-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Monday, December 9

MNI ASIA MARKETS ANALYSIS: CPI Components Narrowly Mixed

- MNI US: President Biden To Deliver "Major Economic Address" Tomorrow

- MNI JAPAN: Kishida To Announce "Bold Economic Package" By End Of Sep following today's cabinet reshuffle

- MNI SECURITY: Russia To Strengthen Cooperation With North Korea "On All Fronts"

- GERMANY TO REVISE 2023 GDP OUTLOOK TO CONTRACTION OF UP TO 0.3%, Bbg

- Sharp Decline in UK Economy in July Revives Recession Risk, Bbg

Key Links:MNI POLICY: Lively Debate At Fed Over Possible R-Star Rise / MNI: Push For New EU Fiscal Regime Before Old Rules Return / MNI UK Labour Market Review: Emerging evidence of wage peak? / US Treasury Auction Calendar

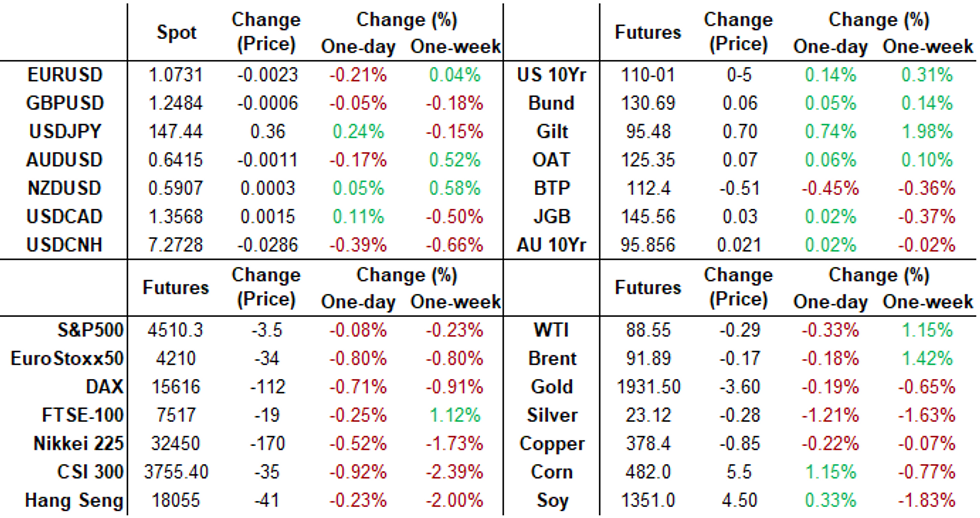

US TSYS FI Shrugs Off Early CPI Driven Volatility, Focus on Thu's PPI

- US FI markets are holding modest gains after the bell, relatively quiet after early CPI data generated volatility. Fast two-way on wide range post-data has segued to better buying with short end outperforming as markets continue to digest stronger than expected core services CPI while goods prices contracted.

- Core CPI accelerated from 0.16% to 0.28% M/M in August, with a large part of the move driven by a relative airfares contribution of +0.09pps (the PCE source for which are PPI and not CPI). Combined with other details from the report, it sees the following preliminary core PCE estimates to be updated after tomorrow’s PPI data (with core PCE due Sep 29).

- General opinion from trading desks: this morning's data does little to change Fed's policy path (no change next week but with a hawkish tone for year end if inflation percolates higher).

- Rate hike projections through year end receded: Sep 20 FOMC is 2.3% w/ implied rate change of +0.06bp to 5.338%. November cumulative of +10.4p at 5.436, December cumulative of 12.2bp at 5.454%. Fed terminal at 5.45% in Jan'24.

- Treasury futures holding modest gains after $20B 30Y auction reopen (912810TT5) tailed by 1bp: 4.345% high yield vs. 4.335% WI; 2.46x bid-to-cover vs. 2.42x in the prior month.

