-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI ASIA MARKETS ANALYSIS: When Hawks Cry

US TSYS: Risk Gains When Hawks Cry

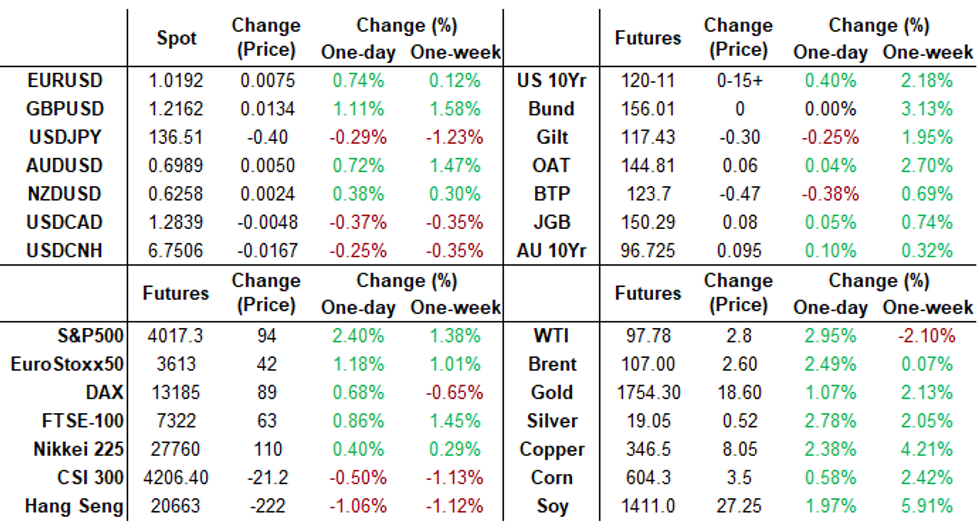

Tsys trade mixed after the bell, curves steeper w/ bonds extending lows (30YY hit 3.0777% high). Post FOMC relief rally for short end rates as forward guidance does not appear to green-light more 75bp (or greater) hike for Sep. Equities surged: SPX 4042.50 high but trimming gains a little on earning miss from Meta ($2.46 vs. $2.541 est.).

- First-half data reacts: Tsy futures trimmed pre-data gains, anticipating 2Q GDP up revision up after better than expected Durable Goods new orders +1.9% vs. -0.4% est, smaller than expected trade deficit -$98.18B vs. -$103.0B est.

- Rates see-sawed higher into/extended session highs after large miss on pending home sales and the worst M/M figure since April 2020. From the NAR: "As escalating mortgage rates and housing prices impacted potential buyers, pending sales fell in all four major regions in June 2022, with the West experiencing the largest monthly decline." (The West region M/M figure was -15.9%).

- Stocks and short end rates bounced after Chairman Powell comments:

"as the stance of monetary policy tightens further, it'll become appropriate to slow the pace of increases while we assess how cumulative policy adjustments are affecting the economy and inflation." - Currently the 2-Yr yield is down 7.7bps at 2.9756%, 5-Yr is down 7.3bps at 2.831%, 10-Yr is down 2.9bps at 2.7776%, and 30-Yr is up 3.1bps at 3.0579%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00400 to 1.56343% (-0.00114/wk)

- 1M +0.02629 to 2.37229% (+0.12000/wk)

- 3M +0.01300 to 2.80586% (+0.03957/wk) * / **

- 6M +0.02428 to 3.37071% (+0.04785/wk)

- 12M -0.00500 to 3.81200% (-0.00229/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3.5Y high: 2.80586% on 7/27/22

- Daily Effective Fed Funds Rate: 1.58% volume: $97B

- Daily Overnight Bank Funding Rate: 1.57% volume: $293B

- Secured Overnight Financing Rate (SOFR): 1.53%, $951B

- Broad General Collateral Rate (BGCR): 1.51%, $376B

- Tri-Party General Collateral Rate (TGCR): 1.50%, $369B

- (rate, volume levels reflect prior session)

