-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI ASIA MARKETS ANALYSIS: April Jobs Beat; Jobless Rate Dips

- MNI BRIEF: Fed’s Bullard-Supported Hike, Doesn’t See Recession

- MNI US DATA: Prime Age Participation Pushes Further Above Pre-Pandemic Levels

- MNI US DATA: Sharp Pullback In Job Losers Underpins Drop In Unemployment Rate

- MNI JAPAN: Unclear If PM Kishida Will Travel To South Korea Following Earthquake

cropfilter_vintageloyaltyshopping_cartdelete

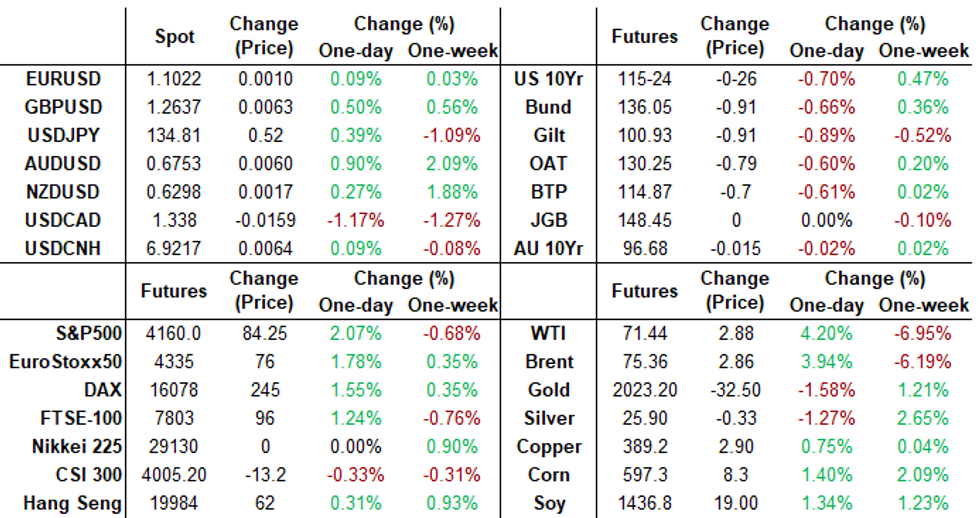

US TSYS: Risk Appetite Improved Following Strong April Employment Data

Treasury futures remain weaker after the bell, drifting near the middle of a wide session range after stronger than expected April employment data took some of the hot air out of rate pause/cuts expectations.- Treasury futures marked session lows after stronger than expected April jobs gain of +253k vs. +185k est: TYM3 hit 115-13.5 low, 10Y yield initially hit 3.4521% high before tapping 3.4635% around noon - is currently at 3.4351% +.0564.

- April's headline household survey stats included the labor force contracting by a modest 43k (of 166.7M), with the participation rate unchanged at 62.6% (including - as we noted earlier - a fresh post-2008 high for prime-age participation). A strong if slightly odd breakdown in the unemployment rate figure though, which was down 0.1pp to 3.4%.

- Treasury futures quickly recovered to near mid-range, trading sideways for the rest of the session. Risk appetite improved as stocks, lead by regional banks (PacWest rallied over 80% this morning!), rallied (SPX eminis +78.25 at 4154.0).

- Fed Funds implied rates are holding close to earlier highs post-payrolls with Bullard supporting them. Now showing zero cuts for the June FOMC (+3.5bp on the day), 10bp of cuts to 4.98% July (+7bp), 26bp of cuts to 4.82% Sep (+11bp) and building to a cumulative 75bp of cuts to 4.33% Dec (+15bp), with the latter from 85bps pre-payrolls.

