-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Broad Position Squaring Ahead NFP

- Treasuries quietly pared losses in the second half, extended session highs ahead of Friday's May NFP.

- Risk assets rebounded as well: stocks, crude, gold as short positions squared ahead the data risk.

- ECB cut rates as expected, otherwise providing little insight surrounding the future path for monetary policy.

US TSYS Tsys Near Late Highs Ahead Friday's Headline May Jobs Data

- Treasury futures have quietly pared losses in the second half, extending modest session highs after this morning's gap bid and quick reversal following the ECB rate cut and higher than expected weekly claims.

- No particular headline driver for the move, just renewed position squaring ahead of Friday's May employment data risk event (Bbg mean estimate +185k vs. +175k prior).

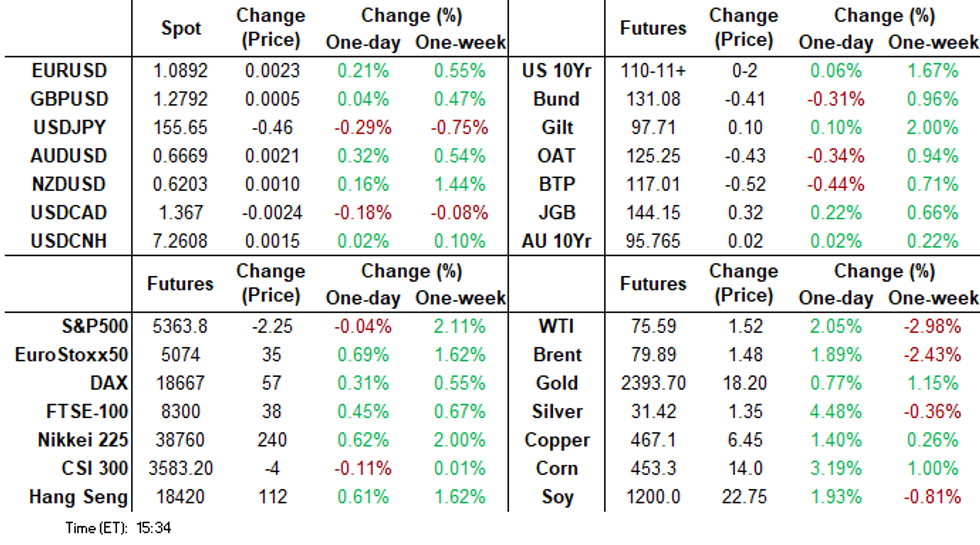

- Futures are mildly higher, Sep'24 10Y Treasury futures are currently +2.5 at 110-12 vs. 110-13 high, focus on technical resistance at 110-17 (High Apr 4).

- Cash yields mixed after the bell: 2s -.0024 at 4.7199%, 10s +.0019 at 4.2774%, 30s -.0028 at 4.4269%, while curves look mildly steeper: 2s10s +0.427 at -44.460, 5s30s +0.084 at 13.465.

- Today’s ECB decision provided little insight surrounding the future path for monetary policy, as Lagarde underscored the Bank’s data-dependent stance, albeit pointing to the likelihood that the ECB has started the “dialing back” of restriction phase.

- Initial jobless claims in the Jun 1 week ticked up 8k to 229k, the highest in 4 weeks and exceeding consensus estimates of 220k (prior was 221k, rev up from 219k). Continuing claims for the preceding week edged 2k higher to 1,792k, non-impactful given a downward 1k revision to prior (to 1,790k).

