-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Classic Risk-On After Strong Data

- MNI US: Brainard: US Economy Showing Resilience Despite Predictions Of Recession

- MNI US: Speaker McCarthy-"Don't Know" If Trump Is Strongest Candidate For 2024 Race

- MNI SECURITY: Prigozhin Arrives In Belarus, Future Of Wagner Group Remains Uncertain

- CHINA'S XI REITERATES CHINA TO PUSH FORWARD ECONOMIC OPENING, Bbg

- FIDELITY PREPARING TO SUBMIT SPOT BITCOIN ETF FILING, Bbg

- ECB VASLE: CORE INFLATION IS GETTING STRONGER AND STRONGER .. IF INFLATION MORE PERSISTENT, MORE RATE HIKING NEEDED, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

Markets Roundup: Tsys Hug Lows After Strong Data

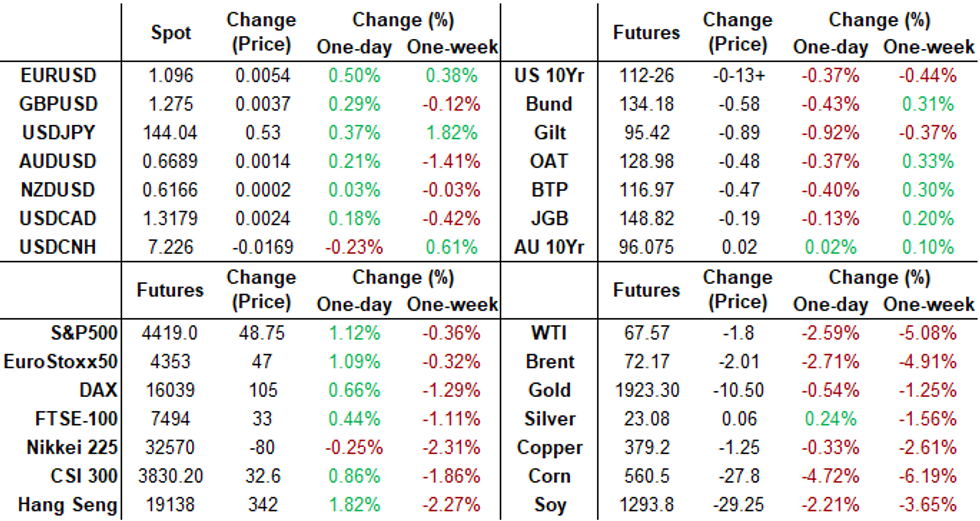

- Treasury futures are trading weaker after the bell, drifting near session lows since late morning after a mildly volatile open. Treasury futures extended highs (TYU3 113-13, +5.5) after the equity open as stocks marched higher through late trade (SP Eminis +41.75 at 4422.00). No specific headline driver for the early support, trading desks suggest early month end buying while bounce in Canadian FI post data may be a contributing factor.

- FI support was short lived as Treasury futures sold-off (TYU3 marking 112-24.5 low, yield 3.7601%) in reaction to stronger than expected data (May durable goods orders, April home prices, May new home sales, and June consumer confidence) that contributed to modest gain in projected rate hike expectations in the second half of 2023.

- Market confidence of a hike at the July 26 FOMC has climbed to 76% from 69% early Monday, implied rate of +19.1bp to 5.267%. September cumulative of +23.6bp at 5.313% while November is fully pricing in a 25bp hike with cumulative at 27.7 at 5.354%. Fed terminal at 5.355% in Nov'23.

- Focus on ECB Central Bank Forum underway in Sintra. Fed Chair Powell, ECB Lagarde, BOJ Ueda and BOE Bailey on policy panel event Wednesday at 0930ET.

