-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Dallas Fed Logan Signals June Hike

- MNI: Fed's Logan Signals Support For June Rate Hike

- MNI INTERVIEW: US Consumption Decline Could Play Out Slowly

- MNI POLICY: ECB's Reinvestment Wind-Down Equates To 25bp Hike

- MNI INTERVIEW: ECB Risks Financial Instability-Italian Banker

- MNI Initial Claims: Massachusetts Upward Bias Reduced But Still There

US

FED: Federal Reserve Bank of Dallas President Lorie Logan Thursday signaled support for an eleventh straight Fed rate hike in June amid sticky core inflation and still-high wages. "The data in coming weeks could yet show that it is appropriate to skip a meeting. As of today, though, we aren’t there yet," she said in prepared remarks

- Core PCE inflation was 4.9% annualized for the first quarter of 2023. "That is higher than overall inflation over the past year, higher than core inflation in the previous quarter and much higher than the inflation rate the public is counting on us to deliver," she said. "We haven’t yet made the progress we need to make. And it’s a long way from here to 2% inflation."

- "The economy is not nearly as far out of balance as when the FOMC began raising rates 14 months ago. But the question for monetary policy is not whether there has been some progress," she said. "It’s whether inflation is on track to return all the way to our 2% target and to do so in a sustainable and timely way." For more see MNI Policy main wire at 0934ET.

FED: The Federal Reserve's inflation goal could remain out of reach for some time as consumers continue to draw down excess savings to make up for lost spending during the pandemic, even as the pieces fall into place for a gradual easing of price increases, St. Louis Fed economist Fernando Martin told MNI.

- Higher interest rates should incentivize consumers to save more and spend less, but with excess savings of roughly USD372 billion still at their disposal and USD721 billion in missed spending during the pandemic, consumption is likely to continue to boost growth at least through the summer, Martin said in an interview.

- "Households still have some excess income from the fiscal packages. That’s slowly dying off, and until it does, people are still spending that. So despite the fact the Fed has been raising rates and creating an incentive to save more, that effect of excess savings hasn't completely disappeared yet," he said. For more see MNI Policy main wire at 0713ET

EUROPE

ECB: Many ECB policymakers believe the wind-up of APP reinvestments will eventually be equivalent to around 25bp in deposit rate rate tightening, although the impact is not a one-off and will be felt over a longer period of time, MNI understands.

- Because of the slow burn of tapering reinvestments over a period of many months, it doesn't have as quick a policy transmission impact as a 25bp rate hike, but over the cycle it would equate to roughly the same.

- At the same time, the ECB is determined to use interest rates as its main policy tool while QT runs in the background to gradually reduce its balance sheet. For more see MNI Policy main wire at 0850ET.

ECB: Further monetary tightening by the European Central Bank runs the risk of prompting financial instability, a senior Italian banker who was appointed by the Bank of Italy to sell off good banks created during Europe’s first bail-in resolution told MNI, adding that authorities should also consider raising deposit guarantees.

- The ECB should pause to monitor the lagged effect of its policy moves since it began raising rates last July before pushing ahead with further tightening, Roberto Nicastro, who was entrusted by the resolution authority to chair the healthy remains of four banks liquidated in 2015 and is now president of Banca AideXa, said in an interview.

- Interest rate decisions over the next quarter will be particularly crucial, he said, pointing to a slide in credit revealed in the ECB’s recent quarterly lending survey. For more see MNI Policy main wire at 0747ET

US TSYS: 10s Back To Mid-March Levels, Late Yr Rate Cuts Receding

Treasury futures continue to extend session lows in late trade: 10Y futures through key support of 113-30.5 (Apr 19 low) to 113-28.5, just above major support at 113-26 Mar 22 Low).- Main factors in play included hawkish Fed speak: Dallas Fed Logan signaled support for an eleventh straight Fed rate hike in June amid sticky core inflation and still-high wages. "The data in coming weeks could yet show that it is appropriate to skip a meeting. As of today, though, we aren’t there yet," Logan stated.

- While optimism over a debt ceiling resolution to avoid default helped push stocks to their best levels since early May, rates trade weaker ahead a likely deluge in bill issuance (estimated over $1T) as the Treasury moves to increase cash buffers following a debt ceiling resolution, roughly the same impact as a 25bp rate hike all else equal.

