-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Curves Twist Flatter Ahead Nov FOMC

- MNI SECURITY: WH NSC Kirby Declines To Rule Out Biden Veto On GOP Israel Bill

- MNI SECURITY: RTRS: Hamas To Release Some Foreign Captives "In Coming Days"

- MNI UKRAINE: US Def Sec-Without Our Support "Putin Will Be Successful"

- ECB: Stournaras Would Opt for ECB Cuts Should Inflation Fall "Permanently" Below 3%

- STARMER: NOW IS NOT THE TIME FOR ISRAEL-HAMAS `CEASEFIRE', Bbg

- VILLEROY: FIRMLY ON PATH TO LOWER INFLATION TOWARD 2% BY 2025, Bbg

- ECB'S KAZAKS: DOOR SHOULD ALWAYS BE OPEN TO HIKES IF NEEDED, Bbg

Key Links:MNI: Yield Spike Cuts Chance Of Fed Dec Hike, Q1 Still In Play / US TSYS/SUPPLY: Borrowing Ests $1.6T In Line, Sets Stage For Tsy Upsizing / Chicago Business Barometer™ - Steady at 44.0 in October / MNI INTERVIEW: Some Positives In Cloudy UK Labour Data / MNI BOJ WATCH: BOJ Relaxes YCC, Sees Limited Rise In Yields

US TSYS Markets Roundup: No Scary Month End, Focus on Wed FOMC

- Tsy futures are drifting in steady to narrowly mixed territory late Tuesday, 10Y and 10Y Ultras closest to steady after the bell, curves flatter but off late morning lows: 3M10Y -3.522 at -60.432 vs. -68.652 low, 2Y10Y -3.147 at -19.336 vs. -22.521 low.

- Main focus on Wednesday afternoon's FOMC annc, most likely leaving rates unchanged for the 2nd consecutive meeting. Economic activity data has been strong and inflation progress has arguably stalled since the September meeting, the Committee will maintain a cautious approach as it assesses the impact of tighter financial conditions and the lagged effects of past tightening.

- Additional focus tomorrow on ADP (0815ET), the final Tsy Refunding announcement (0830ET) and JOLTS Job Openings (1000ET).

- Precursor to Wed's FOMC policy annc, soft China PMI early overnight helped prime Tsys as they broke higher after the BOJ left policy unchanged at -0.1%, left upper limit of YCC framework at 1%. Meanwhile, soft Eurozone CPI and GDP growth helping Tsys extend highs heading into the NY open.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00049 to 5.31959 (-0.00453/wk)

- 3M +0.00563 to 5.38275 (-0.00046/wk)

- 6M +0.00824 to 5.44273 (+0.00210/wk)

- 12M +0.00819 to 5.36741 (-0.00554/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $97B

- Daily Overnight Bank Funding Rate: 5.32% volume: $245B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.470T

- Broad General Collateral Rate (BGCR): 5.30%, $566B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $552B

- (rate, volume levels reflect prior session)

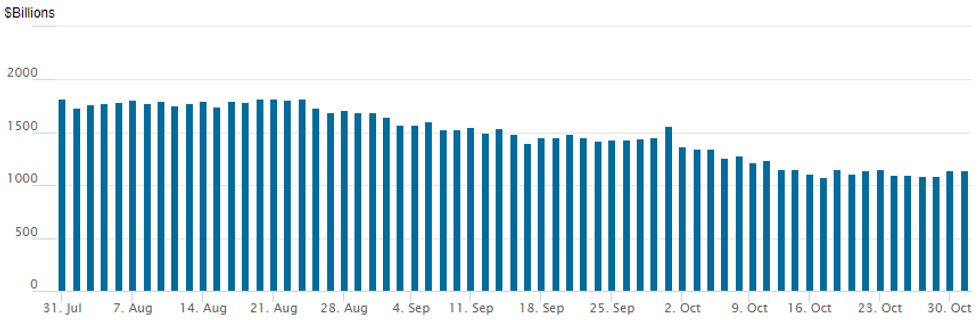

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage slips to $1,137.697B w/100 counterparties vs. $1,138.035B in the prior session. Latest usage compares to $1,082.399B on October 17- the lowest level since mid-September 2021. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Myriad SOFR option flow reported below, while mixed, volumes leaned towards upside SOFR calls, fading softer futures ahead tomorrow's FOMC. Underlying futures reversed early gains while projected rate hikes into early 2024 inched higher: November steady at 0% to 5.325%, December cumulative of 6.8bp at 5.397%, January 2024 cumulative 9.9bp at 5.427%, March 2024 at 7.2bp at 5.401%. Fed terminal at 5.430% in Feb'24.

- SOFR Options:

- over 5,500 SFRG4 94.25/94.37 put spds vs SFRH4 94.75/94.87 call spds

- Block, 30,000 SFRH4 95.00/95.12 call spds, 1.0 ref 94.615 - .62

- Block, -5,000 SFRM4 96.00/97.00 call spds, 8.0 ref 94.825

- Block, 10,000 SFRM4 94.00/94.37 put spds, 7.5 vs. 94.83/0.15%

- +4,000 SFRZ3 94.62/94.75 call spds 1.0 vs. 94.565/0.15%

- -5,000 SFTU4 94.75/96.75 call spds 16.25

- Block, +10,000 SFRM4 94.00/94.37 put spds 7.5 vs. 94.83/0.15%

- +10,000 SFRG4 94.25/94.37 put spds 2.75 vs. 94.64/0.08%

- +3,000 SFRZ3 94.31/94.37/94.43/94.50 put condors, 1.75

- +5,000 SFRZ3 94.75 calls, 2.75 vs. 94.57/0.20%

- 2,500 SFRH4 94.75/95.75 call spds vs. SFRF4 95.00 calls, 0.0

- Block, 3,000 SFRU4 95.00/96.00/97.00 call flys, 12.0 ref 95.15

- 2,000 SFRZ3 94.37/94.43/94.56/94.62 put condors ref 94.57

- 1,500 SFRZ3 94.56/94.62/94.68 call flys

- 15,000 SFRZ3 94.62/94.75 call spds ref 94.575

- 1,000 SFRH4 94.18/94.62/94.68/94.87 broken put condors ref 94.66

- 1,750 SFRX3/SFRZ3 94.50 put spds ref 94.57

- 2,150 SFRH4 94.75/95.12/95.50 put trees vs. SFRF4 94.75 calls ref 94.655

- 8,000 SFRZ3 94.68 calls, 2.75-3.25 ref 94.57

- 3,500 0QZ3 94.93/95.06/95.18 put flys ref 95.40

- Treasury Options:

- 5,000 USZ3 102 puts, 10 ref 109-20

- appr -5,600 TYZ3 104.5/108 strangles (13-14) vs. +16,200 TYZ3 103/109.5 strangles (13) ref 106-16, even to 1cr net for the iron condor

- 2,500 FVZ3 105/106/106.5 broken call flys, ref 104-15.75

FOREX USDJPY Nears 2022 Highs As No Intervention Confirmed

- With late reports on Monday suggesting the Bank of Japan could raise its cap on yields at the October policy meeting, markets were underwhelmed as the BOJ only relaxed the upper limit of its range for the 10-year bond yield. While citing economic uncertainty, the bank indicated that it does not want to see a surge in interest rates.

- There has been sharp weakness for the Japanese Yen as a result and confirmation that there was no intervention earlier in October appeared to give USDJPY bulls the green light. As such, the pair has risen from overnight lows of 149.03 to reach as high as 151.71, just 24 pips shy of the 2022 highs and up a significant 1.6%.

- Obviously given the two separate episodes of MOF intervention last year, markets will be eagerly monitoring any step up in verbal rhetoric or indeed any action from Japanese officials.

- Above 151.95, we have 152.20 and 153.52 as the next resistance points, both Fibonacci projections.

- The price action resulted in the USD index turning early declines into firm gains, with the index rising just over 0.5% on the session. Greenback strength was underpinned by a higher-than-expected employment cost index for Q3 and October consumer confidence in the US beating also beating expectations.

- Elsewhere, EURUSD rose substantially in the lead up to Eurozone inflation data that matched Germany’s releases in coming in below expectations. This along with the firmer greenback led EURUSD all the way back to 1.0558 after printing a 1.0675 high during early European trade.

- Bolstered equity benchmarks did little to enthuse the likes of GBP, AUD, NZD and CAD, all taking their cues from the surging dollar. CHF is also one of the poorest performers on the day with USDCHF rising 0.8% and extending the recovery from last week's lows.

- New Zealand unemployment data headlines the APAC docket on Wednesday before US ADP, ISM Manufacturing and JOLTS data crosses in the US session. Focus then turns to the FOMC decision where Chair Powell’s press conference and the Statement will attempt to underpin market hike pricing which is broadly aligned with the Fed’s previously signalled path.

FX Expiries for Nov01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0585-05(E1.7bln), $1.0665-75(E1.2bln)

- USD/JPY: Y147.00-10($1.1bln), Y147.50-59($924mln), Y148.00-20($1.5bln), Y148.30-50($2.6bln), Y149.80-00($1.6bln), Y150.50-60($1.8bln), Y151.00($686mln), Y151.80-00($759mln)

- EUR/GBP: Gbp0.8675(E500mln)

- USD/CNY: Cny7.3000($1.4bln)

EQUITIES

E-MINI S&P TECHS: (Z3) Bears Remain In The Driver’s Seat

- RES 4: 4459.12 Trendline resistance drawn from the Jul 27 high

- RES 3: 4430.50 High Oct 12

- RES 2: 4365.48 50-day EMA

- RES 1: 4295.88/4285.39 Low Oct 4 / 20-day EMA

- PRICE: 4187.50 @ 13:25 BST Oct 31

- SUP 1: 4122.25 LowOct 27

- SUP 2: 4100.00 Round number support 4124.19

- SUP 3: 4090.35 1.764 proj of the Jul 27 - Aug 18 - Sep 1 price swing

- SUP 4: 4049.00 Low Mar 28

S&P e-minis maintain a softer tone and short-term gains are considered corrective. The contract traded to a fresh cycle low last Friday. Last week’s breach of support at 4235.50, Oct 4 low and bear trigger, confirms a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. MA studies are in a bear-mode position too. The focus is on 4100.00. Initial firm resistance is at 4285.39, the 20-day EMA.

COMMODITIES

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/11/2023 | 0030/1130 | * |  | AU | Building Approvals |

| 01/11/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/11/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/11/2023 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/11/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/11/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 01/11/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/11/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 01/11/2023 | 1230/0830 | ** |  | US | Treasury Quarterly Refunding |

| 01/11/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/11/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/11/2023 | 1400/1000 | * |  | US | Construction Spending |

| 01/11/2023 | 1400/1000 | *** |  | US | JOLTS jobs opening level |

| 01/11/2023 | 1400/1000 | *** |  | US | JOLTS quits Rate |

| 01/11/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 01/11/2023 | 1800/1400 | *** |  | US | FOMC Statement |

| 01/11/2023 | 2015/1615 |  | CA | BOC Governor testifies at Senate hearing |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.