-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Bonds Off Lows, Curves Flatter

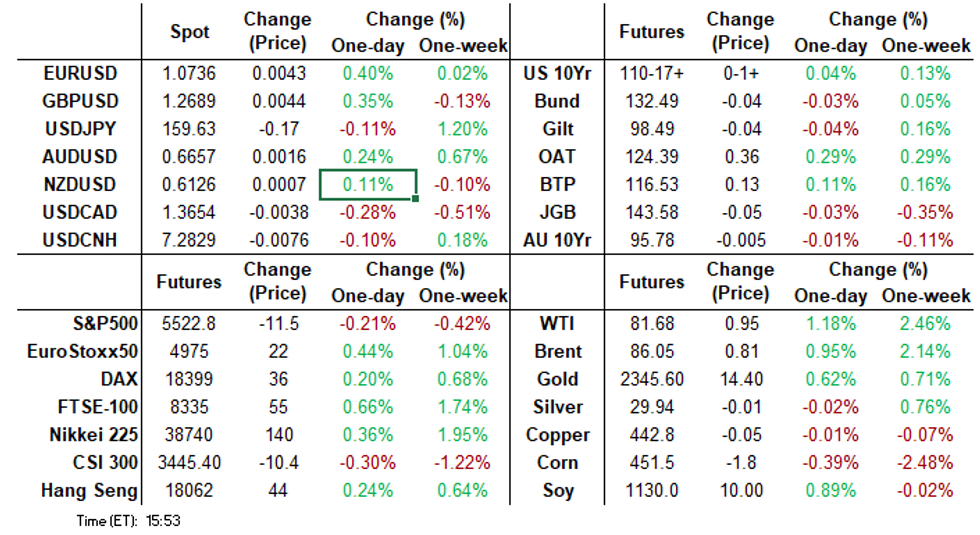

- Treasuries held to a narrow range Monday, off early session lows as the US$ pared back from recent highs.

- Dallas Fed manufacturing index showed upward pressure on prices and wages continued in June.

- Light volumes on the first trading day of summer, data picks up Tuesday with Home Prices, Regional Fed Data and multiple Fed speakers.

US TSYS Curves Flatter With Bonds Gaining On Narrow Range

- Treasuries continue to hold to a narrow overall range after the bell, curves mildly flatter with the short end underperforming a gradual rise in Bonds during the second half.

- Generally quiet start to the first day of summer trade, data limited to in-line Dallas Fed manufacturing index: as expected in June, rising to -15.1 (cons -15.0) from -19.4 in May. The production index suggested activity was essentially flat as it only ticked up from -2.8 to +0.7.

- Fed speak remains cautious: SF Fed Pres Daly notes that "the bumpiness of inflation data so far this year has not inspired confidence", and while "recent readings are more encouraging...it is hard to know if we are truly on track to sustainable price stability."

- Chicago Fed President Goolsbee said monetary policy is "quite restrictive" while he remains "hopeful that we'll get more inflation confidence".

- Treasury futures off early lows by the bell, projected rate cut pricing are steady to mildly higher vs. early Monday levels (*): July'24 at -10% w/ cumulative at -2.5bp at 5.302%, Sep'24 cumulative -18.6bp (-18.4bp), Nov'24 cumulative -28.0bp (-27.1bp), Dec'24 -47.9bp (-46.8bp).

- Tuesday Data Calendar: Fed Speak, Home Prices, Regional Fed Data.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00173 to 5.34350 (+0.01331 total last wk)

- 3M -0.00399 to 5.34056 (+0.00052 total last wk)

- 6M -0.00422 to 5.27136 (-0.00044 total last wk)

- 12M -0.00703 to 5.04462 (+0.00193 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.991T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $760B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $746B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $78B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $265B

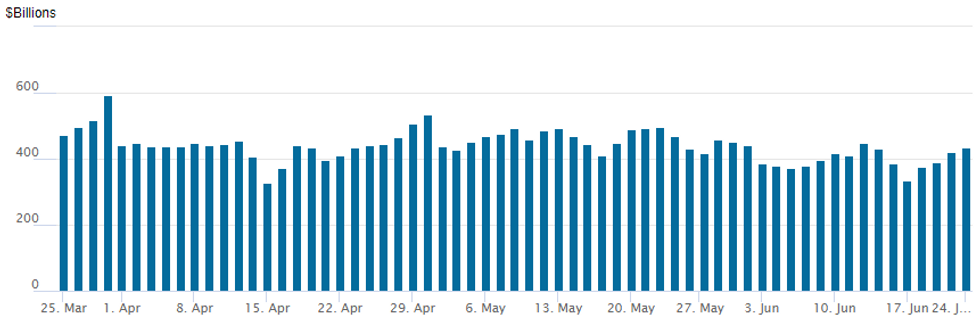

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $435.916B from $421.040B Friday; number of counterparties at 71. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

Muted Treasury and SOFR option summer volumes, underlying futures off early lows by the bell. Projected rate cut pricing are steady to mildly higher vs. early Monday levels (*): July'24 at -10% w/ cumulative at -2.5bp at 5.302%, Sep'24 cumulative -18.6bp (-18.4bp), Nov'24 cumulative -28.0bp (-27.1bp), Dec'24 -47.9bp (-46.8bp). Salient flow includes:

