-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

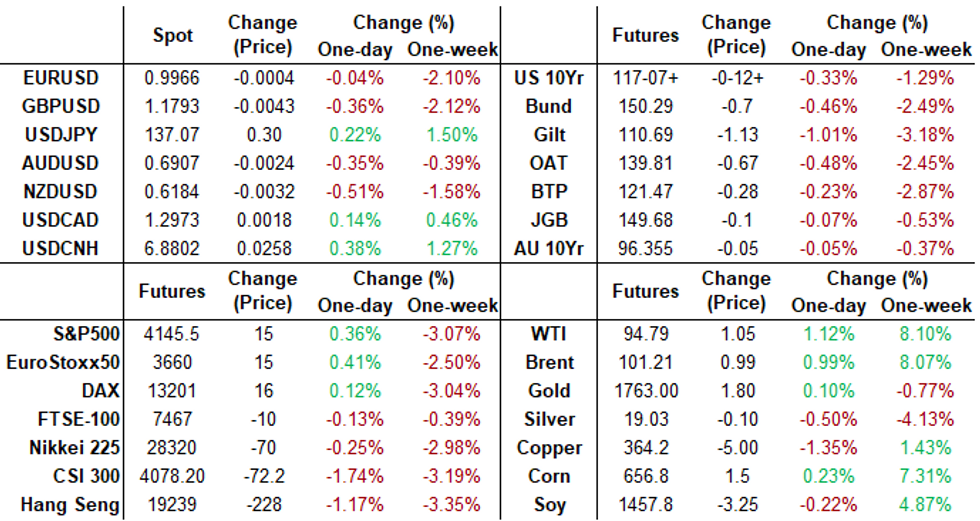

Free AccessMNI ASIA MARKETS ANALYSIS: Hawkish, Pivot or Split Difference?

US TSYS: 30Y Yield Back Over 3.3%

Tsy futures weaker but off second half lows, breaking narrow overnight range following decent Durable Goods report w/ revisions: new orders +0.0% vs. +0.8% est, however, June revised to +2.2%; ex-trans +0.3% vs. +0.2% est.- Tsy 30YY tapped session high of 3.3278% later in the second half after holding near lows following smaller-than-expected decline in July of -1% (cons. -2.6%) from a slightly downward revised -8.9% in June for -22.5% Y/Y.

- Tsy futures held lower range after $45B 5Y note auction (91282CFH9) tailed: 3.230% high yield vs. 3.217% WI; 2.30x bid-to-cover vs. 2.46x last month.

- Yield curves scaling back portion on Tue's steepening, 2s10s -2.943 at -28.719. Heavy overall volumes (TYU2>2.5M) tied to Sep/Dec roll picking up.

- Focus remains on KC Fed's annual Jackson Hole Economic Symposium: Reassessing Constraints on the Economy and Policy, starts Friday w/ Chairman Powell speaking at 1000ET (0800 local), text is expected but no Q&A. Markets keen on pivot after cooling data or will the Fed maintain hawkish stance to squelch inflation.

- Currently, 2-Yr yield is up 8.9bps at 3.3885%, 5-Yr is up 6.7bps at 3.2314%, 10-Yr is up 6bps at 3.1057%, and 30-Yr is up 6.2bps at 3.3166%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00886 to 2.32143% (+0.00029/wk)

- 1M +0.01115 to 2.45486% (+0.06815/wk)

- 3M +0.01314 to 3.01000% (+0.05229/wk) * / **

- 6M -0.07214 to 3.49343% (-0.05414/wk)

- 12M -0.01200 to 4.07914% (+0.06328/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.01000% on 8/24/22

- Daily Effective Fed Funds Rate: 2.33% volume: $91B

- Daily Overnight Bank Funding Rate: 2.32% volume: $281B

- Secured Overnight Financing Rate (SOFR): 2.27%, $952B

- Broad General Collateral Rate (BGCR): 2.26%, $390B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $383B

- (rate, volume levels reflect prior session)

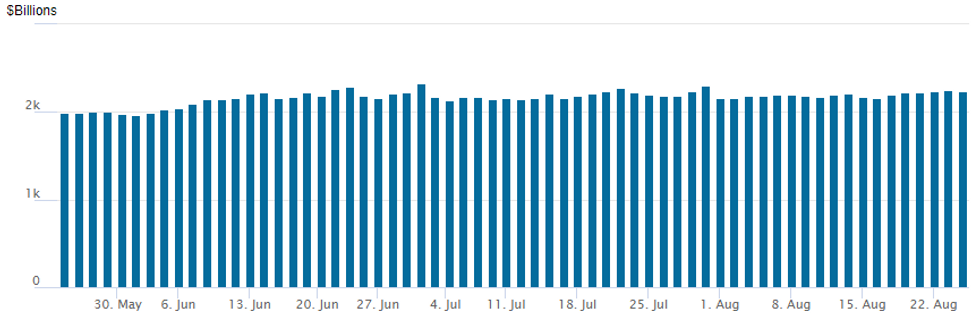

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,237.072B w/ 102 counterparties vs. $2,250.718B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

