-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Digesting FOMC 4.6% Peak Rate

HIGHLIGHTS

- Fed Hikes Rates By 75BPS, Sees 4.6% Peak Rate

- BIDEN SAYS U.S. WILL NOT ALLOW IRAN TO ACQUIRE A NUCLEAR WEAPON- Reuters

- GASOLINE 4-WK DEMAND FALLS TO LOWEST SEASONAL LEVEL SINCE 1997, Bbg

Key links: Fed Chair Powell's Transcript / FOMC Sept Statement Comparison / FED Hikes 75Bp

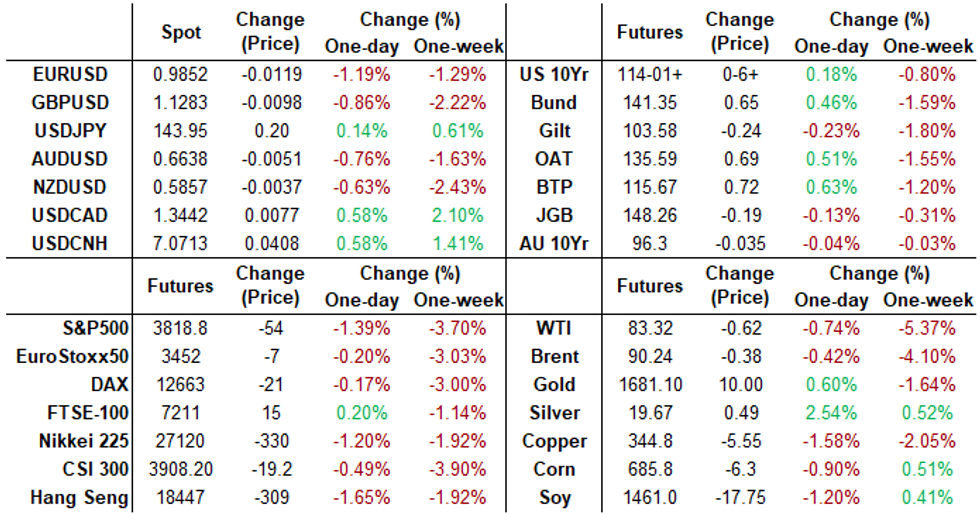

US TSYS: Digesting Hawkish Forward Guidance

Markets still reacting to FOMC's expected 75bp hike but digesting forward guidance as bonds mark new highs, curves extending inversion w/2YY back over 4.0% to 4.0378% at the moment, stocks extending lows after bouncing to new session highs following initial FOMC react.

- Stocks made new lows (3802.25) after initial selling sent SPX to 3836.75 low. Hawkish forward guidance weighed on equities and helped push 2YY to new 15 year highs of 4.1168%, yield curves extending inversion (2s10s -53.757 low).

- The Fed also sharply boosted its forecast for where interest rates are likely to peak next year to 4.6% from its June forecast of 3.8%. “Recent indicators point to modest growth in spending and production,” the FOMC said in a statement.

- Flipside to hiking to is prospect of cutting rates as price stability and inflation comes back to 2.0% target helping current rebound with SPX tapping 3918.75 high.

- Timing of Chair Powell comment on recession risk: "no one knows whether this process will lead to a recession or if so, how significant that recession would be," coincided with dip in stocks to 3890.0. Late risk-off on question regarding economic pain and potential "difficult correction" to get housing fundamentals back in balance.

- Smaller than expected August existing home sale -0.4% decline to 4.80M, helped buoyed 2Y yields as pace slowed abruptly from the -5.7% in July and an average monthly decline of almost -5% through 1H22.

- The 2-Yr yield is up 6.7bps at 4.0335%, 5-Yr is down 0.2bps at 3.7449%, 10-Yr is down 4.5bps at 3.5181%, and 30-Yr is down 7.3bps at 3.4978%.

SHORT TERM RATES

US DOLLAR LIBOR: Settlements resume:

- O/N +0.00428 to 2.31971% (+0.00414/wk)

- 1M +0.00714 to 3.05900% (+0.04514/wk)

- 3M +0.00215 to 3.60386% (+0.03857/wk) * / **

- 6M -0.05114 to 4.12400% (+0.00071/wk)

- 12M -0.01700 to 4.68243% (+0.01029/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.60171% on 9/20/22

- Daily Effective Fed Funds Rate: 2.33% volume: $91B

- Daily Overnight Bank Funding Rate: 2.32% volume: $301B

- Secured Overnight Financing Rate (SOFR): 2.26%, $967B

- Broad General Collateral Rate (BGCR): 2.25%, $390B

- Tri-Party General Collateral Rate (TGCR): 2.25%, $374B

- (rate, volume levels reflect prior session)

