-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: CPI Miss, Dec Step-Down Door Opens

HIGHLIGHTS

- Fed's George Endorses 'More Measured' Rate Increases

- Fed's Mester: Larger Risks as Coming From Tightening Too Little

- US TREASURY REFRAINS FROM DESIGNATING ANY CURRENCY MANIPULATORS, Bbg

- US BIDEN WILL MEET CHINA'S XI NOV. 14 IN BALI, WHITE HOUSE SAYS, Bbg

- SF FED DALY: OCTOBER INFLATION SLOWDOWN IS `FAR FROM A VICTORY', Bbg

- SF FED DALY: STEPPING DOWN IS APPROPRIATE THING TO THINK ABOUT, Bbg

Key links: MNI POLICY: BOE Steering Clear Of Reserve Remuneration Change / MNI: Fed’s Harker Sees Slower Hike In Coming Months / MNI: Logan Says May Soon Be Appropriate For Fed To Slow Hikes / MNI INTERVIEW: Thin Liquidity Complicates Fed Plans To Tighten

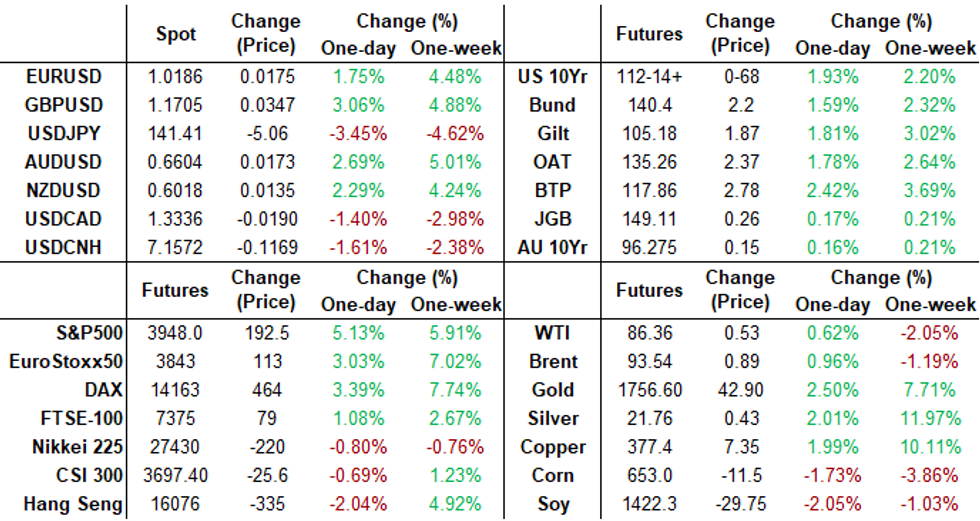

US TSYS: Huge CPI Relief Rally Holds

Huge relief rally in rates (30YY taps 4.0623% low vs 4.2884% high) and stocks (ESZ2 +191.5 at 3947.0) after lower than expected Oct CPI (+0.4% MoM vs. 0.6% est, core +0.27% unrounded vs forecast of 0.5%) cooled rate hike expectations: Dec cumulative down to 49.8bp vs. 57.5bp earlier, 84.7bp to 4.69% for Feb'23 with terminal in May'23 at 4.885%.

- Upbeat but cautious comments from various Fed speakers on the day:

- Dallas Fed Logan: "While I believe it may soon be appropriate to slow the pace of rate increases so we can better assess how financial and economic conditions are evolving, I also believe a slower pace should not be taken to represent easier policy," she said in openings remarks at a Fed conference.

- Cleveland President Loretta Mester: “Despite the moves we have made so far, given that inflation has consistently proven to be more persistent than expected and there are significant costs of continued high inflation, I currently view the larger risks as coming from tightening too little."

- Trading desks note some prop/fast$ selling on the highs, technical selling after Tsy 10Y futures crossed 50-day EMA of 112-12.5 to 112-17 high (+2-06.5), to 112-10 last.

