-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Thune Defends Two-Step 2025 Agenda

MNI US MARKETS ANALYSIS - EUR Steadies Ahead of ECB

MNI ASIA MARKETS ANALYSIS: Bank Panic Cools, Risk Improves

HIGHLIGHTS

- FIRST REPUBLIC POISED TO GET ABOUT $30B IN DEPOSITS FROM BANKS, Bbg

- JPMORGAN, MORGAN STANLEY IN TALKS TO BOLSTER FIRST REPUBLIC, WSJ

- FIRST REPUBLIC WORKING ON OPTIONS INCLUDING CAPITAL RAISE, WSJ

- MACRON GOVT TO FORCE THROUGH PENSION REFORM WITHOUT VOTE, RTRS

- ECB TOLD MINISTERS TUESDAY SOME EU BANKS COULD BE VULNERABLE, Bbg

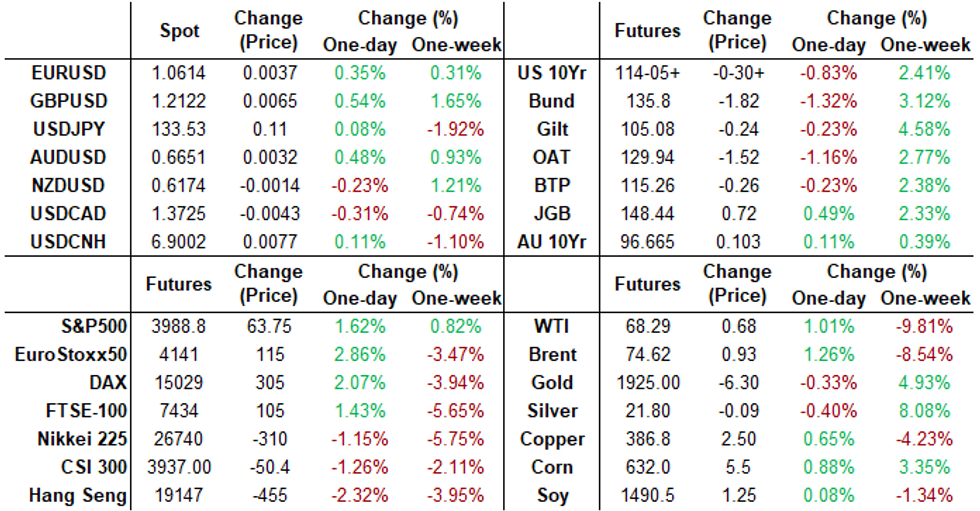

US TSYS: Risk-On Gains Momentum

- Front month Treasury futures remain under pressure after the bell, near session lows as risk-on sentiment tied to a $30B rescue package for First Republic Bank from 11 banks helped equity index futures climbed to highs for the week (ESM3 at 3997.25, nearing firm resistance of 4031.46, 50-day EMA.

- Front month Treasury futures has 30Y Bonds down 105 at 130-17 (30Y yield 3.7065%), 10Y notes -27 at 114-09 (10Y yield 3.5733%) above initial support of 113-08.5 (March 15 low).

- As a result of the tone change in risk, short end rates are gradually unwinding the week's rate-cut (25bp) expectations from July out to November now, while the May Fed terminal rate has climbed to 4.915%.

- Focus turns to Friday's data with Industrial Production, Capacity Utilization, Leading Index and University of Michigan Sentiment on tap.

- US Tsys have rescheduled today's $60B 4W, $50B 8W bill auctions to 1000ET Friday after technical difficulties prevented today's sale at 1130ET.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00885 to 4.55086% (-0.00628/wk)

- 1M +0.05286 to 4.76143% (-0.03714/wk)

- 3M +0.05543 to 4.96257% (-0.17557/wk)*/**

- 6M +0.09829 to 4.93229% (-0.49600/wk)

- 12M +0.10100 to 4.82943% (-0.90871/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $89B

- Daily Overnight Bank Funding Rate: 4.57% volume: $262B

- Secured Overnight Financing Rate (SOFR): 4.58%, $1.252T

- Broad General Collateral Rate (BGCR): 4.55%, $484B

- Tri-Party General Collateral Rate (TGCR): 4.55%, $474B

- (rate, volume levels reflect prior session)

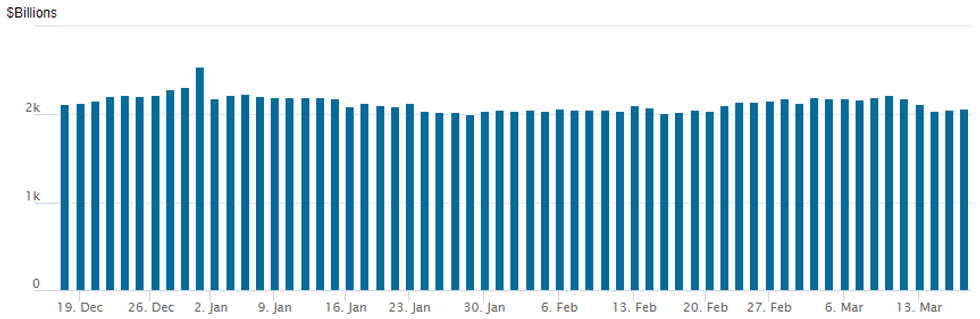

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,066.319B w/ 103 counterparties vs. prior session's $2,.055.823B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Early two way trade with slightly better upside call structure buying faded ahead midday, overall volumes remained light. Low delta put buying picked up in the second half as underlying rates sold off on improved risk appetite as large banks looked at options to aid ailing First Republic Bank (FRC).- SOFR Options:

