-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Factory Confidence Plunges On Tariff Threat

MNI POLITICAL RISK - Congress Turns Attention To Govt Funding

MNI ASIA MARKETS ANALYSIS: Fed "Attentive to Inflation Risks"

US TSYS: The Fed is Not Dovish

FI markets broadly weaker after the bell, off second half lows after 30YY tapped 3.2066% high, 10YY comfortably above 3.0% to 3.1057%; yield curves bear steepening -- are off highs 2s10s +4.882 at33.703 vs. 37.390 high; 5s30s off inversion at 3.730 (+1.896).

- Little react to rise in weekly claims (+19k to 200Kk), modest drop in continuing claims (-0.019M to 1.384M), today's sell-off more in rates and stocks simply an unwind of the view the Fed is not less hawkish for choosing to not hike 75bs or provide guidance to that effect.

- With the FOMC and Tsy Refunding out of the way, markets have some clarity on the non-private sector's involvement in the long end and traders can focus on the still bearish fundamentals: duration risk / inflation etc. with the understanding the Fed is not coming to the rescue.

- Bear curve steepening is an interesting move since it implies confidence that the economy and the Fed will power through this cycle. While the 10Y move is driven mainly by real rates (new cycle high), NOT higher inflation expectations. Further steepening ahead w/ relatively few hikes and QT starting.

- That said, some focus on Friday's April employment data: +380k est vs. +431k prior and Average Hourly Earnings MoM (0.4% est); YoY (5.5% est).

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.48485 to 0.81514% (+0.48514/wk)

- 1M -0.00028 to 0.84486% (+0.04157/wk)

- 3M -0.03543 to 1.37071% (+0.03585/wk) ** Record Low 0.11413% on 9/12/21

- 6M -0.04743 to 1.97214% (+0.06143/wk)

- 12M -0.07629 to 2.67214% (+0.04357/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $77B

- Daily Overnight Bank Funding Rate: 0.32% volume: $273B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $947B

- Broad General Collateral Rate (BGCR): 0.30%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $344B

- (rate, volume levels reflect prior session)

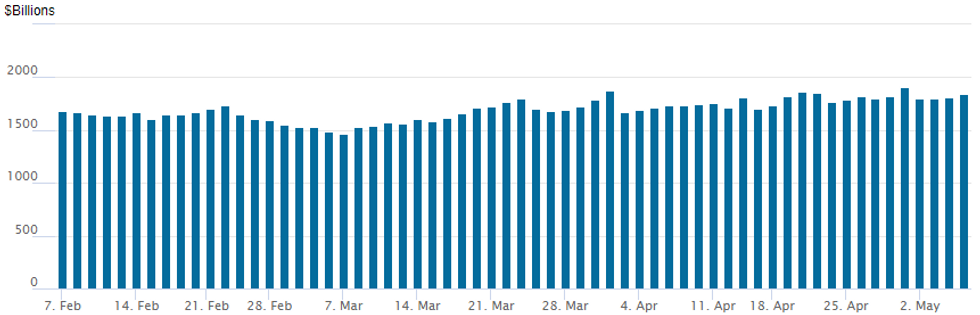

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage at 1,844.762B w/ 86 counterparties vs. prior session's 1,815.656B (all-time high of $1,906.802B on Friday, March 29, 2022).

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

FI option option trade was dominated by put spread selling/position unwinds Thursday as underlying rates reversed Wednesday's post-FOMC "relief rally" when it was deemed Chairman Powell was not overly hawkish by not keeping 75bp rate hike chatter alive.- Tsy futures extended session lows after gaining briefly on BoE dovish hike annc. Bond yld surged to 3.2066% high -- late 2018 levels as curves bear steepened: 2s10s tapped 37.390 high, well off pre-FOMC inversion, the 5s30s spd hit 5.031 high.

- +28,000 short Aug 97.37/97.62 call spds, 2.0 ref: 96.435

- 20,000 Mar 96.00/96.75 put spds, 32 at 1229:10ET

- 17,000 Jun 98.00/98.12/98.25 put flys, 6.0 at 1140:48ET

- 10,000 Jun 97.62/97.87/98.12 put flys, 1.5 at 1138:48ET

- Total 20,000 Mar 96.75/97.00 put spds, 14.5 from 1045-1049ET

- 20,000 Sep 96.62/97.50 put spds, 28.0 at 1036:08ET after

- total 20,000 Sep 97.00/97.50 put spds, 22.0 from 1022-131ET

- -50,000 Sep 97.25/97.50 put spds, 14.0 at 1305:30ET

- 10,000 Jun 96.62/97.87/98.12 broken put flys, 1.5 net at 0945:37ET

- Total -20,000 Dec 96.00/97.00 put spds, 34.0 from 0923-0925ET after 20k Dec 96.00/96.75 put spds sale/Block

