-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

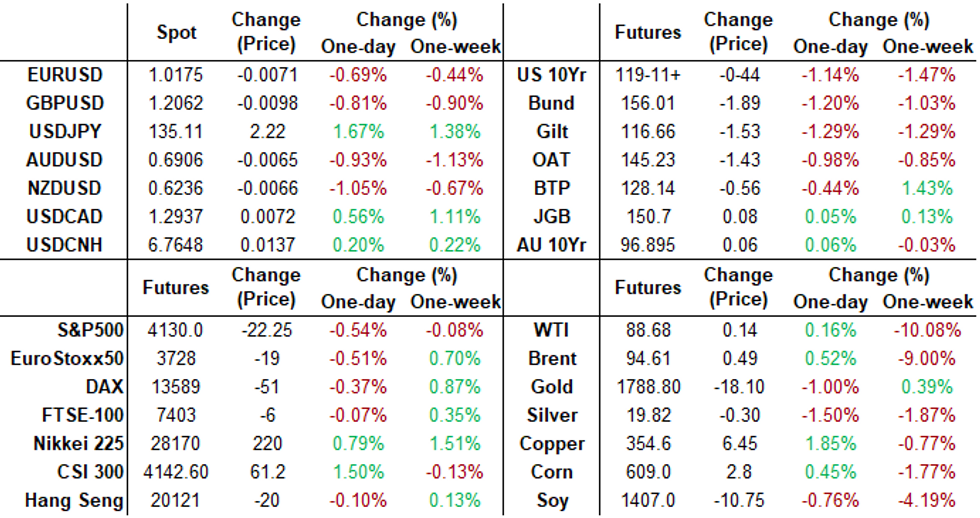

Free AccessMNI ASIA MARKETS ANALYSIS: Hawkish Fed Back This Fall

US TSYS: What Recession?

Rates trading weaker after the bell, just off midday session lows after FI markets gapped lower on stronger than expected jobs gains for July: +528k vs. +250k est, unemployment rate dropped a tenth to 3.5% after flattening out at 3.6% for six months. Average hourly earnings rose 0.5%, a tenth faster than in June. Better than expected data spurred heavy selling across the board but particularly in shorts to intermediates as yield curves extend inversion to new 22 year lows (2s10s -44.034).

- Heavy short end selling included 5Y Blocks as strong data spurs recession position unwinds as payrolls close gap with pre-pandemic levels, 75bp rate hike in September getting priced in again.

- Some faded the deep curve inversions w/ Block buying over 15,000 TUU2, 2s10s currently -5.686 at -41.947. Currently, 2-Yr yield is up 20.2bps at 3.2442%, 5-Yr is up 17.9bps at 2.9709%, 10-Yr is up 14.8bps at 2.836%, and 30-Yr is up 9.9bps at 3.0638%.

- Cross asset update: Stocks marginally lower/off lows (SPX eminis -15.0 at 4137.25 vs. 4104.25 low); Spot Gold weaker -16.10 at 1775.18; Crude weaker (WTI -0.39 at 88.15).

- Data: Slow start to next week, nothing scheduled for Monday except US Tsy bill auctions ($54B 13W, $42B 26W). Tuesday picks up with Nonfarm Productivity (-4.6% est) and Unit Labor Costs (9.8% est), US Tsy $34B 52W bill and $42B 3Y Note auctions.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00243 to 2.31200% (-0.00957/wk)

- 1M -0.00328 to 2.36943% (+0.00714/wk)

- 3M +0.00342 to 2.86671% (+0.07842/wk) * / **

- 6M +0.03286 to 3.42557% (+0.09571/wk)

- 12M -0.01914 to 3.85986% (+0.15257/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3.5Y high: 2.80586% on 7/27/22

- Daily Effective Fed Funds Rate: 2.33% volume: $91B

- Daily Overnight Bank Funding Rate: 2.32% volume: $280B

- Secured Overnight Financing Rate (SOFR): 2.29%, $981B

- Broad General Collateral Rate (BGCR): 2.27%, $393B

- Tri-Party General Collateral Rate (TGCR): 2.27%, $384B

- (rate, volume levels reflect prior session)