- SOFR Options:

- -5,000 SFRH5 95.50/SFRM5 95.75 straddle spds, 20.0 June over

- +20,000 SFRH5 96.75/97.75 call spds, 4.75 ** adds to appr $150k bought last Thu-Fri

- 4,000 SFRZ4 95.06/95.12/95.18/95.25 call condors, ref 95.16

- +5,000 SFRX4 94.93/95.18/95.56 call trees 4.0-4.25 ref 95.16

- +5,000 SFRZ4 94.68/94.93/95.81/96.06 Iron Condor 8.0 vs 95.16

- +12,000 SFRM5 95.25/95.75 put spds 2x1 1.75-2.0 ref 95.72

- +5,000 2QU4 96.12/96.37 put spds 11.75 vs. 96.315

- +5,000 0QN4 97.12 calls 0.25 ref 95.925

- 2,500 SFRU4 94.87/95.00 call spds ref 94.855

- 7,500 SFRU4 94.87 calls, 6.5-7.0

- Treasury Options:

- 5,000 wk4/wk1 10Y 111 call spds, 11 ref 110-14

- 1,100 TYQ4 109.25/111.75 strangles, 42

- 1,500 USQ4 121.5 calls, 119-24

- 5,700 TYQ4 109.5/110.5/111.5 call flys, ref 110-12

- -1,500 wk4 TY 110.5/111 call spds 7 vs. 110-14.5

- 1,100 TUQ4 102.12/102.38/102.62 call trees, ref 102-05.88

- 1,200 wk4 TY 111/111.5 1x2 call spds

EGBs-GILTS CASH CLOSE: Modest Short-End Underperformance

The German and UK curves flattened slightly Monday as short-ends underperformed, with an uptick in risk appetite outweighing further indications of weaker German economic activity.

- A weak June IFO reading and a pullback in the weekly Bundesbank activity tracker added to last week's soft PMI reading in pointing to a weak end to Q2 for German growth.

- But with a lack of key developments in the French political landscape over the weekend ahead of Sunday's election, risk appetite picked up, helping cap EGB/Gilt gains.

- Equities regained some recently-lost ground (Eurostoxx futures +0.8%) with oil prices ticking higher on the day, EUR and GBP appreciating against the USD, and 10Y periphery EGB spreads tightening by a little under 2bp.

- The German and UK short-ends modestly underperformed, with central bank easing expectations pared back by around 1bp cumulatively through the end of 2024 for both ECB and BoE implieds.

- Tuesday's scheduled events include appearances by ECB's Stournaras, Nagel and Panetta. Flash Eurozone June inflation reports remain this week's data focus.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.6bps at 2.805%, 5-Yr is up 1.5bps at 2.43%, 10-Yr is up 0.7bps at 2.419%, and 30-Yr is up 1.5bps at 2.615%.

- UK: The 2-Yr yield is up 2bps at 4.19%, 5-Yr is up 0.9bps at 3.941%, 10-Yr is down 0.2bps at 4.081%, and 30-Yr is down 0.5bps at 4.584%.

- Italian BTP spread down 1.9bps at 151bps / Spanish down 1.7bps at 85.8bps

EGB Options: Multiple Euribor Structures Monday

Monday's Europe rates/bond options flow included:

- OEU4 117/118cs vs 115.50p, sold the cs at 1 and 1.5 in 4.7k

- ERQ4 96.37/96.50cs 1x2, bought for 2.25 in 3k

- ERU4 96.50/96.62/96.75c fly Bought for 1.75 in 5k

- ERU4 96.37/96.25/96.12p fly, bought for 3.25 in 14k

- ERU4 96.25p, bought for 1.25 in 15k

- ERU4 96.37/96.00ps sold at 4.25 in 5k total

- SFIZ4 95.75/95.85cs vs 95.05/94.95ps, bought the ps for 1 in 10k

FOREX Euro Outperforms Amid Moderate Greenback Weakness

- The USD Index is modestly softer to start the week, reversing a small part of last week's late rally. Despite today's pullback, the DXY remains well within range of the multi-month highs posted late last week at 105.92.

- USD weakness has paused USD/JPY's intraday incline - however today's 159.92 print will remain a considerable concern for the Japanese authorities. As such, we have seen brief bouts of volatility which included a sharp spike lower to 158.82 on seemingly no news. Similar bouts are to be expected as USDJPY closes in on 160.00 once more and official rhetoric increases. Indeed, overnight Japan’s top currency official Masato Kanda said they remain ready to act around the clock.

- The Euro is an outperformer, helping EURUSD (+0.30%) undo the post PMI move lower on Friday. The vol space has seen far more action relative to spot prices, gapping higher at the open to incorporate the first round of the French legislative elections on Sunday - 1wk vols were marked higher to 7.7 points, a ~2 point premium over background average vol this year.

