-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Fed Barkin Warms Up For Powell

US TSYS: Tsy Yields Climb Ahead Fed Chair Powell Testimony Wed

US Tsy yields see-saw higher upon return from Juneteenth holiday Tuesday, but scaled back moves well after the close: 30YY off morning high of 3.3922% at 3.3496% (+.0701) w/ futures off late session lows (Block 5Y buy +7,603 FVU2 at 110-12.25 helped get the ball rolling).

- Wide range for steeper yield curves, still well off pre-FOMC levels: 2s10s +4.775 at 8.641 vs. 11.154 high, 5s10s still inverted at -8.448 (3.525) but well off early low (-12.223).

- Limited impact from data: Existing Home Sales for May in-line: -3.4% TO 5.41M SAAR; Chicago Fed National Activity Index 0.01 vs. 0.47 expected, 0.4 prior. Attention turns to Richmond Fed Barkin as he takes part in virtual moderated Q&A session w/ NABE at the top of the hour: "need to raise rates fast .. without breaking anything".

- "I understand why some are forecasting a recession," he said in remarks prepared for a meeting of the Risk Management Association in Richmond, Va. "But the challenge in predicting a recession for tomorrow is the strength of the aggregate data today."

- Focus on Fed Chair Powell semi-annual Senate panel testimony early Wednesday (0930ET) followed by Barkin again, Chicago Fed Evans and Philly Fed Harker.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements- O/N +0.00757 to 1.57500% (+0.00757/wk)

- 1M +0.01528 to 1.64157% (+0.02928/wk)

- 3M +0.03100 to 2.15443% (+0.05857/wk) * / **

- 6M +0.02900 to 2.84186% (+0.06143/wk)

- 12M +0.00486 to 3.62543% (+0.03957/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2+Y high: 2.15443% on 6/22/22

- Daily Effective Fed Funds Rate: 1.58% volume: $84B

- Daily Overnight Bank Funding Rate: 1.57% volume: $243B

- Secured Overnight Financing Rate (SOFR): 1.45%, $923B

- Broad General Collateral Rate (BGCR): 1.46%, $365B

- Tri-Party General Collateral Rate (TGCR): 1.46%, $352B

- (rate, volume levels reflect prior session)

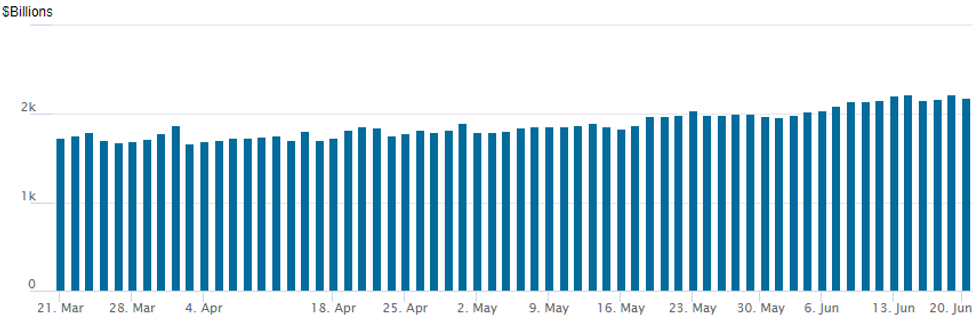

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes from last Friday's record high of $2,229.279B to $2,188.627 w/ 97 counterparties currently.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Eurodollar option trade centered on calls, mirroring EGB derivatives flow Tuesday as yields continued to climb (30YY tapped 3.3922% high) and curves bear steepened (2s10s +7.036 to 10.902 by the bell).- Directionally, flows were mixed. Some faded the sell-off in underlying futures -- looking for a rebound (5,000 Sep 95.87/96.12/97.25/97.50 call condors, 19.5; 10,000 Jul 96.68/97.06 1x2 call spds, 5.5). While others were more repositioning: Block total +20,000 Sep 96.75/97.00/97.25 call trees, 2.5 vs. -20,000 Sep 97.25/97.56/97.75 at 1.0 -- appeared to be a position roll-down/adjust.

- Treasury option volumes centered around position squaring of July options that expire this Friday.

