-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Moderating Hawkish Expectations

US TSYS: Fed's Waller, Bullard Tamp Down 100Bp Hike Pricing

Rates trading weaker after the bell -- are well off first half lows after Fed Gov Waller tamped down on mkt pricing in chance of 100bps hike at the end of the month following Wed's "major league" CPI.

- Short end Fed Funds and Eurodollar futures gapped higher on Fed Gov Waller comments that he supports another 75-basis point increase at the July 26-27 FOMC meeting, bringing the fed funds rate to 2.25% - 2.5%.

- Sidebar: StL Fed Bullard also said he favored a 75bp hike at the end of the month. On Wednesday, Sep'22 Eurodollar futures settled -0.300 to 96.385 as markets reacted to hot Jun CPI inflation data, extending the move late after Fed's Bostic said "everything In play for future policy decisions".

- Waller judges that level is close to neutral," he said. "I think that estimates of the real federal funds rate should be based on the expected policy rate one to one and a half years in the future."

- Though June CPI may have "anchored" Waller's 75bp hike expectation in a couple weeks, He would "lean toward larger, full-point" hike if "retail sales, housing data are 'materially stronger than expected' Rtrs reported.

- Heavy data focus Friday includes Retail Sales MoM (-0.3%, 0.9%); ex-Auto (0.5%, 0.7%), Import/Export Prices, Cap-U/IP, UofMich Sentiment. Expect more Fed speak with policy blackout starting Fri at midnight. Sock earnings continue: Bank of NY Mellon, Wells Fargo, Citi Group, Blackrock, State Stree and US Bancorp on Friday.

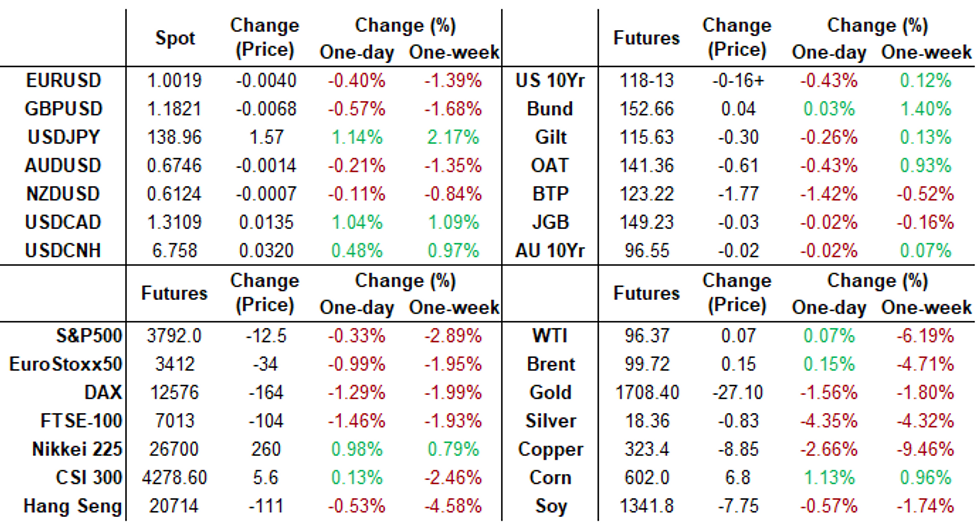

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00315 to 1.55814% (-0.00243/wk)

- 1M +0.15686 to 2.15600% (+0.25629/wk)

- 3M +0.22829 to 2.74029% (+0.31729/wk) * / **

- 6M +0.32029 to 3.32129% (+.33286/wk)

- 12M +0.24415 to 3.97829% (+0.33343/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.51200% on 7/13/22

- Daily Effective Fed Funds Rate: 1.58% volume: $96B

- Daily Overnight Bank Funding Rate: 1.57% volume: $274B

- Secured Overnight Financing Rate (SOFR): 1.53%, $924B

- Broad General Collateral Rate (BGCR): 1.51%, $367B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $358B

- (rate, volume levels reflect prior session)

