-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

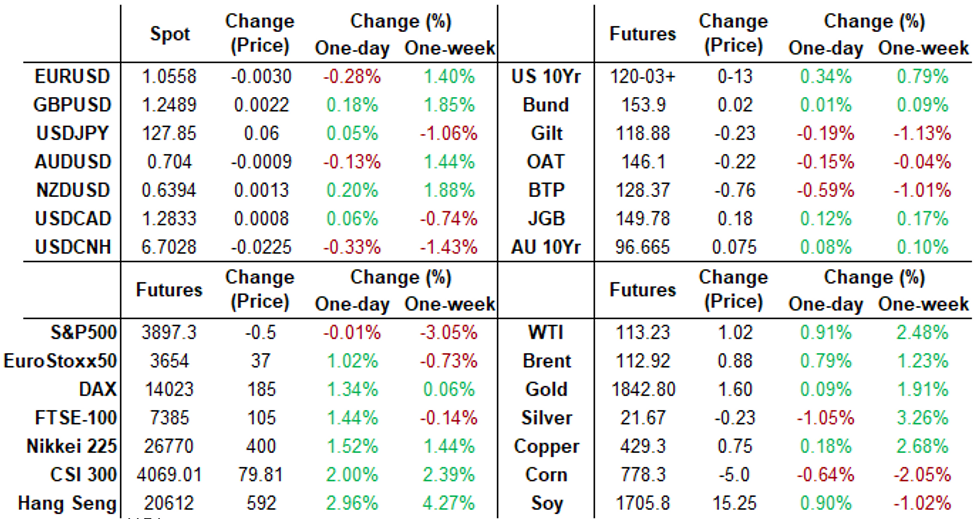

Free AccessMNI ASIA MARKETS ANALYSIS: Stocks Recover, Close Near Steady

US TSYS: Risk Off or Forced Unwinds Run Course? Stock Rebound Late

No data Friday -- But StL Fed President did appear on Fox Business interview in the afternoon. Nothing particularly new from Bullard though he did add he does not see a recession occurring this or next year.

- Bullard said he would leave the "timing" of when to hike rates up to Powell, but sees 50bp hike as a "good plan for now" while "the more we can frontload" hikes, the "better off we'll be." Bullard said he sees economic growth accelerating in the second half of the year to appr 2.5-3.0%, while unemployment will continue to recede.

- Early focus on headline risk with buying/short cover support possibly tied to China/covid headlines (CHINA PORT CITY TIANJIN STARTS MASS TEST IN FIVE DISTRICTS, Bbg).

- Decent overall volumes tied to accelerating Jun/Sep Tsy futures rolling, 5s and 10s lead again w/ over 240k and 175k recorded after the bell.

- Investment-grade corporate credit risk had climbed to new 2Y highs after midday as equity indexes sell-off. Back to March 2021 levels SPX eminis now appr 20% off early Jan high (4778.0) at 3829.00 (-68.75) after breaching key support / bear trigger levels of 3855.00, May 12 low AND 3843.25, the Mar 25 2021 low (cont).

- Equities staged a robust rebound off lows in late equity trade, not headline driven, more program/technical while offers fade, SPX eminis nearly back to steady at 3897.75.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00471 to 0.82471% (-0.00100/wk)

- 1M +0.01286 to 0.97357% (+0.08686/wk)

- 3M +0.00157 to 1.50643% (+0.06272/wk) * / **

- 6M +0.04000 to 2.06557% (+0.07057/wk)

- 12M +0.02400 to 2.73000% (+0.07786wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.50486% on 5/19/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $76B

- Daily Overnight Bank Funding Rate: 0.82% volume: $257B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.79%, $982B

- Broad General Collateral Rate (BGCR): 0.79%, $358B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $344B

- (rate, volume levels reflect prior session)

