-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI ASIA MARKETS ANALYSIS: Weak PMIs, New Home Sales

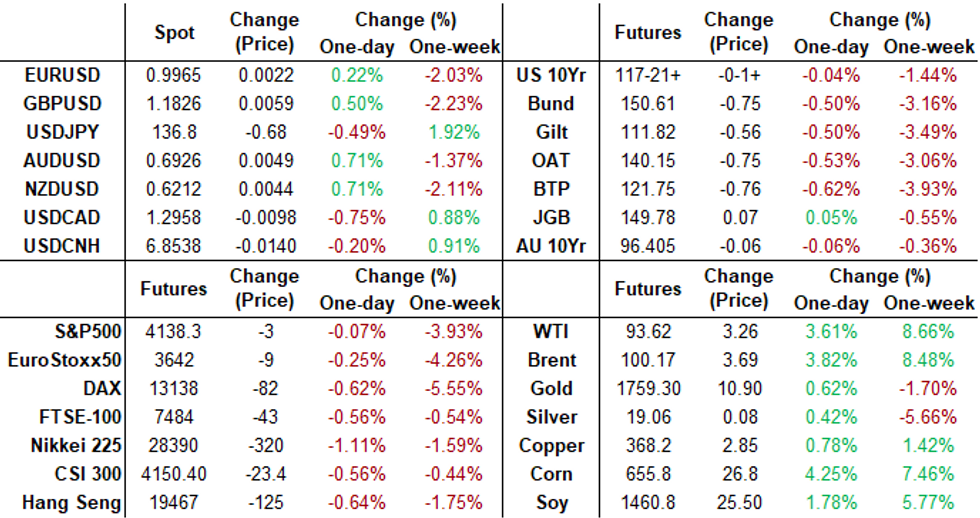

US TSYS: Curve Consistently Steeper

Inside range for Tsys after the bell, curves steeper (2s10s +5.282 at -24.663) with bonds weaker but off early session lows (30YY currently 3.2584% vs. 3.2840% high / 3.1995% low).- Steeper curves the consistent theme on the day as futures see-sawed on the day, heavier volumes (TYU2>1.7M) more tied to Sep/Dec rolls rather than data that kicked things off.

- Tsys extended highs overnight after soft European PMIs (France, Germany, EU in line or better than estimated but still sub-50, mixed UK w/ Mfg 46.0 vs. 51.0 est, Services 52.5 vs. 51.6 est) - only to extend session lows (no obvious headline driver) in the lead-up to US PMIs.

- Tsys have rebounded back near overnight highs, yield curves bull steepening (2s10s +3.648 at -26.297) after US PMIs come out weaker than estimated, particularly Services (44.1 vs. 49.8 est). Further impetus from slump in New Home Sales for July: 511k vs. 575k est, and 590k prior.

- Tsy futures pare gains yest again after $44B 2Y note auction (91282CFG1) tailed: 3.307% high yield vs. 3.290% WI; 2.49x bid-to-cover vs. 2.58x prior.

- Focus remains on KC Fed's annual Jackson Hole Economic Symposium: Reassessing Constraints on the Economy and Policy, starts Friday w/ Chairman Powell speaking at 1000ET (0800 local), text is expected but no Q&A. Markets keen on pivot after cooling data or will the Fed maintain hawkish stance to squelch inflation.

- Currently, The 2-Yr yield is down 1.2bps at 3.2975%, 5-Yr is up 1.8bps at 3.1753%, 10-Yr is up 3.2bps at 3.0461%, and 30-Yr is up 2.5bps at 3.2508%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00457 to 2.31257% (-0.00857/wk)

- 1M +0.01628 to 2.44371% (+0.05700/wk)

- 3M +0.01715 to 2.99686% (+0.03915/wk) * / **

- 6M +0.00000 to 3.56557% (+0.01800/wk)

- 12M +0.05900 to 4.09114% (+0.07528/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 2.99686% on 8/23/22

- Daily Effective Fed Funds Rate: 2.33% volume: $91B

- Daily Overnight Bank Funding Rate: 2.32% volume: $284B

- Secured Overnight Financing Rate (SOFR): 2.28%, $994B

- Broad General Collateral Rate (BGCR): 2.26%, $393B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $384B

- (rate, volume levels reflect prior session)

