-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Weak Tsy Auction Weigh on Rates

US TSYS: Weak 5Y Auction Spurs late Tsy Selling

Rates trade weaker after the bell, near middle of session range, late block buying 5Y futures (+12,635 FVM2 111-03.25) helped yld curves finish steeper, but well off early highs: 2s10s +1.202 at 7.072%, 5s10s still inverted at -6.039. Average overall volumes expected to thin out ahead extended 4Th of July holiday weekend.

- Limited react to stronger than expected pending home sales +0.7% vs. -3.9%, YoY comes in weaker than the prior month at -12.0%, vs. -11.5% prior. Slight dip in rate futures after Durable New orders +0.7%, ex-trans: +0.7%.

- Stocks reversed early gains -- coincided with dip in crude at the time, WTI trades -1.56 at 106.06 a few minutes after extending high of 108.69 in early trade. WTI regained footing in second half tapping 110.44 high before slipping back to 109.50 (+1.88) after the FI close.

- Weak Tsy auctions, particularly 5s weighed on rates:

- Mildly weak 2Y sale, Tsy futures holding near middle of lower session range (curves steeper) after $46B 2Y note auction (91282CEX5) tails: 3.084% high yield vs. 3.077% WI; 2.51x bid-to-cover vs. last moth's 2.61x.

- Tsy futures sell-off after weak $47B 5Y note auction's (91282CEW7) tail: 3.271% high yield vs. 3.237% WI; 2.28x bid-to-cover vs. 2.44x last month.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00514 to 1.57100% (+0.00881 total last wk)

- 1M +0.01958 to 1.65229% (+0.02042 total last wk)

- 3M -0.00286 to 2.23157% (+0.13857 total last wk) * / **

- 6M -0.00443 to 2.86214% (+0.08714 total last wk)

- 12M +0.02729 to 3.57200% (-0.04115 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 2+Y high: 2.19729% on 6/23/22

- Daily Effective Fed Funds Rate: 1.58% volume: $91B

- Daily Overnight Bank Funding Rate: 1.57% volume: $256B

- Secured Overnight Financing Rate (SOFR): 1.46%, $926B

- Broad General Collateral Rate (BGCR): 1.46%, $367B

- Tri-Party General Collateral Rate (TGCR): 1.46%, $352B

- (rate, volume levels reflect prior session)

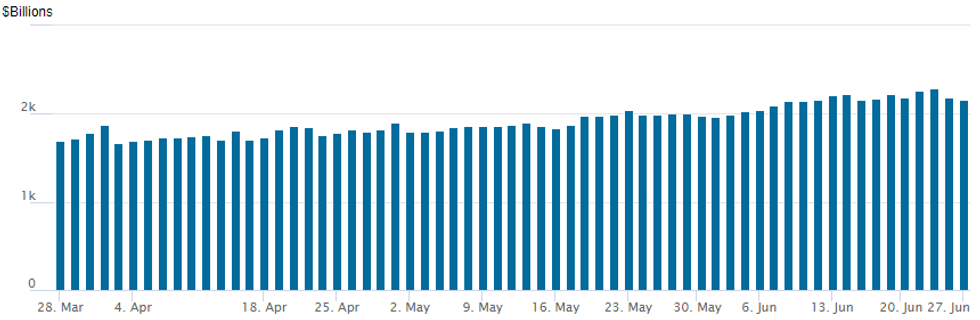

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,155.942B w/ 96 counterparties vs. $2,180.984B prior session. Compares to record high of $2,285.428B from Thursday June 23.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Light summer volumes setting in, flow mixed with Eurodollar options focused on upside calls while the SOFR options (replacing Eurodollar options in June 2023) and Treasury options focused on downside puts.- Fading the sell-off in underlying rates, Eurodollar options saw better upside call volume. Salient trade a block buy of +10,000 Jul 96.62/96.87/97.12 call flys, 3.75 over Jul 96.25/96.56 call spds. Negative rate hedging continues with paper buying 100.12 and 100.25 calls in Red Sep'23 expirys.

- SOFR option trade included modest put fly blocks in August and October expirys while Treasury option trade included put spread buying in 5s, 10s and 30s. Wk1 10Y midcurve options drew largest volume with 30,000 wk1 TY 113/114 put spds trading early.

