-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Dollar Shrugs Off Yield Dive

Highlights:

- Treasury yields dive, shrugging off second best retail sales reading ever

- Acute curve flattening, with 5s30s on track for largest flattening move in months

- Equities rip further as S&P 500 crests at new high

US TSYS SUMMARY: Rally Suggests Market Got Ahead Of Itself On Recovery

Treasuries rallied sharply Thursday, with prices rallying to touch the best levels since early March. The move came despite the stronger-than-expected retail sales and weekly jobless claims data, taking out resistance at 132-09+ in the process. The break of this level signals scope for a stronger upside correction amid a broader bearish trend. Beyond that markets look to 132-27 / 133-00+ as the next upside targets.

This was followed by big curve flattening after the NY Fed long-end buying operation. Markets were scratching their head over the move, and there was no straightforward explanation but likely multiple factors:

- Nothing in Thursday's data to trigger a big bull flattening move as retail sales / jobless claims and regional activity indices were much stronger than expected (though arguably IP / manufacturing disappointed slightly).

- But it looks increasingly like strong data for this part of the cycle was already priced in so it's a bit of "sell the rumour, buy the fact". If the market has indeed got ahead of the recovery, the narrative could change quickly to "the pace of the recovery has peaked".

- Some desks citing corporate issuance hedging (JPM and Goldman announcing $ bond issues) and foreign buying (i.e. Japan) helping fuel the move as well.

- Either way there is definitely demand for long-end Tsys at these yields, with the strong 30-Yr Tsy auction earlier in the week.

- Some technicals coming into play as well, with TYs pushing through two key levels of resistance Thursday.

EGBs-GILTS CASH CLOSE: Big Rally Alongside US Tsys

Bunds and Gilts enjoyed a strong Thursday, with yields steadily falling all session and closing just off the lows. While both curves bull flattened, and German yields saw their biggest fall since the beginning of the month, the UK outperformed.

- Bunds and Gilts moving in line with US Tsys which are on track for their strongest rally since late Feb. As such it wasn't a European catalyst for the move - though worth noting large EGB redemptions today (E29.3bln).

- BTP spreads narrowed sharply despite the gov't announcing a projected 2021 budget deficit of 11.8% of GDP, with debt rising to a 101 year high as a % of GDP.

- Ireland sold E3.5bln of 20-Yr IGB via syndication.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 1.1bps at -0.699%, 5-Yr is down 2.4bps at -0.627%, 10-Yr is down 3.2bps at -0.29%, and 30-Yr is down 2.8bps at 0.267%.

- UK: The 2-Yr yield is down 2.2bps at 0.039%, 5-Yr is down 4.6bps at 0.321%, 10-Yr is down 6.7bps at 0.737%, and 30-Yr is down 7.6bps at 1.269%.

- Italian BTP spread down 3bps at 102.1bps / Spanish down 0.9bps at 66.5bps

EUROPE OPTION FLOW SUMMARY: Busy Session

Thursday's options flow included:

- OEM1 134.50 put bought for 9 in 10k

- RXK1 172.5/173.0 1x2 put spread bought for 0.5 in 1.5k

- RXK1 170/169.50 put spread bought for 8 in 4.5k

- RXK1 172.00/171.00/170.00 put ladder sold at 58 in 1.25k

- RXM1 168.50/167.50/166.50 put fly bought for 5 in 2.5k

- RXM1 170/168 put spread vs 172 call bought for 3 in 1.5k

- RXM1 171.5/172.5 1x2 call spread bought for 3.5 in 1.2k

- RXM1 172/173 1x2.5 call spread bought for -3.5 (receiving) in 1.5k

- 3RK1 100.25 put sold at 3.25 in 8k

- 3RZ1 100.375/100.50/100.625 call fly sold at 1.75 in 3kLZ1 99.75/100.00 combo bought for flat (+put, -call) in 7k (vs 99.89)

- 0LM1 99.75/99.625 put spread with 99.875 call bought for 2.75 in 4k

- 0LH2 100.00 call buyght for 2.75 in 20k

- 0LM1 + 0LU1 99.625/99.75/99.875 c1x3x2 strip sold at 2.25 in 3k

- 2LM1 99.375/99.125 put spread sold at 2.75 in 2.5k

- 2LM1 99.50^ sold down to 13.25 in 3k

- 2LU1 99.375/99.125 put spread with 2LU1 99.25/99.00 put spread, bought for 10.25 in 4k

- 3LZ1 99.00/98.50/98.25 broken put fly bought for 9 in 10k

SHORT TERM RATES

USD LIBOR FIX

- O/N 0.07325 (-0.00038)

- 1W 0.08388 (-0.00287)

- 1M 0.11500 (-0.00063)

- 3M 0.18975 (0.00612)

- 6M 0.21938 (-0.00012)

- 12M 0.28775 (0.00100)

FOREX: CAD Reverses Course, USD Shrugs Off Yield Dive

- A more volatile US fixed income market Thursday failed to make any impact on currencies, as the dive in US 10y yields left the USD relatively nonplussed. The USD Index held the morning's losses into the NY close, with prices holding above the key 50-dma support at 91.581.