- Also of interest, the Federal Reserve Board annual bank stress tests results will be tomorrow afternoon at 1630ET.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01805 to 5.10536 (+.02169/wk)

- 3M +0.00461 to 5.23932 (+.00062/wk)

- 6M +0.00391 to 5.32433 (-.00475/wk)

- 12M +0.00553 to 5.26322 (-.02038/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 to 5.06386%

- 1M +0.01385 to 5.19171%

- 3M +0.00771 to 5.52871% */**

- 6M +0.04614 to 5.71971%

- 12M +0.02958 to 5.91429%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.55743% on 6/12/23

- Daily Effective Fed Funds Rate: 5.07% volume: $138B

- Daily Overnight Bank Funding Rate: 5.06% volume: $292B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.429T

- Broad General Collateral Rate (BGCR): 5.03%, $610B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $596B

- (rate, volume levels reflect prior session)

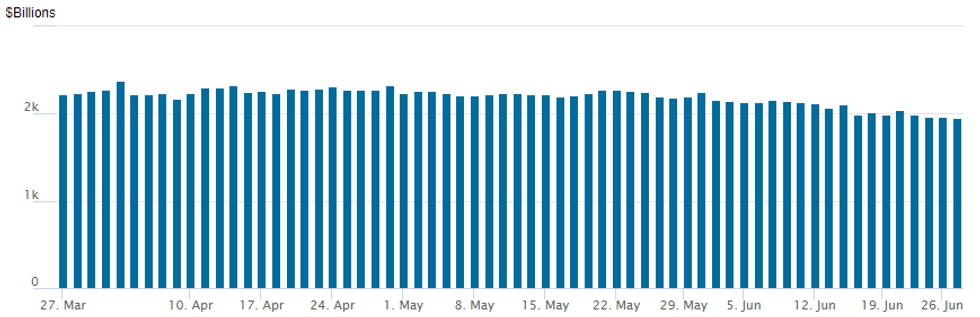

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $1,951.098B w/ 101 counterparties, compared to $1,961.027B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Modest summer volumes segued from downside put structures overnight into early New York trade, to better calls trade in the second half. Accounts alternately repositioned or faded weaker underlying futures as projected 25bp rate hike at one of the next four meetings persist.- SOFR Options:

- Block, 16,000 SFRU3 94.75/95.00/95.50 broken call flys, 1.25 ref 94.635

- +10,000 SFRZ3 96.50 calls, 6.0 vs. 94.72/0.10%

- Block, 15,000 SFRU3 94.62/94.87 2x1 put spds, 9.0 net ref 94.645

- -5,000 SFRV3 95.00/95.25 call spds, 4.25

- +10,000 SFRN3/SFRQ3 95.00/95.12 call spd spd, 0.5/Aug over

- 1,000 SFRV3 94.12/94.37/94.50/94.62 put condors

- 1,000 SFRN3 94.50/94.56/94.62/94.68 put condors

- 1,000 SFRZ3 94.50/94.62/94.75/94.87 put condors ref 94.765

- 1,000 SFRN3 94.56/94.62/94.68 put trees, 3.0 ref 94.655

- 1,000 OQN3 95.57/96.00/96.12 call flys, ref 95.885

- Block, 2,000 SFRU3 94.75/95.00 put spds, 20.5 ref 94.66

- Treasury Options:

- -6,000 TYU3 111 puts, 33 vs 112-27.5/0.16%

- 3,100 FVQ3 108 calls, 30.5 ref 107-27

EGBs-GILTS CASH CLOSE: Bear Flatter As Sintra Comments, US Data Weigh

Gilts led a European core FI sell-off Tuesday, with central bank hiking expectations rising.

- Both the German and UK curves bear flattened, with UK yields up double-digits through the 5Yr tenor as BoE peak rate pricing rose 6bp and exceeded 6.25%. ECB peak is again seen above 4% after a 4bp rise today.

- Rhetoric from the ECB's annual Sintra event has been mostly on the hawkish side. Highlights included Lagarde's comment that the ECB won’t be able to “state with full confidence” in the near future that the peak for rates has been reached; MNI interviewed Belgium's Wunsch in Sintra: he sees a September hike absent a fall in core inflation.

- Stronger-than-expected US data in the afternoon helped relieve recession concerns and cemented the European selloff into the cash close.

- Periphery EGB spreads tightened (combo of higher bund yields and a risk asset rally), with 10Y Greece/Germany at fresh post-2021 lows.

- Italy kicks off the June eurozone inflation readings Wednesday - our preview for that release and the EZ numbers was published today (available here). We also get commentary from BoE's Pill and Bailey.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.3bps at 3.16%, 5-Yr is up 6.7bps at 2.516%, 10-Yr is up 4.7bps at 2.356%, and 30-Yr is up 1.7bps at 2.391%.