- Tys climb back near midday highs after strong $21B 30Y auction (912810TL2): 3.2bp stop-through with 4.080% high yield vs. 4.112% WI; 2.42x bid-to-cover vs. 2.39x prior month.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00272 to 3.81486% (-0.00143/wk)

- 1M -0.00543 to 3.87314% (+0.01500/wk)

- 3M +0.01971 to 4.64971% (+0.09942/wk) * / **

- 6M -0.02272 to 5.13357% (+0.12228/wk)

- 12M -0.00157 to 5.63129% (-0.03514/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.64971% on 11/10/22

- Daily Effective Fed Funds Rate: 3.83% volume: $100B

- Daily Overnight Bank Funding Rate: 3.82% volume: $293B

- Secured Overnight Financing Rate (SOFR): 3.78%, $969B

- Broad General Collateral Rate (BGCR): 3.75%, $405B

- Tri-Party General Collateral Rate (TGCR): 3.75%, $390B

- (rate, volume levels reflect prior session)

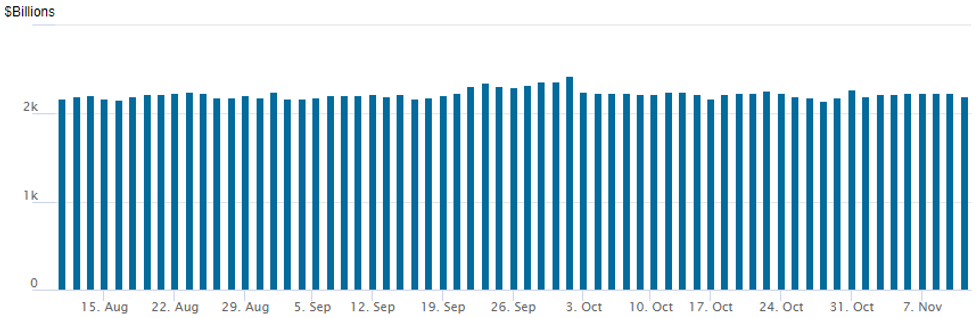

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls back to $2,200.586B w/ 95 counterparties vs. $2,237.812B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Heavy volumes with better call buying on net Thursday as underlying rates gapped higher on softer than expected CPI inflation data. Receding rate hike expectations for year end/early 2023 spurred heavy call buying in SOFR and 5-10Y Treasury options, puts two-way with mix of position unwinds and new buys as some looked to fade the rally. Salient trade: Block buy +75,000 FVH 111/112 call spds from 6-7 in early trade, +30,000 SFRZ2 95.62/95.75 call spds, 0.75 and +10,000 SFRZ2 95.75/95.87 call spds, 0.5. Put Sales include: -20,000 TYZ 108/109 put spds, 1- SOFR Options:

- Block, 5,000 SFRM3 95.5 puts, 48.5

- Block, 5,000 SFRM3 94.75/95.50 2x1 put spds, 23.0

- Block, +7,500 SFRU3 98.50 straddles, 83.5 total volume over -20k

- +30,000 SFRZ2 95.62/95.75 call spds, 0.75

- Block, 10,000 SFRH3 94.50 puts, 2.0 vs. 95.155/0.06%

- Block, 10,000 SFRM3 94.87/95.06 put spds, 7.0 ref

- Block, 3,000 SFRZ2 95.12/95.50/95.62 broken put trees, 9.0

- Block, 8,000 SFRG3 94.25/94.50/94.75 put flys, 1.5

- Block, +10,000 SFRZ2 95.75/95.87 call spds, 0.5

- Block, 10,000 SFRH3 94.62 puts, 7.5 vs. 94.98/0.23%

- Block, 11,500 SFRG3/SFRH3 95.62/95.87 call spd spd

- 1,500 short Nov 95.25/95.37/95.43/95.56 put condors ref 95.35

- 2,500 SFRX 95.37/95.43/95.50/95.56 call condors ref 95.41

- 2,000 SFRH3 94.93/95.12/95.31 call flys ref 94.975

- 14,300 SFRZ3 94.25 puts, ref 95.33 to -.32

- 1,500 SFRJ 94.37/94.62/94.87 put flys

- Eurodollar Options:

- 2,000 short Nov 95.25 calls, ref 95.045

- 5,000 Dec 95.00/95.12/95.25 call flys

- 3,000 Dec 95.12 calls

- Treasury Options:

