-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI China Daily Summary: Tuesday, December 10

MNI ASIA MARKETS ANALYSIS: Early Risk Off Tempers Wed's Moves

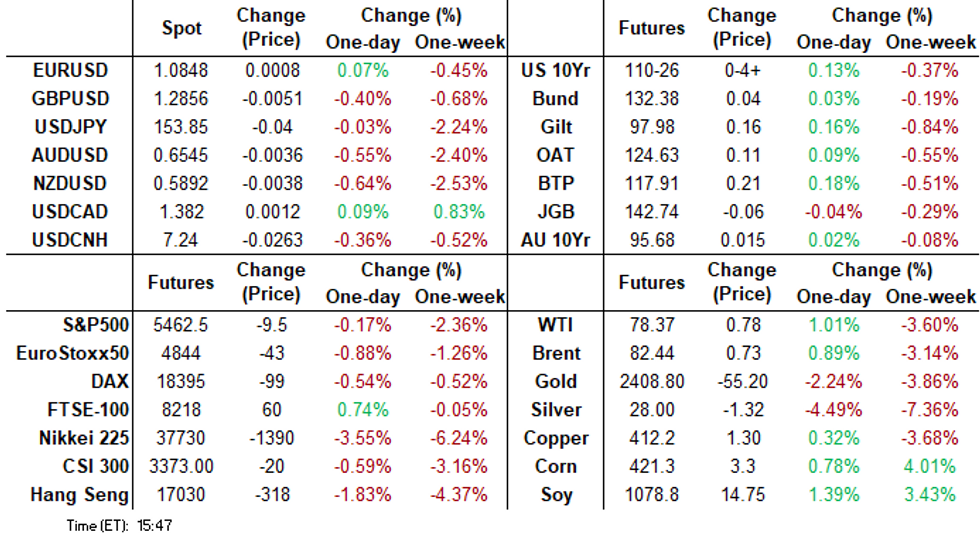

- Treasuries look to finish modestly weaker in the short end to higher in 5s-30s Thursday, as early session risk off support cooled.

- Treasury futures pare gains after higher than expected GDP, weekly/continuing jobless slightly lower than expected, while durable goods orders decline.

- While futures scaled back support in late trade, projected rate cut pricing into year end scaled back from this morning's highs.

US TSYS Off Early Highs, Short End Underperforms, Rate Cut Odds Still Supported

- Treasury futures look to finish mixed Thursday, well off early session highs with the short end mildly weaker after the bell. Curves unwound a portion of yesterday's steepening with 2s10s -3.763 at -18.867. Sep'24 10Y futures neared initial technical resistance of 111-13+ (July 16 high) before finishing at 110-26 (+4.5).

- Tsys climbed past yesterday's early highs on a variety of dovish/risk off factors (20bp medium-term lending facility rate cut by PBOC, soft EU data and carry-over weakness in global equities after Wed's rout). In turn, projected rate cut pricing into year end surged briefly with almost three 25bp cuts priced in by December.

- Treasuries pared gains after higher than expected GDP, weekly/continuing jobless slightly lower than expected, while durable goods orders decline. Real GDP growth: 2.84% annualized in Q2 (cons 2.0, Atlanta Fed’s GDPNow 2.7) after 1.4% in Q1 and the average 4.1% in 2H23. Initial jobless claims pulled back slightly more than expected to a seasonally adjusted 235k (cons 238k) in the week to Jul 20 after an upward revised 245k (initial 243k).

- Headline durable goods orders unexpectedly collapsed in June, falling the most (-6.6% M/M vs +0.3% expected, +0.1% prior) since the start of the Covid pandemic (April 2020 -20.0%). The seasonally-adjusted level of durable goods orders thus fell back to levels not seen since November 2021.

- Cross asset roundup: US$ receded, stocks bounced after Wednesday's rout, Gold sold off while crude prices rebounded.