More mixed FI option trade Wednesday appeared to favor upside call and call structure buying, taking advantage of weaker underlying futures to fade the move in the lead-up to Friday morning (1000ET) appearance by Fed Chairman Powell at the Jackson Hole economic summit. Will he be hawkish (in the face of softer economic data the last few weeks), will he pivot (due to same data), will he try to thread the needle with some stance in the middle?- Today's trade could be loosely described as favoring the pivot: less hawkish rhetoric from the chairman will likely see FI markets rally, and curves bull steepen in the short term. However, given the amount of time and data yet to come between the summit and the next FOMC announcement on September 21 - it's all more likely just short term squaring rather than a major shift in positioning.

- SOFR Options:

- +4,000 SFRU3 96.50 straddles, 123-124

- Block -14,876 SFRH3 96.25 straddles, 75.0

- +20,000 SFRZ2 97.00/97.25/97.50 call flys, 0.5 vs. 96.40/0.05%

- Eurodollar Options:

- Block, 10,000 Dec 96.25 calls 14.75 vs. SFRZ2 96.62 calls, 14.0

- Block, 20,000 Nov 95.50/95.75 put spds, 4.75

- 2,000 Dec 95.81/95.93 put spds

- 6,000 Green Sep 96.25 puts

- Treasury Options: Reminder, Sep options expire Friday

- +4,000 TYZ 118.5/120.5 call spds, 41-42

- +10,000 TYU 117.75/118.75 call spds, 10

- 4,000 USV 128/130/132/134 put condors, 26

- Block, 30,000 TYU 117.75/118.75 call spds, 10

- Block, 9,000 wk3 TY 114.5/115.5 put spds, 11

- +3,250 wk5 TY 116.5/116.75 put spds, 4

- -3,600 TYV 1198/TYZ 117 put spds, 22-21

- -7,000 TYV 116.5 puts 3 over TYV 118/119.5 call spds

- 1,000 TYU 117/117.75/118.5 put flys, 31

- 2,000 TYU 118.25/118.75 call spds, 5

- Block, 5,000 TYZ 123.5/124.5 call spds, 6

EGBs-GILTS CASH CLOSE: Short-End UK Yields Continue To Soar

The UK short end continued its sell-off Wednesday, with the curve bear steepening and badly underperforming its global peers. Higher inflation expectations on the back of soaring energy prices continues to be the key driver.

- At the beginning of last week, 2Y Gilts were trading just above 2%, but at one point today traded at 2.95% and posted a 6th straight post-2008 high close.

- BoE rates are now seen exceeding 4.3% by mid-next year (up 27bp implied on the day, and vs under 3% two weeks ago). ECB rate hike pricing has ticked up too but not to the same extent (mid-2023 seen just under 2%).

- Periphery spreads were fairly well behaved, with BTP spreads narrowing slightly.

- Attention remains firmly on Friday's speech by Fed Chair Powell at Jackson Hole.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 6.7bps at 0.921%, 5-Yr is up 5.4bps at 1.158%, 10-Yr is up 5.1bps at 1.37%, and 30-Yr is up 1.7bps at 1.504%.

- UK: The 2-Yr yield is up 21.9bps at 2.938%, 5-Yr is up 20.3bps at 2.703%, 10-Yr is up 12.2bps at 2.698%, and 30-Yr is up 5.1bps at 2.934%.

- Italian BTP spread down 1.5bps at 231.8bps / Greek up 0.6bps at 262.5bps

EGB Options: Bund And Bobl Downside, Sonia Put Fly Feature

Wednesday's Europe rates/bond options flow included:

- RXV2 136p, bought for 19 in 5k

- RXV2 139/136.50ps 1x1.5, bought for -0.5 (receive), and flat in 6k

- OEV2 123.5/122.5ps with 123/122ps strip, bought for 55 in 1.5k

- OEV2 127.50/128.00cs, sold at 5 in 2.5k

- SFIH3 95/94.5/94.00 p fly, bought for 4 in 5k

FOREX: Sharp EURUSD Bounce Keeps Lid On Greenback Advance

- The USD Index spent the majority of Wednesday trading in positive territory, recovering modestly from the data-inspired dip during yesterday’s session. However, a quick spike in EURUSD weighed on the broader dollar, sending the DXY briefly into negative territory. Momentum quickly waned and the index has now consolidated at unchanged levels ahead of the APAC crossover.

- EURUSD’s bounce from 0.9920 to 0.9999 had no apparent newsflow attached to the move. However, flow driven price action was likely in play given the close proximity to the WMR fixing window around 1600BST.

- The USDJPY dip overnight to 136.17 was well supported and price action was buoyed by the upward trajectory for US yields throughout the session. After regaining the 137 handle, the pair largely shrugged off the fix-related volatility.

- Broader G10 ranges have remained subdued. The likes of AUD, NZD and GBP have all fallen between 0.4%-0.55% and are underperforming G10 peers, while NOK and SEK post modest gains.