- The latest EURJPY move higher means that key trendline support remains intact, coinciding with exponential moving averages underpinning the move. Sights are on the bull trigger at 171.56, of which a breach may then target 172.77, 2.0% 10-dma envelope.

- In addition, EURGBP has been slowly edging back towards 0.8500, a level that remains very significant on a closing basis. Spot has been capped today by initial firm resistance at 0.8475, the 20-day EMA.

- In emerging markets, USDMXN (-0.90%) has extended below the 18.00 mark on Monday with gains for major equity benchmarks and the moderate improvement in the domestic backdrop contributing to the ongoing peso recovery, with eyes on the Banxico decision later this week.

- Canada CPI is the data highlight Tuesday, before US consumer confidence and Richmond manufacturing also cross.

FX Expiries for Jun25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.2bln)

- USD/JPY: Y158.75($530mln), Y160.00($1.3bln)

- AUD/USD: $0.6665-75(A$859mln)

- USD/CNY: Cny7.3000($506mln)

Late Equities Roundup: DJIA Leads, Energy, Utilities Outperform

- Equities remain mixed after the bell, the DJIA continues to outperform weaker Nasdaq stocks. Currently, the DJIA is up 265.92 points (0.68%) at 39416.11, S&P E-Minis down 6 points (-0.11%) at 5528.75, Nasdaq down 114 points (-0.6%) at 17576.18.

- Energy and Utility sectors led gainers in late trade, oil & gas servicer shares supporting the former as crude inched higher (WTI +0.88 at 81.61): APA Corp +4.95%, Devon Energy +4.65%, Baker Hughes +4.45%.

- Utilities outpaced Financials in the second half, independent power and multi-energy providers trading strong: NRG Energy +3.0%, AES Corp +2.82%, Public Service Enterprises Group +2.41%.

- On the flipside, Information Technology and Consumer Discretionary sectors continued to underperform, semiconductor shares weighing on the former: Despite Friday's four-fold upweighting in the SPDR S&P U.S. Technology Select Sector ETF (XLK), Nvidia traded -4.87%, Qualcomm -3.83%, Broadcom -2.57%.

- Meanwhile, broadline retailers lagged better gainers in the Consumer Discretionary sector: Amazon -1.35%, Tractor Supply -1.29%, Home Depot -1.0%.

E-MINI S&P TECHS: (U4) Trend Needle Points North

- RES 4: 5622.69 2.764 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5600.00 Round number resistance

- RES 2: 5594.66 2.618 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5588.00 High Jun 20

- PRICE: 5525.00 @ 1430 ET Jun 24

- SUP 1: 5452.35/5360.55 20- and 50-day EMA values

- SUP 2: 5267.75 Low May 31 and key support

- SUP 3: 5213.25 Low May 6

- SUP 4: 5155.75 Low May 3

The uptrend in S&P E-Minis remains intact and the contract continues to trade closer to its recent highs. Price has recently cleared 5430.75, the May 23 high and bull trigger. This confirmed a resumption of the uptrend. Note that moving average studies are in a bull-mode position too, highlighting positive market sentiment. Sights are on 5594.66 next, a Fibonacci projection. Initial support lies at 5452.35, the 20-day EMA.

COMMODITIES Crude Erases Friday’s Losses, Spot Gold Edges Higher

- Crude has found further support today, reversing Friday’s losses. Expectations of rising product demand during the summer travel season and a weaker USD on the day have been supportive.

- WTI Aug 24 is up 1.1% at $81.6/bbl.

- The EU imposed sanctions on 27 ships, including 17 that have been transporting oil on behalf of Moscow, Bloomberg reported.

- For WTI futures, the climb above $80.11, the May 29 high, has opened $82.24, a Fibonacci retracement point. Initial firm support to watch is $78.65, the 20-day EMA.

- Meanwhile, Henry Hub has ended the day trading higher, bolstered by an expectation of rising cooling demand.

- US Natgas Jul 24 is up 4.0% at $2.81/mmbtu.

- Spot gold has risen by 0.5% on Monday to $2,334/oz.

- Gold continues to trade below resistance - for now. The yellow metal recently pierced the 50-day EMA, at $2,318.3, a clear break of which would open $2,277.4, the May 3 low. Initial firm resistance is $2,387.8, the Jun 7 high.

- Meanwhile, gold may rise to $3,000/oz over the next 12-18months, according to separate reports from BofA and Citi. Citi notes that expected Fed rate cuts should be particularly bullish for precious metals.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/06/2024 | 0600/0800 | ** |  | SE | PPI |

| 25/06/2024 | 0700/0900 | *** |  | ES | GDP (f) |

| 25/06/2024 | 0700/0900 | ** |  | ES | PPI |

| 25/06/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 25/06/2024 | 1100/0700 |  | US | Fed Governor Michelle Bowman | |

| 25/06/2024 | 1230/0830 | *** |  | CA | CPI |

| 25/06/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/06/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/06/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/06/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/06/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/06/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/06/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 25/06/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 25/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 25/06/2024 | 1600/1200 |  | US | Fed Governor Lisa Cook | |

| 25/06/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 25/06/2024 | 1810/1410 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.