- at 21.0 and 15k Sep 96.62/97.37 put spds at 20.0-20,000 Dec 96.00/96.75 put spds, 21.0 from 0858-0901ET

- -15,000 Sep 96.62/97.37 put spds, 20.0 at 0829:42ET ref 97.33

Treasury Options: Aside from unwinding puts/put spds seeing pick-up in call buyer fading sell-off in underlying.

- +11,500 TYM 118.5 calls, 44 vs. 118-10.5

EGBs-GILTS CASH CLOSE: Dovish BoE Spurs UK Steepening

A dovish Bank of England meeting spurred a strong steepening in the UK yield curve as short-end yields fell sharply Thursday.

- But long-end yields underperformed in both the UK and Germany, defying a stock-selloff. One factor seen was ECB's Rehn saying the bank should hike rates in July and continue to raise gradually after that.

- With equities reversing sharply in the afternoon, peripheral spreads mostly widened: BTP 10Y / Bund closed just shy of 200bp for the 2nd straight day.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.4bps at 0.285%, 5-Yr is up 5.1bps at 0.766%, 10-Yr is up 7.3bps at 1.044%, and 30-Yr is up 9.1bps at 1.171%.

- UK: The 2-Yr yield is down 9.1bps at 1.547%, 5-Yr is down 5.7bps at 1.67%, 10-Yr is down 0.2bps at 1.964%, and 30-Yr is up 4.7bps at 2.125%.

- Italian BTP spread up 0.9bps at 199.5bps / Greek down 3.7bps at 240.8bps

EGB Options: SONIA Plays Pre-BoE

Thursday's Europe rates / bond options flow included:

- RXM2 155.0/156.5/158.0/159.5c condor, bought for 33 in 10k

- RXM2 156.50/158.00cs, sold at 14 in 2.5k

- RXM2 151.5/148.5ps sold at 53.5 in 2k

- OEM2 126.75 put sold at 47/47.5 in 3.5k (ref 127.02)

- ERU2 99.87/99.75ps, bought for 6.25 in 4k (ref 99.795)

- ERZ2 99.25/99.50/99.75c fly bought vs selling 98.50p for flat in 2k

- ERZ2 99.625/99.375/99.25/98.75 broken p condor, bought for 0.75 in 7.5k

- ERZ2 99.00/99.25/99.50 iron fly, sold at 20 in 10k

- SFIK2 98.65/98.75cs, bought for 3.25 in 4.5k

- SFIK2 98.70/98.90cs bought for 1.75 and 2 in 10k

FOREX: GBP Confirms Status as EM Currency

- Global risk off environment combined with renewed geopolitical risk have been weighing on 'risk-on' assets, including GBP.

- Historically, the British pound has been the weakest performing currency in high-volatility regime among the G10 world, averaging -30bps in monthly returns when VIX is trading above 20.

- The top chart shows the average monthly performance of the G9 currencies (vs. USD) when the VIX rises above 20 since January 1990 (VIX inception); the choice is arbitrary but a VIX higher than 20 has generally been defined as a 'high-volatility regime'.

- In addition, we have seen that GBP/USD has shown a strong co-movement with EM equities since the EU referendum in June 2016 (bottom chart).

- Therefore, the underperformance of theUK economy (relative to the US), rising recession risks (BoE raised flag today that UK is heading for a recession), vulnerable EM equities and persistent USD strength could continue to weigh on Sterling in the near to medium term.

- Cable broke back below its 1.25 support in today's trading session, which corresponds to the 61.8% Fibo retracement of the 1.1410 - 1.4250 range.