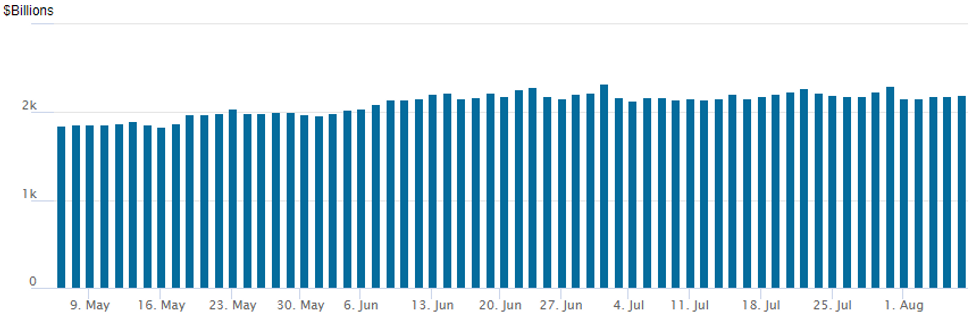

FED Reverse Repo Operation

NY Fed reverse repo usage inched higher to $2,194.927B w/ 97 counterparties vs. $2,191.546B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better buyers of FI puts in the latter half of the week made the right call as underlying futures came under heavy pressure early Friday after an unexpectedly strong July employment report. July jobs gained +528k vs. +250k est. while, unemployment rate dropped a tenth to 3.5% after flattening out at 3.6% for six months. Average hourly earnings rose 0.5%, a tenth faster than in June.- Surge of selling in shorts to intermediates, yield curves extended inversion to new 22 year lows (2s10s -44.034) as pricing of another 75bp rate hike in September returned. Friday's option volume was rather disappointing, however, victim to summer trade malaise.

- Salient trade included +7,500 October SOFR 96.00/96.25 put spds 1.0 over 97.00 calls as well as a sale of -10,000 March'23 SOFR 98.25 calls .75 over 95.25/95.56/96.00 put flys. An early Eurodollar block post had -11,500 Mar 96.37/96.87 1x2 call spds, 5.0 vs. 11,500 Mar 95.50/96.00 2x1 put spds, 2.0. Meanwhile, Treasury options included +21,000 (7.5k blocked) FVV 111/111.75 put spds, 9.5.

- -10,000 SFRZ2 97.50/97.75 call spds, 1.25

- +7,500 SFRV2 96.00/96.25 put spds, 1.0 over 97.00 calls

- -10,000 SFRH3 98.25 calls .75 over 95.25/95.56/96.00 put flys

- 3,000 SFRU 97.00/97.06/97.12 call flys

- Block, 10,000 short Dec 97.87/98.37/98.62 broken call flys, 3.0

- +10,000 Dec 99.00 calls, 0.75

- Block, 11,500 Mar 96.37/96.87 1x2 call spds, 5.0 vs.

- Block, 11,500 Mar 95.50/96.00 2x1 put spds, 2.0

- +21,000 Dec 98.50/98.75 call spds, 0.25

- 4,500 FVV 109/110 put spds

- +4,000 TYX 122 calls, 50-51

- -5,000 FVU 113.25 calls, 15

- 21,000 (7.5k blocked) FVV 111/111.75 put spds, 9.5

FOREX: USDJPY Soars Back Above 135.00 Following Stellar Payrolls

- The significant beat in US non-farm payrolls (+528k) plus a small upward two-month revision sees US jobs close the gap with pre-pandemic levels. In line with soaring front-end yields, the US Dollar sharply rallied following the release.

- Despite being off its best levels, the USD index remains up 0.9% on Friday, as the market places a greater likelihood to continued aggressive tightening in September.

- While, greenback gains were broad based following the release, the Japanese Yen was the main victim, extending a string of highly volatile trading sessions.

- Despite briefly trading around 132.50 overnight, USDJPY had recovered back above 133 before the data and the release sparked a huge gap higher, with price action gaining momentum above the week’s highs at 134.55. Relentless demand saw the pair rally another big figure, breaching the 20-day EMA resistance and notably more than 500 pips above the Tuesday low print at 135.50. Price has since moderated to the 135.00 mark, however the pair remains up 1.6% for the session as markets reassert bullish sentiment.

- Overall weakness in equities naturally weighed on the likes of AUD and NZD, retreating around 1%, however a smaller adjustment was seen in the Euro.

- EURUSD feel from 1.0230 down to 1.0142 shortly after the data, however, downside momentum failed to emerge as EURJPY broke above the best levels of the week. Indeed, EURUSD has since pared a good portion of the move and sits just 50 pips below pre-announcement levels.

- Next week’s calendar remains quiet ahead of Wednesday’s important US July CPI print.

