-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS - Week Ahead 2-8 December

MNI POLITICAL RISK - Trump Targets BRICS w/New Tariff Threat

MNI ASIA MARKETS ANALYSIS: May Job Gains Better Than Expected

US TSYS: Compelling Case for 50Bp Hikes

Tsys futures trade weaker, off lows to near middle of session range on light volumes for a headline payroll session, TYU2 less than 950k after the bell. Tsys gapped lower following May NFP gain of +390k vs. +310k est, 30YY climbs to 3.1554% high, while yield curves steepened out briefly.

- Fed hike expectations gained slightly out the curve while 50bp hikes at each of the next two meeting remain a lock. Implied Fed hikes firm slightly for meetings later in the year after payrolls. The 143bp for Sep takes it back to yesterday highs whilst the 199bp to year-end nudges 1bp higher and closes on the post May FOMC high of 202bps.

- Limited react to S&P Global composite PMI revised 0.2pts lower in the final release, 53.6 in May. Short end eased after ISM Services index slightly softer than expected, falling from 57.1 to 55.9 (cons 56.5), still Seeing Covid-19 Impact.

- Aside from data, market reacted negatively to reports of Elon Musk email to Tesla execs: "pause all hiring worldwide" late Thu. Reuters reported Musk would like to cut 10% of Tesla's workforce due to a "super bad feeling" about the economy. Musk clarified later in the day: hiring freeze for salaried employees while hourly jobs to rise.

- Cleveland Fed Pres Mester states she wants to see "COMPELLING EVIDENCE INFLATION IS ON DOWNWARD PATH" implying the Fed will continue to hike past signs of inflation peaking. Follow up headline: Mester "COULD BACK 50 BPS SEPT. HIKE IF INFLATION DOESN’T COOL, Bbg.

Needless to say, nothing really new, markets not reacting to CNBC interview - Reminder Fed enters media blackout at midnight tonight. No significant data next Monday, but Tsy does have two bill auctions

SHORT TERM RATES

US DOLLAR LIBOR: No LIBOR settles today w/ London banks out for Spring and Platinum Jubilee holidays, settles resume Monday. Meanwhile, lead quarterly EDM2 holding steady at 98.2325.

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $83B

- Daily Overnight Bank Funding Rate: 0.82% volume: $256B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.79%, $974B

- Broad General Collateral Rate (BGCR): 0.79%, $368B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $355B

- (rate, volume levels reflect prior session)

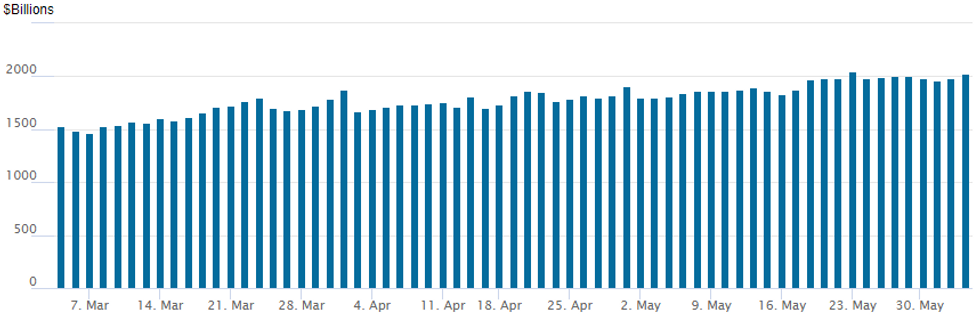

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 2,031.228B w/ 101 counterparties vs. 1,985.239B prior session, shy of Monday, May 23 record high $2,044.658B.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Modest overall volumes Friday w/ London banks still out for Spring and Platinum Jubilee holidays. A few notable exceptions as underlying rate futures sold off following better than expected May jobs gain of +390k vs. +310k est.- Fed hike expectations gained slightly out the curve while 50bp hikes at each of the next two meeting remain a lock. Implied Fed hikes firm slightly for meetings later in the year after payrolls. The 143bp for Sep takes it back to yesterday highs whilst the 199bp to year-end nudges 1bp higher and closes on the post May FOMC high of 202bps.

