-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Restrictive Policy Appropriateness

US TSYS: Relief Rally, Nothing In Minutes That Hasn't Already Been Said

Risk-on gained traction after some initial two-way trade -- Tsys holding narrow range with 2s and 10s outperforming while stocks posted new session highs -- relieved after the minutes showed no discussion of larger rate hikes.- "A restrictive policy stance may well become appropriate depending on the evolving economic outlook and the risks to the outlook," the minutes said, highlighting that officials saw upside risk to inflation.

- Several participants also noted the potential for "unanticipated effects on financial market conditions" related to the asset-runoff process.

- After some initial two-way trade, SPX eminis extended session highs after the FI close, ESM2 climbed to 3997.25 high.

- Earlier, Tsy futures holding modest gains in 2s-10s, after $48B 5Y note auction (91282CET4) tails slightly: 2.736% high yield vs. 2.732% WI; 2.44x bid-to-cover vs. 2.41x last month.

- Heavy volumes again as Jun/Sep roll neared 75% completion, both FVM and TYM traded over 3M contracts after the bell more than half of which tied to rolling to Sep that takes lead position on May 31.

- Thursday focus: Wkly Claims (215k vs. 218k prior), GDP (8.0%), PCE (2.8%), and $42B 7Y Tsy note sale. Fed speak add: SF Fed Daly interview on CNBC's "The Exchange" at 1300ET.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00443 to 0.81943% (-0.00528/wk)

- 1M +0.00643 to 1.02300% (+0.04943/wk)

- 3M +0.02186 to 1.55286% (+0.04643/wk) * / **

- 6M -0.01685 to 2.05429% (-0.02242/wk)

- 12M -0.00486 to 2.68400% (-0.04600/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.53100% on 5/24/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $82B

- Daily Overnight Bank Funding Rate: 0.82% volume: $253B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $968B

- Broad General Collateral Rate (BGCR): 0.79%, $366B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $350B

- (rate, volume levels reflect prior session)

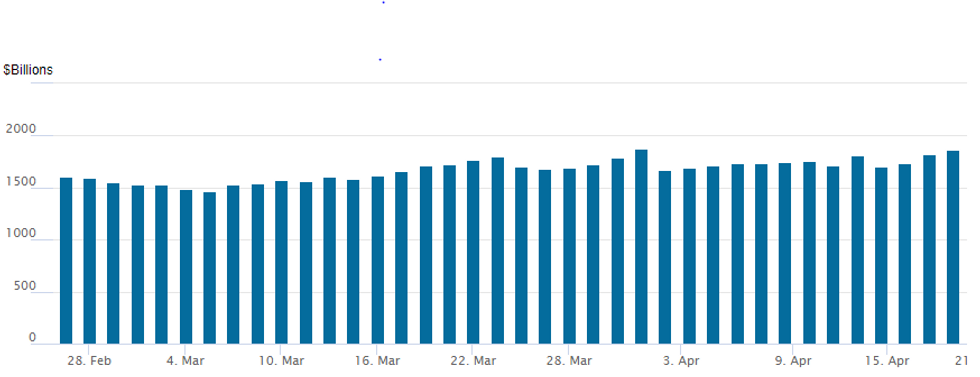

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 1,995.750B w/ 924counterparties vs. 1,987.865B prior session, compares to Monday's record $2,044.658B.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

FI option trade volumes were rather modest Wednesday, some accounts plying the sidelined in the leadup to the FOMC minutes release. Risk-on gained traction after some initial two-way trade -- Tsys holding narrow range with 2s and 10s outperforming while stocks posted new session highs -- relieved after the minutes showed no discussion of larger rate hikes.

- Block, total 7,500 SFRH3 97.25/97.75 1x2 call spds, 1.5 ref: 997.125

- 1,500 SFRU2 97.43/97.56/97.68/97.93 call condors

- -4,000 Oct 97.00/97.50 call spds 6.5 over 96.50 puts

- +4,000 short Jun 96.75/97.00 put spds, 5.25

- Update, over 7,000 short Jun 97.00/97.12 call spds, 3.0 ref 96.86

- -2,000 Dec 97.00 straddles, 66.5-65.5

- -2,000 Green Sep 97.12 puts, 26.0 vs. 97.215/0.46%

- 12,500 Jun 98.31 calls, 1.0

- 16,500 Jun 98.18/98.25 put spds

- 8,700 short Jun 96.50 puts, 2.5

- +10,000 FVQ 107 puts, 1

- 10,000 TYN 115 puts, 2

- +2,500 TYU 122.5 calls, 53 ref 120-10.5

- 5,000 FVN 114.5/116 call spds

- 11,900 TYN 119 puts, 31

- Block, 5,000 TYN 116.5/118/119.25 broken put flys, 11

EGBs-GILTS CASH CLOSE: ECB Hike Pricing Softens Despite 50bp Speculation

Having easily outperformed Tuesday, Gilts underperformed Bunds Wednesday as European curves steepened.

- Long-end yields moved in tandem with equities, falling to session lows mid-afternoon before rebounding late; but short-end yields maintained their drop.

- Monday's Lagarde blog post implying 25bp hikes in Jul and Sep was one of the main points of discussion; Knot said he "fully support[ed] everything that is in the blog" but went on to say that hiking 50bp in July is also compatible with the blog post.

- VP de Guindos didn't appear to totally dismiss a hike bigger than 25bp, stressing data dependence, while Panetta said normalisation should be done "gradually". In the end, ECB hike pricing moderated slightly on the day.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 4.1bps at 0.34%, 5-Yr is down 3.1bps at 0.655%, 10-Yr is down 1.5bps at 0.952%, and 30-Yr is up 2.9bps at 1.197%.

