-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 50Bp Rate Cut Hopes Persist

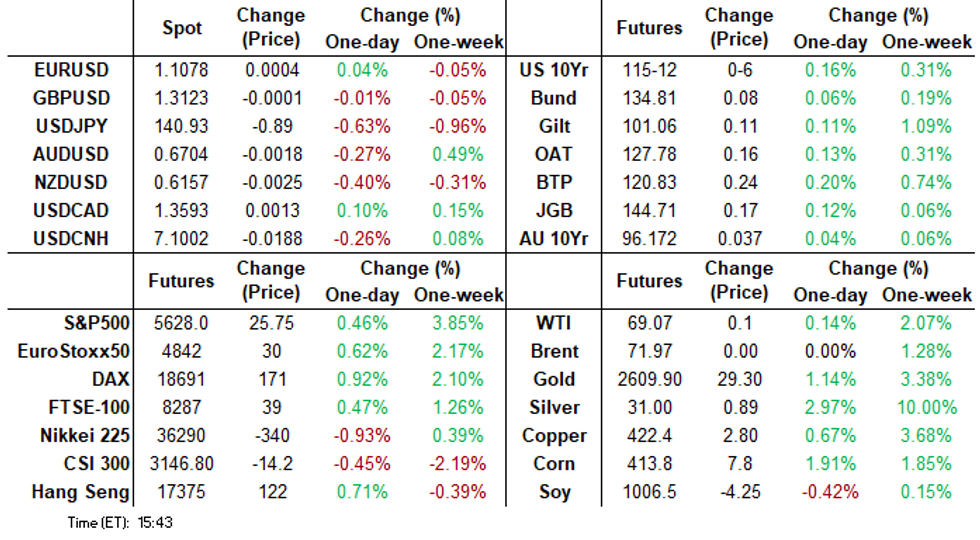

- Treasury curves bull steepened Friday as speculation over larger than a 25bp cut from the Fed at next week's FOMC continued, 2s10s climbing to the highest level since early July 2022 (8.516).

- Heavy short end buying (Dec'24 SOFR +.090 at 95.975) helped projected rate cut pricing by December climb to 117.2bp.

- Market speculation over lower yields also continued to underpin stocks as major indexes climbed to two week highs.

- Steeper yield curves and projected rate cut gains into year end were underscored by a modest dip in this morning's UofM 1Y inflation expectations (2.7% vs. 2.8% est) and a rise in sentiment (69.0 vs. 68.5 est).

US TSYS Great Expectations, For Lower Rates

- Continued speculation over more than an expected 25bp rate cut at next Wednesday's FOMC policy announcement (includes Summary of Economic Projections), buoyed short end rates as curves climbed to the steepest levels since early July 2022 (2s10s 8.816 high) Friday.

- Sep'24 Treasury futures trade +7 at 115-13 after the bell, compared to 115-18.5 overnight high, well inside initial technicals: resistance at 115-23.5 (High Sep 11), support at 114-27.5/13 (Low Sep 10 / 20-day EMA).

- Projected rate hikes through year end firmer vs. late Thursday levels (*) : Sep'24 cumulative -38.1bp (-31.5bp), Nov'24 cumulative -76.6bp (-68.6bp), Dec'24 -117.4bp (-107.5bp).

- Treasury futures held inside a narrow session range after UofM data showed a slight increase in sentiment, a dip in 1Y inflation expectations vs. a slight increase in 5-10Y expectations. 1Y inflation: 2.7% (cons 2.8) after 2.8% in Aug to dip to its lowest since Dec 2020. For what it’s worth, three of the four latest preliminary reports have been revised down in the final release as well.

- Import prices were softer than expected in August at -0.3% M/M (cons -0.2), and more notably import prices ex-petroleum at -0.1% M/M (cons 0.2).