- -20,000 TYZ 108/109 put spds, 1

- 5,000 TYF3 109.5/110.5 put spds, 10 ref 112-18.5

- Block, -8,500 wk2 TY 111/112 call spds 57 ref 112-15

- 3,500 FVZ 108.25/109.5 1x2 call spds, 11

- 5,000 TYZ2 110/111 put spds, 10 ref 112-08.5

- Block, +75,000 FVH 111/112 call spds, 6-7 from 0844:19ET-0849:46ET

- -4,000 TYZ2 109/112.5 call over risk reversals, 3 net ref 110-23

- +2,000 TYF 113/115/116 broken call flys, 16

- 1,600 FVZ 106.75 straddles ref 106-18.25

- 2,500 FVZ 105.5/106 put spds, 5 ref 106-13.25

- 3,500 TYZ 109 puts, 15 ref 110-13.5

- 4,000 TYF3 113/114 call spds, 12 ref 110-25 to -23.5

- 5,000 FVZ 105 puts, 5 ref 106-16.75

- Block, 10,000 FVZ2 105.5/106.75 put spds, 28.5

EGBs-GILTS CASH CLOSE: Strong Rally On US Inflation Relief

EGBs and Gilts rallied strongly Thursday in response to a softer-than-expected US CPI reading for October.

- Terminal rate pricing for both the ECB and BoE fell sharply in the aftermath of the inflation data, and closed with about 12bp in hikes removed from each rate path to mid-2022.

- The German and UK curves bull steepened on the day, with the belly outperforming on the German curve, and 10Y on the UK.

- Periphery bonds rallied, with 10Y BTP yields falling nearly 30bp. BTP spreads to Bunds closed below 200bp for the first time since mid-July.

- Attention swiftly turns to UK GDP and final German CPI first thing Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 13.1bps at 2.08%, 5-Yr is down 16.6bps at 1.927%, 10-Yr is down 16.3bps at 2.009%, and 30-Yr is down 9.2bps at 1.998%.

- UK: The 2-Yr yield is down 12.7bps at 3.103%, 5-Yr is down 14.3bps at 3.309%, 10-Yr is down 16.5bps at 3.292%, and 30-Yr is down 16bps at 3.406%.

- Italian BTP spread down 12.3bps at 199.2bps / Spanish down 3.3bps at 101.1bps

EGB Options: Full Range Of German Contracts

Thursday's Europe rates / bond options flow included:

- DUZ2 116.70/116.50ps, bought for 4.5 in 4k

- RXZ2 145/146 1x2 call spread sold at -2.5 in 5k (sold the 1)

- RXZ2 141c, sold at 39.5 down to 39 in 3k

- RXZ2 141.5/143.5/144.5 call fly bought for 40 in 2k

- OEZ2 119.00/118.25ps, sold at 8 in 4k

- OEZ2 121.0/121.5 call spread vs 119.5/119.0 put spread. paid 5.5 in 4.4k

- UBZ2 164/168cs, bought for 7 in 3.5k

FOREX: Lower US CPI Weighs Significantly On Greenback, USDJPY Plummets 3.3%

- Lower US Inflation data across the board on Thursday prompted significant weakness for the US dollar, with the USD index plummeting over 2% on the day. Big deflation in core goods (a 7-month low of -0.38% M/M vs +0.02% prior) and core services slowing sharply kept the greenback on the backfoot for the entire session, close to session lows against most counterparts approaching the APAC crossover.

- With 2-yr yields falling over 25bps and markets scaling back their December pricing, 2022’s favourite trade of being short JPY unwound aggressively. USDJPY looks set to post a 512 pip range on the day, currently down 3.25% and below 141 for the first time since September 23. The technical focus now shifts to 140.74, the 100-DMA and 140.36, Low Sep 22 / Intervention Low.

- Surging equity markets also underpinned the likes of AUD and NZD which have both risen by over 2%, with EURUSD (+1.7%) comfortably back above 1.0094 resistance. With this resistance giving way, the bullish case strengthens, again highlighting the bullish significance of the recent bear channel breakout that occurred on Oct 25. The continuation higher narrows the gap with 1.0198, the Sep 12 high, before 1.0273 which is a Fibonacci projection.

- In emerging markets, there has been a notable move in the Brazilian Real. After brushing off the initial post-election optimism, renewed anxieties over the nation’s fiscal trajectory have prompted a 4% move higher for USDBRL, in the face of the broad greenback weakness and rallying LatAm counterparts such as MXN and CLP.

- UK GDP is the data point of note on Friday with Uni-Mich Sentiment data crossing in the US. France, the US and Canada all have national holidays.