- Fed funds implied move for the next FOMC on June 14 inches up to 8.1bp, while projected late year rate cuts recede: September cumulative is -4.9bp (-20.8bp early Tuesday) at 5.030%, November cumulative -22.8bp (-43.7bp early Tuesday) at 4.851%, Dec'23 cumulative -44.6bp (-69.0bp Tuesday) at 4.633%, while Jan'24 cumulative is -64.7bp (-93.3bp Tuesday) at 4.32%. Fed Terminal currently at 5.165% in Jul'23 this morning.

OVERNIGHT DATA

- US MAY PHILADELPHIA FED MFG INDEX -10.4

- US JOBLESS CLAIMS -22K TO 242K IN MAY 13 WK

- US PREV JOBLESS CLAIMS REVISED TO 264K IN MAY 06 WK

- US CONTINUING CLAIMS -0.008M to 1.799M IN MAY 06 WK

US: Earlier, initial jobless claims fell by more than expected in the week to May 13, back to a seasonally adjusted 242k (cons 252k) after the surprise jump to 264k the week prior.

- We touched upon the elevated level of Massachusetts claims, previously linked to fraudulent activity, and its 14k decline in non-seasonally adjusted terms played a big role behind the -18.6k in the raw total.

- Comparing with ‘typical’ weeks in the pre-pandemic era, we can see that the Massachusetts level of 21k is still notably elevated, although it has moved closer to levels from a month ago before the recent lurch higher.

- In comparison, California is the largest US state by population and unsurprisingly also has the highest level of claims, but these are tracking much more in line with pre-pandemic weeks.

- If more broadly representative, it could mean some scope for modest further declines in the level of seasonally adjusted nationwide initial claims.

- US APRIL EXISTING HOME SALES FALL 3.4% TO 4.28 MILLION RATE

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 46.8 points (-0.14%) at 33370.55

- S&P E-Mini Future up 19 points (0.46%) at 4190.25

- Nasdaq up 124.6 points (1%) at 12624.18

- US 10-Yr yield is up 8.2 bps at 3.6457%

- US Jun 10-Yr futures are down 21/32 at 113-29.5

- EURUSD down 0.0072 (-0.66%) at 1.0768

- USDJPY up 0.95 (0.69%) at 138.63

- WTI Crude Oil (front-month) down $1.07 (-1.47%) at $71.73

- Gold is down $25.1 (-1.27%) at $1956.71

- EuroStoxx 50 up 44.22 points (1.02%) at 4367.45

- FTSE 100 up 19.07 points (0.25%) at 7742.3

- German DAX up 212.06 points (1.33%) at 16163.36

- French CAC 40 up 47.45 points (0.64%) at 7446.89

US TREASURY FUTURES CLOSE

- 3M10Y +4.338, -163.09 (L: -182.32 / H: -159.43)

- 2Y10Y -2.88, -62.507 (L: -63.187 / H: -57.408)

- 2Y30Y -6.658, -37.319 (L: -38.471 / H: -28.036)

- 5Y30Y -6.791, 19.934 (L: 19.141 / H: 28.302)

- Current futures levels:

- Jun 2-Yr futures down 6.75/32 at 102-20.5 (L: 102-19.75 / H: 102-28.875)

- Jun 5-Yr futures down 15.75/32 at 108-30 (L: 108-28.75 / H: 109-17.25)

- Jun 10-Yr futures down 21/32 at 113-29.5 (L: 113-28.5 / H: 114-24)

- Jun 30-Yr futures down 27/32 at 127-30 (L: 127-27 / H: 129-09)

- Jun Ultra futures down 22/32 at 135-29 (L: 135-17 / H: 137-19)

US 10YR FUTURE TECHS: (M3) Bear Cycle Extends

- RES 4: 117-29+ High Aug 26 2022 (cont)

- RES 3: 117-01+ High Mar 24 and bull trigger

- RES 2: 117-00 High May 4

- RES 1: 115-18+/116-16 High May 16 / 11

- PRICE: 114-00 @ 16:20 BST May 18

- SUP 1: 114-00 Low May 18

- SUP 2: 113-30+ Low Apr 19 and a key support

- SUP 3: 113-26 Low Mar 22

- SUP 4: 113-23 50.0% retracement of the Mar 2 - 24 rally

Treasury futures traded lower again Thursday. This week’s price action has resulted in a break of both the 20- and 50-day EMAs. The move lower has cracked support at 114-10, the May 1 low and 113-30+ is now the market focus. This level marks the Apr 19 low and a key support. On the upside, initial firm resistance is seen at 115-18+, the May 16 high. A break of this level is required to ease the current bearish threat.

