-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Crude Oil Jumps On Red Sea Disruption

HIGHLIGHTS:

- Treasuries bear steepen as supply chain pressures come into pressure with Red Sea vessel attacks and FOMC participants pushed back against the market timing and size of rate cuts.

- The higher yields have weighed on the JPY ahead of the upcoming BoJ decision, but otherwise the USD is little changed on a broader USD index basis.

- Some US stock indices see solid gains despite higher yields, led by mega-caps with some notable outsized performance.

- Crude futures have firmed and cleared initial resistance on the Red Sea tensions, with a lesser extent for gold.

US TSYS: Early Bear Steepening Sets The Tone, BoJ Decision Next Up

- Cash Tsys trade between 1.5-6bp cheaper, having established the move earlier in the US session before mostly sidelining.

- The primary cheapening came from crude futures surging higher on Red Sea traffic disruption. Separately, further FOMC pushback from Goolsbee and Mester on the market timing and size of rate cuts, both over the weekend and early today, initially had limited impact but might have helped feed into the move.

- 10Y yields sit 4.3bp higher on the day, driven entirely by real yields +4.8bps. At 1.74%, the latter remains within Friday’s range and is firmly below the ~2% levels seen prior to Wednesday’s FOMC decision.

- TYH4 at 112-07+ trades just off an earlier low of 112-06 having kept to a particularly narrow 4 tick range for more than five hours now. It remains off support at 111-31+ (Dec 14 low) whilst the trend needle points north with resistance at 112-28+ and 113-12+ (Fibo projections of the Oct 19 – Nov 3 – Nov 13 price swings).

- Fed Funds show 19bp of cumulative cuts for March and 142bp to end-2024.

- Overnight sees the BoJ decision (preview here) before tomorrow’s docket features further Fedspeak and housing data.

EGBs-GILTS CASH CLOSE: Bunds Underperform Despite ECB Cut Pushback

EGBs and Gilts closed flat-to-weaker Monday, with Bunds modestly underperforming, as nascent gains early in the session reversed in the afternoon.

- Shrugging off ECB policymakers' pushback against 2024 rate cuts (including Vasle and Kazimir), Bunds gained in morning European trade, helped by German IFO missing to the downside.

- This was the first session in the past 6 that 10Y Bund yields have risen, stalling just above the 2% mark. The German curve bear steepened modestly.

- The UK's bear flattened, having flipped from bull flattening earlier in the session (in line with Friday's surprise BoE APF sales plans). BoE Broadbent's speech didn't really move market pricing.

- Periphery spreads tightened, as the less-onerous-than-expected ECB PEPP tapering/wind-down plan announced last Thursday continued to be digested.

- Tuesday's key release is final Euro inflation data, which will provide more clues as to underlying dynamics; we also get appearances by ECB's Simkus, Kazimir, Vijcic, and BoE's Breeden.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.9bps at 2.553%, 5-Yr is up 5.3bps at 2.052%, 10-Yr is up 6.3bps at 2.079%, and 30-Yr is up 6.4bps at 2.279%.

- UK: The 2-Yr yield is up 3bps at 4.32%, 5-Yr is up 1.3bps at 3.749%, 10-Yr is up 0.8bps at 3.695%, and 30-Yr is up 1.7bps at 4.177%.

- Italian BTP spread down 2.2bps at 168.5bps / Greek down 2.9bps at 113.1bps

FOREX: Higher Yields Weigh On JPY Ahead Of BOJ Meeting

- The Japanese Yen is one of the poorest performers in G10 to start the week, largely in accordance with higher core yields as major central bank officials push back against cut pricing in early 2024.

- Despite the move higher for US yields, the USD index has maintained a narrow range on Monday overall, trading in very minor negative territory as we approach the APAC crossover.

- A softer-than-expected IFO was unable to dent the Euro’s resilient feel on Monday, outperforming its major counterparts. This has seen the likes of EURJPY rise 0.80%, as well as EURGBP receiving a half a percent boost.

- However, last week’s move lower in EURJPY reinforces the bearish theme and the recent recovery from 153.23, the Dec 7 low is considered corrective. Key short-term resistance to watch is at 157.68, the Dec 11 high.

- A similar theme for USDJPY (+0.60%) ahead of the key risk event overnight. Bearish conditions have been reinforced and on the upside, key short-term resistance remains defined at 146.59, the Dec 11 high.

- Our analysis aligns with the prevailing consensus, which once again foresees the BoJ keeping all key targets and YCC parameters unchanged. We anticipate that any revisions to forward guidance would likely coincide with the publication of an Outlook Report.

- Elsewhere on Tuesday, New Zealand trade balance data and the RBA minutes are scheduled. Final CPI readings for the Eurozone will cross as well as Canada CPI data for November.

US FI OPTIONS: Monday Options Summary

Monday's US rates/bond options flow included:

- SFRH4 94.81/94.75/94.68/94.62p condor, bought for 1.5 in 1k

- SFRH4 94.87/94.75/94.62/94.50p condor, sold at 4.5 in 20k total.