- Block, 6,000 SFRV2 95.75/96.00/96.25 put flys, 2.25 ref 96.375

- Block, 10,000 Jul 96.68/97.06 1x2 call spds, 5.5 at 1357:12ET

- Block, total +20,000 Sep 96.75/97.00/97.25 call trees, 2.5 vs. -20,000 Sep 97.25/97.56/97.75 at 1.0

- +5,000 Dec 95.25/96.00 2x1 put spd w/ Dec 95.00/95.75 2x1 put spds strip, from 7-8

- +5,000 Sep 95.87/96.12/97.25/97.50 call condors, 19.5

- +2,000 Dec 95.00/95.75 2x1 put spds, 3.25

- 15,300 Green Dec 97.75/98.25 call spds

- 4,000 Oct 95.75/96 put spds

- +13,000 FVQ 114.5 calls, 2 ref 110-11.5

- -2,000 USQ 127/130 put spds, 36 ref 133-18

- Block, 9,000 TYN 114 puts, 4

- 10,000 USN 128/129/130 put trees

- 4,500 TYN 114.25 puts, 5

- 32,000 TYN 113/114 put spds

- Blocks, total 7,500 TYN 115 puts 59-61

- 12,000 TYN 116.25 calls

- 12,700 TYN 117.5 calls

- 2,000 USN 131 puts, 15

- 2,000 USN 130 puts, 8

- 3,000 USQ 124 puts, 17

- over 31,000 TYN 117 calls

EGBs-GILTS CASH CLOSE: Supply Pushes Long-End Yields Higher

European curves bear steepened Tuesday, with periphery EGBs outperforming as speculation continued over an ECB anti-fragmentation tool.

- 50Y Gilt supply via syndication helped Gilts underperform with curve steepening. 30Y yields rose to post-2014 highs just shy of 2.9% at one point.

- Likewise long-end green NGEU (and German 2038 Bund sale Weds) underpinned a rise in core/semicore EGB yields.

- Early comments by ECB's Rehn that the central bank was "firmly committed" to contain "unwarranted fragmentation" helped periphery spreads continue compressing.

- GGBs outperformed with spreads over 10Y bunds down nearly 10bp; BTP spreads closed at the tightest since May 26th.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 0.2bps at 1.155%, 5-Yr is up 0.2bps at 1.552%, 10-Yr is up 2.2bps at 1.771%, and 30-Yr is up 3.4bps at 1.975%.

- UK: The 2-Yr yield is up 1.6bps at 2.316%, 5-Yr is up 3.1bps at 2.34%, 10-Yr is up 5bps at 2.654%, and 30-Yr is up 7.5bps at 2.871%.

- Italian BTP spread down 2.8bps at 192.7bps / Greek down 9.8bps at 217.4bps

Mostly Call Buying Tuesday

Tuesday's Europe rates / bond options flow included:

- RXN2 135p, trades 1.5 in 5k

- RXQ2 141.5/138.5ps, bought for 69 in 4.2k

- RXU2 147/151/155 call fly bought for 58 in 6k

- ERU2 99.25/99.37/99.50/99.62c condor, bought for 4 in 3k

- ERU2 99.25/99.37cs 1x2, bought the 1 for -5 (receive) in 3.5k

- 0RU2 98.00p sold at 63 in 3k (ref 97.56, -69 del)

FOREX: Greenback Recovers Early Declines, USDJPY Trend Remains North

- A more positive tilt to risk sentiment and bolstered global equity indices prompted further significant pressure on the Japanese Yen on Tuesday. USDJPY’s firm bounce following the BOJ meeting last Friday has extended and the pair’s trend needle continues to point North.

- Cycle highs at Y135.59 have been broken momentum buying through the break level has seen USDJPY print as high as 136.45, now residing at its highest level since 1998. The pair remains in close proximity of the day’s best levels as we approach the APAC crossover. With a number of resistance points being breached, the next focus technically will be on 137.30, the 1.50 Fibonacci projection of the Feb 24 - Mar 28 - 31 price swing.

- Naturally cross/JPY has seen some significant gains, with the likes of AUDJPY and CADJPY up close to 1.5%, capitalising on the improved risk environment.

- Early risk on also placed the US dollar on the backfoot, with the DXY trading down roughly half a percent approaching the US open. However, a slow grinding recovery sees the Index now trading at close to unchanged levels for the session.

- The better bid greenback weighed on a previously perky Euro, which saw EURUSD fall from a 1.0582 intra-day peak back down to around 1.0530/40 as of writing.