- Block, 5,000 SFRV2 95.75/96.00/96.25 put flys, 2.25

- Block, 2,500 SFRQ2 97.06/97.31/97.56 put flys, 4.0

- Block, 5,000 SFRZ2 95.50/96.00 put spds, 10.0 vs. 96.565/0.12%

- Block, +10,000 Jul 96.62/96.87/97.12 call flys, 3.75 over Jul 96.25/96.56 call spds

- 2,000 Red Sep'23 100.25 calls, 2.5

- 2,000 Red Sep'23 100.12 calls, 2.5

- 1,500 USQ 128/132 2x1 put spds, 26

- 2,500 TYQ 116.5/118/119.5 put flys

- 5,800 FVQ 109 puts, 8

- Block, 8,000 TYU 115 puts, 57 vs. 117-00/0.31%

- over 30,000 wk1 TY 113/114 put spds

- 5,600 wk2 TY 115.5 puts

- 2,000 TYQ 113/114/115 put flys

EGBs-GILTS CASH CLOSE: Yields Maintain Rise Despite Equity Fade

Core EGB and Gilt yields rose sharply to start the week.

- While initial bond weakness came alongside a morning rebound in equities, yields gave nothing back in the afternoon as stocks retraced and risk appetite faded.

- Short end / belly underperformed in Germany (Bobl yields in particular underperformed), while the UK curve more clearly bear steepened.

- Fairly minimal newsflow and fairly light volumes, with ECB speakers (incl Lagarde, Lane) due to speak in the next 24 hours.

- Periphery EGB spreads tightened for the most part, with 10Y BTPs coming back down through the 200bp mark vs Germany.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 9.2bps at 0.905%, 5-Yr is up 12.6bps at 1.289%, 10-Yr is up 10.5bps at 1.547%, and 30-Yr is up 6.1bps at 1.752%.

- UK: The 2-Yr yield is up 8.1bps at 2.013%, 5-Yr is up 8.6bps at 2.04%, 10-Yr is up 9.1bps at 2.393%, and 30-Yr is up 9.7bps at 2.644%.

- Italian BTP spread down 5bps at 197.1bps / Greek down 2.9bps at 230.9bps

EGB Options: Bund Put Buying Features

Monday's Europe rates / bond options flow included:

- RXQ2 144.00/143.00 ps vs 151.50/152.00 cs, bought the ps for 10 up to 12 in 3k

- RXQ2 134 put bought for 20/20.5 in 6k

- DUU2 108.50/107.90 put spread vs 109.40 call, bought for 1.5 in 3.25k

- SFIU2 97.50/97.40 ps with 97.45/97.35ps strip, sold both down to 6 in 8k (ref 97.62)

FOREX: Euro Crosses Outperform, USD Index On Backfoot

- Early strength in equities underpinned a calmer outlook to currency markets on Monday and as a result, the greenback traded marginally softer to start the week. Despite global equity benchmarks paring these gains the USD Index remains -0.25% weaker and resides through last week's lows.

- Across G10, performance was mixed with the Euro shining above other majors. EURUSD briefly made a two-week high above 1.0605 but has since fallen back around 25 pips. The single currency strength is more notable in the crosses with EURAUD and EURNZD advancing around 0.7% and maintaining their upward trajectory throughout June.

- USDJPY printed just shy of 134.50 during the APAC session as within a summary of opinions from the BoJ's most recent monetary policy meeting, one member said the Bank should pay "due attention" to FX market developments. However, the early yen strength was gradually but firmly reversed throughout Europe and US trading hours, peaking at 135.55.

- USDJPY remains in an uptrend. The pair broke to new cycle highs last week, which confirmed a resumption of the primary uptrend. The move higher also maintains the bullish price sequence of higher highs and higher lows and has opened 136.88 next, the Oct 1998 high

- Turning to Tuesday, commentary is expected from ECB board members at the ECB Forum on Central Banking in Sintra. President Lagarde is due to give an introductory speech before multiple sessions are chaired by ECB Board Member Philip Lane.

- A very light day for data with US consumer confidence and Richmond manufacturing index headlining the calendar.