- SFR4 94.87/94.75/94.62/94.50p condor, sold at 4.5 in 5k

- SFRF4 with SFRG4 94.87/95.00/95.12/95.25c condor strip, sold at 8 in 2k

- SFRF4 95.00/95.87/94.50 broken p fly traded for 4.25 in 2.5k.

- SFRJ4 95.12/95.00/94.68 broken p fly traded half in 1k

- SFRM4 95.00/95.25cs vs94.37/94.12ps traded 13.5 in 4.5k

- SFRM4 95.12/95.00/94.68 broken p ladder traded half in 1k

- SFRM4 95.00/95.87cs vs 2QM4 97.00/97.25cs traded flat in 2.5k

- SFRM4 95.00/95.50/95.75 broken c fly, traded 18.5 in 4k. (block trade)

- 0QM4/2QM4 96.00/97.00cs bought for 9 in 2k

EU FI OPTIONS: Euro Rate Flattener Unwind Features In Light Trade Monday

Monday's Europe rates/bond options flow included:

- RXF4 134.50p, bought for 3 in 2k

- DUG4 105.30p, sold at 21 in 4k vs 1.8k DUH4 at 106.405

- -7.25k ERF4 96.37/96.25 1x2 ps sold out at 4.5, +7.25k 0RF4 97.12 puts bought back for 0.5

US STOCKS: S&P E-mini Dips Back Below 4800 But Major Resistance Still Eyed

- The ESH4 has seen some late, albeit modest, selling pressure coinciding with the largest sell program of the day on the TICK index with 820 names.

- It comes with a rejection of a push above the round 4800 with a brief high of 4802.25, after which sits major resistance at 4808.25 (Jan 4, 2022 high).

- The day’s gains for equities have come despite a narrow range to broader USD moves, with some outsized gains for mega-caps at play.

- Meta (+3.7%), Amazon (+3.0%), Nvidia (+2.9%) and Google (+2.8%). Apple (-0.6%) meanwhile still weighs but has pared earlier losses concerning earlier Apple watch production halting headlines.

- Those names help drive communication services (+2.2%) to outperform SPX, followed by consumer staples (+1.2%) and energy (+1.0%) with net WTI strength amidst Red Sea traffic disruption but off earlier higher. Real estate lags meanwhile (just -0.2%) amidst higher yields.

- Comparing e-minis, the S&P 500 (+0.6%) follows the Nasdaq 100 (+0.85%), whilst the Dow (+0.0%) and Russell 2000 (+0.0%) have seen their underperformance extend through the session.

COMMODITIES: Red Sea Vessel Attacks See Crude Futures Clear 20-day EMAs

- Crude futures have pared earlier gains but still see strong gains on the day. Growing disruption in the Red Sea, with companies such as BP and Equinor diverting their cargoes has sparked fears for supply passing through the key chokepoint.

- Vessel attacks in the Red Sea are increasing. Yemen’s Iranian-backed Houthi rebels have claimed responsibility for attacks on two ships Dec. 18 - the Swan Atlantic and MSC Clara - using naval drones, according to Alarabiya news.

- The US is seeking a regional coalition to secure the Red Sea shipping corridor, with a virtual summit set for Dec. 19, but Houthi officials have since told Al Jazeera that we’ll be able to confront any possible coalition that could be formed.

- Oil exports out of Texas are surging in the final weeks of 2023, according to Reuters, driven by record production levels and the need to avoid high year-end taxes on inventories.

- WTI is +1.8% at $72.74, with its high of $74.23 clearing resistance at $73.27 (20-day EMA) to open $76.37 (50-day EMA).

- Brent is +2.2% at $78.22, also clearing $77.81 (20-day EMA) with its high of $79.49 stopping short of resistance at $80.76 (50-day EMA).

- Gold is +0.4% at $2027.01, buoyed by increased geopolitical tensions but still well within Friday’s range. It has pulled back off a high of $2033.47, after a swift $10 gain came on little 'new' newsflow before partly retracing the move.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR FIXES

1mth 5.35792 0.00217

3mth 5.37039 0.0064

6mth 5.25127 0.03141

12mth 4.91471 0.05676

REPO REFERENCE RATES (rate, change from prev. day, volume):

* Secured Overnight Financing Rate (SOFR): 5.32%, 0.01%, $1776B

* Broad General Collateral Rate (BGCR): 5.30%, no change, $642B

* Tri-Party General Collateral Rate (TGCR): 5.30%, no change, $629B

SOFR ticked back up 1bp to 5.32% after three sessions at 5.31%. Highest SOFR volumes since Dec 5, closer to the high of $1850 from Nov 30.

New York Fed EFFR for prior session (rate, chg from prev day):

* Daily Effective Fed Funds Rate: 5.33%, no change, volume: $101B

* Daily Overnight Bank Funding Rate: 5.32%, no change, volume: $263B

EFFR unchanged, with Fed Funds volumes falling $7B from Thu but still firmly within recent ranges.

FED: RRP Uptake Continues Trend Decline

- RRP uptake lifted $41B to $725B today but it does little to alter the recent renewed trend decline after Friday’s slide to $683B (-$86B) and -$54B on Thu, for new recent lows since Jun 2021.