FX: Expiries for Aug08 NY Cut 1000ET (Source DTCC)

- EURUSD; 1.0100 (542mln), 1.0175 (234mln), 1.0200 (225mln)

- USDJPY: 134.85 (230mln), 135.00 (300mln).

- GBPUSD: 1.1990 (517mln)

- USDCAD: 1.2950 (872mln).

- AUDUSD: 0.6910 (777mln), 0.7000 (972mln)

- USDCNY: 6.75 (545mln)

Late Equity Roundup: Mildly Weaker, Consumer Discretionary Weighs

Stock trading mildly weaker after the FI close, near the middle of wide range on modest position squaring ahead the weekend. Currently, SPX eminis trades -21.5 (-0.52%) at 4131.75; DJIA -14.29 (-0.04%) at 32715.8; Nasdaq -121.6 (-1%) at 12599.4.- Much stronger than expected jobs gains for July: +528k vs. +250k est , weighed on Tsy and equity markets as strong data spurs recession bet positioning as payrolls close gap with pre-pandemic levels, 75bp rate hike in September getting priced in again.

- SPX leading/lagging sectors: Energy sector rebounds (+2.30%) lead by EOG Resources (EOG) +6.91%, Diamond back Energy (FANG) +4.64%; Financials (+0.72%) followed by Materials (+0.06%). Laggers: Consumer Discretionary (-2.06%) weighed down by autos, particularly Tesla (-6.76%), Communication Services (-1.21%) w/ media and entertainment lagging, followed by Information Technology (-0.53%).

- Dow Industrials Leaders/Laggers: JP Morgan (JPM) +3.47 at 115.83, Chevron (CVX) +3.14 at 154.28, Goldman Sachs (GS) +3.01 at 334.88. Laggers: Boeing (BA) -2.13 at 164.37, McDonalds (MCD) -1.92 at 258.72, Microsoft -1.74 at 281.91.

E-MINI S&P (U2): Pullback Considered Corrective

- RES 4: 4345.75 2.00 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 3: 4306.50 High May 4

- RES 2: 4204.75 High May 31 and a key resistance

- RES 1: 4173.25 High Aug 4

- PRICE: 4130.00@ 1500ET Aug 5

- SUP 1: 3991.98/13.25 50-day EMA / Low Jul 26 and key S/T support

- SUP 2: 3820.25 Low Jul 18

- SUP 3: 3723.75/3639.00 Low Jul 14 / Low Jun 17 and a bear trigger

- SUP 4: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis traded higher Thursday to reinforce current bullish conditions. Today’s pullback is considered corrective. The break of Monday’s 4147.25 high confirms a resumption of the current bull cycle and maintains the price sequence of higher highs and higher lows. This opens 4204.75 next, May 31 high and the next key resistance. On the downside, initial trend support is at 3913.25, the Jul 26 low. The 50-day EMA intersects at 3991.98.

COMMODITIES: Oil Ends A Week Of Heavy Declines Nudging Higher

- Soft demand fears have dominated this week for crude oil with a strong payrolls report offering little support to a week of heavy declines. WTI is currently -9.8% having at one point been more than 10% for the worst weekly performance since early April and Brent even weaker at -13.8% with US grades outperforming as more exports flow to Europe to offset lower Russian imports.

- WTI is +0.5% on the day at $89.03 with vulnerability to current bearish conditions. Support is seen at $87.55 (Aug 4 low) having earlier in the week cleared a key support at $88.23 (Jul 14 low).

- Brent is +0.7% at $94.84 with bearish price activity, next eyeing support at $93.20 (Aug 4 low) with a bearish trigger of $91.22 (Jul 14 low) ultimately eyed.

- Gold meanwhile gives back more than half of yesterday’s jump higher, falling -0.9% to $1774.4 as Treasury yields and the dollar surge in response to a very strong payrolls report. It leaves a volatile week up just 0.5%, with resistance at $1795.0 (Aug 4 high) and support at $1754.4 (Aug 3 low).

- European gas firmed on the week, with TTF prices +2.8% and NBP +6.2% as tight Russia supply bites. US gas on the other hand sees the opposite, falling -2% as expanding domestic inventories eased winter-supply concerns.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/08/2022 | 0545/0745 | ** |  | CH | unemployment |

| 08/08/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 08/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 08/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 09/08/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/08/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/08/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 09/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/08/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 09/08/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 09/08/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.