-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: BOC 50Bp Move Gives Hawks Pause

HIGHLIGHTS

- BANK OF CANADA LIFTS KEY LENDING RATE TO 3.75% FROM 3.25%

- UK MEDIUM TERM FISCAL PLAN BEING DELAYED TO NOV 17: BBC - bbg

- US 30-YR FIXED MORTGAGE TOPS 7% FOR FIRST TIME IN 20 YRS: MBA

- FORD FINALIZES EXIT FROM PREVIOUSLY SUSPENDED OPS IN RUSSIA, Bbg

US TSYS: Hawks Eat Crow After BOC Hikes Less Than Expected

Tsys holding strong gains after the close. Tsys had gapped to new session highs early Wed after the BOC hiked less than expected: 50bp to 3.75% vs. 75bp to 4.0% as "hikes beginning to weigh on growth" BOC Gov Macklem. Tsy yields were already extending lows as softer data cools expectations of more hawkish year end policy expectations - before 30YY fell to 4.1401% low on the annc.

- Tsy futures scaled back support slightly in the minutes post-BOC, see-sawed near highs amid debate over exogenous factor will really have on influencing the Fed's policy making over the next two meetings.

- Despite a 0.075 rally to 94.98 in Dec Eurodollar futures, expectations of a 75bp hike on Nov 2 remains intact, chances of another 75bp in Dec continue to cool.

- While last Fri's WSJ/Timiraos + Fed Daly comments over hiking too much have helped take the pressure off year end expectations, some pundits see risks swinging back towards hawkish again as Fed Chairman Powell likely to push back on less hawkish rate hike optimism and reiterate Sep messaging/DOT plot guidance.

- Reminder, the next employment report (covering October) is on November 4 - after the FOMC. An in-line read will likely tip the scales back toward 75bp hike in Dec.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00185 to 3.06086% (-0.001600/wk)

- 1M +0.03586 to 3.63229% (+0.04672/wk)

- 3M +0.01586 to 4.37386% (+0.01543/wk) * / **

- 6M +0.01629 to 4.93186% (+0.05686/wk)

- 12M -0.00628 to 5.39343% (-0.08214/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.37386% on 10/26/22

- Daily Effective Fed Funds Rate: 3.08% volume: $103B

- Daily Overnight Bank Funding Rate: 3.07% volume: $283B

- Secured Overnight Financing Rate (SOFR): 3.02%, $961B

- Broad General Collateral Rate (BGCR): 3.00%, $395B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $379B

- (rate, volume levels reflect prior session)

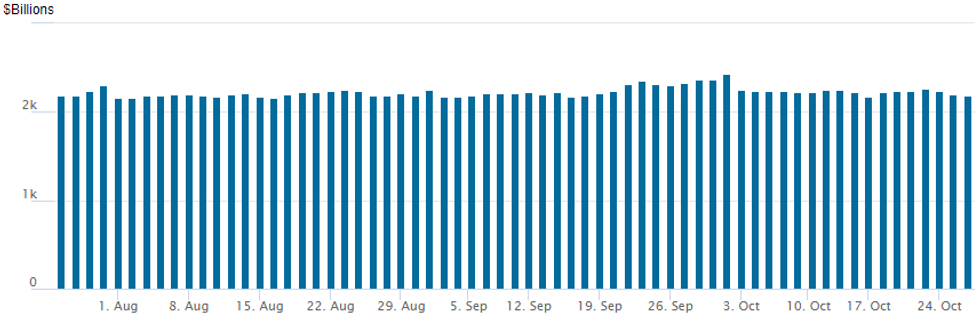

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,186.856B w/ 101 counterparties vs. $2,195.616B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better first half upside call buying evaporated in the second half as the post-BOC tied rally in underlying FI futures leveled out. Salient trade:- SOFR Options:

- Block, 3,000 SFRH3 97.12/97.50 call spds, 0.5

- 4,000 SFRZ2 95.62/95.75 3x2 call spds

- Block/screen, 30,000 Green Nov 96.37/96.56/96.75 call flys, 2.5

- 3,000 SFRZ 95.68/95.87/96.06 call flys

- Treasury Options:

- 15,000 FVZ2 105.5/106.75 put spds, 34

- 10,000 TYZ 111.5 calls, 56 ref 111-03

- Blocks, +15,000 TYZ2 112.75/114 call spds, 17-18 ref 110-29.5 to -30

- -5,000 TYZ2 110.75 straddles, 222

- +5,000 TYZ 111.25 calls, 61 ref 110-25.5

- Blocks, 15,000 TYZ2 112.5 calls, 32-33 ref 110-24.5

- Block/screen total +20,000 TYZ2 112.5 calls, 31 ref 110-26

- 3,500 FVZ2 105.5/106.75 put spds

- 7,000 TYZ 108/109 put spds, 12

- 2,500 TYZ2 108/108.25/109.5 broken put flys

- Block, 5,000 TYZ2 112.25/113 call spds, 15, more on screen

EGBs-GILTS CASH CLOSE: Canadian Surprise Seals Pre-ECB Gains

European yields erased an intraday rise to finish lower Wednesday, with one eye on Thursday's ECB decision.

- Bunds and Gilts traded with a bullish tone early in a carry-over from Tuesday's price action, though sank in late morning as UK uncertainty returned with news that the Gov't medium term fiscal statement would be delayed from Oct 31 to Nov 17.

- Later, Bunds and Gilts surged to session highs following a surprise 50bp hike by the Bank of Canada (vs the 75bp expected), which advanced the narrative that global rate hike expectations may be overdone for now.

- Periphery spreads round-tripped, tightening early, widening by early afternoon, then falling back toward opening levels again by the close as the BoC decision ignited a global risk-on rally.

- Thursday's ECB decision remains the week's key focus, with a 75bp hike still very much the expectation - our MNI Markets Team preview is here, while our Policy Team reports that the Governing Council is likely to retroactively modify the conditions of TLTRO loans to banks.

CLOSING YIELDS / 10-YR PERIPHERY EGB SPREADS TO GERMANY:

- Germany: The 2-Yr yield is down 2.7bps at 1.945%, 5-Yr is down 3.8bps at 1.997%, 10-Yr is down 5.9bps at 2.111%, and 30-Yr is down 3.5bps at 2.107%.

- UK: The 2-Yr yield is down 13.9bps at 3.278%, 5-Yr is down 9bps at 3.663%, 10-Yr is down 6.1bps at 3.576%, and 30-Yr is up 0.6bps at 3.678%.

- Italian BTP spread up 1.1bps at 221.8bps / Greek up 1.4bps at 252.9bps

EGB Options: More Upside Trades In Quieter Pre-ECB Session

Wednesday's Europe rates / bond options flow included:

- RXZ2 144.5/147.5 call spread bought for 31 in 14k, v 138.57

- RXZ2 144.00/146.00 call spread sold at 26 in 1.66k. Hearing liquidation of long position

- ERZ2 98.00/98.12/98.25/98.375 call condor bought for 1.25 in 4k

- ERZ2 97.875/98.00/98.125 call fly bought for 2 in 3k

FOREX: Broad Greenback Weakness Extends, EUR Surges Ahead Of ECB

- The US Dollar saw another wave of weakness in early European hours, with the price action reminiscent of the greenback dip after the US equity open on Tuesday. Weakness stretched into the remainder of Wednesday’s session with the USD index approximately 1.15% lower on the day.

- Chinese Yuan strength has been notable, with USDCNH over 2% below the day’s highs. The price action will raise suspicion of intervention via state-run banks as we've seen in recent weeks - particularly after the pair hit record highs this week and the Chinese authorities conducted a survey of banks to gauge both positioning and market sentiment toward the currency. Redback strength has filtered through to the likes of AUD and NZD with the latter rising to a one-month high against the USD.

- EURUSD has also extended its recovery following multiple breaches of resistance through parity and then 1.0051, the Sep 20 high, trading close to most recent highs of 1.0086 approaching the APAC crossover.