- The number of counterparties increased by four to 86.

- The latest trend decline in RRP usage comes amidst still strong demand for Treasury t-bill issuance (with today’s 26-week issue seeing the highest bid-to-cover since early September) and ICI money market fund assets recently touching new highs of $5.9tn.

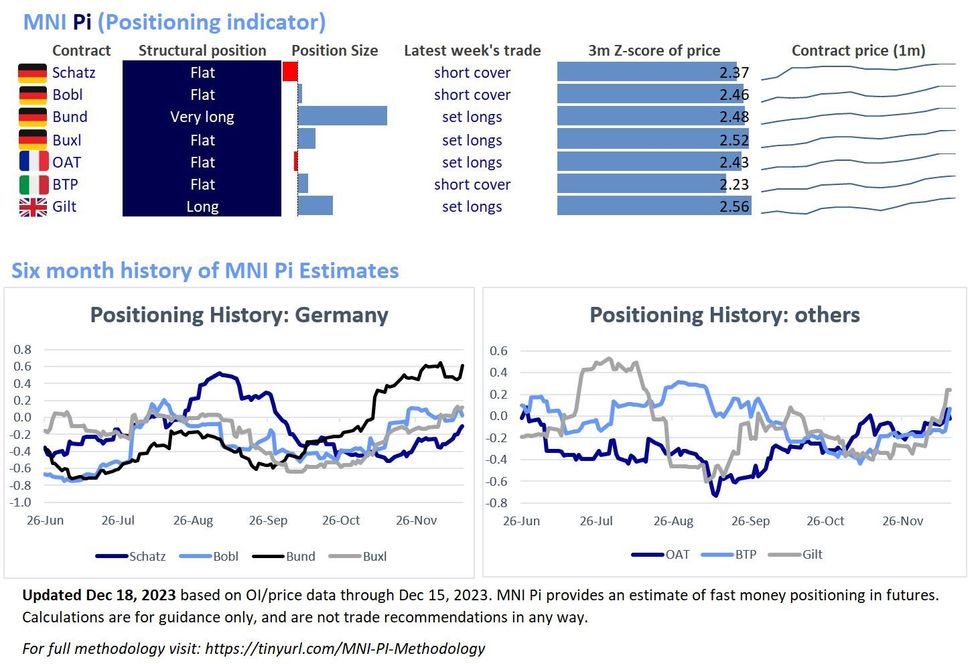

MNI Europe Pi (Positioning Indicator): Bund/Gilt Longs Emerge

EXECUTIVE SUMMARY:

- A week after the Eurex roll concluded, EGB contracts were showing mostly flat with some long structural positioning.

- The more dovish-than-expected Fed meeting on Dec 13 helped spark drive long setting and short cover across all contracts, in spite of less dovish messages from the ECB and BoE.

Full PDF Analysis:

- GERMANY: Three of the four German contracts are in flat structural positioning. This marks a change from pre-roll for Schatz (was short from mid-Oct-late Nov), but Bobl and Buxl have been flat for some time. The standout here is Bund which has moved to "very long" structural positioning from merely "long" pre-rolls. The most recent week of trade was indicative of long-setting in Bund and Buxl, with short covering in Schatz and Bobl.

- OAT: OAT has fluctuated between flat and short structural positioning since October - and is back at flat (vs short pre-roll) presently. Longs were set last week.

- GILT: Gilt structural positioning has moved to decisively long for the first time since mid-August. Longs were set last week. BTP structural positioning remains flat, with some short cover in evidence in the most recent week of trade.

- BTP: Gilt structural positioning has moved to decisively long for the first time since mid-August. Longs were set last week. BTP structural positioning remains flat, with some short cover in evidence in the most recent week of trade.

US DATA: NAHB Index As Expected But With Some Mildly Stronger Details

- The NAHB housing market index met expectations in December, rising from 34 to 37 to unwind half of the latest decline in November.

- As noted beforehand, this consensus reading belies the improvement seen in S&P homebuilder price to book ratios.

- The bounce was limited by an unchanged reading for present sales (40), whilst futures sales (45, +6pts) and prospective buyer traffic (24, +3pts) both increased after five/four consecutive monthly declines.

- There were further differences when looking by region as well, with the West continuing to lag with an overall index unchanged at 28 vs increases across the other major three regions.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/12/2023 | 0300/1200 | *** |  | JP | BOJ policy announcement |

| 19/12/2023 | 0900/1000 |  | EU | ECB Elderson Statement On Banking Risks and Priorities | |

| 19/12/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 19/12/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/12/2023 | 1300/1300 |  | UK | BOE Breeden Speech At IIF Policy Series | |

| 19/12/2023 | 1330/0830 | *** |  | CA | CPI |

| 19/12/2023 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/12/2023 | 1330/0830 | *** |  | US | Housing Starts |

| 19/12/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 19/12/2023 | 1730/1230 |  | US | Atlanta Fed's Raphael Bostic | |

| 20/12/2023 | 2350/0850 | ** |  | JP | Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.