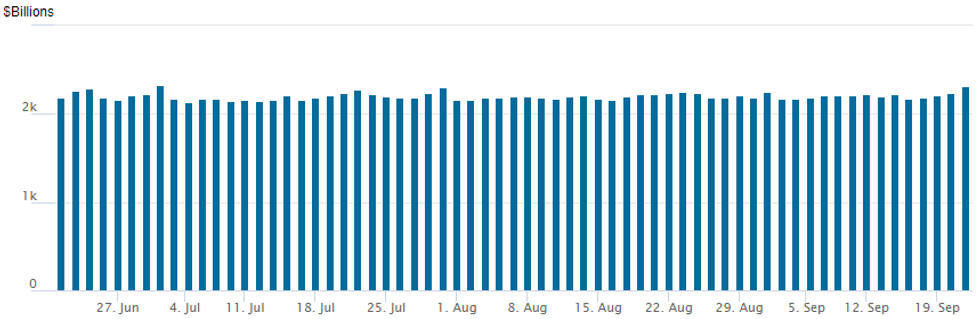

FED Reverse Repo Operation: Second Highest on Record

NY Fed reverse repo usages climbs to $2,238.840B w/ 102 counterparties vs. $2,238.840B prior session. Nearing record high that still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

- SOFR Options:

- Block, +10,000 SFRV2 95.43/95.56 put spds, 2.5 vs. 95.71/0.10%

- Block, 5,000 SFRV2 95.00/95.25 put spds, 0.75 vs. 95.685/0.05%

- Eurodollar Options:

- 13,000 Dec 97.25/97.50/97.75 put trees

- 2,000 Green Dec'24 98.00/99.00/99.50broken call flys

- Treasury Options:

- +9,000 FVX 111 calls, 9

- +1,000 USX 130 calls, 205 vs. 119-26/0.49%

- +2,000 TYX 111.5 puts, 22 ref 113-29/0.10%

- -9,000 TYZ2 114 straddles, 308-306

- 6,500 TYX 116 calls, 25 ref 114-01, total volume 13,700

- 3,000 TYV 118/118.5 put spds

- 8,000 TYV 112/113 put spds, 7

- +20,000 TYZ 119.5/121.5 1x2 call spds, 1vs. 113-31.5 to 114-02/0.10%

- +10,000 TYX 112.5 puts, 35, total volume over 19,000 from 32-36

- 3,300 TYX 110.5/112.5 1x2 put spds

- Block, 7,500 FVX 108.25/108.75 put spds, 12

- 5,700 FVX 110 calls, 20

- 22,000 TYX 118 calls, 9

EGBs-GILTS CASH CLOSE: Gilts Underperform As Short-End Weakens Pre-Fed

European curves twist flattened Wednesday with the short end underperforming ahead of the Federal Reserve decision later in the evening.

- After core instruments gained early on a safe-haven bid with Russia-Ukraine tensions in focus, short-end yields / STIR implied rates rose for the rest of the session, exacerbated by higher US terminal rate pricing going into the much-anticipated Fed meeting.

- Some segments of the German and UK curves reached multi-year flats, with German 5s30s inverting for the first time since 2008.

- Most of the UK curve underperformed, with the government's energy price support scheme for businesses coming in largely in line with expectations, and focus turning to Fed/BoE Thursday/fiscal announcements Friday.

- Periphery EGBs traded mixed, with BTP spreads narrowing as broader equities gained.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 4.6bps at 1.759%, 5-Yr is up 1.5bps at 1.839%, 10-Yr is down 3.3bps at 1.893%, and 30-Yr is down 8.3bps at 1.838%.

- UK: The 2-Yr yield is up 6.4bps at 3.39%, 5-Yr is up 7.4bps at 3.38%, 10-Yr is up 2.1bps at 3.311%, and 30-Yr is down 0.1bps at 3.589%.

- Italian BTP spread down 2.3bps at 224.2bps / Greek up 2.9bps at 256.9bps

FOREX: Kneejerk Surge For Greenback Reverses, Still Holding Solid Daily Advance

- Broad greenback strength emanated overnight following comments from Russian President Vladimir Putin on the partial mobilisation effective today across Russia. These gains sharply extended following the release of the FOMC decision/statement, with the USD Index soaring to fresh cycle highs above 111.50.

- Despite the hawkish initial reaction to the Fed seeing a 4.6% peak rate, markets reversed all the moves throughout the press conference, with most asset classes trading back to pre-announcement levels. With that said, the USD Index is holding onto 0.8% gains on the day and is set to close at its best levels since June, 2002.