- Topside momentum has been gaining traction following the pair breaking above the notable 2022 channel resistance on Tuesday. Given the current price action and tomorrow’s ECB meeting in focus, it is worth noting the next level on the topside at 1.0198, the Sep 12 high and a key resistance. Short-term support now resides at October 4th’s high of 0.9999 that, as noted, was an acceleration point during European hours.

- CAD underperformed following a smaller than expected 50BP rate hike from the BoC, however, the broad-based USD weakness still weighed on the pair overall, 0.35% lower on the day.

- Following the ECB rate decision on Thursday, we also have the release of Advanced US GDP for Q3.

FX: Expiries for Oct27 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9750-60(E953mln), $0.9800(E1.6bln), $0.9850(E2.1bln), $1.0000(E1.5bln), $1.0025-40(E1.1bln), $1.0050-60(E711mln)

- USD/JPY: Y145.00($714mln), Y147.50($580mln)

- GBP/USD: $1.1490-00(Gbp752mln)

- AUD/USD: $0.6430-35(A$674mln)

- USD/CAD: C$1.3470($710mln), C$1.3685-00($572mln)

- USD/CNY: Cny7.1800($600mln), Cny7.2000($907mln), Cny7.2500($1.7bln)

Late Equity Roundup: Communication Services, IT Broadly Weaker

Stocks continued to reverse midday gains Wednesday, back near early session levels after the FI close, Communication Services and IT weighing on SPX eminis currently trading -32.5 (-0.84%) at 3837.25; DJIA -46.01 (-0.14%) at 31789.1; Nasdaq -230.6 (-2.1%) at 10967.83.

- SPX leading/lagging sectors: Laggers: Communication Services (-4.63%) weighed by interactive media/services: Google -8.74%, META -6.48%; Information Technology (-2.27%) follows w/ software and services underperforming -- Microsoft hammered despite beating earnings est ($2.35 vs. 2.257 est). Leaders: Energy (+1.22%) lead by oil and gas names (Haliburton/HAL +4.29%; Hess/HES +5.16%, Occidental/OXY +2.00%) as crude oil rebounds (WTI +2.55 at 87.99). Health Care (+0.96%) and Consumer Staples (+0.53%) follow.

- Dow Industrials Leaders/Laggers: Visa (V) +8.15 at 202.53, Amgen (AMGN) +6.17 at 266.16, 3M (MMM) +3.61 at 122.11. Laggers: Microsoft (MSFT) -17.63 at 233.07, Boeing (BA) -13.77 at 132.88, Salesforce.com (CRM) -4.99 at 160.28.

COMMODITIES: Oil Supported by Lower Rates, EIA Data

US rates rallying and the USD falling have provided a positive backdrop for many commodities today, with crude oil further boosted by updated EIA data stocking a build in crude and still strong distillate implied demand. Further, Hess sees global oil demand steadily increasing coming out of Covid and sees more upside to oil price than downside, whilst hedging oil production right now is too expensive.

- WTI is +3.1% at $87.98, through resistance at $87.14 (Oct 20 high) to open $88.66 (Oct 12 high) after which sits key resistance at $92.34 (Oct 10 high).

- Brent is +2.4% at $95.79, through resistance at $95.17 (Oct 12 high) to open key near-term resistance at $98.75 (Oct 10 high).

- Gold is +0.8% at $1666.8 having earlier cleared resistance at $1673.6 (Oct 26 high) to open $1691.7 (50-day EMA).

- EU natural gas prices meanwhile have bounced 4.5% (TTF) or 6.5% (NBP) as even though a price-cap is still possible this winter according to EU energy commissioner Kadri Simson, we are already well into the heating season although have been helped by mild weather.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/10/2022 | 0030/1130 | ** |  | AU | Trade price indexes |

| 27/10/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/10/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 27/10/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/10/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/10/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 27/10/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 27/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 27/10/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/10/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 27/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/10/2022 | 1245/1445 |  | EU | ECB post-policy decision press conference | |

| 27/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 27/10/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/10/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.