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00161 to 5.32630 (-0.00351/wk)

- 3M -0.00307 to 5.33444 (-0.00840/wk)

- 6M -0.00956 to 5.27509 (-0.03910/wk)

- 12M -0.02095 to 5.09229 (-0.10968/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.00), volume: $1.989T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $762B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $745B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $100B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $280B

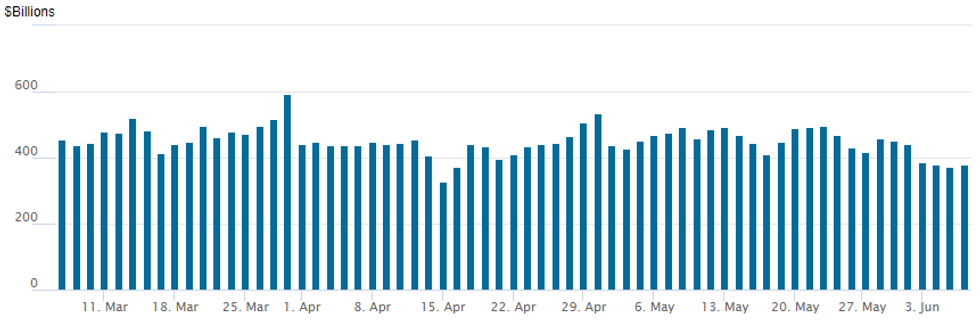

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $378.125B from $371.841B prior; number of counterparties slips to 72 from 76. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury option flow remained mixed Thursday. Low delta put joining better upside call buying all week. Heavy short end buying (appr +300k ESFRM4 in late trade) as specs join of Friday's May employment data. Late session short end support has supported late year rate cut projections vs. late Wednesday levels (*): June 2024 at -3.8% w/ cumulative rate cut -.9bp at 5.323%, July'24 at -18% w/ cumulative at -5.4bp (-4.3bp) at 5.278%, Sep'24 cumulative -21.3bp (-20.2bp), Nov'24 cumulative -30.7bp (-28.9bp), Dec'24 -49.7bp (-47bp).

- SOFR Options:

- 8,900 SFRZ4 95.12 calls ref 95.17

- -5,000 SFRN4 94.68/94.75/94.93/95.00 iron condors, 2.25 ref 94.88

- +5,000 SFRZ4 94..62/94.75 2x1 put sods, 0.0 vs. 95.17/0.05%

- -2,000 0QV4 95.75 straddles, 62.5 ref 96.01

- +5,000 0QM4 95.93/96.12 call spds, 2.0

- 4,000 SFRU4 94.93/95.06/95.18 call flys, ref 94.88

- 4,000 SFRH5 94.87 puts ref 95.435

- 1,000 SFRU4 94.87/95.00/95.12 2x5x3 call flys ref 94.899

- 1,500 SFRZ4 96.00/96.50/97.00 call flys ref 95.16

- 2,000 SFRZ4 95.5/96 call spds, ref 95.155

- Treasury Options

- Block, 15,000 wk2 FV 107.25 calls, 14.5 ref 106-24

- Block, 30,000 wk2 FV 107 calls 19 ref 106-24.5

- +15,000 wk2 TY 109.5/111 call over risk reversals 0.0 vs. 110-06/0.59%

- 5,000 wk2 10Y 109.5 puts, 17 ref 110-08

- 5,000 wk2 10Y 110/110.5 call spds ref 110-07.5

- 3,300 TYU4 110 puts, 1-10 ref 110-09

- 1,500 FVN4 107.25/108 1x2 call spds ref 106-24.5

- +7,500 TYN4 109.5/111.5 strangles, 35-34

- 2,000 FVN4 105.5/105.75/106/106.25 call condors ref 106-25.25

- 2,000 TYQ4 107/108.5/110 put flys ref 110-06.5

- 2,000 USN4 116/118 put spds, 35 ref 118-30

- 4,500 TYU4 110 straddles, 240-236 ref 110-06

- 11,000 wk2 FV 107.5/107.75 call spds, ref 106-23.25 to -23.5

- 4,200 TYU4 113/115 call spds ref 110-07

EGBs-GILTS CASH CLOSE: Bunds Weaken With ECB Cut Path Left Unclear

EGB curves bear flattened Thursday, as the ECB delivered a slightly hawkishly-perceived message alongside its well-anticipated 25bp rate cut.