SOFR FUTURES CLOSE

- Jun 23 -0.058 at 94.808

- Sep 23 -0.10 at 95.015

- Dec 23 -0.130 at 95.390

- Mar 24 -0.160 at 95.865

- Red Pack (Jun 24-Mar 25) -0.185 to -0.155

- Green Pack (Jun 25-Mar 26) -0.14 to -0.105

- Blue Pack (Jun 26-Mar 27) -0.095 to -0.08

- Gold Pack (Jun 27-Mar 28) -0.08 to -0.07

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00886 to 5.08212 (+.02521/wk)

- 3M +0.01703 to 5.12936 (+.05956/wk)

- 6M +0.02488 to 5.09376 (+.10829/wk)

- 12M +0.04230 to 4.79666 (+.19552/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00014 to 5.06057%

- 1M +0.01600 to 5.14843%

- 3M +0.01014 to 5.37914% */**

- 6M +0.02628 to 5.42514%

- 12M +0.04672 to 5.39243%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.37914% on 5/18/23

- Daily Effective Fed Funds Rate: 5.08% volume: $130B

- Daily Overnight Bank Funding Rate: 5.07% volume: $292B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.401T

- Broad General Collateral Rate (BGCR): 5.02%, $576B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $569B

- (rate, volume levels reflect prior session)

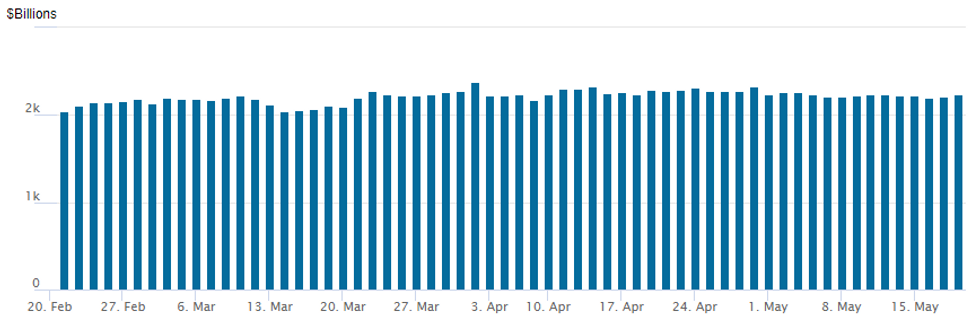

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,238.266B w/ 102 counterparties, compares to prior $2,213.676B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: Corporate Issuance Pause After Heavy Start to Week

No new issuance as yet Thursday after whopping $64.05B corporate debt issued in the first half of the week, lead by Pfizer's record $31B 8-part jumbo on Tuesday. $12.15B Priced Wednesday:- Date $MM Issuer (Priced *, Launch #)

- 05/17 $3B *EDF $1B 5Y +215, $1B 10Y +270, $1B 30Y +310

- 05/17 $2.5B *Schwab $1.2B 6NC5 +205, $1.3B 11NC10 +227

- 05/17 $1.25B *Blackrock 10Y +130

- 05/17 $1.1B *SoCal Edison $400M 3Y +112.5, $700M 30Y +200

- 05/17 $1B *NRW Bank 3Y +32

- 05/17 $1B *SoCal Gas 10Y +165, 30Y +190

- 05/17 $800M *ITC $300M 5Y +135, $500M 10Y +185

- 05/17 $500M *BNY Mellon 3NC2 +100

- 05/17 $500M *LYB Int Finance 10Y +205

- 05/17 $500M *Amcor Finance 10Y +217

- 05/17 $3.5B Venture Global 5NC2, 8NC3 investor calls

EGBs-GILTS CASH CLOSE: Yields Resume Their Ascension

The long ends of the German and UK curves saw double-digit yield rises Thursday in a bear steepening.