FX: Expiries for Nov11 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9955-65(E1.3bln), $1.0000(E1.8bln), $1.0050-65(E1.4bln), $1.0240(E2.2bln)

- USD/JPY: Y144.40-50($560mln)

- GBP/USD: $1.1600(Gbp503mln)

- AUD/USD: $0.6475(A$624mln), $0.6575(A$680mln)

- USD/CAD: C$1.3605-20($1.2ln)

- USD/CNY: Cny7.20($1.1bln)

Late Equity Roundup: IT Leads SPX Near 8W Highs

Stocks holding sharply higher in late trade - broad based relief rally after October CPI inflation measures cool (0.4% MoM vs. 0.6% est), while rate hike expectations for year end/early 2023 recede.

- SPX eminis currently trading +173.5 (4.62%) at 3928.75 (mid-September levels); DJIA +1018.97 (3.13%) at 33532.59; Nasdaq +639.1 (6.2%) at 10991.78.

- SPX leading/lagging sectors: Information Technology (+6.80%) w/ semiconductors outperforming software and hardware makers edged pastConsumer Discretionary (+6.68%) w/ on-line and direct retailers still strong (ETSY +14.40%, Amazon +11.83%, Ebay +8.75%); Real Estate (+6.45%) and Communication Services (+5.77%) follow. Laggers: Consumer Staples (+1.71%), Health Care (+2.11%) and Industrials (+3.68%).

- Dow Industrials Leaders/Laggers: Home Depot (HD) +22.62 at 309.37, Microsoft (MSFT) +15.06 at 239.57, Goldman Sachs (GS) +16.83 at 378.83. Laggers: Amgen (AMGN) -1.55 at 288.10, McDonalds (MCD) -2.81 at 274.98, Merck (MRK) -0.06 at 101.53.

E-MINI S&P (Z2): Rallies And Remains Above Support

- RES 3: 4100.00 Round number resistance

- RES 2: 4023.44 61.8% retracement of the Aug 16 - Oct 13 downleg

- RES 1: 3981.25 High Sep 14

- PRICE: 3938.50 @ 1500ET Nov 10

- SUP 1: 3704.25/3641.50 Low Nov 3 / Low Oct 21

- SUP 2: 3590.50/3502.00 Low Oct 17 / 13 and the bear trigger

- SUP 3: 3491.13 50.0% retracement of the 2020 - 2022 bull cycle

S&P E-Minis are trading higher today. The contract remains above 3704.25, Nov 3 low. A breach of this level would expose the key short-term support at 3641.50, the Oct 21 low, where a break would signal scope for a continuation lower. For bulls, a stronger reversal higher and more importantly a breach of 3928.00, the Nov 1 high, is required to confirm a resumption of the recent bull theme. This would open 3981.25, the Sep 14 high.

COMMODITIES: Gold Surges Past Bull Trigger/Oil Also Supported By US CPI Miss

- The significant rally in US yields and sell-off in USD from the miss in US CPI breathed some life into crude oil prices after two day’s of solid declines, up circa 1%, with gold seeing particularly large gains in the process.

- In other news, gaps in G7/EU Russian oil price cap plans could leave tankers stranded at sea according to insurers via Reuters.

- WTI is +1.1% at $86.74 although a bearish candlestick patten remains, with resistance at $89.24 (Nov 9 high) and key support at $85.30 (Oct 31 low).

- Brent is +1.4% at $93.92 in a modest pullback of scope for a bearish extension lower. Resistance is seen at $95.65 (Nov 9 high) with key support at $91.46 (Oct 31 low).

- Gold is +2.6% at $1751.66, clearing three resistance levels including the bull trigger at $1729.5 (Oct 4 high), opening $1765.5 (Aug 25 high) in the process.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/11/2022 | 0700/0700 | *** |  | UK | GDP First Estimate |

| 11/11/2022 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 11/11/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 11/11/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 11/11/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 11/11/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 11/11/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 11/11/2022 | 1200/1300 |  | EU | ECB Panetta Speaks at ISPI | |

| 11/11/2022 | 1200/1300 |  | EU | ECB de Guindos Q&A at Encuentro de Economia en S'Agaro | |

| 11/11/2022 | 1310/1310 |  | UK | BOE Tenreyro Speech at Society of Professional Economists | |

| 11/11/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 11/11/2022 | 1600/1700 |  | EU | ECB Lane Panels Jacques Polak Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.