- An upgrade in core inflation projections drove an initial sell-off in Euro rates, after which Pres Lagarde warned of a "bumpy" inflation path ahead and wouldn't fully endorse that the ECB had entered a "dialing back" phase of rate decisions, stressing data dependence.

- Bunds would bounce from mid-press conference lows, but the German curve saw belly underperformance as 2024 ECB cuts (beyond today's expected 25bp reduction) were pared to 36bp from 40bp pre-decision.

- Periphery EGBs largely took the relatively hawkish communications in stride, with spreads closing only slightly wider of Bunds.

- Gilts easily outperformed EGBs, with bull steepening in the UK curve.

- Friday brings German industrial production and Eurozone final Q1 GDP data, after which the session's focus will be US nonfarm payrolls.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.7bps at 3.017%, 5-Yr is up 4.4bps at 2.604%, 10-Yr is up 3.7bps at 2.549%, and 30-Yr is up 2.2bps at 2.674%.

- UK: The 2-Yr yield is down 4bps at 4.331%, 5-Yr is down 2.8bps at 4.067%, 10-Yr is down 1bps at 4.174%, and 30-Yr is unchanged at 4.611%.

- Italian BTP spread up 1.2bps at 132.1bps / Spanish up 0.2bps at 73.2bps

EGB Options: Tilting Toward Upside Call Structures On ECB Cut Day

Thursday's Europe rates/bond options flow included:

- RXU4 135/137cs, bought for 21 in 5k. This was also bought Wednesday for 22, adding to the position

- ERU4 96.62/96.75/96.87/97.00c condor, bought for half in 4k

- ERZ4 96.625/96.75cs, bought for 5 in 4k

FOREX EURUSD Holds Narrow Range Post ECB, NFP Awaits

- There was a modest uptick for the single currency as the ECB’s well telegraphed 25bp cut was offset by higher-than-expected revisions to both growth and inflation for 2024 and for inflation in 2025.

- Additionally, by not committing to any particular rate path, and the confirmation of a meeting-by-meeting approach, this leaves markets unclear on the immediate next steps for the ECB’s Governing council.

- Overall, EURUSD held a narrow 40-pip range on Thursday. The brief move back above the 1.09 handle failed to garner any momentum as markets remain on the sidelines ahead of tomorrow’s key employment data from the US. Above here, the week’s high of 1.0916 precedes the more significant Fibonacci retracement at 1.0933, before 1.0964/81, the March highs.

- Separately, EURGBP continues to flirt with the key 0.8500 level, of which the pair has failed to close below since August 2022.

- The USD index sits moderately in the red as US yields continue to hover at the lowest levels of the week and major equity indices remain buoyant.

- AUD has outperformed, rising 0.35% against the dollar, which further underpins the bull cycle that started Apr 19 for AUDUSD. Short-term pull backs appear to be corrective in nature, and a continuation higher signals scope for the bull trigger to be tested at 0.6714, May 16 high.

- Friday’s release of nonfarm payrolls is expected to partially rebound in May from April’s surprisingly low 175k, with 188k in headline gains per MNI’s sell-side analyst median. While still an acceleration from the prior month, the consensus outcome if realized would be seen as reinforcing the view that the labor market has shifted into a softer but still-solid phase of growth.

Late Equities Roundup: Paring Losses Ahead Jobs Data Risk

- Stocks are paring losses in late trade, squaring up ahead of Friday's employment data risk event. Currently, the DJIA is up 81.71 points (0.21%) at 38890.91, S&P E-Minis down 2.75 points (-0.05%) at 5363, Nasdaq down 19.2 points (-0.1%) at 17168.81.