- Slow start to next week, focus is on CPI read for April on Wednesday, while President Biden and House speaker McCarthy are expected to discuss the debt limit on Tuesday.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00681 to 5.05026 (+.03156/wk)

- 3M -0.03397 to 5.03873 (-.04259/wk)

- 6M -0.08292 to 4.94551 (-.13406/wk)

- 12M -0.16456 to 4.55360 (-.25548/wk)

- O/N +0.00115 to 5.05986%

- 1M +0.00572 to 5.10443%

- 3M +0.01315 to 5.33686% */**

- 6M -0.03814 to 5.35286%

- 12M -0.06043 to 5.19971%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.33686% on 5/5/23

- Daily Effective Fed Funds Rate: 5.08% volume: $114B

- Daily Overnight Bank Funding Rate: 5.06% volume: $282B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.590T

- Broad General Collateral Rate (BGCR): 5.03%, $575B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $566B

- (rate, volume levels reflect prior session)

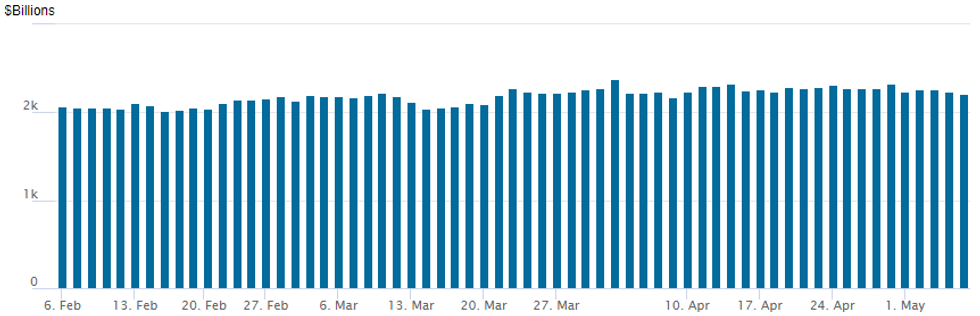

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips back to $2,207.415B w/ 101 counterparties, compares to prior $2,242.399B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTIONS SUMMARY

Early Friday trade favored upside call structure trade in SOFR and Treasury 5Y options - carry-over speculative hedging after the Fed opened the door to a potential pause in June. The post-employment data sell-off in underlying futures dampened the appetite for rate cut insurance, however. Volumes ebbed in the second half as participant drifted to the sidelines ahead the weekend. Salient trade:- SOFR Options:

- Block, 12,500 OQV3 96.25/96.50/97.00 broken put trees, 5.5 ref 97.13

- Block, 20,000 SFRN3 94.75/94.87 put spds, 2.5 ref 95.295 to -.30

- 7,500 SFRZ3 98.00 calls, 12.5 ref 95.775

- 6,800 SFRZ3 99.00 calls

- Block, 13,000 SFRZ3 96.00/96.50/97.00 call fly, 3.75 net/splits ref 95.81

- Block, 12,000 OQM3 95.75/96.00/96.25 put flys, 2.0 ref 96.80

- Block, 5,000 SFRM3/SFRQ3 94.68/94.75 put spd spd, 0.25 net

- Block, 20,975 SFRV3 95.00/95.25/95.37/95.62 put condors, 5.0 net ref 95.775

- 37,450 pit/screen and 5k Block: SFRM3 94.93/95.06/95.18 call flys, 1.0-1.5 ref 94.985 to -.99

- Block, 5,000 SFRN3 95.75/96.25 call spds 9.0 ref 95.385

- Block, 5,000 OQN3 97.62/98.00 call spds, 8.0 ref 97.13

- 4,250 SFRK3 95.50 calls, 1.25 ref 94.985

- 9,000 SFRM3 95.12/95.62 call spds ref 94.985

- 10,000 SFRU3 95.50/96.00 call spds, ref 95.41 to -.415

- Treasury Options:

- 5,000 FVM3 111/112 call spds, 13 ref 110-07.5

- Block, 7,750 TYU3 111.5 puts, 29 vs. 115-26/0.32%

- 2,500 FVM3 110.25/110.75 put spds ref 110-11

- 5,300 FVM 111.25 calls ref 110-19.75

- Block, 10,000 FVM3 111 calls, 34.5 vs. 110-20.25/0.43%

- 1,500 FVU3 106.5/108/109.5 put flys ref 111-10

- 3,000 USM3 128/130 put spds

EGBs-GILTS CASH CLOSE: Gilts Underperform Bunds Post-ECB, Pre-BoE

Gilts underperformed Bunds in a risk-on session Friday, with both the German and UK curves bear steepening.