- Having traded firmly throughout the first half of the Thursday session, CAD reversed course in NY hours, slipping to the bottom of the G10 pile as markets found support ahead of any test on the key bear trigger at 1.2365. USD/CAD bulls now eye any recovery above the 1.2598 50-dma to secure a more stable outlook, but the picture remains weak for now.

- CAD was the weakest alongside the EUR, while AUD and NZD outperformed throughout Thursday trade.

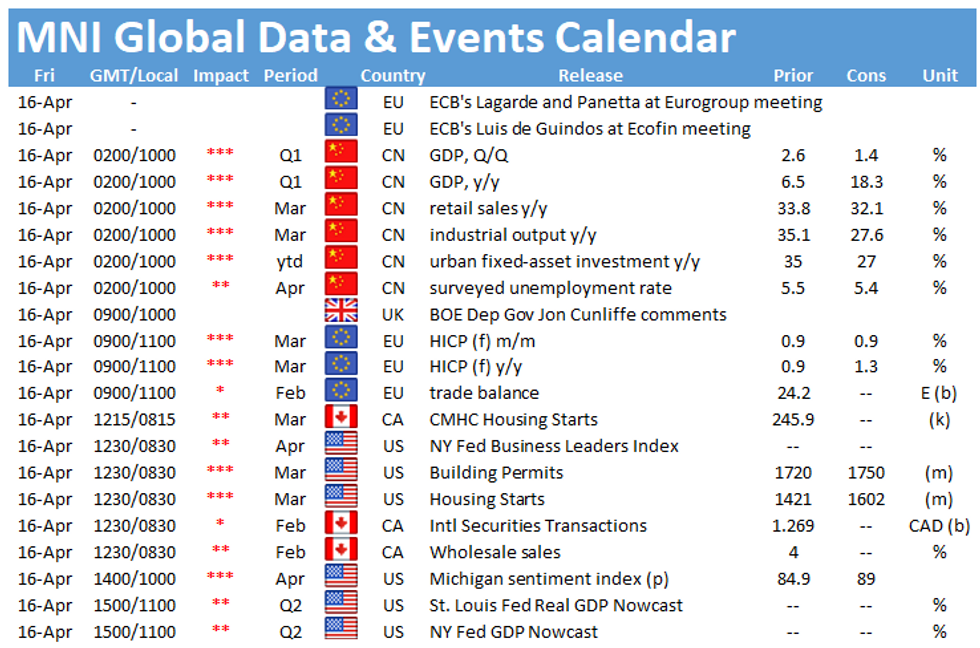

- Focus Friday turns to Chinese GDP data for Q1, with March retail sales and industrial production also due. US housing starts/building permits and the prelim Uni. of Michigan confidence numbers make up the US calendar. Ahead of the FOMC media blackout this weekend, Fed's Kaplan is due to speak.

FX OPTIONS: Expiries for Apr16 NY cut 1000ET (Source DTCC)

- USD/JPY: Y108.00($545mln), Y108.95-00($807mln)

- GBP/USD: $1.3650(Gbp580mln)

- AUD/USD: $0.7550(A$519mln)

- USD/CAD: C$1.2480-85($1.1bln)

EQUITIES: Stocks Shrug Off Yield Dive, Geopolitical Tensions to Secure New Highs

- US indices once again traded higher, with the S&P 500 securing new all time highs and shrugging off both a dive in US yields as well as simmering geopolitical tensions in the process.

- Gains across the three main indices came despite a mixed set of earnings, with Blackrock gaining, while Bank of America and Citigroup edging lower after their respective reports.

- A stellar US retail sales report helped buoy sentiment, with March seeing a rise of 9.8% vs. Exp. 5.8%. This was allied with a considerable drop in weekly initial jobless claims, which hit new post-pandemic lows.

- In Europe, stocks finished generally higher, with the EuroStoxx50 finishing higher by 0.4%, while the FTSE-100 outperformed to secure gains of 0.6% Thursday. Peripheral continental equities lagged, with both the Italian FTSE-MIB and Spain's IBEX-35 closing lower by 0.2%.

COMMODITIES: Metals Surge, Oil Benchmarks Consolidate Gains

- Lower treasury yields and a slightly softer US dollar spurred precious metals on Thursday. Spot gold and silver both rallied around 2% as 10-yr yields in the US fell around 10 basis points.

- Gold soared to best levels since late February, trading above $1,765 an ounce.

- Price action in Gold suggests the yellow metal has been building a base since Mar 8. If correct, this signals a potential technical reversal and key nearby resistance levels appear exposed. MNI full technical piece can be found here: https://marketnews.com/double-bottom-reversal-in-gold

- Copper was also a beneficiary on Thursday, extending 3-day gains to around 5.5%. Futures (HGA) rallied another 2.25%, probing the March highs and potentially setting up a move to the 2021 highs of 437.55. The extension of the move north comes after notable price upgrades earlier this week. Goldman Sachs raised their 12-month target to $11,000 per ton and projects prices will hit $15,000 by 2025 as the global green-energy transition propels demand for the metal used in power grids, wind turbines and electric vehicles.

- Oil prices consolidated Wednesday's near 5% gains after the monthly IEA report released forecasts of a significant rise in global oil demand in the second half of the year. Benchmarks took a back seat today with much more contained ranges but the consolidation bolsters the potential breakout following tight ranges over the past month.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.