calls, at 32.5 vs. 114-019.5 on 0.45% delta.- Eurodollar futures gained after latest 3M LIBOR settle falls -0.03914 to 0.96686%, -0.01600 total on week now after climbing to 1.00600% Tuesday -- highest since April 2020, futures finishing near highs across the strip as market pricing in multiple rate hikes for 2022 cools (203bp from 220bp on Monday).

- Salient mixed wing trade: included buyer of 15,000 short Jul 98.62/98.87 call spds, 3.0 vs. 96.85/0.06%.

- Block, 10,000 Jun 98.12/98.43 2x1 put spds, 6.5

- +15,000 short Jul 98.62/98.87 call spds, 3.0 vs. 96.85/0.06%

- -4,000 Red Jun'23 96.00/97.50 call over risk reversal, 1.0 vs. 96.85/0.60%

- +5,000 Red Dec'23 96.25 puts. 54.5

- +3,000 short May 96.62/96.87 2x1 put spds, 1.5 vs. 96.80/0.20%

- 2,500 Blue Jun 96.62/96.75/96.87 2x3x1 put flys

- Overnight trade

- Blocks, total 12,000 Blue Jun 96.75/97.12 put spds, 8

- +2,500 TYM 126.5 calls, 13

- -5,000 TYM 124.5 calls, 36

- +5,000 wk2 TY 124.5 calls, 5

- +5,000 wk3 TY 124.5 calls, 9

- 6,100 TYM 123/125.5 call spds, 43

- +25,000 FVK 114.5 calls, 32.5 vs. 114-09.5/0.45%

- 4,000 TYM 125 calls, 25

- +2,000 TYM 124/125 call spds, 16

- Overnight trade

- Block+screen: 27,000 FVK 114 puts, 24-25.5

EGBs-GILTS CASH CLOSE: Negative Yields Disappearing

German FI underperformed UK counterparts Wednesday with sharp bear flattening in the curve as ECB rate hike expectations edged higher.

- Higher-than-expected Spanish and German inflation data spurred a sell-off at the short end, more than offsetting weak economic sentiment data.

- As end-2022 ECB rate expectations rose into positive territory for the first time, likewise Schatz yields closed above 0% for the first time since 2014.

- Greece outperformed, with 10Y GGB spreads narrowing 10bp.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.5bps at 0.002%, 5-Yr is up 5.2bps at 0.484%, 10-Yr is up 1.3bps at 0.646%, and 30-Yr is up 0.7bps at 0.732%.

- UK: The 2-Yr yield is up 2.7bps at 1.382%, 5-Yr is up 2.6bps at 1.443%, 10-Yr is up 2.4bps at 1.666%, and 30-Yr is up 2.4bps at 1.813%.

- Italian BTP spread unchanged at 148.2bps / Greek down 10.3bps at 212.6bps

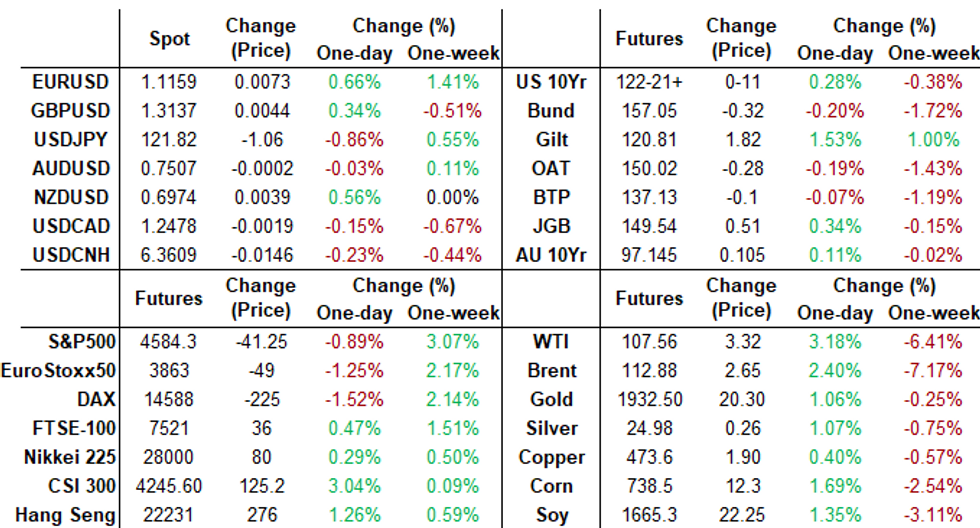

FOREX: Greenback Declines For Second Day, DXY Lowest Print Since March 3

- The dollar index retreated for a second consecutive session and briefly hit a near four-week low as the greenback unwinds a good portion of the March gains for the index.

- USD losses were broad based with the Japanese Yen and the Swiss France the main beneficiaries.

- The JPY has risen 0.82%, extending the bounce off the multi-year cycle lows printed earlier in the week. This places USD/JPY back below the Y122.00 handle approaching the APAC crossover. The move is considered corrective and is beginning to allow a recent extreme overbought condition to unwind. Any extension lower would open 120.95, the Mar 24 low ahead of the 120.00 handle.

