-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: 25Bp Cut Still Expected From FOMC Wednesday

MNI ASIA MARKETS ANALYSIS: Ylds Climb to 3W Highs Ahead FOMC

MNI ASIA MARKETS ANALYSIS:CPI Lower Than Exp, Fed Minutes Calm

HIGHLIGHTS

- FED: Staff See Mild Recession Later This Year But Powell Had Hinted At Such

- MNI: BOC WATCH: Rate Held, Pause Phrase Gone, Hike Talk Stays

- MNI: BOC Inflation Fight Not Done, Prepared To Hike Further

- BLS SAYS NO INDICATION OF EARLY RELEASE OF MARCH CPI DATA, Bbg

- GOLDMAN SACHS NO LONGER EXPECTS JUNE FED RATE INCREASE, Bbg

- US PLANS TO REFILL STRATEGIC OIL RESERVE, GRANHOLM SAYS, Bbg

- ECB SHOULD HIKE RATES BY 50 BPS IN MAY, HOZMANN TELLS BZ

- SWISS LOWER HOUSE VOTES FOR 2ND TIME AGAINST UBS-CS GUARANTEES Bbg

US TSYS: Post-March FOMC Minutes Calm

- Treasury futures holding modestly higher for the most part, near the middle of a wide session range. Futures fell back to pre-CPI levels after the Tsy $32B 10Y note auction tailed 2.3bp, but gradually climbed to middle of range (TYM3 115-25.5 +13.5) in the aftermath of the March FOMC minutes release.

- Federal Reserve officials debated a temporary pause to interest rate hikes last month as a banking sector crisis raged but unanimously decided inflation pressures were still sufficiently worrisome to warrant a quarter point interest rate increase.

- Post-minutes calm, projected year end rate cuts back to approximately -50bp cumulative for December after paring the move around midday. Initial impetus from the lower than anticipated CPI (CPI 0.1%, CORE 0.4%; CPI Y/Y 5.0%, CORE Y/Y 5.6%) has since scaled back the move while less than a 25bp hike at the May meeting holding steady.

- Markets showed little reaction to several unscheduled Fed speakers this morning Richmond Fed initially stayed away from discussing policy at a annual conference on investing, reiterated "THERE IS STILL MORE TO DO TO GET CORE INFLATION DOWN ... while PAST PEAK INFLATION BUT WE STILL HAVE WAYS TO GO" at a midmorning CNBC interview.

- Meanwhile, SF Fed President Daly said the U.S. economy could slow enough to bring down inflation without the Federal Reserve lifting interest rates further.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00143 to 4.81486% (+0.00515 total last wk)

- 1M +0.00842 to 4.94571% (+0.04542 total last wk)

- 3M +0.00972 to 5.25129% (+0.05343/wk)*/**

- 6M -0.00957 to 5.34200% (-0.06600 total last wk)

- 12M +0.04329 to 5.36643% (-0.13629 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.25129% on 4/12/23

- Daily Effective Fed Funds Rate: 4.83% volume: $108B

- Daily Overnight Bank Funding Rate: 4.82% volume: $273B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.365T

- Broad General Collateral Rate (BGCR): 4.78%, $528B

- Tri-Party General Collateral Rate (TGCR): 4.78%, $522B

- (rate, volume levels reflect prior session)

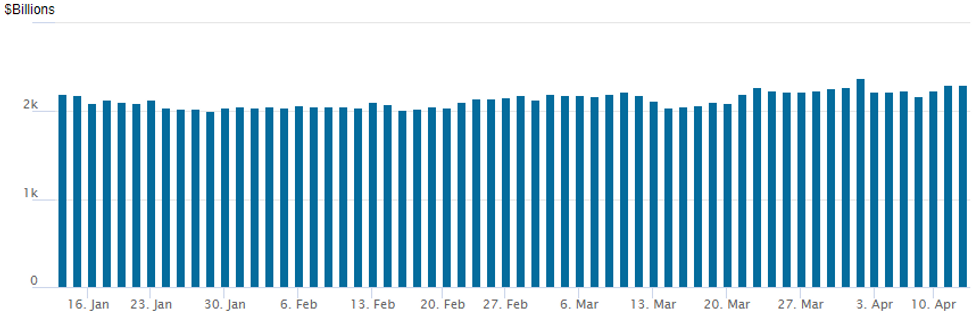

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,303.862B w/ 106 counterparties, compares to prior $2,297.208B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Decent volumes on mixed overall option trade Wednesday as underlying futures retreated from initial post-CPI gap bid. Modest two-way positioning in May options as accounts hedge perceived policy moves from the FOMC.- SOFR Options:

- Block, 5,000 SFRK3 95.50/95.75 call spds, 1.75 ref 95.045

- Block, 10,000 SFRK3 95.12/95.25/95.75 call trees, 0.5 net, 2 legs over ref 95.05

- +5,000 SFRU3 95.06/95.25 2x1 put spds, 12

- Block, 5,000 SFRZ3 95.87/96.25/96.50 broken call flys, 5.5 vs. 95.735/0.05%

- Block, 6,000 SFRU3 93.75/94.25/94.75 put flys, 6.0 ref 95.35

- -5,000 SFRN3 95.12/95.25/95.50/95.62 iron condors, 10.0 ref 95.345

- Block, 5,000 SFRK3 94.81/95.06 put spds, 10.5 ref 95.065

- Block, 10,000 SFRK3 94.93/95.18 put spds, 15.5 ref 95.065

- Block, +10,000 SFRM3 94.75/94.87/95.00 put flys, 3.5 ref 95.07

- 15,000 SFRM3 94.93 puts, ref 95.065

- +4,000 SFRH4 94.62/94.87/95.12 put flys, 1.75

- Update, 15,000 SFRZ3 94.25/95.25 put spds ref 95.78

- 15,000 SFRM3 95.50/96.25 call spds ref 95.01

- 2,500 SFRK3 95.06/95.18 call spds vs.

- 10,000 SFRM3 95.00/95.12/95.31/95.43 call condors, 1.75

- 4,000 SFRJ3 95.75 calls ref 95.00

- 4,000 SFRZ3 95.00/95.06/95.12 put flys, ref 95.63

- Block, 24,000 SFRZ 93.25/93.50 put spds, 1.0 ref 95.635 to -.64

- 2,000 SFRJ3 95.12/95.25 2x3 call spds ref 95.005 to -.01

- 4,000 OQK3 96.00/96.25/96.62 broken put flys ref 96.495

- 1,375 SFRJ3 95.00/95.25/95.50 put flys, ref 95.015

- 4,000 OQK3 98.00 calls, 1.5 ref 96.505

- Treasury Options:

- -3,200 FVM 109 puts, 28.5 ref 110-00

- +5,000 TYK 112/119 strangles, 3

- 2,500 TYK3 117.5/119 call spds, 5 ref 115-27

- Block, 15,000 TYK 116.5 calls, 23 vs. 7,500 TYM 114 puts, 30 vs. 5,475 TYM 116-00

- over 9,600 TYK3 116.75 calls, 18 ref 115-30

- 5,000 FVM3 107/108/109 put trees, 7.5 ref 110-09

- Block, 25,000 FVM3 112.5/113.5 call spds 8 vs. 110-08.5/0.08%

- 4,500 TYM3 119 calls, 20 ref 115-09.5

- 2,000 FVM3 111.25/111.75 call spds ref 109-26.5

EGBs-GILTS CASH CLOSE: Bearish Intraday Reversal

European yields fully reversed a sharp intraday drop set after a soft US CPI report Thursday, with Bunds underperforming Gilts.

- Core FI was caught wrong-footed by the inflation print: 10Y Bund yields had risen by 15bp and Gilts 11bp this week going into the data, but those rises were trimmed by 8bp and 9bp respectively immediately after the release.

- Then the reversal more than reversed, with 10Y yields jumping 15bp from the lows, as the CPI data was eventually interpreted as not being a game-changer for the inflation path ahead or for Federal Reserve policy.

- The publication of an interview with ECB's Holzmann in which he eyed a 50bp May hike and a need to keep hiking beyond next month sent European yields to session highs.

- ECB hike pricing hit a post-Mar 10 high, with a peak Depo rate of 3.74% now seen in October - up 8bp on the day (and 23bp above session lows). BoE pricing was steady.

- Periphery spreads reversed most of the narrowing, with BTPs closing a couple of basis points tighter to Bunds.

- Thursday's schedule includes an MNI event with BoE's Pill, as well as UK GDP data and final Eurozone national CPI prints.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9bps at 2.796%, 5-Yr is up 7.5bps at 2.397%, 10-Yr is up 5.9bps at 2.37%, and 30-Yr is up 5.6bps at 2.445%.