- Slow start to the week ahead with Empire Manufacturing early Monday, Tuesday Retail Sales precedes Wednesday's FOMC annc at 1400ET.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.01378 to 5.08273 (-0.02711/wk)

- 3M -0.00546 to 4.94118 (-0.01346/wk)

- 6M +0.00844 to 4.57892 (-0.01307/wk)

- 12M +0.01942 to 3.99185 (-0.06175/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.01), volume: $2.087T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $820B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $785B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $111B

- Daily Overnight Bank Funding Rate: 5.33% (+0.00), volume: $265B

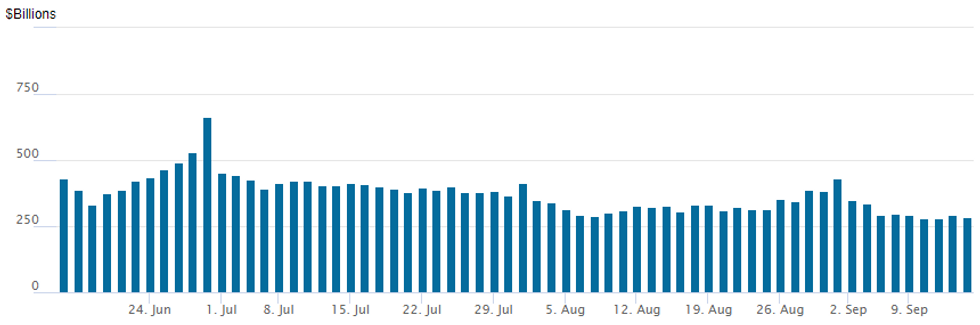

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage slips up to $284.951B from $294.464B on Thursday. Compares to Wednesday's multi-year low of $279.215B (early May 2021 levels). Number of counterparties at 62 from 58 on Thursday.

US SOFR/TREASURY OPTION SUMMARY

Aside from the heavy volume in Sep'24 SOFR option that expire today (over 350,000 in the SFRU4 95.12 strike alone), option desks reported continued interest in SOFR and Treasury option upside calls Friday. Carry-over support in underlying futures (SFRU4 +.050 at 95.1425; SFRZ4 +0.080 at 95.965) remained strong as speculation over more than a 25bp rate cut at next week's FOMC continued. Projected rate hikes through year end firmer vs. late Thursday levels (*) : Sep'24 cumulative -38.1bp (-31.5bp), Nov'24 cumulative -76.6bp (-68.6bp), Dec'24 -117.4bp (-107.5bp).- SOFR Options: Reminder, Sep options expire today

- +20,000 SFRV4 96.25/96.37/96.50/96.62 call condors 1.0 ref 95.965

- +7,000 SFRZ4 95.68/95.75/95.81 put flys, 0.75 vs. 95.86/0.02%

- +40,000 SFRZ4 95.50 puts, 2.25

- -10,000 SFRH5 96.37/96.75 call spds 11.0 over 0QH5 97.25/97.37 call spds

- Block, 33,750 SFRH5 95.50/95.75/96.00/96.25 call condors, 5.5 ref 96.625

- +10,000 SFRV4 95.81/96.06/96.18 call trees, 6.75-7.0 ref 95.965

- +5,000 SFRX4 96.12/96.25/96.37/96.50 call condors, 1.75 vs. 95.98/0.05%

- +4,000 SFRH5 95.50/96.00/96.37 put flys, 6.5 ref 96.61

- -10,000 SFRU4 95.12 calls, 1.5 vs. 95.1275/0.53%

- 10,000 SFRV4 95.62/95.68/95.75/95.81 put condors ref 95.955

- Block, 5,000 SFRH5 95.50/95.75/96.25/96.50 iron condors, 11.5 vs. 96.61/0.18%

- 5,000 SFRZ4 97.00 calls ref 95.945

- 2,000 SFRV4 96.00/96.06/96.12/96.18 call condors

- 2,500 2QZ4 96.50/96.62/96.75/96.87 put condors ref 97.155

- 5,000 SFRZ4 95.87/96.12/96.37 call flys ref 95.945

- 5,000 SFRV4 96.12/96.31 call spds ref 95.96

- 1,500 SFRH5 96.50/96.87 call spds vs. 2QH5 97.37/97.75 call spds

- 2,000 0QV4 96.62/96.87 put spds vs. 2QV4 97.37/97.50 call spds

- 3,500 SFRV4 96.00/96.25 call spds ref 95.95

- Block, 5,000 SFRH5 97.00/97.25 call spds, 5.5 vs. 96.63/0.08%

- 2,000 SFRX4 95.93/96.00/96.06 call flys ref 95.95

- 2,500 SFRZ4 95.62/95.75/95.87 call flys

- 6,000 SFRV4 96.00/96.18/96.50 broken call flys ref 95.945 to -.935

- Block, 4,000 SFRU4 95.06 puts, cab

- 5,000 SFRU4 95.06/95.12/95.18 call flys

- 6,500 SFRX4 95.25/95.37/95.50 put flys, ref 95.955

- Treasury Options:

- 2,000 TYV4 113.25/113.5/114 broken put flys ref 115-14.5

- -7,500 TYX 114 puts, 27

- +3,500 FVX4 109.5/111.5 call over risk reversals, 9

- -3,000 FVX4 113/114 put spds 2

- over 5,400 TYV4 114 puts

- 2,000 TYV4 114.25 puts, 4

- 1,500 TUV4 104.62/104.87 call spds ref 104-13.38

- 3,500 FVX4 109.5//111.5 strangles ref 110-21.75

- 1,500 FVZ4 111/112 call spds

- 1,200 TUV4 103.87/104.12 put spds

BONDS: EGBs-GILTS CASH CLOSE: Yields Dip On Outsized Fed Cut Speculation

European yields fell slightly Friday, partially reversing some of Thursday's rise.

- The main driver of Friday's gains was rising speculation over an outsized 50bp cut by the Federal Reserve next week following media reports after the European bond cash close Thursday.

- With Bund and Gilt futures having gapped higher on the re-open, gains were pared fairly steadily over the rest of the session, with the long end lagging overall as equities gained.

- Friday's session included plenty of ECB speakers following Thursday's decision, with hawk Holzmann expressing an openness to cut rates once more this year (likely in December).

- The German and UK curves bull steepened. Periphery EGB spreads tightened, reflecting a rebound in equities. Note Spain and Greece's sovereign ratings are due for review after the market close.

- Next week's Europe event risk is focused on the UK, including CPI data on Wednesday and the BoE decision Thursday, though of course the size of next Wednesday's expected Fed rate cut will be a major global driver.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.4bps at 2.211%, 5-Yr is down 0.5bps at 2.02%, 10-Yr is down 0.2bps at 2.148%, and 30-Yr is up 0.6bps at 2.431%.

- UK: The 2-Yr yield is down 1.8bps at 3.8%, 5-Yr is down 1.8bps at 3.622%, 10-Yr is down 1.3bps at 3.768%, and 30-Yr is down 1.7bps at 4.359%.

- Italian BTP spread down 3bps at 136.2bps / Greek down 2.2bps at 97bps

EGB OPTIONS: Profit Taking On Lower Implied Rates

Friday's Europe rates/bond options flow included:

- DUX4 107.10/107.40cs, bought for 8 in 4k.

- ERV4 97.12/97.25cs, bought for 1.25 in 14.4k total

- ERZ4 96.625/97.00cs sold at 27 in 25k (profit taking).

- ERZ4 96.625/97.00cs, sold at 27 in 3k.

- ERH5 97.75/98.25/98.75c fly sold at 4.75 in 8k

- ERH5 98.00c, sold at 7.5 in 80k, vs 17.6k at 97.545 (was bought for 3 and 3.25 on 17th July).

FOREX: USDJPY Remains Weaker on Session, Key Support Holds For Now

- The USD index has been consolidating near session lows across the US session and while USDJPY (-0.75%) trades with an offered tone overall, key support at 140.25 continues to hold as we approach the weekend close, with the pair rising around 40 pips in recent trade.

- A breach of 140.25 would see spot at the lowest level since July 2023, and further momentum through the psychological 140.00 mark will be closely monitored next week.

- USDJPY’s weakness today has been yield driven, however the elevated levels for major equity benchmarks appear to have provided just enough support to cross/JPY. Furthermore, there may be limited appetite for such significant technical breaks so close to the weekend close.

- As noted earlier, the next two supports of note are at 139.87 and 139.00, the 1.236 and 1.382 Fibonacci projections of the Aug 15 - 26 - Sep 3 price swing. Initial resistance remains much higher at 143.04.

- Strength for the low yielders has also boosted the Swiss Franc, with USDCHF down 0.35%, although it is worth noting the pair remain around 50 pips higher on the week.

- Despite the aforementioned equity strength, both AUD and NZD are around 0.3% weaker on Friday, while EUR and GBP reside in moderate positive territory.

- China activity data is expected on Saturday and it’s worth noting that both Japan and China have national holidays on Monday. Inflation data in Canada and the UK should play second fiddle to Wednesday’s FOMC decision.

Late Equities Roundup: Program Sales Temper Support

- Stocks are holding near late session highs following a few rounds of late profit taking sell programs Friday as markets continue to debate chances of a 50bp vs. 25bp rate cut at next week's FOMC announcement.