- EURUSD is holding onto losses over 1% on Wednesday as trend conditions are being highlighted by a break of the bear trigger at 0.9864, the Sep 6 low. The next immediate levels of note on the downside are:

- SUP 1: 0.9800 Round number support

- SUP 2: 0.9785 2.00 projection of the Jun 9 - 15 - 27 price swing

- Similarly, GBPUSD has moved sharply lower and has broken through the 1.13 mark. Nearest support levels are:

- SUP 1: 1.1200 Round number support

- SUP 2: 1.1153 1.764 proj of the Jun 16 - Jul 14 - Aug 1 price swing

FX: Expiries for Sep22 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900(E1.7bln), $0.9950-55(E963mln), $1.0000(E4.2bln), $1.0050(E1.2bln)

- USD/JPY: Y137.00($1.0bln), Y143.45($570mln)

- GBP/USD: $1.1490-05(Gbp1.2bln)

- USD/CAD: C$1.3150($840mln), C$1.3200($665mln), C$1.3420($740mln), C$1.3450($613mln)

- USD/CNY: Cny7.00($2.5bln)

Late Equity Roundup: Hawkish Guidance, Late Session Volatility

Late session volatility - stock indexes were firmer after experiencing some post-FOMC swings: Hawkish forward guidance weighed on equities (initial selling sent SPX to 3836.75 low) and helped push 2YY to new 15 year highs of 4.1168%, yield curves extending inversion (2s10s -52.492 low).

- But flipside to hiking to is prospect of cutting rates as price stability and inflation comes back to 2.0% target helping current rebound with SPX tapping 3918.75 high. Round of selling on late question regarding economic pain and potential "difficult correction" to get housing fundamentals back in balance.

- Currently, SPX eminis trades -23.75 (-0.61%) at 3850.25; DJIA -210.28 (-0.68%) at 30509.19; Nasdaq -52 (-0.5%) at 11378.06.

- SPX leading/lagging sectors: Consumer Staples lead for the second day running (+0.79%) lead by food, beverage and tobacco shares, followed by Information Technology (+0.36%) while Industrials (+0.17%) scaled back earlier gains. Laggers: Consumer Services (-0.47%) weighed by telecom shares, followed by Materials (-0.38%) and Consumer Discretionary (-0.23%) with services underperforming.

- Dow Industrials Leaders/Laggers: Rebounding after heavy pressure Tue, Home Depot (HD) +3.37 to 277.54, Walmart (WMT) +3.08 at 136.63, Goldman Sachs (GS) +3.02 at 326.18. Laggers: United Health (UNH) -2.95 at 519.85, Caterpillar (CAT) -2.68 at 175.3, Visa (V) -2.57 at 189.5.

E-MINI S&P (Z2): Bear Threat Still Present

- RES 4: 4345.75 High Aug 16 and a bull trigger

- RES 3: 4313.50 High Aug 18

- RES 2: 4234.25 High Aug 26

- RES 1: 4002.92/4175.00/47 20-day EMA / High Sep 13

- PRICE: 3892.75 @ 14:28 BST Sep 21

- SUP 1: 3843.25 Low Sep 20

- SUP 2: 3819.54 76.4% retracement of the Jun 17 Aug 16 bull leg

- SUP 3: 3741.75 Low Jul 14

- SUP 4: 3657.00 Low Jun 17 and a major support

S&P E-Minis are consolidating but remain soft. A bearish outlook follows last week’s reversal and break of a key short-term support at 3900.00, the Sep 7 low. This confirmed a resumption of the bear cycle that started mid-August and has paved the way for a move towards 3819.54, a Fibonacci retracement. Key short-term resistance has been defined at 4175.00, the Sep 13 high. Initial resistance is at 4002.92, the 20-day EMA.

COMMODITIES: Mixed Session For Oil Whilst Gold Gains Despite USD Net Strength

- Crude oil has seen a mixed day but is ultimately finishing broadly unchanged, rising on Putin’s address and partial mobilisation along with “overt nuclear threats” in the words of Biden, before being helped lower by weak US gasoline demand and then ultimately moving sideways through the FOMC announcement and press conference.

- WTI is -0.3% at $83.66, not troubling the bear trigger at $81.20 (Sep 8 low) but the path of least resistance still lower. In the CLX2, most active strikes today have been $75/bbl puts.

- Brent is -0.1% at $90.56, still eyeing support at $88.5 (Sep 19) and then the bear trigger at $87.24 (Sep 8 low).

- Gold is +1.1% at $1682.5 despite net USD strength on the day having earlier cleared $1688.9 (Sep 1 low) to open resistance at $1735.1 (Sep 12 high).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/09/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 22/09/2022 | 0730/0930 |  | CH | SNB interest rate decision | |

| 22/09/2022 | 0730/0930 | *** |  | CH | SNB policy decision |

| 22/09/2022 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 22/09/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 22/09/2022 | - | *** |  | JP | BOJ policy announcement |

| 22/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 22/09/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 22/09/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 22/09/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/09/2022 | 1400/1000 |  | US | Leading Index | |

| 22/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 22/09/2022 | 1500/1100 |  | US | Kansas City Fed Manufacturing Activity | |

| 22/09/2022 | 1500/1700 |  | EU | ECB Schnabel Keynote at Network Luxemburg | |

| 22/09/2022 | 1500/1600 |  | UK | BOE Tenreyro on Climate | |

| 22/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 22/09/2022 | 1830/1930 |  | UK | BOE Haskel Panellist at Lecture |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.