FV: Expiries for Jun28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E1.5bln), $1.0585-00(E1.2bln)

- USD/JPY: Y132.00-15($1.2bln), Y135.00($780mln)

Late Equity Roundup: Energy Shares Outperform

Inside range for stocks Monday, major indexes mildly weaker w/ ESU2 trading -10.5 (-0.27%) at 3905.25; DJIA -53.41 (-0.17%) at 31442.92; Nasdaq -67.3 (-0.6%) at 11539.2.

- SPX leading/lagging sectors: Energy sector outperforming (+2.49%) (outperforming: Valero Energy +7.35%, Devon Energy +7.10%); Utilities (+0.59%) followed by Health Care (+0.56%). Laggers: Communication Services continued to underperform (-1.09%) followed by Consumer Discretionary (-0.93%) and Materials (-0.81%)

- Dow Industrials Leaders/Laggers: United Health (UNH) pares gain slightly, +11.02 to 506.66; Chevron (CVX) a distant second gains 2.94 at 147.71 and Caterpillar (CAT) +2.0 at 187.49. Laggers: SalesForce.Com (CRM) -4.33 at 181.59, Boeing (BA) -2.85 at 138.68 followed by Nike (NKE) -2.34 at 110.57 and Microsoft (MSFT) -2.43 at 265.27.

E-MINI S&P (U2):Corrective Cycle Still In Play

- RES 4: 4308.50 High Apr 28

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 4042.61 50-day EMA

- RES 1: 3948.00 Intraday high

- PRICE: 3926.75 @ 14:24 BST June 27

- SUP 1: 3735.00/3639.00 Low Jun 23 / 17 and the bear trigger

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis traded higher Friday confirming an extension of the current bullish corrective cycle. The contract has traded above the 20-day EMA and this signal scope for a climb towards the 50-day EMA, currently at 4042.61. The primary trend direction remains down though and a reversal lower would signal the end of the correction. This would also refocus attention on the bear trigger at 3639.00, the Jun 17 low.

COMMODITIES: Oil Firms With Supply Constraints Whilst Gold Dips

- Crude oil prices have increased more than +1.5% today coming ahead of the G7's expected new package of sanctions against Russia including a price cap and OPEC+ trimming its 2022 market surplus forecast from 1.4mbpd to 1.0mbpd.

- CFTC data released late Fri showed a reduction in US oil net longs to the lowest since Apr’20 but a rise for European oil markets, with Brent net longs up 10.5k to 239k on continue supply risks. Separately, hardware issues have further prevented the release of EIA’s petroleum status report.

- WTI is +1.7% at $109.49 as it moves closer to initial resistance at the 20-day EMA of $110.87, clearance of which could open $116.58 (Jun 17 high).

- Brent is +1.6% at $114.90 as it moves closer to initial resistance at $116.25 (Jun 21 high), clearance of which could open $121.25 (Jun 17 high).

- ICE futures data for Brent showed a trimming of net longs across futures and options by 30k to 209k.

- Gold is -0.1% at $1824.27, having first firmed on G7 sanctions announcing a ban on new imports from Russia before fading with questions over how effective it might be. Support at $1805.2 (Jun 14 low) continues to appear exposed, clearance of which could open a bear trigger at $1787 (May 16 low).

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/06/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/06/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/06/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/06/2022 | 0800/1000 |  | EU | ECB Lagarde Intro at ECB Forum | |

| 28/06/2022 | 0830/1030 |  | EU | ECB Lane on Globalisation & Labour Markets at ECB Forum | |

| 28/06/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 28/06/2022 | 0930/1130 |  | EU | ECB Elderson on Energy Prices & Sources at ECB Forum | |

| 28/06/2022 | 1100/1300 |  | EU | ECB Panetta on Digital Currencies at ECB Forum | |

| 28/06/2022 | 1100/1200 |  | UK | BOE Cunliffe Panels ECB Forum | |

| 28/06/2022 | 1200/0800 |  | US | Richmond Fed President Tom Barkin | |

| 28/06/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/06/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/06/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 28/06/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/06/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 28/06/2022 | 1630/1230 |  | US | San Francisco Fed's Mary Daly | |

| 28/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.