- Focus turns to Thursday's August PPI, Retail Sales and Weekly Claims data.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00136 to 5.33220 (+0.00274/wk)

- 3M +0.00121 to 5.40943 (-0.00104/wk)

- 6M +0.00229 to 5.47350 (+0.00153/wk)

- 12M +0.01033 to 5.43164 (+0.00772/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $108B

- Daily Overnight Bank Funding Rate: 5.32% volume: $274B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.448T

- Broad General Collateral Rate (BGCR): 5.30%, $573B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $561B

- (rate, volume levels reflect prior session)

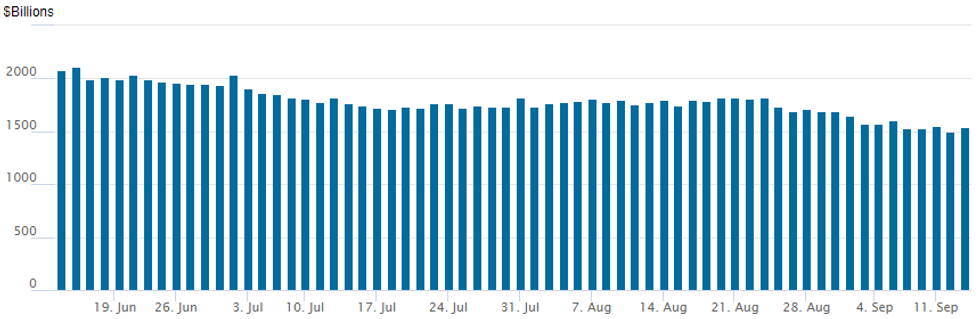

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation rebounds to 1,546.225B w/95 counterparties, compared to $1,493.781B in the prior session - the lowest level since early March 2022. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury option trade remained mixed on the best volumes of the week Wednesday. Traders reported slightly better call interest from late morning on as underlying futures rebounded from a knee-jerk sell-off following the August CPI data. Rate hike projections through year end receded: Sep 20 FOMC is 2.3% w/ implied rate change of +0.06bp to 5.338%. November cumulative of +10.4p at 5.436, December cumulative of 12.2bp at 5.454%. Fed terminal at 5.45% in Jan'24.

- SOFR Options:

- 7,500 SFRZ3 97.25 calls, 1.0 ref 94.55

- Block, total 20,000 SFRH4 94.87/95.37 call spds, 7.75 splits ref 94.695 to -.70

- Block, total 10,000 SFRZ3 94.50/94.62 put spds, 6.75 vs. 94.54/0.18%

- Block, 5,000 SFRZ3 95.50 puts. 98.5 vs. 8,750 SFRU4 95.25 puts, 50.0

- +5,000 0QZ3 96.00/96.25 call spds, 5.25

- +5,000 SFRU4 95.25/95.50/95.87/96.12 call condors, 3.75

- +2,000 SFRZ4 95.62/96.62 call spds, 29.75-30

- -7,000 SFRV3 94.56/94.62/94.68/94.75 call condors 2.5-2.25

- 3,000 SFRU4 97.50/97.75 call spds ref 95.265

- 4,000 0QZ3 95.25/95.38/95.50/95.62 put condors

- 2,000 0QV3 95.5/2QV3 96.12 put spds

- 8,000 SFRX3 94.38/94.50 put spds ref 94.54 to -.545

- 2,200 0QU3 95.25/95.38/95.62 broken call trees ref 95.215

- over 3,900 0QU3 95.31/2QU3 96.18 call spds

- 3,500 0QZ3 95.38 puts ref 95.55

- 2,000 0QZ3 96.50/96.75 call spds ref 95.55

- 3,000 SFRM4 94.38/94.75/95.00 broken put trees ref 94.905

- 1,000 SFRZ3 93.87/94.00 put spds ref 94.54

- 1,000 SFRM4 94.25/94.75 put spds, ref 94.905

- over 4,400 0QU3 95.06/95.12/95.18 put trees ref 95.225

- Treasury Options:

- +10,600 TUX3 101.12/102.12 call over risk reversals, 0.0 ref 101-18

- 11,000 FVV3 106.5 106.75/107.25 call spds

- Block, 11,000 TYV3 109 puts, 13 vs. 109-24/0.18%

- -10,000 TYV3 109.25 puts, 25 vs. 109-13.5/0.32%

- over 22,000 FVX3 106 calls

- over 22,100 TYV3 108.5 puts, mostly from 9-10, trades 6 last ref 109-24.5

- 17,700 wk5 10Y 111/112/113 call flys ref 109-18 to -17.5

- 1,200 TYV3 110.5/111.25 call spds 9 ref 109-20.5

- 2,500 USX3 122/123 call spds ref 119-00

- over 5,000 FVX3 107 calls, 20.5-21 ref 106-01

- over 13,400 TYV3 108.5 puts, 9-10 ref 109-21

- 2,500 wk3 10Y 110 calls 13 ref 109-21

- 1,250 TYV3 108.75 puts, 12 ref 109-22.5

EGBs-GILTS CASH CLOSE: German Short End Underperforms Again Pre-ECB

UK yields dropped sharply Wednesday, with EGB yields rising ahead of Thursday's ECB decision. The German short end was a notable underperformer for the 2nd consecutive session.