- UK: The 2-Yr yield is up 11.3bps at 5.273%, 5-Yr is up 11.8bps at 4.675%, 10-Yr is up 7.4bps at 4.375%, and 30-Yr is down 0.9bps at 4.376%.

- Italian BTP spread down 1.3bps at 162.8bps / Greek down 1.9bps at 121.7bps

EGB Options: Several Euribor Rates Trades Tuesday, Mostly Upside

Tuesday's Europe rates / bond options flow included:

- DUQ3 104.90/80/70/60 p condor, bought for 1.5 and 1.75 in 4.5k

- ERQ3 97.00 call bought for 0.75 in 7k

- ERU3 96.25/96.125/96.00p ladder, bought for 2.25 in 11k

- ERU3 96.12/96.25/96.37/96.50 call condor bought for 2 in 4k

- ERU3 96.00p, bought for 7.25 in30k (ref 96.07).

- ERV3 96.00/95.87/95.75p fly vs ERU3 95.75p, bought the Oct for -0.5 (receive)in 2k.

- ERZ3 95.50/95.00 1x1.5 put spread bought for 3.25 in 6.5k

- ERZ3 96.00/96.25cs 1x2, bought for -5.75 in 3.5k.

FOREX: EUR Bolstered Ahead Of Eurozone Inflation Prints, JPY Extends Downtrend

- The Euro continued its grind higher from late on Friday as the single currency was buoyed by some moderate hawkish ECB rate re-pricing and reports of potentially supportive month-end flows. This prompted EURJPY to approach the 158 handle, advancing 0.85% on the day.

- Despite the pair oscillating either side of 150 in late May and early June, the sharp rally across the last eleven trading sessions equates to around a +5.2% surge, as it eats into the sharp decline witnessed in 2008.

- EURJPYprice action reinforces the current technical bullish theme after recently clearing key resistance at 151.61, the May 2 high and an important bull trigger. Moving average studies are in a bull mode position too, highlighting positive market sentiment and the topside focus is on 158.72, a Fibonacci projection.

- Elsewhere, a slew of positive data surprises was unable to spark a broad US dollar revival, with the USD index sitting 0.20% lower on the session as we approach the APAC crossover.

- However, USDJPY did surge from the lows, breaking above 144.00 in the process, as the upward pressure on front-end yields further hampered the struggling yen.

- The run higher in USD/CNH stopped just in front 7.2500 during Asia-Pac hours, with a slightly more forceful PBoC lean against further weakness (albeit not large by historic terms) and Reuters reports suggesting that “state banks sold dollars against the yuan” providing the most meaningful signs yet that authorities have started to get a little uncomfortable with at least the speed of the recent run lower in the value of the yuan. Spot deals around 7.2250 as of writing.

- On Wednesday, CPI data for Australia and Italy will receive attention. Likely the market focus will be on the ECB Forum in Sintra, where Fed’s Powell, ECB’s Lagarde, BOJ’s Ueda and BoE’s Bailey all have a joint event.

FX: Expiries for Jun28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800-15(E916mln), $1.0845-50(E1.3bln), $1.0900-10(E3.0bln), $1.0970-75(E999mln), $1.0999-00(E1.4bln)

- USD/JPY: Y139.00($1.1bln)

- GBP/USD: $1.2650-65(Gbp1.2bln)

- AUD/USD: $0.6550(A$1bln), $0.6650(A$790mln)

- USD/CNY: Cny7.1500($1.4bln), Cny7.2000($512mln), Cny7.2100($544mln), Cny7.2200($553mln)

Equities Roundup: Bull Theme Intact, Autos, Durables, Chips Leading

- Stocks continue to march higher in late trade, after trading near the lowest levels since July 12 this morning, S&P E-Mini futures are currently up 49.5 points (1.10%) at 4419.75, DJIA up 226.77 points (0.67%) at 33941.36, Nasdaq up 228.1 points (1.7%) at 13564.05.