- UK: The 2-Yr yield is down 2.3bps at 1.43%, 5-Yr is down 0.6bps at 1.56%, 10-Yr is up 2.3bps at 1.91%, and 30-Yr is up 2.9bps at 2.16%.

- Italian BTP spread down 1.2bps at 200.1bps / Spanish down 1.1bps at 110.9bps

EGB Options: All Euribor

Wednesday's Europe rates / bond options flow included:

- ERN2 99.75/99.62/99.25p fly, bough for half and 0.75 in 5k

- ERU2 99.62/99.50/99.37p fly, bought for 1.75 in 4k

- ERU2 99.62/99.75/99.87c ladder, bought for 3 in 4.25k

FOREX: USD Trades On Surer Footing, DXY Rises 0.35%

- The US Dollar trended weaker in early Wednesday trade, taking its cue from risk sentiment which was tilted to the downside.

- Despite a recovery in major equity benchmarks, the greenback failed to retreat ahead of the FOMC minutes.

- Following the minutes the USD took a very brief initial hit on the release as it was noted that there was no active discussion of rate increases larger than 50bps. However, the pop lower for the greenback was short-lived and the DXY looks set to post a 0.35% intra-day advance.

- CNH (-0.82%) is the weakest performer following comments from Chinese Premier Li Keqiang. The yuan fell as his comments warned the world's second-largest economy is doing worse in some ways than when the pandemic first hit in 2020. Furthermore, Beijing recorded more Covid cases and the nearby port city of Tianjin locked down a city-center district prompting the offshore yuan to break a four-session advance.

- EURUSD snapped its recent strength as the single currency fell back below $1.07. As noted, there is technical scope for further potential strength towards channel top resistance intersecting at 1.0840. Initial support remains at 1.0533, May 20 low.

- Potential further comments from RBNZ Governor Orr overnight, who is due to testify before the Finance and Expenditure Select Committee, in Wellington.

- Some European holidays in observance of Ascension Day on Thursday. Canadian March retail sales data is scheduled as well as the second release of Q1 US GDP. US April Pending home sales rounds off Thursday’s docket.

Late Equity Roundup: Testing Early Highs

Following late two-way immediately after the FOMC minute release, major indexes regain footing looking to test earlier highs. SPX emini futures currently +28.75 (0.73%) at 3969, Dow Industrials +98.31 (0.31%) at 32024.4, Nasdaq +149 (1.3%) at 11413.33.

- Key technical resistance for SPX still well above at 4099.0, May 9 high.

- SPX leading/lagging sectors: Similar to earlier levels, Consumer Discretionary sector continues to outperform (+2.70%) lead by autos (Tesla in particular: +4.70% at 657.68). Energy sector follows (+1.40%) as O&G outpaces equipment/services.

- Laggers: Health Care sector (-0.41%) as bio-tech and pharmaceuticals lag, followed by Utilities (-0.29%) and Consumer Staples holding steady.

- Dow Industrials Leaders/Laggers: Home Depot (HD) extends early gains, now +4.71 at 292.63, American Express (AXP) +3.41 at 159.04 while Salesforce (CRM) climbs 1.93 at 158.86. United Health (UNH) -5.45 at 492.11, Proctor Gamble (PG) -3.45 at 144.18, JNJ -1.95 at 179.45.

E-MINI S&P (M2): Trend Needle Still Points South

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4099.00/4206.55 High May 9 / 50-day EMA

- PRICE: 3938.25 @ 14:49 BST May 25

- SUP 1: 3807.50 Low May 20 and the bear trigger

- SUP 2: 3801.97 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont)

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis are trading above recent lows, but remain vulnerable. This follows the reversal from 4095.00, May 18 high. The pullback has left key resistance at 4099.00 intact, May 9 high. The reversal lower, and last Friday’s trend low, signals a resumption of the downtrend and opens 3801.97 next, 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont). Clearance of 4099.00 is required to ease the bearish threat and signal a potential short-term base.

COMMODITIES: Oil Firms Despite Smaller US Inventory Drawdown

- Crude oil prices have edged higher today despite moving lower with EIA data as crude inventories saw a smaller-than-expected drawdown entering the driving season (-1.02M vs -2.046M expected).

- Prospects for revising the 2015 Iran nuclear deal are seen tenuous at best according to the US Envoy to Iran, Malley, limiting the likelihood for Iranian oil supply coming to market.

- WTI is +0.7% at $110.53 in what’s been a relatively tight range. It sits below resistance at $113.20 (May 17 high) whilst support remains at $103.24 (May 19 low).

- Brent is +0.5% at $114.12, equally holding onto recent gains and coming very close to earlier testing $115.69 (May 17 high), clearance of which could have opened a bull trigger close by at $115.76 (Mar 24 high).

- Gold is -0.6% at $1854.48 in an unwinding of yesterday’s rise as the dollar reversed tracks and moved higher, although the yellow metal has been slow to react to the pop lower in BBDXY on the FOMC minutes.

- Gold maintains a firmer short-term tone but doesn’t trouble resistance at $1869.7 (May 24 high) or support at $1807.5 (May 18 low).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/05/2022 | 0130/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 26/05/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/05/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/05/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 26/05/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 26/05/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 26/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 26/05/2022 | 1230/0830 | *** |  | US | GDP (2nd) |

| 26/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/05/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 26/05/2022 | 1400/1000 |  | MX | Mexican central Bank policy meet minutes | |

| 26/05/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 26/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 26/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/05/2022 | 1600/1200 |  | US | Fed Vice Chair Lael Brainard | |

| 26/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.