- The UK curve leaned bull flatter on the day with outperformance in the central bank rate-sensitive 5Y segment (peak BoE hike pricing dipped to a fresh 3-month low).

- This followed a soft UK GDP print, with the US CPI data largely in line with expectations adding fresh downward impetus to global yields through the afternoon.

- The German curve twist flattened as ECB hike pricing firmed further.

- A 25bp raise Thursday briefly hit 75% implied probability after a hawkish Reuters sources piece out after market close Wednesday.

- Periphery EGB spreads widened, led by BTPs, evident of some caution ahead of tomorrow's ECB decision.

- With an otherwise quiet schedule Thursday, all attention will be on the ECB decision and the Lagarde press conference. Our meeting preview is here.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.3bps at 3.17%, 5-Yr is up 2.8bps at 2.682%, 10-Yr is up 0.8bps at 2.651%, and 30-Yr is down 1.4bps at 2.753%.

- UK: The 2-Yr yield is down 5.6bps at 4.985%, 5-Yr is down 7.9bps at 4.565%, 10-Yr is down 6.9bps at 4.347%, and 30-Yr is down 6.7bps at 4.664%.

- Italian BTP spread up 3.7bps at 179.6bps / Spanish up 1.6bps at 107.1bps

EGB Options Heavy Euro Rate Action On ECB Eve

Wednesday's Europe rates / bond options flow included:

- DUZ3 104.60/105.20/105.80 iron fly, sold at 41.5 in 4k

- RXV3 132/133/134/135c condor sold at 8.5 in 5k

- ERU3 96.12/96.00ps 1x2, bought for 5.75 in 5k

- ERU3 96.12/96.25cs sold at 3.25 in 8k

- ERV3 96.12/00/87p fly 1x3x2, bought for 2.25 in 3.5k

- ERV3 96.12/96.00ps 1x2, bought for 2.75 in 10k

- ERZ3 96.12/37/50/62 c condor sold at 4.75 in 6k.

- ERZ3 96.00/96.12/96.25c fly, bought for 1.5 in 5k

- ERH4 96.12/96.00/95.87p fly bought for 2.25 in 12k

FOREX US CPI Induced Volatility Tempered As ECB Takes Focus

- The greenback initially spiked higher on the back of the slightly higher than expected monthly reading for US core inflation. However, the initial knee jerk moves higher then more than reversed owing to the ‘low’ nature of the unrounded headline Y/Y and core M/M beats.

- Overall, the USD index sits close to unchanged on the day, a fairly subdued reaction given front-end treasury yields have shifted lower by around 5 basis points.

- Emphasising the lack of impact on G10 currency markets, USDJPY actually stands a touch higher on the session, although is well off a session best of 147.73. This high fell around 10 pips shy of Friday’s closing mark, a gap that has yet to be filled following the weekend’s hawkish remarks from Bank of Japan Governor Ueda.

- The resumption of the uptrend last week opens 148.40 next, the Nov 4 2022 high. On the downside, 144.45 represents the key short-term support, the Sep 1 low. A break of this level is required to highlight a short-term top.

- Liquidity matters seem to be supporting CNH which has outperformed on Wednesday, with T/N points and 1-month CNH HIBOR back towards recent highs, while 3-month CNH HIBOR has moved to the highest level seen since ’18. Technically, trend conditions remain bullish for USDCNH and the move lower in recent sessions appears to be a correction, despite price narrowing the gap with key short-term support at 7.2392, the Sep 1 low.

- With the focus for global markets turning to tomorrow’s close-call ECB rate decision, it is worth noting EURUSD has stuck to a fairly tight range this week, back above the 107.00 mark. EURUSD conditions remain bearish and the recent consolidation appears to be a bear flag formation. Moving average studies are in a bear mode set-up, highlighting the market's current sentiment and the next downside level is 1.0668 next, the Jun 7 low. Key resistance is at 1.0945, the Aug 30 high.

- Additional data of note on Thursday includes Australian employment and US retail sales for August.