- Consumer Discretionary and Energy sectors led gainers in late trade, auto makers and broadline retailers supporting the former: Etsy +1.76%, Amazon +1.14%, Tesla +1.65% and parts maker Aptiv +0.55%. Energy sector shares gained as crude prices bounced off lows (WTO +1.5 at 75.57): Haliburton +1.0%, Schlumberger and Valero +0.90%, APA +0.84%.

- On the flipside, Utility and Industrial sector shares underperformed: independent energy shares weighed on the former, Vistra -8.67%, NRG energy -4.68%, Constellation Energy 4.30%. Industrials weighed by engineering relates shares: Eaton Corp -4.13%, Hubbell Inc -3.94%, Johnson Controls -3.03%.

- Notable earnings releases still to come this week: Vail Resorts and Docusign after today's close, Autodesk, Rubrik Inc, Casey's General Store, Oracle and GameStop tomorrow.

E-MINI S&P TECHS: (M4) Resumes Its Uptrend

- RES 4: 5462.77 2.236 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5417.75 2.00 proj of the Apr 19 - 29 - May 2 price swing

- RES 2: 5400.00 Round number resistance

- RES 1: 5372.75 Intraday high

- PRICE: 5365.00 @ 1500 ET Jun 6

- SUP 1: 5283.13/5205.50 20-day EMA / Low May 31 and key support

- SUP 2: 5155.75 Low May 6

- SUP 3: 5099.25 Low May 3

- SUP 4: 5036.25 Low May 2

The uptrend in S&P E-Minis remains intact and this week’s gains reinforce this set-up. Price has traded above 5368.25, the May 23 high and bull trigger. The break confirms a resumption of the uptrend. A continuation higher would signal scope for a climb towards the 5400.00 handle next. On the downside, key short-term support has been defined at 5205.50, the May 31 low. Clearance of this level is required to signal a short-term reversal.

COMMODITIES Crude Markets Extend Recovery, Silver Surges Over 4%

- Crude markets have found further support on Thursday, with Brent briefly passing the $80/b mark. Upside comes from a moderate fall in the dollar during the afternoon as US yields consolidate at the lowest levels of the week. Prices are also readjusting after a sharp fall following OPEC+’s output plan announced June 2.

- Front month futures are still net down on the week after the bearish reaction to the OPEC+ plan to increase supply later this year. OPEC retains the flexibility to alter that plan depending on market developments.

- OPEC+ will continue to manage the oil market, even with Saudi plans to boost exports in the coming years, the Kingdom’s energy minister Prince Abdulaziz bin Salman said at the St. Petersburg International Economic Forum, cited by Platts.

- Initial resistance for WTI is at $76.15, the May 24 low and a recent breakout level.

- Precious metals are rising and the 0.75% advance for gold has been surpassed by the impressive 4.3% jump for spot silver.

- Gains have been supported by the lower US yields and for silver, upside momentum was exacerbated through the weekly highs around 30.80/88.

- The medium-term trend structure for gold remains bullish and the recent move down appears to be a correction that is allowing an overbought condition to unwind. However, tomorrow’s employment report, combined with CPI and the FOMC meeting are likely to be the key drivers of short-term sentiment.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/06/2024 | 0600/0800 | ** |  | DE | Trade Balance |

| 07/06/2024 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/06/2024 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/06/2024 | 0800/1000 |  | EU | ECB's Schnabel participates in panel discussion at the Federal Ministry of Finance | |

| 07/06/2024 | 0900/1100 | *** |  | EU | GDP (final) |

| 07/06/2024 | 0900/1100 | * |  | EU | Employment |

| 07/06/2024 | - | *** |  | CN | Trade |

| 07/06/2024 | 1230/0830 | *** |  | US | Employment Report |

| 07/06/2024 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 07/06/2024 | 1400/1000 | ** |  | US | Wholesale Trade |

| 07/06/2024 | 1415/1615 |  | EU | ECB's Lagarde in Atelier Maurice Allais | |

| 07/06/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 07/06/2024 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.