- Though Ascension Day holidays meant a fairly thin calendar (BoE TSC testimony was a non-event), yields resumed their ascent largely on US-centric considerations.

- Optimism over a debt ceiling deal in Washington kept risk assets bid, and an indication of support for a June Fed hike from Dallas Fed Pres Logan put pressure on the global short-end.

- Greece was the standout performer, with spreads vs Italy falling 9bp to nearly the biggest all-time premium to BTPs (closed 27.2bp vs the record 29.2bp close on Jul 27) ahead of May 21 elections.

- After a dearth of data today, we get some 2nd tier reports Friday to conclude the week, including German PPI. We also hear from BoE's Haskel, along with the ECB's Schnabel, Lagarde, and de Cos.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 6.1bps at 2.762%, 5-Yr is up 8.9bps at 2.416%, 10-Yr is up 11bps at 2.446%, and 30-Yr is up 12bps at 2.632%.

- UK: The 2-Yr yield is up 8.8bps at 3.955%, 5-Yr is up 10.7bps at 3.795%, 10-Yr is up 12bps at 3.957%, and 30-Yr is up 11.2bps at 4.381%.

- Italian BTP spread up 2bps at 186.7bps / Greek down 6.8bps at 159.5bps

FOREX: Greenback Rally Extends, USDJPY Highest Since November

- The greenback spent Thursday building upon its most recent strong performance, with a notable 0.70% advance for the USD index. Gains were broad based against all others in G10 as further optimism for a debt ceiling deal underpin the dollar bid. Furthermore, hawkish remarks Dallas Fed Pres Logan put pressure on the global short-end, adding an additional tailwind for the greenback.

- The pressure on front-end yields has boosted USDJPY to fresh highs this year and with the powerful break a key resistance zone between 137.77-91 strengthens bullish conditions and confirms a resumption of the uptrend that started on Jan 16. The pair trades just below session highs of 138.69 approaching the APAC crossover, the best levels since November 2022. The focus above is on 139.00 and 139.59, a Fibonacci retracement.

- In similar vein, EURUSD continues to weaken and Thursday’s move lower marks an extension of the bear leg that started on Apr 26. Price action has narrowed the gap with 1.0713, the Mar 24 low.

- USDCNH (+0.64%) has extended the move higher this week, confirming a resumption of the bull trend that started mid-January. This week’s breach of key resistance at 6.9971, the Mar 8 high, represents an important bullish short and medium-term price development.

- The pair is approaching the neckline of a former head and shoulders reversal pattern. The line intersects at 7.0655 and if this level is breached, it would signal scope for a climb further out towards the top of a bull channel that is drawn from the Feb 2 low. The channel top intersects at 7.1313 today. Initial support lies at 6.9971 and 6.9425, the 20-day EMA.

- Canadian retail sales headlines a quiet Friday global docket, however, markets will remain attentive to any comments from Fed Chair Powell, due to participate in a panel discussion with Ben Bernanke.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/05/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 19/05/2023 | 2330/0830 | *** |  | JP | CPI |

| 19/05/2023 | 2330/0830 | *** |  | JP | CPI |

| 19/05/2023 | 0600/0800 | ** |  | DE | PPI |

| 19/05/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 19/05/2023 | 1245/0845 |  | US | New York Fed's John Williams | |

| 19/05/2023 | 1300/0900 |  | US | Fed Governor Michelle Bowman | |

| 19/05/2023 | 1400/1000 | * |  | US | Services Revenues |

| 19/05/2023 | 1455/1655 |  | EU | ECB Schnabel Speech at Conference on Financial Stability and Monetary Policy | |

| 19/05/2023 | 1500/1100 |  | US | Fed Chair Jerome Powell | |

| 19/05/2023 | 1600/1800 |  | EU | ECB Schnabel Panels Conference on Financial Stability and Monetary Policy | |

| 19/05/2023 | 1900/2100 |  | EU | ECB Lagarde Video Presentation at Banco Central Brasil |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.