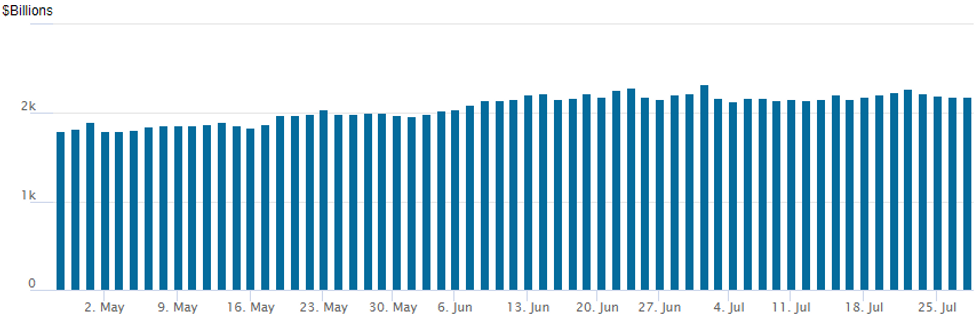

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,188.994B w/ 102 counterparties vs. $2,189.474B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

SOFR Options:- Block 3,250 SFRV2 95.75/96.00/96.25 put flys, 1.75

- -4,000 SFRQ2 96.50/96.62 put spds, 0.25

- Block, 5,000 SFRZ2 96.00/96.25 put spds, 7.0 vs. 96.59/0.10%

- Block, 5,000 SFRU2 96.68/96.81 put spds, 3.0

- +8,000 SFRQ 96.50/96.62 put spds, 0.75

- +5,000 short Dec SOFR 96.50/96.75 put spds 0.5 over SFRZ 96.87/97.12 call spds

- over -10,000 Dec 96.75 calls .25 over SFRZ2 97.12 calls adds to Block

- Block, -20,000 Dec 96.75 calls .25 over SFRZ2 97.12 calls vs. 97.705/0.05%

- 11,000 Dec 99.00/99.62 put spds

- -15,000 Dec 97.00/97.25 call spds, 2.75 vs. 96.21/0.06%

- +12,000 Aug 96.75/96.87 call spds, 1.75 vs. 96.615/0.10%

- 5,700 FVU 111 puts, 10.5

- 5,000 TYU2 117/118.5 2x1 put spds, 4 ref 119-25

- 5,000 TYU 120.5 calls, 51 ref 119-25

- Block, 2,000 FVU 113 calls, 43.5

- Block, 5,000 TYU 120.5 calls, 49

EGBs-GILTS CASH CLOSE: Pre-Fed Bear Flattening

European curves bear flattened ahead of the Federal Reserve decision after the cash close.

- A positive risk tone (equities green across the board) helped underpin Bund yields.

- In the last hour of the session, short-end yields sold off sharply, with some desks pointing a possible early release of the Rhineland-Palatinate July CPI (German state/national due out tomorrow) which showed a strong M/M reading.

- German 2s10s hit the flattest level since June 14.

- UK instruments underperformed beyond the short end, with the 10Y spread to Germany nearing the April high of 106.1bp.

- Italian spreads widened following Tuesday's downward S&P outlook revision.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 9.8bps at 0.444%, 5-Yr is up 4.6bps at 0.708%, 10-Yr is up 2.1bps at 0.946%, and 30-Yr is down 0.2bps at 1.198%.

- UK: The 2-Yr yield is up 5.2bps at 1.882%, 5-Yr is up 4.7bps at 1.732%, 10-Yr is up 4.4bps at 1.961%, and 30-Yr is up 4.7bps at 2.524%.

- Italian BTP spread up 6bps at 238.2bps / Spanish up 0.7bps at 119.3bps

EGB Options: Light Trade Pre-Fed

Wednesday's Europe rates / bond options flow included:

- DUU2 109.60/109.30ps vs 110.30/110.60cs, bought the ps for 3.5 in 17k

FOREX: Greenback Sharply Lower As No Guidance For September Sparks Risk Rally

- The US Dollar has traded significantly lower on Wednesday, following the July FOMC decision and subsequent press conference.

- The greenback received only a modest downtick following the decision to hike rates by 75bps, with the statement flagging softer spending and production indicators. However, Chair Powell’s signal that the September meeting has no particular guidance and that rate hikes will eventually slow, has sparked a relief rally across equity markets and in turn weighed heavily on the USD.

- EURUSD made light work of the day’s highs through 1.0172, trading as high as 1.0221 towards the end of the presser. The pair hovers just below the highs approaching the APAC crossover.