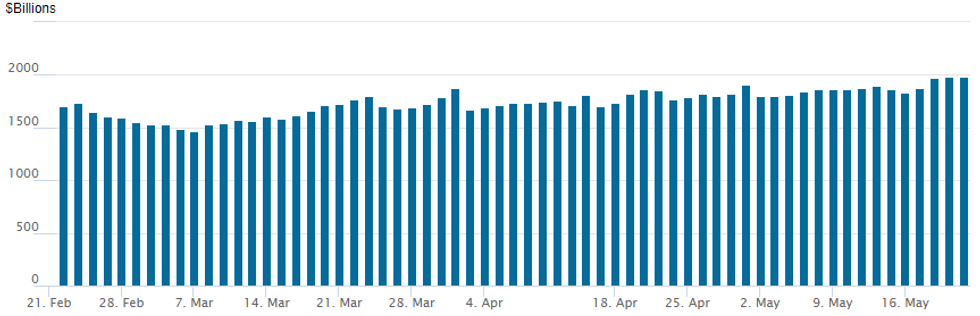

FED Reverse Repo Operation, Third Consecutive New High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new all-time high of 1,987.987B w/ 89 counterparties vs. Thursday's prior record $1,981.005B.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Eurodollar and SOFR option trade centered on buying upside call insurance as underlying rates see-sawed higher through the session (30YY below 3.0% again at 2.9827%). Yield curves bull flattened as short end resisted the rally. Nevertheless, rate hike hedging cooled somewhat and option accounts favored buying upside call plays.

- +5,000 SFRZ2 97.00/97.12/97.37/97.50 put condors, 3.0 ref: 97.18/0.10%

- Block, 6,000 SFRU2 97.68/97.87/98.06 1x3x2 call flys, wings bought over 0.0 ref 97.63

- Additional 11k SFRU2 97.68/97.87/98.06 1x3x2 call flys, wings bought over 0.0 ref 97.63

- +20,000 Green Oct 97.00/97.50 call spds 3.5 over Green Oct 96.62 puts

- Block, 20,000 Sep 97.50/97.75 call spds, 6.5

- +15,000 Sep 97.50/97.62/97.75 call flys, 1.25 wings over

- -3,500 Green Mar 97.12 straddles, 94.0 ref 97.08

- -1,500 Dec 96.87 straddles, 86.0 ref 96.655

- -1,500 Green Dec 97.12 straddles, 166.0

- +4,000 FVQ 113.5/114.25/115 call flys, 6

- 3,000 FVM 113.5 calls, 0.5

- 5,700 TYN 116 puts, 10-12, 11 last

- +4,500 TYU 117/122 strangles, 143-144

- +5,000 FVN 110.75/111.75/112.75 put flys, 11.5 ref 112-24.75

EGBs-GILTS CASH CLOSE: Periphery Spreads Widen Sharply

German bonds outperformed their UK counterparts Friday, with steepening in both curves - though periphery weakness took centre stage.

- With no particular catalyst evident, periphery spreads widened sharply: 10Y BTPs out 10bp to close above 200bp (though just shy of the May high); GGBs underperformed, nearly 18bp wider and starting to threaten the April 2020 wides.

- Gilt and Bund yields faded earlier highs in the afternoon as stocks came off their highs. UK underperformed as BoE hike pricing rose following stronger-than-expected data this week and analyst hike projection upgrades.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 3bps at 0.342%, 5-Yr is down 3.7bps at 0.655%, 10-Yr is down 0.5bps at 0.944%, and 30-Yr is up 4.6bps at 1.116%.

- UK: The 2-Yr yield is up 1.6bps at 1.507%, 5-Yr is up 1.7bps at 1.603%, 10-Yr is up 2.8bps at 1.893%, and 30-Yr is up 3.6bps at 2.13%.

- Italian BTP spread up 10bps at 205.5bps / Greek up 17.8bps at 277.7bps

EGB Options: Euribor Call Flies And Downside Plays

Friday's Europe rates / bond options flow included:

- RXN2 149/147/146.5p ladder, bought for 1 in 1.5k

- ERU2 99.125/99.375/99.875/100.125c condor, bought for 19.25 in 3k

- ERZ2 99.25/99.50/99.75c fly, bought for 4.75 in 8k

- ERZ2 98.75/98.25ps 1x1.25 bought for 5.5 in 14k (ref 99.21, 12d)

FOREX: Greenback Trades On Surer Footing As Equities Resume Decline

- The US dollar edged higher throughout the US trading session as risk-off sentiment prevailed across global equity benchmarks approaching the close on Friday.

- G10 currency volatility remained subdued throughout the final trading day of the week as the focus remained on the sharp turnaround in equities as the S&P 500 registered a 20% decline from January’s high, set to enter bear market.

- EURUSD fell just shy of Thursday’s high above 1.0600, with the single currency losing steam and settling back to trade at 1.0550, but retaining ~1.5% gains for the week.