- UK: The 2-Yr yield is up 3.3bps at 3.519%, 5-Yr is up 2.1bps at 3.405%, 10-Yr is up 2.8bps at 3.57%, and 30-Yr is up 3.4bps at 3.895%.

- Italian BTP spread down 1.6bps at 184.5bps / Spanish down 0.8bps at 104bps

EGB Options: Hedged Bobl Upside And Euribor Upside Unwinding

Wednesday's Europe rates/bond options flow included:

- OEM3 119c, bought for 62.5 in 5k vs 1.6k at 117.71

- ERU3 96/95.5/95p fly, sold at 7 in 3k

- ERZ3 96.00/96.75/97.50 call fly sold at 20.25 in 4k. hearing unwind

- ERU3 97.00/98.00 call spread bought for 7 in 10k (vs 96.24)

FOREX: Greenback Extends Downtrend, USD Index Pressing Towards 2023 Lows

- Following the marginally below-estimate US inflation data, pressure remained on the US dollar on Wednesday as the DXY continues to gravitate towards last week’s lows around 101.45 and has the 2023 lows as the next obvious target. The FOMC minutes release had close to zero effect on currency markets as Wednesday’s session drew to a close.

- The Euro and Swiss franc are outperforming. USDCHF (-0.85%) has cracked support at 0.9000 handle, marking a resumption of the broader downtrend that started from the Oct 2022 high of 1.0148. The break lower signals scope for weakness towards 0.8926 and 0.8871, the Feb 16 2021 low.

- In similar vein, both EURUSD and GBPUSD are hugging session highs and remain in close proximity of the 2023 peaks of 1.1033 and 1.2525 respectively. For cable, this level marks the bull trigger to resume the next stage of the medium-term uptrend. Additionally, both SEK and NOK have gained over 1% against the greenback, retracing the entirety of yesterday’s weakness amid the firmer commodity/oil backdrop.

- With US yields retracing a solid portion of their initial move following the US data, the Japanese yen is broadly underperforming across G10, with moderate weakness against the greenback but lower on the day against a host of other currencies.

- Australian employment data headlines the overnight docket before final German CPI and UK GDP in Europe. The US session will look at PPI data for March as well as the latest jobless claims figures.

FX Expiries for Apr13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E3.4bln), $1.0850(E1.7bln), $1.0885-90(E1.1bln), $1.0900(E6.3bln), $1.0950(E1.5bln), $1.1000(E3.1bln)

- USD/JPY: Y131.25-30($800mln), Y132.00-05($1.3bln), Y132.20-25($663mln), Y133.00($1.2bln), Y134.00-05($1bln)

- GBP/USD: $1.2360-80(Gbp1.1bln)

- EUR/GBP: Gbp0.8795-10(E595mln)

- AUD/USD: $0.6625-30(A$1.7bln), $0.6645-50(A$1.7bln)

- USD/CAD: C$1.3525($1bln)

- USD/CNY: Cny6.8785-00($500mln), Cny6.9000($852mln)

COMMODITIES: WTI Clears Key Resistance After US CPI, SPR Refill Headlines

- Crude oil prices have been buoyed today by the USD weakening after US CPI inflation.

- The Biden administration plans to refill the US SPR soon, and hopes to refill it at lower oil prices if it's advantageous to taxpayers during the rest of the year, according to US Energy Secretary Granholm, with an aim to getting back to pre-Ukraine war level after selling 180m bbls last year.

- WTI is +2.1% at $83.25, pushing through key resistance at $83.04 (Jan 23 high) to open $85.01 (Nov 14 high).

- Some downside protection has been seen in the CLK3 with most active strikes on the day at $80/bbl puts.

- Brent is +1.9% at $87.24, earlier coming closer to resistance at $87.87 (Jan 27 high) after which lies the key resistance of $88.35 (Jan 23 high).

- Gold is +0.7% at $2017.3, also benefiting from the weaker dollar whilst remaining below resistance at $2032.1 (Apr 5 high).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/04/2023 | 0130/1130 | *** |  | AU | Labor force survey |

| 13/04/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 13/04/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/04/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/04/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 13/04/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/04/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/04/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 13/04/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank, G20 Finance Ministers' Meetings | |

| 13/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/04/2023 | 1230/0830 | *** |  | US | PPI |

| 13/04/2023 | 1300/0900 |  | CA | Governor Macklem speaks at IMF | |

| 13/04/2023 | 1300/1400 |  | UK | BOE Pill Speaker at MNI Connect | |

| 13/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/04/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.