- Leading gainers: Consumer Discretionary and Information Technology sectors have bounced back from Monday's lows. Autos (Tesla +2.65%, Ford +1.95%, GM +1.8%) leading the former with household durables shares contributing: Newell Brands +7.75%. IT sector shares supported by strong showing in semiconductor stocks: Microchip +3.7%, Texas Inst +3.45%, Applied Materials +3.35%.

- Laggers: Health Care, Utilities and Energy sectors underperformed. Energy shares unwinding support over the last couple sessions as crude prices recede (WTI -1.25 at 68.12), Hess Energy -1.15%, Exxon Mobil -0.5%.

- The technical bull theme in S&P E-minis remains intact and the recent pullback appears to be a correction. The move lower is allowing a recent overbought condition to unwind. Initial key support lies at the 20-day EMA, at 4360.26.

- A break of this average would strengthen a short-term bearish theme and signal scope for a deeper pullback. On the upside, the bull trigger is 4493.75, the Jun 16 high. A break would open 4506.23 the top of a bull channel.

E-MINI S&P TECHS: (U3) Corrective Cycle Remains In Play

- RES 4: 4556.71 2.382 projection of the May 4 - 19 - 24 price swing

- RES 3: 4532.08 2.236 projection of the May 4 - 19 - 24 price swing

- RES 2: 4509.24 Bull channel top drawn from the Oct 2022 low (cont)

- RES 1: 4493.75 High Jun 16 and the bull trigger

- PRICE: 4420.00 @ 1425ET Jun 27

- SUP 1: 4360.26 20-day EMA

- SUP 2: 4278.23 50-day EMA

- SUP 3: 4154.75 Low May 24

- SUP 4: 4098.25 Low May 4 and a key support

A bull theme in S&P E-minis remains intact and the recent pullback appears to be a correction. The move lower is allowing a recent overbought condition to unwind. Initial key support lies at the 20-day EMA, at 4360.26. A break of this average would strengthen a short-term bearish theme and signal scope for a deeper pullback. On the upside, the bull trigger is 4493.75, the Jun 16 high. A break would open 4506.23 the top of a bull channel.

COMMODITIES: Stronger US Data Fails To Durably Lift Crude Oil But Does Hit Gold

- Crude oil prices has seen solid declines today as a bounce on stronger than expected US data proved short-lived, with some seeing continued concerns on weak China demand at the same time as there is ample supply despite OPEC+ cuts and additional voluntary Saudi cuts starting Jul 1.

- WTI is -2.5% at $67.61, moving closer to testing support at $66.96 (Jun 12 low), which if probed could open a key support at $64.41 (May 4 low).

- Bearish sentiment is evident in options space with the day’s most active strikes at $65/bbl puts for the CLQ3.

- Brent is -2.7% at $72.20, also moving closer to support at $71.50 (May 31 low) after which lies $71.20 (Jun 20 and May 4 lows).

- Gold is -0.5% at $1914.15, weighed by rising US yields after strength particularly in US consumer confidence and new home sales. Its earlier low of $1911.15 started to eye $1910.3 (Jun 23 low) at what was otherwise the lowest since mid-March. Failure for markets to provide support here would be resolutely bearish, although support is holding up for now.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/06/2023 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 28/06/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/06/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 28/06/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/06/2023 | 0800/1000 | ** |  | EU | M3 |

| 28/06/2023 | 0800/1000 | ** |  | IT | PPI |

| 28/06/2023 | 0800/1000 |  | EU | ECB de Guindos Panels ECB Forum | |

| 28/06/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 28/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 28/06/2023 | 0900/1100 |  | EU | ECB de Guindos Panels ECB Forum | |

| 28/06/2023 | 1030/1130 |  | UK | BOE Pill Panels ECB Forum | |

| 28/06/2023 | 1030/1230 |  | EU | ECB Lane Panels ECB Forum | |

| 28/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/06/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/06/2023 | 1330/1430 |  | UK | BOE Bailey Panels ECB Forum | |

| 28/06/2023 | 1330/1530 |  | EU | ECB Lagarde Panels ECB Forum | |

| 28/06/2023 | 1330/0930 |  | US | Fed Chair Jerome Powell | |

| 28/06/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 28/06/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/06/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.