Late Equity Roundup: Near Highs

- Stocks remain firmer in late trade, near session highs after this morning's post-CPI knee-jerk sell-off. Currently, S&P E-Mini futures are up S&P E-Mini Future up S&P E-Mini Future up 8.25 points (0.18%) at 4521.75, Nasdaq up 58.8 points (0.4%) at 13832.67, DJIA down 12.22 points (-0.04%) at 34635.34.

- Leaders: Utilities, Consumer Discretionary and Information Technology sectors continue to outperform. Natural gas shares lead the former with Ameren +2.32% Duke Energy +2.25%, Alliant Energy +2.09%. Autos buoyed Consumer Discretionary sector, Ford outperformed Tesla for once, +2.0% vs. +1.75% respectively while GM gained 0.25%.

- IT sector shares rebounded from better selling Tuesday, chip stocks and software makers outperforming hardware: Synopsis +3.08%, AMD +2.6%, Oracle +2.45%. On the flipside, SolarEdge -4.63%, Enphase -3.25%, HP Inc -1.8%.

- Laggers: Energy, Real Estate and Industrials sectors underperformed. Equipment and services lagged oil and gas shares after trading stronger the last couple sessions as crude prices soared (WTI currently -.25 at 88.59). APA -5.7%, Schlumberger -2.15%, Baker Hughes -2.15%. Commercial real estate services and investment firm CBRE fell 8% on the day after presenting at a Barclays conf.

- Technicals: despite Wednesday's bounce, a bear cycle in the E-mini S&P contract and short-term gains are considered corrective for now. A stronger sell-off would signal scope for a move towards the key support and bear trigger at 4397.75, the Aug 18 low. Clearance of this support would strengthen a bearish case.

E-MINI S&P TECHS: (Z3) Bear Cycle Remains In Play

- RES 4: 4685.25 High Jul 27 and key resistance

- RES 3: 4617.40 61.8% retracement of the Jul 27 - Aug 18 sell-off

- RES 2: 4597.50 High Sep 1 and a near-term bull trigger

- RES 1: 4553.25 High Sep 6

- PRICE: 4510.00 @ 1510 ET Sep 13

- SUP 1: 4482.00 Low Aug 29

- SUP 2: 4397.75 Low Aug 18 and a bear trigger

- SUP 3: 4378.75 Low Jun 9

- SUP 4: 4352.50 Low Jun 8

A bear cycle in the E-mini S&P contract and short-term gains are considered corrective for now. Key resistance has been defined at 4597.50, the Sep 1 high where a break is required to reinstate the recent bullish theme. A stronger sell-off would signal scope for a move towards the key support and bear trigger at 4397.75, the Aug 18 low. Clearance of this support would strengthen a bearish case.

COMMODITIES Crude Ultimately Weighed Marginally By US Stocks Build, Gold Under Further Pressure

- Crude futures have reversed earlier gains after some mixed trading, ultimately weighed by a build in US crude stocks, with weekly EIA data showing +3,955 build vs expectations of +1,993. The elevated level of oil is still supported though by tight supplies and the drawdown in global inventories with support from demand optimism from US and strong China crude imports.

- Global oil demand will outpace supply by 1.24mbpd in the second half of this year, given strong demand from China according to the IEA Monthly Oil Market Report.

- Brent prices could exceed $100/b before 2024, driven by OPEC+ supply cuts and a more positive demand backdrop in Asia, Bank of America said in a note Sep. 12.

- WTI is -0.3% at $88.57, but remains far above support at $83.91 (20-day EMA) after its recent strong run.

- Brent is -0.15% at $91.91 but also remains far above support at $87.59 (20-day EMA).

- Gold meanwhile sees further weakness, down -0.24% at $1909.06 off a low of $1905.69 that took another step closer to support at $1903.9 (Aug 25 low). It’s an outsized loss considering Treasury yield pushing lower after US CPI and only minimal USD strength on balance.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/09/2023 | 0130/1130 | *** |  | AU | Labor Force Survey |

| 14/09/2023 | 0600/0800 | *** |  | SE | Inflation Report |

| 14/09/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 14/09/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 14/09/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 14/09/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 14/09/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/09/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 14/09/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 14/09/2023 | 1230/0830 | *** |  | US | PPI |

| 14/09/2023 | 1400/1000 | * |  | US | Business Inventories |

| 14/09/2023 | 1415/1615 |  | EU | ECB's Lagarde speaks at Podcast | |

| 14/09/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/09/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/09/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.