- The DJIA trades up 275 points (0.67%) at 41369.95, S&P E-Minis up 24.5 points (0.44%) at 5626, Nasdaq up 99.8 points (0.6%) at 17669.06.

- Utilities and Materials sectors led gainers in the second half, independent power providers supported the former as a reversal in crude prices (WTI -0.32 at 68.65 vs. 70.29 midmorning high) in the second half saw Energy share pare gains. Vistra Corp +6.08%, Constellation Energy +3.36%, AES Corp +2.48%.

- Metal/mining stock continued to outperform as Gold hit new highs (2582.75/oz): Nucor +2.42%, Freeport-McMoRan +2.30%, Steel Dynamics +2.19%.

- Conversely, Real Estate and Health Care sectors lagged the broad based rally, specialized and retail REITs weighed on the former: Digital Realty -1.0%, Public Storage -0.68%, Extra Space -0.44%. Health Care sector continued to underperform, Moderna down another 3% after falling -18% at one point Thursday amid plans to cut costs by $1.1B including research.

EQUITY TECHS: E-MINI S&P: (U4) Approaching Resistance

- RES 4: 5821.25 1.00 proj of the Apr 19 - Jul 16 - Aug 5 price swing

- RES 3: 5800.00 Round number resistance

- RES 2: 5721.25 High Jul 16 and key resistance

- RES 1: 5669.75 High Sep 3

- PRICE: 5625.50 @ 1520 ET Sep 13

- SUP 1: 5519.28/5394.00 50-day EMA / Low Sep 6 and a bear trigger

- SUP 2: 5367.50 Low Aug 13

- SUP 3: 5330.00 61.8% retracement of the Aug 5 - Sep 3 bull leg

- SUP 4: 5249.74 76.4% retracement of the Aug 5 - Sep 3 bull leg

S&P E-Minis remains firm. This week’s recovery highlights a bullish reversal and the end of the corrective cycle between Sep 3 - 6. The contract is trading above the 20- and 50-day EMAs and a continuation higher would signal scope for a test of 5669.75, Sep 3 high. Clearance of this level would open 5721.25, the Jul 16 high and bull trigger. On the downside, a reversal lower and a breach of 5394.00, the Sep 6 low, would reinstate a bearish theme.

COMMODITIES: Spot Gold Extends All-Time Highs

- Further dollar weakness helped gold extend its all-time highs on Friday, reaching $2,586/oz earlier in the session.

- The yellow metal is currently up by 1.0% on the day at $2,582/oz, taking the weekly gain to 3.4%.

- The immediate focus from here is on resistance at $2,584.0/oz, the 1.764 proj of the Jul 25 - Aug 2 - Aug 5 price swing. This level shields round number resistance at $2,600/oz.

- Meanwhile, silver has outperformed again, up 2.6% to $30.7/oz, now at its highest since July 17.

- The Jul 11 high at $31.754 provides the next resistance, before the bull trigger at $32.518, the May 20 high.

- That leaves the Gold/Silver ratio on track for a third straight decline at 84.2. The Aug 27 low at 83.5732 provides initial support.

- WTI has moved into losses on the day, as output returns in the USGC following Hurricane Francine. However, crude is headed for a net weekly gain, supported by previous production disruptions in the Gulf of Mexico, and risk-on sentiment ahead of expected Fed rate cuts.

- WTI Oct 24 is down 0.2% at $68.8/bbl.

- WTI futures remain in a bearish condition, suggesting that the most recent bounce is a short-term correction. A resumption of the downtrend would open $63.93 next, a Fibonacci projection point. Firm resistance is at $71.05, the 20-day EMA.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 16/09/2024 | 0800/1000 | ** |  | Italy Final HICP |

| 16/09/2024 | 0810/1010 |  | ECB's De Guindos at VII Foro Banca event | |

| 16/09/2024 | 0900/1100 | * |  | Trade Balance |

| 16/09/2024 | 1200/1400 |  | ECB's Lane Speech at European Investment Bank Chief Economists' Meeting | |

| 16/09/2024 | 1230/0830 | ** |  | Monthly Survey of Manufacturing |

| 16/09/2024 | 1230/0830 | ** |  | Empire State Manufacturing Survey |

| 16/09/2024 | 1300/0900 | * |  | CREA Existing Home Sales |

| 16/09/2024 | 1530/1130 | * |  | US Treasury Auction Result for 13 Week Bill |

| 16/09/2024 | 1530/1130 | * |  | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.