- Following a sharp drop at the open (aligning with a bounce in equities overnight as US bank fears dissipated), the rise in UK and German yields was fairly steady, with the exception of a stronger-than-expected US jobs report that saw yields spike to session highs.

- Periphery EGB spreads tightened, with Greece leading the way, with 10Y GGBs closing at the tightest level to Bunds since January 2022.

- ECB hike pricing stabilised after Thursday's fall (our review of the decision went out today), flat on the day with terminal depo at 3.65%. ECB speakers didn't make much difference, nor did softer-than-expected economic data (retail sales, German industrial orders).

- Looking ahead to next week, UK markets are closed Monday due to holidays, but the BoE decision takes centre stage Thursday, BoE terminal pricing rose 7bptoday to 4.89%, though there is room for a surprise either way in next week's decision with just 80% pricing for a 25bp raise vs a pause.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.3bps at 2.572%, 5-Yr is up 10.9bps at 2.231%, 10-Yr is up 10.1bps at 2.291%, and 30-Yr is up 9.7bps at 2.463%.

- UK: The 2-Yr yield is up 11.4bps at 3.792%, 5-Yr is up 11.2bps at 3.594%, 10-Yr is up 12.8bps at 3.781%, and 30-Yr is up 11.3bps at 4.182%.

- Italian BTP spread down 3.1bps at 190.1bps / Greek down 12.5bps at 174.7bps

EGB Options: Limited Post-ECB Options Flow In Europe

Friday's Europe rates / bond options flow included:

- SFIK3 95.25/95.15ps x1 vs 95.60/95.70cs x3, bought the ps for 1 in (3333 x9999).

FOREX: Greenback Reverses Post-NFP Strength, CAD Surges

- Following the release of the US employment data the greenback had a knee-jerk higher. However, notable revisions took the shine off the headline beat for the change in non-farm payrolls and the USD steadily lost favour over the course of the US session.

- Additionally, better performing US regional banks and a corresponding firming of major equity indices weighed on the USD index, which finds itself sitting 0.2% in the red approaching the close.

- The uptick for US yields has kept pressure on the Japanese yen, with USDJPY consolidating modest gains on the day, just below the 135 handle. However, there have been strong USD reversals elsewhere in G10 with GBP and AUD notable performers.

- A very decent climb for cable sees the pair at fresh trend highs, narrowing the gap with the May 2022 highs at 1.2667. The trend outlook in GBPUSD remains bullish and this fresh cycle high reinforces current conditions. Above those highs, attention will shift to 1.2733, the 2.0% 10-dma envelope and 1.2759, a Fibonacci retracement.

- The best performers on Friday have been the Canadian dollar and the Norwegian Krone, both benefitting from the firmer risk sentiment which translated into a solid 4% recovery for crude futures to end the week.

- For CAD in particular, an additional tailwind came with the April jobs report. Net change in employment of +41.4k doubled the surveyed median estimate. Despite the balance being toward part-time job creation, a lower unemployment rate and higher hourly wage rates underpinned a substantial 1% rally for the Canadian dollar on Friday. Price action resumes the bear leg that started Apr 28. Note too that price has breached both the 20- and 50-day EMAs and this suggests scope for a deeper retracement. Immediate sights are on 1.3385, the April 19 low.

- A quiet start to next week with a lack of tier-one data and Monday’s holiday in both the UK and France. Focus swiftly turns to US CPI data on Wednesday and the Bank of England rate decision on Thursday.