- In similar vein, the Euro continued to grind higher amid the dollar weakness and in the process breached the key near-term resistance of 1.1137, Mar 17 high. A break of this hurdle eases recent bearish threats and instead highlights a developing bullish theme. Note too that the 50-day EMA intersects at 1.1150, an equally important resistance. A breach of this zone opens 1.1232 as a target.

- A slightly more muted session for equities/oil prices leaves the likes of AUD and CAD hovering around unchanged for Wednesday and underperforming their G10 counterparts.

- Chinese PMI’s on the data docket overnight before a flurry of minor European data points including German/Eurozone unemployment.

- US Core PCE Price Index headlines the US schedule as well as Canadian GDP for January being released. Later on Thursday, we will publish the MNI Chicago Business Barometer.

FX: Expiries for Mar31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1000(E3.4bln), $1.1069-80(E1.2bln), $1.1100(E1.5bln), $1.1110-15(E531mln), $1.1125(E759mln), $1.1200(E1.7bln)

- GBP/USD: $1.3195-00(Gbp804mln)

- USD/JPY: Y121.60($585mln)

- AUD/USD: $0.7400(A$500mln), $0.7500(A$1.5bln)

- USD/CNY: Cny6.3270($750mln), Cny6.3355($631mln)

Late Equity Roundup: Extending Lows, Well Above 20D EMA Support

Stock indexes extending lows heading into the FI close -- modest unwind of Tue's rally in SPX, eminis still up for the week at 4591.0 (-34.5).

As has been the case for weeks, geopol headline risk tied to Russia war in Ukraine, nascent peace talks and troop (re)deployment an ongoing source of volatility for market.

- Rates inside range, near highs on mixed drivers including month end buying, technical support, trading desks posited earlier. No react from Tass headline:

- "South Ossetia to hold referendum on whether the Georgian breakaway region should become part of Russia"

- SPX eminis still trading well above key support: 4428.55, the 20-day EMA.

- On the flipside: Resistance at 4578.50, Feb 9 high has been cleared. The break opens 4663.50, Jan 18 high.

- Dow trades -135.67 (-0.38%) at 35160.3, and Nasdaq -149.1 (-1%) at 14470.93.

- SPX leading/lagging sectors: Energy sector gaining +0.91%, outpacing Utilities (+0.44%). Laggers: Consumer Discretionary (-1.48%) lead by weaker retail (-1.92%) and consumer durables (-1.37%) shares.

- Dow Industrials Leaders/Laggers: United Health (UNH) extends gains of +7.69 to 518.42, Walmart +2.32 at 149.55. Home Depot extends losses -10.41 to 307.30.

- RES 4: 4730.50 High Jan 1

- RES 3: 4663.50 High Jan 18

- RES 2: 4578.50 High Feb 9 and a key resistance

- RES 1: 4633.44 76.4% retracement of the Jan 4 - Feb 24 downleg

- PRICE: 4586.00 1515ET Mar 30

- SUP 1: 4428.55 20-day EMA

- SUP 2: 4129.50/4094.25 Low Mar 15 / Low Feb 24 and a bear trigger

- SUP 3: 4055.60 Low May 19 2021 (cont)

- SUP 4: 4029.25 Low May 13 2021 (cont)

COMMODITIES: Oil Prices Firm As Russia Repositions Forces

- Oil and gold prices have firmed after softening yesterday as Russia repositions forces in a push to take the Donbas.

- A much larger than expected draw on crude inventories in the US gave a small boost but it’s small compared to broader moves.

- OPEC+ meets tomorrow and is expected to continue with the planned modest monthly production increase.

- WTI is +3.3% at $107.6 having briefly cleared initial resistance from yesterday’s high of $107.84 which opens the bull trigger of $116.64 (Mar 24 high).

- Relatively low volumes in the May’22 contract today. The most active calls have been $115/bbl and the most active puts have been $100/bbl.

- Brent is +2.7% at $113.3 although didn’t quite test resistance at $114.83 (Mar 29 high). Support remains $104.84 (Mar 28 low).

- Gold is +0.75% at $1934.0. It hasn’t challenged resistance of $1966.1 (Mar 24 high) and is comfortably above support from yesterday’s low at $1890.2 (Mar 29 low).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/03/2022 | 2350/0850 | ** |  | JP | Industrial production |

| 31/03/2022 | 0030/1130 | * |  | AU | Building Approvals |

| 31/03/2022 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 31/03/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 31/03/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 31/03/2022 | 0630/0730 |  | UK | DMO Gilt Operations Calendar April-June | |

| 31/03/2022 | 0630/0830 | ** |  | CH | retail sales |

| 31/03/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/03/2022 | 0645/0845 | ** |  | FR | PPI |

| 31/03/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/03/2022 | 0755/0955 | ** |  | DE | unemployment |

| 31/03/2022 | 0800/1000 |  | EU | ECB Lane Lecture at Paris School of Economics | |

| 31/03/2022 | 0900/1100 | ** |  | EU | unemployment |

| 31/03/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/03/2022 | 1000/1200 |  | EU | ECB de Guindos Discussion at University of Amsterdam | |

| 31/03/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 31/03/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/03/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 31/03/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/03/2022 | 1300/0900 |  | US | New York Fed's John Williams | |

| 31/03/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/03/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 31/03/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 31/03/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 31/03/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 31/03/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 31/03/2022 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 01/04/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.