- Price remains below immediate resistance at 1.0278, the Jul 21 high of which a break above would once again resume short-term bullish conditions and signal scope for an extension higher within the bull channel - the top intersects at 1.0441.

- Broad dollar weakness (DXY -0.78%) and the overall firm dovish effect on risk sees the likes of GBP and AUD atop the major currency leaderboard, mirroring gains of close to 1% and USDJPY roughly 100 pips off its best levels around 136.50.

- Despite Chair Powell essentially cementing the idea that the FOMC won't pay much attention to tomorrow's GDP number, markets will inevitably eagerly await the data for clues as to the ongoing trajectory for US growth. As a reminder, Treasury Secretary Yellen is due to speak following the data.

- Aussie retail sales will hit the wires overnight before preliminary regional German CPI data will be released throughout the European morning.

Late Equity Roundup, Strong Relief Rally, MSFT Surge

More of a relief rally than a risk-on move as stocks continue to gain after the FI close. SPX well through first resistance of 4016.25 ( July 22 high), ESU2 currently 4028.75. Stocks gained momentum amid no definitive hawkish guidance for Sep as Fed remains data dependent, soft landing still a significant challenge. Chair Powell says he does not see the US currently in a recession with "too many areas of the economy that are performing too well and of course" namely the labor market.

- Currently, DJIA +463.02 (1.46%) at 32229.85; Nasdaq +473.4 (4.1%) at 12036.55.

- Earnings after the close: Meta $2.541 est, Equinix (EQIX) $5.032 est, NCR Corp $0.604, Qualcomm $2.862 est, ETSY $0.609 est, Raymond James Fncl $1.633 est. Heavy earnings slate continues Thursday.

- SPX leading/lagging sectors: Communication Services (+5.32%) lead by interactive media/entertainment: Google +8.3%, Meta +6.98%, Match Grp +5.5%. Information Technology (+4.63%) and Consumer Discretionary (+4.22%) follow, autos leading the latter, Tesla outperforming +6.31%. Laggers:Utilities (+0.17%), Real Estate (+0.63%), Health Care (+0.88%).

- Dow Industrials Leaders/Laggers: Microsoft (MSFT) +17.21 at 269.11, Salesforce.Com (CRM) +11.70 at 182.16, Goldman Sachs (GS) +7.68 at 326.23. Laggers: Visa (V) -1.34 at 211.15, 3M (MMM) -1.12 at 139.63, Travelers (TRC) -1.06 at 159.80.

E-MINI S&P (U2): Remains Above Tuesday’s Low

- RES 4: 4306.50 High May 4

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 4145.75 High Jun 9

- PRICE: 4021.50 @ 1515ET Jul 27

- SUP 1: 3900.64 20-day EMA

- SUP 2: 3820.25 Low Jul 18

- SUP 3: 3723.75/3639.00 Low Jul 14 / Low Jun 17 and a bear trigger

- SUP 4: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis have recovered from yesterday’s low. The short-term outlook is bullish. Last week’s gains confirmed a break above the 50-day EMA. This reinforces a bullish theme and suggests scope for a climb towards 4145.75 next, the Jun 9 high. The next key resistance is at 4204.75, the May 31 high. On the downside, the 20-day EMA, at 3900.64, is the first support to watch. Major support lies at 3639.00, the Jun 17 low.

COMMODITIES

- WTI Crude Oil (front-month) up $2.77 (2.92%) at $97.78

- Gold is up $19.53 (1.14%) at $1736.10

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/07/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 28/07/2022 | 0130/1130 | *** |  | AU | Retail trade quarterly |

| 28/07/2022 | 0130/1130 | ** |  | AU | Trade price indexes |

| 28/07/2022 | 0600/0800 | *** |  | SE | GDP |

| 28/07/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/07/2022 | 0645/0845 | ** |  | FR | PPI |

| 28/07/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/07/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/07/2022 | 0800/1000 | *** |  | DE | Hesse CPI |

| 28/07/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 28/07/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/07/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 28/07/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/07/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/07/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 28/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 28/07/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 28/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/07/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/07/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/07/2022 | 1730/1330 |  | US | Treasury Secretary Janet Yellen |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.