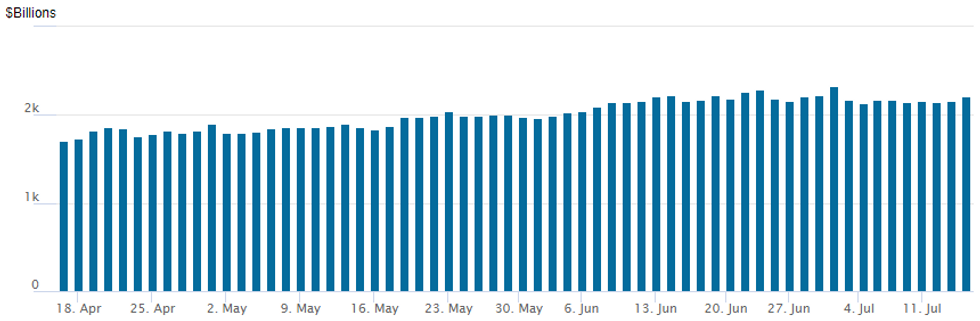

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,207.121B w/ 97 counterparties vs. $2,155.290B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Outsized put spread trade early Thursday evaporated by late morning as underlying futures in the short end gapped higher as hawkish rate hike expectations cooled suddenly.- Tamping down on mkt pricing in chance of 100bps hike at the end of the month following Wed's "major league" CPI, short end Fed funds and Eurodollar futures gapped higher after Fed Gov Waller commented that he supports another 75-basis point increase at the July 26-27 FOMC meeting, bringing the fed funds rate to 2.25% - 2.5%. Waller judged that level is close to neutral," he said. "I think that estimates of the real federal funds rate should be based on the expected policy rate one to one and a half years in the future."

- Some early highlight Eurodollar trade included a buy of 6,200 Sep 95.87/96.12/97.25/97.50 put condors and 21,300 Sep 96.75/Mar 96.12 put calendar spds. Treasury Options more mixed with two-way in 5Y puts: -9,000 FVQ 111.25/111.5 put spds, 6.5 after overnight Blocks: 10,000 FVU 111/111.25 put spds, 5.5 and 12,500 FVU 111.25 puts, 43.5 vs. 111-30.75/0.40%.

- 40,000 SFRZ2 97.25/97.50/97.75 call flys

- Block, 2,000 SOFR short Aug 96.12/96.25/96.50 broken out flys, 2.0

- Block, 1,500 SFRQ2 97.12/97.25/97.37 call flys, 0.25 wings over

- 6,200 Sep 95.87/96.12/97.25/97.50 put condor

- 21,300 Sep 96.75/Mar 96.12 put calendar spd

- 3,000 Sep 96.37/96.62/96.81 put flys

- 5,000 USU 130/134 put spds, 36

- -5,000 FVU2 112.5 calls 46.5-46

- 5,000 TYU 120/121 call spds, 14

- 2,000 TYU 114.5/120.5 strangles,

- -9,000 FVQ 111.25/111.5 put spds, 6.5

- -22,500 TYU 119/121 call spds, 41 ref 118-11 to -11.5

- 10,300 TYQ 116 puts

- Block, 10,000 FVU 111/111.25 put spds, 5.5

- Block, 12,500 FVU 111.25 puts, 43.5 vs. 111-30.75/0.40%

- Block, 5,000 FVU 111.5/111.75 2x3 put spds vs. 20,000 FVU 112.75 calls,

EGBs-GILTS CASH CLOSE: BTPs Rally Late As Draghi Seen Staying

The German and UK curves bear flattened Thursday, with Gilts underperforming - though Italian politics stole the show.

- Italy PM Draghi's government won a closely-watched Senate confidence vote, but his future remains uncertain after 5-Star abstained from supporting (a situation which he had previously said would mean the fall of the government).

- BTP spreads fell sharply from intraday highs (closed 207bp, vs 218bp high) going into the close after reports Draghi hadn't submitted his resignation as had been speculated - he's set to hold a cabinet meeting at 1815CET.

- ECB / BoE hike pricing firmed, following Fed 100bp hike speculation overnight post-US CPI, but faded toward session end on comments by FOMC's Waller that pointed to a 75bp raise.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 6.5bps at 0.523%, 5-Yr is up 3.8bps at 0.874%, 10-Yr is up 3.3bps at 1.178%, and 30-Yr is up 0.3bps at 1.383%.

- UK: The 2-Yr yield is up 16.4bps at 1.962%, 5-Yr is up 7.8bps at 1.833%, 10-Yr is up 4.1bps at 2.101%, and 30-Yr is up 2.9bps at 2.551%.

- Italian BTP spread up 7.1bps at 207.2bps / Spanish up 5bps at 115.8bps

EGB Options: Light Trade Thursday, Euribor Features

Thursday's Europe rates / bond options flow included:

- ERU2 99.50/99.375ps, sold at 9 in 15k

FOREX: USD Paring Gains Amid Bounce In Equities Following Fresh Cycle Highs

- With the focus on a potential acceleration of the Fed’s tightening pace following Wednesday’s inflation data, the greenback has continued to rally, prompting the USD index to print fresh cycle highs. Early weakness across both equity and commodity markets exacerbated the safe haven demand across currency markets, although the greenback rally has been tempered amid the most recent recovery in major equity benchmarks.

- USD/JPY was the early mover, breaking through 138 overnight and indeed accelerating above 139 throughout European trade. The rally narrowed the gap with next resistance at 139.48 (the 1.00 proj of the Jun 16 - 22 - 23) ahead of the psychological 140.00 level.