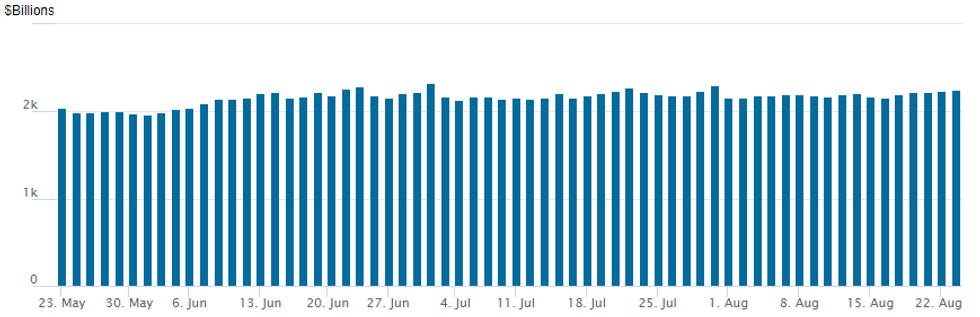

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches higher to $2,250.718B w/ 97 counterparties vs. $2,235.665B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Mixed trade on light overall volume noted Tuesday, accounts near the sidelines ahead Friday's annual eco-summit in Jackson Hole. SOFR options saw better downside put structure buying while Eurodollar and Treasury options saw better upside call buying as short end rates gained on weaker PMIs and New Home sales.- SOFR Options:

- -2,500 SFRU2 96.68/96.87/97.06 put flys, 7.75

- Block, total 30,000 SFRH3 96.00/96.25 put spds 11.25 on splits

- 2,000 short Dec 95.00 puts

- Block, 1,500 SFRZ2 95.93/96.31 2x1 put spds, 4.0 ref 96.375

- Eurodollar Options:

- +10,000 short Sep 96.37/96.50/96.62/96.75 call condors, 2.0 vs. 96.21/0.05%

- Treasury Options:

- +1,500 USU 138 calls, 43 vs. 137-25/0.46%

- +6,500 FVV 114 calls, 5

- -2,500 USV 130/134 put spds, 50-51

- 2,000 TYV 117.5 puts, 60

- 1,500 TYU 117.5 puts, 24 total volume >6.8k

- 8,000 TYU 117 puts, 9

- 3,900 USU 140.5 calls, 9

EGBs-GILTS CASH CLOSE: UK Underperformance Continues

A weak set of U.S. data dragged German yields back down Tuesday afternoon, but UK yields kept marching higher - with 10Y vs Bund spreads reaching their widest since March.

- A weak French flash PMI initially set a dovish tone for the day, pushing core yields to session lows, though a more encouraging German reading more than reversed the drop. UK services PMI held up well, though manufacturing disappointed.

- While the German curve twist steepened, Gilts bear flattened once again: 2Y yields set their 5th consecutive new post-2008 high close, off 4bp from session highs. UK 5Y underperformed on the curve, piercing the 2.50% mark for the first time since 2011.

- Greece notably underperformed its periphery peers with a double-digit spread widening.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 4.1bps at 0.854%, 5-Yr is down 1.7bps at 1.104%, 10-Yr is up 1.3bps at 1.319%, and 30-Yr is up 3.6bps at 1.487%.

- UK: The 2-Yr yield is up 8.9bps at 2.719%, 5-Yr is up 11.9bps at 2.5%, 10-Yr is up 6.2bps at 2.576%, and 30-Yr is up 4.4bps at 2.883%.

- Italian BTP spread up 0.6bps at 233.3bps / Greek up 11.6bps at 261.9bps

EGB Options: Euribor Structures In Decent Size Tuesday

Tuesday's Europe rates / bond options flow included:

- RXU2 147/151/155c fly sold at 227 in 5k

- OEV2 126/125.5ps, sold at 34 in 4k

- ERU2 99.00/12/25/37c condor, sold at 6 in 4k

- ERZ2 99.12/99.00/98.78p fly, sold at 0.75 in 18k

- ERZ2 98.75/98.50ps vs 99.00c, bought the ps for 3.25 in 8k

- ERU3 98.875/99.125/99.75c ladder, sold at 0.75 in 14k

FOREX: USD Index Set To End Winning Streak Following Softer US Data

- A trifecta of weaker-than-expected data from the US weighed on the greenback during the US session prompting the dollar index to post 0.45% declines on Tuesday. This looks set to end a significant winning streak that has seen the index rise close to 4.5% in less than two weeks, with today’s pre-data high just two pips shy of the July/cycle highs at 109.29.

- US Manufacturing and Services PMI, Richmond Fed Manufacturing and New Home Sales data all fell below median surveyed estimates, sparking a strong kneejerk reaction lower for the USD. As has been the case over most recent US data releases, USDJPY was extremely volatile and had a steep selloff, falling roughly 150 pips to intra-day lows of 135.81. The pair has since bounced back to around 136.70 but remains down 0.57% on Tuesday.

- With major equity indices in more of a consolidation mode on Tuesday, the likes of AUD, NZD and CAD were able to capture near 0.75% gains. SEK and NOK are the strongest G10 performers as ~4% gains for crude futures have underpinned the 1.3% advance for the Norwegian Krone.

- EURUSD weakness did extend heading into the start of European trading, however, 0.9900 proved firm support following slightly better than expected European Flash PMI’s. Potential short covering took EURUSD back above yesterday’s breakdown point of 0.9952 shortly before the US data, however, the poor US prints fuelled a quick spike back above parity to 1.0018 highs. Given the short-term bearish technical developments and the ongoing concerns regarding the European energy crisis, the pair fell quickly back below 1.0000 and remains just 0.25% higher on the day, relatively underperforming it’s G10 peers and the magnitude of the DXY adjustment.