- Next support to watch on the downside stands at 1.2260 (June 2020 low)

FX: Expiries for May06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0425-30(E550mln), $1.0570-75(E523mln), $1.0600(E581mln), $1.0650(E782mln), $1.0700(E569mln)

- GBPUSD: $1.2450(Gbp542mln)

- EUR/GBP: Gbp0.8500-10(E551mln), Gbp0.8575(E755mln)

- USD/JPY: Y128.50($1.1bln)

- AUD/USD: $0.7100(A$765mln), $0.7200(A$931mln), $0.7300(A$2.1bln)

- AUD/NZD: N$1.1000(A$509mln), N$1.1050(A$507mln)

- USD/CAD: C$1.2700($639mln), C$1.2750-60($934mln), C$1.2800($991mln), C$1.2840($1.4bln), C$1.3055($1.7bln)

- USD/CNY: Cny6.6500($630mln), Cny6.7000($1.5bln)

Late Equity Roundup: Sell-Off Accelerates

Equities looking to test midday lows again after FI close, completely reversing the post-FOMC relief rally by midmorning, SPX emini futures ESM2 -187 points (-4.35%) at 4108.75

- Technicals for SPX eminis, ESM2 eying key support of 4056.0 bear trigger and May 2 low. Next key support at 4029.25 May 13 2021 high.

- Severity of moves had desks looking up exchange circuit breakers. For reference:

- -7% Breaker: ESM2 at 3994.25; DMM2 31,585; NQM2 12,584.00

- -13% Breaker: ESM2 3736.25; DMM2 29,542; NQM2 11,771.75

- -20% breaker: ESM2 3435.25; DMM2 27,157; NQM2 10,824.25

- SPX leading/lagging sectors: Utilities underperforming the least (-1.71%) followed by Energy shares (-2.09%). Laggers: Consumer Discretionary (-6.63%) weighed by autos followed by Information Technology (-5.83%).

- Meanwhile, Dow Industrials currently trades -1299.64 points (-3.82%) at 32762.54, Nasdaq -765.5 points (-5.9%) at 12200.54.

- Dow Industrials Leaders/Laggers: Coca-Cola (KO) -0.79 at 64.24, Verizon (VZ) -0.90 at 47.47. Laggers: Home Depot (HD) -18.82 at 296.43, United Health (UNH -16.97 at 490.65, Microsoft (MSFT) -14.95 at 275.03.

- RES 4: 4588.75 High Apr 5

- RES 3: 4509.00 High Apr 21 and a key short-term resistance

- RES 2: 4375.43 50-day EMA

- RES 1: 4303.50/4355.50 High Apr 26/28 / Low Apr 18

- PRICE: 4123.00 @ 1430ET May 5

- SUP 1: 4056.00 Low May 2 and the bear trigger

- SUP 2: 4029.25 High May 13 2021

- SUP 3: 4000.00 Psychological round number

- SUP 4: 3958.00 2.00 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis rallied sharply higher yesterday, extending the recovery from Monday’s trend low of 4056.75. Broader trend conditions remain bearish and the current bull phase is likely a correction. Initial resistance to watch is at 4303.50, the Apr 26/28 high. A break would suggest scope for an extension higher towards the 50-day EMA at 4375.43. A resumption of weakness would refocus attention on the bear trigger at 4056.00.

COMMODITIES: Oil See Clashing Forces From US Reserve Replenishment And Growth Fears

- Oil prices saw a boost the US giving timing and size details on plans to replenish its oil reserve (seeking bids to buy 60mln bbls of crude this fall as a first step) before unwinding gains on growing global growth fears and sliding equities.

- WTI is +0.5% at $108.3 having cleared first resistance at $109.2 to open $113.51 (Mar 24 high).

- Brent is +0.8% at $111.0, earlier probing key near-term resistance of $113.61 (Apr 18 high).

- Gold is -0.2% at $1876.7 as rising Tsy yields to north of 3% again compete for safe haven demand. Resistance is eyed at the 20-day EMA of $1913.9 whilst support is seen at the $1850.5 (May 3 low).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/05/2022 | 2350/0850 | ** |  | JP | Tokyo CPI |

| 06/05/2022 | 0130/1130 |  | AU | RBA May SoMP | |

| 06/05/2022 | 0545/0745 | ** |  | CH | unemployment |

| 06/05/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 06/05/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 06/05/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 06/05/2022 | 0730/0930 |  | SE | Riksbank Minutes April meet | |

| 06/05/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 06/05/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/05/2022 | 1115/1215 |  | UK | BOE Pill Monetary Policy Report National Agency briefing | |

| 06/05/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 06/05/2022 | 1230/0830 | *** |  | US | Employment Report |

| 06/05/2022 | 1315/0915 |  | US | New York Fed's John Williams | |

| 06/05/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/05/2022 | 1500/1600 |  | UK | BOE Tenreyro Lecture at Irish Economic Association | |

| 06/05/2022 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 06/05/2022 | 1900/1500 | * |  | US | Consumer Credit |

| 06/05/2022 | 1920/1520 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.