- Approaching the US cash equity open, EURUSD then finally gave way below parity. After breaching, yesterday’s low of 0.9998, a flurry of activity saw the pair trade as low as 0.9952, in close proximity of 0.9944 support, a Fibonacci projection. Despite the bounce back above parity throughout the US trading session, Trend signals still point south and daily/weekly closes below this psychological level will be significant for further momentum to the downside to gain traction.

- Matching the Japanese Yen, the Canadian dollar equally felt the pinch just a day after the BOC’s aggressive 100bp rate hike. USDCAD strength was exacerbated on a break of yesterday’s high at 1.3060 and the pair surged to 1.3224 highs. Despite the pair reversing 100 pips lower ahead of the APAC crossover, it remains up 1.1% on the day.

- Chinese growth and activity data will be the focus of Friday’s APAC session. US retail sales, empire state manufacturing and university of Michigan sentiment data are all notable releases on the US calendar to finish the week.

FX: Expiries for Jul15 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9950(E523mln), $1.0150(E564mln), $1.0200(E1.2bln)

- GBP/USD: $1.1890-00(Gbp644mln)

- USD/JPY: Y137.50-60($590mln)

- AUD/USD: $0.6900($1.0bln), $0.7000(A$515mln), $0.7120(A$515mln)

- USD/CAD: C$1.3000($1.3bln), C$1.3100($694mln), C$1.3150($551mln), C$1.3230-50($797mln)

- USD/CNY: Cny6.6500($1.8bln), Cny6.7200($510mln)

Late Equity Roundup: Trimming Losses, NASDAQ Outperforming

Stocks turning mixed in late FI trade, well off lows with Nasdaq outperforming.

Stocks bounced earlier after Fed Gov Waller cooled carry-over expectations of a 100bp hike at July FOMC after yesterday's "major league" CPI read.

- While the June CPI may have "anchored" Waller's 75bp hike expectation in a couple weeks, He would "lean toward larger, full-point" hike if "retail sales, housing data are 'materially stronger than expected' Rtrs reported.

- SPX eminis currently trading -10.25 (-0.27%) at 3793; DJIA -146.43 (-0.48%) at 30624.17; Nasdaq +9.6 (0.1%) at 11256.33.

- SPX leading/lagging sectors: Information Tech continues to outperform (+1.15%), Consumer Staples (+0.12%), Utilities (-0.15%). Laggers: Energy (-2.82%), Materials (-2.21%), and Financials (-1.86%).

- Dow Industrials Leaders/Laggers: Apple (AAPL) pulls ahead +3.08 at 148.58, Boeing (BA) +2.69 at 146.64, while Walmart (WMT) gains +2.73 at 128.10. Laggers: Goldman Sachs (GS) -8.38 at 281.77, JPM -4.30 at 107.61, MS -0.55 at 74.43.

- Earnings: Morgan Stanley earnings miss (1.44 vs. 1.57 est) after JP Morgan (2.76 vs. 2.883 est) -- both citing unprecedented volatility and deteriorating macro conditions. Bank of NY Mellon, Wells Fargo, Citi Group, Blackrock, State Stree and US Bancorp on Friday.

E-MINI S&P (U2): Approaching First Support

- RES 4: 4308.50 High Apr 28

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 3967.37 50-day EMA

- RES 1: 3950.00 High Jun 27

- PRICE: 3798.00 @ 1520ET Jul 14

- SUP 1: 3735.00/3639.00 Low Jun 23 / 17 and the bear trigger

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis have traded lower again today but the contract remains above its recent lows. The outlook is bearish, following the reversal from 3950.00, the Jun 28 high. The next support lies at 3735.00, the Jun 23 low. A breach of this level would expose key support at 3639.00, the Jun 17 low. On the upside, clearance of resistance at 3950.00 is required to reinstate a bullish theme. This would open the 50-day EMA, currently at 3967.37.

COMMODITIES

- WTI Crude Oil (front-month) up $0.07 (0.07%) at $96.40

- Gold is down $25.66 (-1.48%) at $1709.93

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/07/2022 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/07/2022 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/07/2022 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/07/2022 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 15/07/2022 | 0200/1000 | *** |  | CN | GDP |

| 15/07/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 15/07/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 15/07/2022 | - |  | EU | ECB Lagarde & Panetta at G20 CB Meeting | |

| 15/07/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 15/07/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/07/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/07/2022 | 1245/0845 |  | US | Atlanta Fed's Raphael Bostic | |

| 15/07/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/07/2022 | 1300/0900 |  | US | St. Louis Fed's James Bullard | |

| 15/07/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 15/07/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 15/07/2022 | 1400/1000 | * |  | US | Business Inventories |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.