- +5,000 SFRU2 97.25/97.50 put spds, 5.5

- +5,000 SFRZ2 96.00 puts, 3.5

- 3,100 short Jun SOFR 96.56/96.68/96.81 put flys

- Update +40,000 Aug 97.50 calls, 7.0 vs. 97.355-.35

- 5,400 short Jun 96.31 puts

- 2,000 Dec 96.00/96.50 put spds

- 1,500 short Jun 96.37/96.62 put spds

- -4,000 TYU 118.5 straddles, 302

- -5,000 FVN 111.5/112 put spds, 10.5

- +20,000 TYN 122 calls, 4

- +20,000 FVN 112.5 puts, 36-38

- 4,000 TYU 126 calls

- 8,500 TYN 116/117 put spds

FOREX: Dollar Extends Bounce Off Support on NFP Beat

- The May NFP report was swallowed positively by markets Friday, with the headline beat on job gains allied with positive net revisions to make for a solid release. Markets brushed off the unchanged unemployment rate (median was for a 0.1 ppts drop) to help the USD Index bounce further off support at the 50-dma, which remains a key for markets headed through June and the next Fed rate decision.

- The JPY was among the weakest currencies in G10 Friday, with EUR/JPY hitting fresh YTD highs as the cross rallied through the Y140.00 bull trigger (the April 2022 high) to hit the highest levels since 2015.

- USD/CAD extended the recent downtick into the Friday close, extending the CAD rally that followed the hawkish nudge on Thursday from Dep Gov Beaudry, who noted that the Bank can act “more forcefully” on rates.

- The recovery in NZD/USD across the May stalled Friday as the pair failed to mount an attempt on the key resistance at the 0.6601 50-dma.

- Rate decisions from the Eurozone, Australia, India, Russia and Poland should keep markets busy next week. China PMI, trade balance & inflation releases are the data highlights alongside Japanese GDP.

FX: Expiries for Jun06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0647-50(E1.6bln), $1.0675(E743mln), $1.0700(E1.4bln), $1.0800(E1.5bln)

- USD/JPY: Y127.00($1.2bln), Y129.00-05($540mln), Y130.00($545mln)

- EUR/GBP: Gbp0.8750-75(E516mln)

- USD/CAD: C$1.2500($600mln), C$1.2650($600mln), C$1.2725-35($1.7bln)

- USD/CNY: Cny6.80($1.2bln)

EQUITIES: Late Equity Roundup: Sideways Above Lows for Week

Trading sideways off late morning lows in relatively quiet late session trade. SPX emini futures, ESM2 currently trading 4112.0 (-63.775).

- SPX leading/lagging sectors: Energy sector continued to gain (+1.32%) with crude firmer but off week highs (WTI +1.58 at 118.47), Utilities off lows (-0.20%) followed by industrials (-0.28%) w/construction/engineering shares outperforming.

- Laggers: Consumer Discretionary (-2.56%) as autos remain weak -- notably Tesla (-8.87% at 706.28) after waiting period to purchase Twitter under the Hart-Scott-Rodino Antitrust Improvements Act expired. (Twitter shares bounced to 41.04 high). Communication Services and Information Technology paired (-2.27%) weighed by semiconductor and hardware makers (Micron, Nvidia, Apple and Intuit lead laggers).

- DJIA -301.01 (-0.91%) at 32951.22; Nasdaq -298.3 (-2.4%) at 12019.64.

- Dow Industrials Leaders/Laggers: Caterpillar (CAT) 2.43 at 222.43, Chevron (CVX) +1.40 at 177.40 as crude moved back to early week highs. Laggers: Apple (AAPL) -5.82 at 145.39, Goldman Sachs (GS) -5.29 at 318.96, and Microsoft (MSFT) -4.11 at 270.17.

E-MINI S&P (M2): 50-Day EMA Remains Exposed

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4184.37/4202.25 50-day EMA / High May 31

- PRICE: 4112.20 @ 1445ET June 3

- SUP 1: 3960.50/3807.50 Low May 26 / Low May 20 and bear trigger

- SUP 2: 3801.97 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont)

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis maintain a firmer tone despite today’s pullback. The contract continues to test the 50-day EMA, at 4184.37 today. A clear break of this EMA would strengthen current bullish conditions and signal potential for a climb towards a key resistance at 4303.50, the Apr 26/28 high. Recent gains are still considered corrective and the primary trend is down. A reversal lower would refocus attention on the bear trigger at 3807.50.

Monday/Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/06/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 06/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 06/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 07/06/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 07/06/2022 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 07/06/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 07/06/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 07/06/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/06/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 07/06/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/06/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/06/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 07/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/06/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/06/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/06/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.