FX: Expiries for May08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900(E532mln), $1.1000(E1.1bln), $1.1045-50(E958mln), $1.1125(E1.2bln)

- USD/JPY: Y134.35($523mln), Y135.90-00($864mln)

- EUR/JPY: Y150.00(E514mln)

- USD/CAD: C$1.3750-70($720mln)

- USD/CNY: Cny6.8500($1.4bln), Cny6.9500($675mln)

S&P 500 E-Minis Back Above 4,100 As Regional Banks Firm Pre-Market

E-minis firm to fresh session highs as NY participants file in, we flag a couple of areas of focus:

- Apple’s firmer than expected earnings & equity buyback announcement.

- A bounce In regional banking names pre-market, likely aided by the American Bankers Association urging regulators to investigate a deluge of sizeable short sales of publicly traded banking equities that the body deemed "disconnected from the underlying financial realities.

- Elsewhere, a BBG source report released late Thursday noted that the U.S. is “poised to exempt smaller lenders from kicking in extra money to replenish the government’s bedrock deposit insurance fund, and instead saddle the biggest banks with much of the bill” (although that further opens up incentivization debate re: large banks cherry picking from failed banks).

- The major e-mini futures sit 0.5-0.7% higher (S&P 500 leading, just, DJIA lagging), with yesterday’s high (4,118.00) layered in above current S&P 500 contract levels as it shows back above 4,100. Bulls are trying to chew away at week-to date losses, with the 20-day EMA (4,127.43) providing the most meaningful area of technical resistance ahead of the May 1 high (4,206.25).

- Participation remains subdued pre-NFP, which will likely be the major tone setter in front of the weekend (excluding regional banking news/speculation)..

E-MINI S&P TECHS: (M3) Short-Term Bearish Threat Still Present

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4223.00 High Feb 14

- RES 1: 4127.43/4206.25 20-day EMA / High May 1

- PRICE: 4117.50 @ 14:31 BST May 5

- SUP 1: 4062.25 Low May 4

- SUP 2: 4052.50 Low Mar 30

- SUP 3: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

- SUP 4: 4006.00 Low Mar 29

S&P E-minis have found some support today. This week’s move lower has resulted in a breach of both the 20- and 50-day EMAs. Furthermore, the contract has pierced a key support at 4068.75, the Apr 26 low. This highlights a bearish threat and a resumption of weakness would open 4022.75, the 50.0% retracement of the Mar 13 - May 1 bull leg. Key resistance is far off at 4206.25, the May 1 high.

COMMODITIES: Risk-On Dominates But Only Partial Retracement Of Week's Theme

- Crude oil has jumped 4% today, gaining through all three regional trading sessions including a push higher with payrolls coming in stronger than expected in April despite more than offsetting downward revisions to Feb/Mar.

- Nevertheless, WTI is still down 7% on the week as the market assess economic driven demand concerns against the potential for tighter supplies with the start of OPEC cuts this month and potential higher demand from China.

- WTI is +4.1% at $71.39, eyeing resistance at $71.9 (May 3 high).

- Brent is +3.9% at $75.30, nudging resistance at $75.58 (May 3 high) after which lies $77.36 (Apr 27 low and recent breakout level).

- Gold is -1.7% at $2016.54, sliding in the risk-on environment with higher Treasury yields and equities as bank stocks bounce. It fleetingly dipped below support at $2000.4 (20-day EMA) before bouncing.

- Weekly moves: WTI -7.1%, Brent -5.3%, Gold +1.3%, US nat gas -11.9%, EU TTF nat gas -5.1%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/05/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 08/05/2023 | 0130/1130 | * |  | AU | Building Approvals |

| 08/05/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 08/05/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/05/2023 | 1400/1600 |  | EU | ECB Lane Speech/Q&A at Forum New Economy | |

| 08/05/2023 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 08/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 08/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.