- Block, 6,000 SFRH4 97.00/98.00 call spds, 20.0 ref 96.10

- over 12,500 SFRM3 97.00/97.50/97.75 put trees on a 4x3x3 ratio trade on the day

- Block, 5,000 SFRU3 96.00 straddles vs. SFRZ3 96.12 straddles, 9.0 net/Dec over

- -25,000 SFRZ3 98.00/98.50 call spds, 7.0

- 3,800 SFRU3 94.00/94.50/95.00 put flys, ref 95.985

- 13,500 OQU3 97.87/SFRU4 97.50 call spd ref 96.68

- Block, 3,500 OQK3 97.00/3QK3 97.50 call spd, 17.0

- Block, 5,000 OQJ3 96.00/2QJ3 96.87 call spd, 40.0 net conditional curve

- Block, 3,750 OQM3 97.00/97.62 call spds, 15.5 vs. 96.465/0.15%

- 7,500 SFRK3 94.75/94.62 put spds vs. 95.75/95.87 call spds

- 7,500 SFRM3 94.75/94.62 put spds vs. 95.75/95.87 call spds

- 10,000 SFRZ3 94.50/95.50 put spds, ref 96.05 to -.045

- 2.000 SFRK3 94.75/95.00/95.25 put flys, ref 95.58

- over 13,700 OQM3 95.75 puts ref 96.53 to -.445

- Block, 2,500 SFRJ3 95.43 calls, 54.0 vs. 95.55/0.55%

- Blocks, 25,250 SFRK3 94.00 puts, 3.5-1.5

- Block/screen, 4,000 SFRM3 94.75/95.25/95.75 call flys, 8.5

- Treasury Options:

- 2,000 TYM3 112/120strangles, 133

- over 6,700 FVM3 109 puts around 57-100 ref 110-03.5 to -02.25

- 1,600 TYJ3 116.5/120 call spds, 27 ref 115-01

EGBs-GILTS CASH CLOSE: Bear Flattening On ECB 50bp Hike And Bank Relief

The UK and German curves bear flattened Thursday and periphery EGB spreads tightened as the ECB delivered a 50bp hike and concerns over US and European banks dissipated somewhat.

- Yields initially rose on overnight news that Credit Suisse was strengthening its liquidity position.

- With a better-than-even probability of 25bp or a hold priced in going into the ECB decision vs a 50bp hike, the half-point raise surprised to the upside.

- But the overall takeaway was slightly more dovish, with the ECB shying away from providing guidance on further hikes.

- MNI Sources reported afterward that all of the four or so dissenters preferred no hike at all rather than a smaller 25bp move.

- EGB yields fell through Lagarde's press conference and bottomed for the day as it wrapped up, then rose on diminished banking sector panic with major US institutions reportedly propping up troubled First Republic Bank.

- An appearance by ECB's Simkus features early Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 19.9bps at 2.608%, 5-Yr is up 18.1bps at 2.318%, 10-Yr is up 16bps at 2.29%, and 30-Yr is up 16.7bps at 2.312%.

- UK: The 2-Yr yield is up 12.3bps at 3.415%, 5-Yr is up 12.8bps at 3.342%, 10-Yr is up 10.4bps at 3.425%, and 30-Yr is up 9.8bps at 3.853%.

- Italian BTP spread down 8.3bps at 189.8bps / Greek down 9.9bps at 200.3bps

EGB Options: Vol Trades Post-ECB

Thursday's Europe rates/bond options flow included:

- Before ECB:

- ERM4 100.25c, bought for 4 in 5k

- RXK3 131/128 ps with RXM3 128/125 ps vs RXJ3 137/140 cs, bought the put spread strip for 4 in 8k (ref 136.00, 40% del)

- After ECB:

- ERU3 96.00/97.50 strangle bought for 38 in 13.5k

- ERU3 96.875^ sold at 93 & 92 in 10k

- ERU3 96.62^, sold at 90.0 in 9k

FOREX: Late Equity Surge Underpins Cross/JPY Recovery

- Optimism across global markets rose in the latter half of Thursday trade on diminished banking sector panic with major US institutions reportedly propping up troubled First Republic Bank. The news supported a punchy recovery for Cross/JPY which had come under extended pressure in earlier trade.

- For USDJPY, fresh lows for the week were printed at 131.72, largely in the lead up to and the immediate aftermath of the ECB decision. EURJPY also tracked through Wednesday’s worst levels to trade as low as 139.13. However, as the dust settled on the ECB’s 50bp hike and fresh news underpinned a significant recovery for First Republic shares and major indices alike, the Japanese yen came under consistent pressure with USDJPY rising back to unchanged on the session around 133.50 as we approach the APAC crossover.