- Headlines suggesting the China FX regulator informally warns several banks against shorting the Chinese yuan sparked an immediate dip in USDCNH from 6.8850 to 6.86. With market sentiment skewed towards buying the dip in USD/CNH, combined with fresh property concerns in China, the pair grinded back above 6.88, narrowing the gap with the earlier cycle highs at 6.8876.

- Thursday will bring the minutes of the ECB's July policy meeting and the German IFO business survey. Focus remains on Fed Chair Powell’s remarks from Jackson Hole, scheduled for Friday.

Expiries for Aug25 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9950(E888mln), $1.0000(E2.1bln), $1.0090-00(E1.0bln)

- USD/JPY: Y135.00($912mln), Y135.90-00($809mln), Y137.00($503mln), Y139.30-45($614mln)

- GBP/USD: $1.1820(Gbp574mln), $1.2150(Gbp682mln)

- NZD/USD: $0.6110-30(N$1.0bln)

- USD/CAD: C$1.2850-65($881mln)

- USD/CNY: Cny6.8500($1.4bln), Cny6.9500($2.2bln)

Late Equity Roundup: Real Estate Edges Past Consumer Discretionary

Stock indexes hold modest gains in late trade - near middle of session range after extending lows for the week overnight, Real-Estate sector edging past Consumer Discretionary in the second half. Currently, SPX eminis trade +14.75 (0.36%) at 4145.25; DJIA +79.52 (0.24%) at 32990.25; Nasdaq +70.5 (0.6%) at 12452.11.

- Notable earnings annc's after today's close: Salesforce.com (CRM) $1.028 est and Nvidia (NVDA) $0.532 est, Dell late Thursday $1.636 est.

- SPX leading/lagging sectors: Real Estate outperformed in the second half (+0.81%) lead by Iron Mountain (IRM) +2.33%, Duke Realty (DRE) +1.96%, Prologis (PLD) +1.89%. Consumer Discretionary close behind (+0.61%) as consumer durables outpaced autos. Laggers: Materials (-0.04%), Utilities (+0.12%) and Information Tech (+0.15%) semiconductor share weighing on the latter.

- Dow Industrials Leaders/Laggers: Salesforce.Com (CRM) +4.50 at 180.50, Boeing (BA) +2.55 at 162.62, Disney (DIS) +2.02 at 116.88. Laggers: seeing some profit taking after strong rally Tuesday, Caterpillar (CAT) -3.62 at 193.59, IBM -1.61 at 133.13 and Dow Inc (DOW) -1.46 at 54.16.

E-MINI S&P (U2): Approaching The 50-Day EMA

- RES 4: 4419.15 2.236 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 3: 4345.75 2.00 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 2: 4288.00/4327.50 High Aug 19 /16 and the bull trigger

- RES 1: 4221.50 High Aug 22

- PRICE: 4137.00 @ 1400ET Aug 24

- SUP 1: 4082.81 50-day EMA

- SUP 2: 4000.00 Round number support

- SUP 3: 3994.50 Low Jul 28

- SUP 4: 3913.25 Low Jul 26 and a key support

A corrective cycle remains in play in the S&P E-Minis contract, signalling scope for a deeper pullback near-term. This is allowing an overbought reading in momentum studies to unwind. The 20-day EMA has been breached and attention is on the 50-day EMA, at 4082.81 - a key pivot support. Key resistance and the bull trigger is at 4327.50, the Aug 16 high. Initial resistance is at 4221.50, Monday’s high.

COMMODITIES: Crude Oil Firms With Inventory Draw And Wait For US Public Iran Response

- Crude oil has seen a volatile session, with a larger than expected draw in US crude inventories (3.3mln bbls vs 1.2mln expected) but only a small draw for gasoline inventories (27k vs 1.4mln expected). That came before varied speculation over the contents of the US’ response to the EU’s latest proposal to revive the JCPOA with the State Dept’s Kirby later not divulging much apart from we're closer than just a couple weeks ago but with a lot of gaps remaining.

- WTI is +1.1% at $94.77 having cleared two resistance levels including the 50-day EMA at $94.31, next opening key resistance at $99.75 (Jul 29 high).

- Brent is +1.0% at $101.23, moving closer to resistance at $102.41 (Aug 2/3 high).

- Gold is +0.1% at $1750.03 although the bear cycle is seen in play with sights on $1711.1 (Jul 27 low) and key resistance at the bull trigger of $1807.9 (Aug 10 high) but first with the 20-day EMA of $1763.3 standing in the way.

- European gas has jumped 10.6% in the UK and 8.6% for TTF on spillover from Freeport re-opening delay announced late yesterday.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/08/2022 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/08/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/08/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/08/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 25/08/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/08/2022 | 1130/1330 |  | EU | ECB publishes accounts of July 20-21 meet | |

| 25/08/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 25/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 25/08/2022 | 1230/0830 | *** |  | US | GDP (2nd) |

| 25/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/08/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 25/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.