- Equity weakness weighed on the Australian dollar with AUDUSD retreating 0.5%. NOK was the poorest performing G10 ccy, down 0.94% against the greenback, erasing around half of the prior day’s advance.

- German IFO data kicks off Monday’s data calendar with Canada out for a local holiday. Also, potential comments from Bank of England Governor Bailey. He is due to participate in a panel discussion titled "Monetary policy, policy interaction and inflation in a post-pandemic world with severe geopolitical tensions" at the Oesterreichische National Bank Annual Economic Conference, in Vienna.

- European flash PMI’s hit on Tuesday with the RBNZ meeting and FOMC minutes highlights throughout the week.

Late Equity Roundup: Supply Disruptions, Inflation Metrics Weigh

Trading weaker after the FI close, major indexes reversed early session gains and continued to sell-off through the second half- Unlikely related to StL Fed President Bullard comments on Fox Business interview, but Tsys have pared gains and equities staged modest rebound off lows, held near lows late: SPX emini futures currently -55.25 (-1.42%) at 3841.25, Dow Industrials -360.18 (-1.15%) at 30887.12, Nasdaq -246.1 (-2.2%) at 11139.39.

- Nascent risk-off momentum likely gained - likely due to supply-chain disruptions and the resulting inflation tied to China zero tolerance for Covid infections. puts additional focus on next week's earnings: Best Buy (BBY) reports early Tuesday, Toll Bros (TOL) after the close Tue along w/ Intuit (INTU) and Nordstrom (JWN).

- SPX leading/lagging sectors, little change: Real Estate (+0.33%) investment funds outperforming, Health Care (+0.08%) as biotech/pharmaceuticals see support.

- Laggers: Consumer Discretionary (-3.23%) w/ auto shares underperforming (Tesla -9.47% to 642.16) followed by Industrials (-2.22%) as road and rail names under pressure for a second day running.

- Dow Industrials Leaders/Laggers: McDonalds (MCD) +1.81 at 230.81, JNJ +1.40 at 175.34, Salesforce (CRM) +1.06 at 156.66. Laggers: Caterpillar (CAT) continued to sell off: -11.96 at 194.88, Boeing (BA) -9.01 at 118.13 and Goldman Sachs (GS) -7.37 at 300.83.

E-MINI S&P (M2): Bearish Threat Still Present

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4099.00/4240.82 High May 9 / 50-day EMA

- PRICE: 3901 @ 1600ET May 20

- SUP 1: 3855.00/3843.25 Low May 12 / Low Mar 25 2021 (cont)

- SUP 2: 3820.25 2.50 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis remain vulnerable following the reversal from Wednesday’s high of 4095.00. This left initial key resistance - 4099.00, the May 9 high - intact. The reversal lower signals a potential resumption of the primary downtrend and attention is on support and bear trigger at 3855.00, May 12 low. A break would resume the downtrend and open 3843.25, the Mar 25 2021 low (cont). Clearance of 4099.00 is required to ease the bearish threat.

COMMODITIES: Oil Finishing A Volatile Week Nudging Higher

- Crude oil is finishing a volatile week nudging higher. Continued supply worries dominate, most recently including a South Korean refinery explosion and the US looking to rule out importing any oil from Iran or Venezuela. The weekly US rig count jumped more than expected but production has been rising accordingly so far this year.

- The demand side has been more mixed from China, with Shanghai partly easing lockdown restrictions but further restrictions elsewhere plus mass testing starting in five districts in the port city Tianjin.

- WTI is +0.6% at $112.87 for +2.1% on the week after a fleeting clearance of $113.2 (May 17 high).

- Brent is +0.4% at $112.51 for +0.9% on the week. Resistance remains at $115.69 (May 17 high).

- Gold is unchanged at $1841.66 to leave it up a solid +1.7% on the week as haven demand and a falling dollar drive it higher. Resistance eyed at $1858.8 (May 12 high) with support at $1807.5 (May 18 low).

- Russia will cut gas supplies to Finland from Saturday in retaliation to its application to join NATO, although gas making up just 5% of Finland’s energy mix. TTF natural gas fell -3.4% today for -9% on the week.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/05/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 23/05/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 23/05/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 23/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 23/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/05/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/05/2022 | 1615/1715 |  | UK | BOE Governor Bailey Panels Discussion |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.