- With the focus on the volatile yen, EURUSD traded in a fairly narrow range despite the ECB decision and press conference outcomes being blurred in recent sessions by the Credit Suisse situation. Some early selling pressure on the lack of forward guidance for May was swiftly absorbed and the pair returned back north of the 1.06 handle for much of the session.

- In emerging markets, the sensitive Mexican peso reacted very favourably to the latest developments. USDMXN, after briefly trading to fresh weekly highs at 19.1792 has slipped all the way back to 18.77 as of writing with the peso partially clawing back the steep losses incurred since late last week. 18.4707, the 20-day EMA, is the first support to watch.

- On Friday, Final Eurozone CPI readings will cross before US industrial production and Uni Mich consumer sentiment and inflation expectations cap off the week. Focus then turns to the March FOMC meeting next Wednesday.

FX: Expiries for Mar17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.2bln), $1.0660-80(E1.7bln), $1.0690-10(E5.1bln), $1.0775(E1.4bln)

- USD/JPY: Y130.00($3.3bln), Y130.92-00($937mln), Y132.00($1.7bln), Y133.00-10($2.0bln), Y133.60-68($698mln), Y134.00-20($1.2bln), Y134.90-00($1.5bln)

- EUR/JPY: Y131.00(E1.0bln)

- AUD/USD: $0.6580(A$831mln), $0.6650(A$1.1bln), $0.6700(A$611mln)

- USD/CNY: Cny6.8500($1.5bln)

Equities Roundup: Big Banks Deposit $30B into Beleaguered FRC

- Support for US equities continued to gain momentum late Thursday, front month S&P futures marking new session high of 3994.5 - best level since last Thursday before news of Silicone Valley Bank's collapse hit (in-turn spurring reversal in rate hike expectations ahead next week's FOMC with rate cuts priced in by mid-year).

- Leading gainers are Communication Services, IT, Consumer Discretionary and Financial sectors.

- The main trigger for the strong rally was news that JP Morgan, Citi, BofA, Well Fargo and seven other banks will make a total of $30B in deposits to support First Republic Bank (FRC). FRC was assailed this week after Silicone Valley Bank collapse last Friday, FRC trading +15% at 35.84 at the moment vs. 52W low of 17.53.

- Incidentally, the improved risk appetite for stocks weighed on US rates markets, particularlly in the short end as midweek implied rate cut pricing receded.

- From a technical standpoint, short-term gains are still considered corrective. Price last week cleared a key short-term support at 3960.75, Mar 2 low to confirm a resumption of the bear cycle that has been in place since Feb 2. The move lower signals scope for an extension towards 3822.00 next, the Dec 22 low. Initial firm resistance is seen at 4031.46, the 50-day EMA.

E-MINI S&P (M3): Remains Vulnerable

- RES 4: 4244.00 High Feb 2 and key resistance

- RES 3: 4200.00 Round number resistance

- RES 2: 4119.50 High Mar 6

- RES 1: 3972.50/4031.46 High Mar 14 / 50-day EMA

- PRICE: 3965.0 @ 13:56 GMT Mar 16

- SUP 1: 3839.25 Low Mar 13

- SUP 2: 3822.00 Low Dec 22 and a key support

- SUP 3: 3778.00 Low Nov 3

- SUP 4: 3724.86 76.4% retracement of the Oct 13 - Feb 2 bull cycle

The trend condition in S&P E-Minis remains bearish and short-term gains are considered corrective. Price last week cleared a key short-term support at 3960.75, Mar 2 low to confirm a resumption of the bear cycle that has been in place since Feb 2. The move lower signals scope for an extension towards 3822.00 next, the Dec 22 low. Initial firm resistance is seen at 4031.46, the 50-day EMA.

COMMODITIES: Oil Sees Intraday Bounce On Saudi-Russia Cooperation, Equities Recovering

- Crude oil edges out gains after slides over recent sessions have taken Brent sub $75 and WTI sub $70.

- Earlier losses following the ECB’s 50bp hike were reversed by headlines that Saudi Arabia and Russia have agreed to enhance market stability. It was further buoyed intraday from the macro backdrop by a recovery in risk sentiment and some modest dollar weakness after the latter surged yesterday on Credit Suisse concerns.

- WTI is +1.0% at $68.25, with an earlier low of $65.71 coming close to resistance at $65.60 (Dec 3 2021 low cont) before the aforementioned bounce. Resistance is seen at $72.56 (Mar 15 high).

- After the recent focus on puts, the day’s most active strikes in the CLJ3 are currently in $69/bbl calls with reduced volumes compared to the past few sessions.

- Brent is +1.2% at $74.58, off a low of $71.91 that came close to yesterday’s low of $71.67. Resistance remains $78.84 (Feb 6 low).

- Gold is +0.03% at $1919.27, keeping within yesterday’s high of $1937.4 whilst also comfortably above support at $1871.6 (Mar 13 low). The outlook remains bullish with a focus on $1959.7 (Feb 2 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/03/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 17/03/2023 | 0930/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 17/03/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 17/03/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/03/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/03/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 17/03/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.