- NZD shows relative underperformance on the back of a quarterly Westpac Survey showing that consumer confidence in New Zealand tumbled to a record low. CAD (+0.43%) outperforms following a decent set of April retail sales data that came in above estimates, underpinning the loonie.

- Coming up during Wednesday’s APAC session will be NZ trade data as well as the BOJ minutes from the June meeting. Focus will then turn to CPI data from both the UK and Canada before Fed Chair Jerome Powell is due to testify on the Semi-Annual Monetary Policy Report before the Senate Banking Committee.

Expiries for Jun22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E594mln), $1.0580(E595mln), $1.0595-00(E714mln), $1.0630-35(E554mln), $1.0650-60(E760mln)

- USD/JPY: Y134.40-57($710mln)

- GBP/USD: $1.2245(Gbp738mln)

- EUR/GBP: Gbp0.8700(E570mln)

- USD/CAD: C$1.3020($550mln)

- NZD/USD: $0.6300(N$998mln)

- USD/CNY: Cny6.70($920mln)

Late Equity Roundup: Near Session Highs

Stocks holding near late session highs after the FI close, SPX emini futures ESU2 currently +99.25 at 3775 vs. 3782.75 high. Less of a risk-on move and more like tactical positioning/buy the dip as myriad risk factors remain.

- SPX leading/lagging sectors: Energy sector continued to outperform (+5.55%) with O&G and equipment related shares trading strong (Diamond Back Energy +9.02% at 133.32; Exxon +6.87% at 92.04; Schlumberger +6.65% at 39.07). Consumer Discretionary up net (+3.00%) supported by strong rally for autos -- yes, Tesla leads +10.71% at 719.90; Borg Warner a distant second (+5.11% at 35.39). Laggers: Materials (+1.57%) followed by Communication Services (+1.83%) and Utilities 1.95%.

- DJIA +658.83 (2.2%) at 30553.05; Nasdaq +269.7 (2.5%) at 11069.23.

- Dow Industrials Leaders/Laggers: United Health Grp (UNH) extends the rally: +29.24 to 481.31 -- after annc $1.5B purchase of health tech company EMIS. Microsoft (MSFT) +6.42 at 254.07. Laggers: Home Depot (HD) -1.42 at 269.31; Disney (DIS) -0.92 at 93.40; 3M (MMM) gained 0.29 to 130.13.

E-MINI S&P (U2): Trend Needle Still Points South

- RES 4: 4396.75 High Apr 22

- RES 3: 4308.50 High Apr 28

- RES 2: 4082.13/4204.75 50-day EMA / High May 31

- RES 1: 3843.00/3933.84 High Jun 15 / 20-day EMA

- PRICE: 3775 @ 1545ET June 21

- SUP 1: 3639.00 Low Jun 17

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis are trading above last week’s lows. The outlook though remains bearish. Recent weakness resulted in a break of 3810.00, May 20 low and a bear trigger. The clear break confirmed a resumption of the primary downtrend and maintains the bearish sequence of lower lows and lower highs and the focus is on 3600.00 next. Firm resistance is seen at 3933.84, the 20-day EMA. Short-term gains would be considered corrective.

COMMODITIES

- WTI Crude Oil (front-month) up $1.09 (0.99%) at $110.95

- Gold is down $7.07 (-0.38%) at $1834.53

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/06/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 22/06/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 22/06/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 22/06/2022 | 0700/0900 |  | EU | ECB de Guindos Q&A at Universidad Internacional Menendez Pelayo | |

| 22/06/2022 | 0735/0935 |  | EU | ECB Elderson Speech on Climate & Q&A at Frankfurt School of Finance | |

| 22/06/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 22/06/2022 | 0840/0940 |  | UK | BOE Cunliffe Panels Point Zero Forum | |

| 22/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/06/2022 | 1230/0830 | *** |  | CA | CPI |

| 22/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/06/2022 | 1300/0900 |  | US | Richmond Fed President Tom Barkin | |

| 22/06/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/06/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 22/06/2022 | 1440/1040 |  | CA | BOC Deputy Rogers "fireside chat" | |

| 22/06/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/06/2022 | 1600/1200 |  | US | Richmond Fed's Tom Barkin | |

| 22/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 22/06/2022 | 1730/1330 |  | US | Fed's Patrick Harker and Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.