- US Durable Goods and Pending Home Sales are the only data points on Wednesday. Thursday will bring the minutes of the ECB's July policy meeting and the German IFO business survey. Focus remains on Fed Chair Powell’s remarks from Jackson Hole, scheduled for Friday.

Expiries for Aug24 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9835-50(E811mln), $0.9925(E570mln), $1.0140-55(E972mln)

- USD/JPY: Y135.00($637mln), Y136.00-05($840mln), Y136.80-00($1.3bln)

- EUR/GBP: Gbp0.8750(E893mln), Gbp0.9000(E1.2bln)

- USD/CAD: C$1.2835-55($565mln)

- USD/CNY: Cny6.7900($1.0bln)

Late Equity Roundup: Energy Sector Remains Strong

Stock indexes remain mixed in late trade, strong Energy sector helping SPX stave off weaker Health Care, Real Estate and Utilities sectors., Nasdaq outpacing weaker DJIA. Currently, SPX eminis trade -3.5 (-0.08%) at 4137.5; DJIA -124.42 (-0.

38%) at 32939.88; Nasdaq +34.9 (0.3%) at 12417.5.

- SPX leading/lagging sectors: As noted Energy sector continues to outperform (+3.52%) buoyed by Haliburton (HAL) +6.95%, Occidental (OXY) +7.10%, Marathon (MRO) +4.38%, Schlumberger (SLB) +6.47% and Diamondback Energy (FANG) +3.29%. Materials (+0.99) and Consumer Discretionary follow (+0.65%). Laggers: Real Estate (-1.30%), Health Care (--1.08%) weighed by Medtronics (MDT) -2.77%, Communication Services (-0.54%).

- Dow Industrials Leaders/Laggers: Caterpillar (CAT) +4.94 at 196.70, Chevron (CVX) +4.68 at 161.58 and Boeing (BA) +1.40 at 160.38. Laggers: United Health (UNH) -6.94 at 537.63, Home Depot (HD) -5.04 at 307.21 and Procter & Gamble (PG) -2.96 at 146.37.

- Notable earnings annc's yet this week: Salesforce.com (CRM $1.028 est and Nvidia (NVDA) $0.532 est late Wednesday, Dell late Thursday $1.636 est.

E-MINI S&P (U2): Corrective Pullback Still In Play

- RES 4: 4419.15 2.236 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 3: 4345.75 2.00 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 2: 4288.00/4327.50 High Aug 19 /16 and the bull trigger

- RES 1: 4221.50 High Aug 22

- PRICE: 4139.00 @ 14:27 BST Aug 23

- SUP 1: 4080.86 50-day EMA

- SUP 2: 4000.00 Round number support

- SUP 3: 3994.50 Low Jul 28

- SUP 4: 3913.25 Low Jul 26 and a key support

A corrective cycle remains in play in the S&P E-Minis contract, signalling scope for a deeper pullback near-term. This is allowing an overbought reading in momentum studies to unwind. The 20-day EMA has been breached and attention turns to the 50-day EMA, at 4080.86. Key resistance and the bull trigger is at 4327.50, the Aug 16 high. Initial resistance is at 4221.50, Monday’s high.

COMMODITIES: Oil Sees Supply-Led Surge Whilst Further Gas Volatility On Freeport Delay

- Crude oil has surged nearly 4% today, partly on continued spillover from yesterday’s OPEC+ comments that it may need to cut production to stabilise the volatile market and with further boost from OPEC+ sources saying it could cut production when and if Iranian production returns along with a weaker USD. Further supply issues stem from Kazakh oil exports potentially disrupted for months due to damaged moorings.

- Natural gas meanwhile sees yet new swings, with the projected restart of the Freeport LNG terminal in Texas pushed back to early to mid-November having been targeting a restart in October. It saw US nat gas prices slide -4.4% at $9.25/MMBtu having surged to north of $10 earlier today, but came after EU markets closed, with a sharp rise set for tomorrow’s open to further exacerbate EU energy woes.

- WTI is +3.7% at $93.67, clearing the 20-day EMA of $91.69 and moving closer to resistance at $94.17 (Aug 11) and $94.34 (50-day EMA).

- Brent is +3.9% at $100.21, clearing the $97.88 Aug 19 high and currently testing the 20-day EMA of $100.21.

- Gold is +0.6% at $1746.3, a rare break from consistent declines for the yellow metal as dollar strength reverses. It remains off initial resistance eyed at $1764.9 (20-day EMA) whilst support in the event of renewed downward pressure is $1727.8 (Aug 22 low).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 24/08/2022 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/08/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 24/08/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 24/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 24/08/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 24/08/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.