- Focus turns to Friday's personal income & spending data and UofM inflation sentiment.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00214 to 5.34712 (+0.00069/wk)

- 3M -0.01565 to 5.26356 (-0.01943/wk)

- 6M -0.03153 to 5.10750 (-0.02718/wk)

- 12M -0.04955 to 4.76862 (-0.03164/wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.00), volume: $2.083T

- Broad General Collateral Rate (BGCR): 5.33% (+0.01), volume: $799B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.01), volume: $778B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $86B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $219B

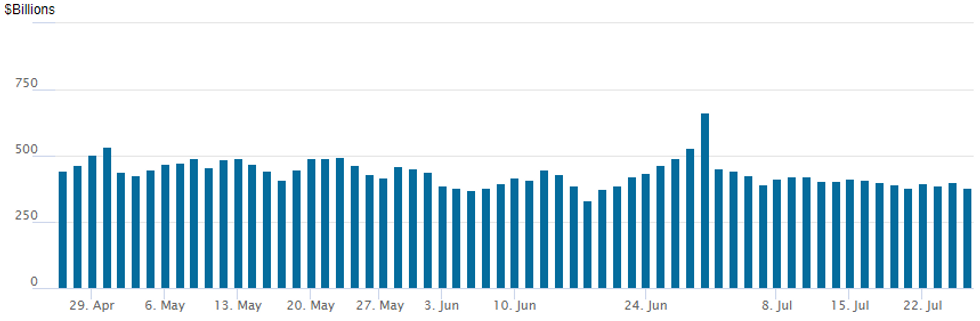

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage recedes to $377.433B from $399.121B on Wednesday. Number of counterparties falls to 69 from 75 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

Heavy SOFR and Treasury option flow leaned towards upside calls Thursday as underlying futures climb past yesterday's early highs on a variety of dovish/risk off factors (20bp medium-term lending facility rate cut by PBOC, soft EU data and carry-over weakness in global equities after Wed's rout). Highlight flow was a scale buyer of over 180,000 TYU4 112 calls from 25-30 on the day, strike corresponds to appr 4.08% 10Y yield vs. 4.2544% at the moment, on an appr of $77M. While futures scaled back support in late trade, projected rate cut pricing into year end scaled back from this morning's highs (*): July'24 at -6.5% w/ cumulative at -1.6bp (-2.6bp) at 5.313%, Sep'24 cumulative -27.8bp (-31.3bp), Nov'24 cumulative -43.9bp (-48.7bp), Dec'24 -66.2bp (-71.1bp). Salient flow includes:

- Treasury Options:

- +10,000 FVU4 106.25/106.75/107.25 put trees

- Block/screen over +180,000 TYU4 112 calls, 25-30 (open Interest only 77,595)

- 4,000 TYU4 110.5/111.5/112.5 call flys, ref 110-31

- Block, 1,500 TUQ4 102.37/102.5 put spds, 1.0 ref 102-20.88

- 1,250 TUQ4 102.5/102.62 put spds

- 5,000 TYQ4 111.5/112 call spds ref 111-04

- 1,200 TUU4 102.25/102.5/102.75 call trees

- 2,500 TYQ4 110.5 puts, 5 ref 111-02

- 3,000 TYU4 109.5/112.5 strangles, 32

- 3,000 FVU4 108/109/110 call flys

- 6,500 FVQ4 107.75/108.25 call spds vs. wk1 FV 108/108.5 call spds

- over 18,000 TYU4 111/112 call spds, 21 ref 110-26.5

- `over 9,000 TYU4 109.5 puts, 15 last

- SOFR Options:

- Block, 10,000 0QQ4 96.00 puts, 3.5 ref 96.21

- -4,000 SFRU4 94.93/95.18 call spds 5.25 ref 95.375

- -5,000 SFRZ4 94.68/95.00 put spds, 2.5 vs. 95.375/0.10%

- +10,000 SFRU4 94.68/94.81/94.87/94.93 put condor 0.75-0.875 ref 94.95

- +7,500 SFRZ4 96.00/96.25 call spds 1.5-1.625 ref 95.36

- -10,000 SFRZ4 95.50/95.75 call spds 4.75, vs. 95.37/0.14%

- +22,000 SFRZ4 95.43/95.87 1x2 call spds 2.0 ref 95.37

- -5,000 0QU4 95.93/96.75 strangle 11.5 vs. 96.21/0.12%

- 4,600 SFRU4 95.12/95.25 call spds ref 94.96

- -10,000 SFRZ4 95.50/95.75 call spds, 4.75 vs. 95.37/0.14%

- +7,000 SFRZ4 95.31/95.50/95.68 call trees 2.25-2.5 ref 95.37

- Block, 5,000 SFRH5 95.00 puts, 3.5

- 3,000 SFRQ4 95.00/95.12/95.25/95.37 call condors ref 94.98

- Block, 3,000 SFRV4 95.25 straddles, 27.5 vs. 95.405/0.40%

- 8,000 SFRU4 94.68 puts ref 94.98

- over 7,700 SFRU4 94.75 puts, 1.0 last

- over 7,800 SFRU4 94.87 puts

- Block, 2,974 SFRZ5 96.50/97.50 call spds, 29.5 ref 96.345

- 10,000 SFRV4 95.62 calls ref 95.405

- 3,000 0QQ4 95.75 puts, 0.5

- Block/screen 7,500 SFRQ4 94.93/95.06/95.18 put flys ref 94.965

- 2,000 SFRU4 94.93/95.06/95.18 call flys ref 94.955

- 3,000 SFRQ4 95.06/95.25 call spds ref 94.965

- 2,200 SFRU4 95.12/95.25 call spds ref 94.965

- 7,000 SFRZ4 96.00/96.50 call spds ref 95.375 to -.385

- 1,800 SFRZ4 95.62/95.87 call spds ref 95.39

- 1,300 SFRV4 95.37/0QV4 96.50 call spds

EGBs-GILTS CASH CLOSE: Gains Fade, But UK Short-End Rally Stands Out

Gilts and core EGBs strengthened Thursday, with periphery spreads mostly wider.

- The session began with a risk-off tone in a resumption of the previous day's price action. Gilts and Bunds both gained, helped by an unexpected PBOC rate cut overnight, soft German IFO data, and weak corporate earnings reports - each of which underlined global growth concerns.

- Price action shifted negative in the afternoon following stronger-than-expected US GDP data, though Bund and Gilt futures partially recovered and closed higher on the day.

- The German curve bull flattened, with the UK's bull steepening.

- UK short-end outperformance was notable, with 2Y yields seeing their lowest close since May 2023 as BoE rate cut probabilities crept higher.

- Having widened in early trade, periphery EGB spreads regained ground over the course of the session as equities found their footing. BTPs underperformed, closing wider to Bunds, with PGBs outperforming.

- Looking ahead, Friday's docket includes more Eurozone consumer confidence surveys, and ECB inflation expectations.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.1bps at 2.634%, 5-Yr is down 2.2bps at 2.348%, 10-Yr is down 2.7bps at 2.417%, and 30-Yr is down 3.2bps at 2.629%.

- UK: The 2-Yr yield is down 4.1bps at 3.948%, 5-Yr is down 2.5bps at 3.917%, 10-Yr is down 2.6bps at 4.13%, and 30-Yr is down 0.3bps at 4.67%.

- Italian BTP spread up 1.1bps at 136.1bps / Portuguese down 1.2bps at 64.1bps

EGB Options: Predominantly Call Fly Buying In Rates Thursday

Thursday's Europe rates/bond options flow included:

- DUQ4 106.0 call, sold for 5.25 in 4k

- DUU4 106.5/107.0 call spread, bought for 2.75 in 4.5k

- RXQ4 131.5 C vs 2x RXU4 133/135 c1x1.5 ppr sold at 36 In 2k (bought call spread)

- ERU4 96.25/96.375/96.50 put fly, bought for 1.5 in 4k

- ERX4 96.75/96.875/97.00 call fly, bought for 2.5 in 8k

- ERZ4 97.125/97.375/97.625 call fly, bought for 1 in 10k

- SFIU4 95.05/95.10/95.20 1x1.5x0.5 call fly, bought for 1.5 in 3.5k

FOREX JPY Rally Slows, But Trend Direction is Still Higher

- The week's JPY rally persisted well through the European morning, pressing USD/JPY through the Y152.00 handle for the first time since early May, marking a total correction off the cycle highs of 1,000 pips. The aggressive short covering-triggered rally pressured EUR/JPY, NZD/JPY and AUD/JPY to new pullback lows.

- A strong set of US growth numbers briefly interrupted the one-way traffic in the JPY, as advanced GDP data for Q2 came in ahead of expectations. The stabilization above the lows allows the near-term oversold condition in USD/JPY to unwind.

- Outside of JPY, CHF has extended recent outperformance, as soft global equities and JPY volatility undermines the carry trade dynamics that have dominated across the first half of 2024. USD/CHF broke to a new low and through the 0.88 handle in the process.

- Focus for Friday turns to Tokyo CPI for July - one of the last looks at inflation momentum in Japan ahead of next week's BoJ decision - at which markets continue to speculate over the possibility of a further rate hike from the Bank of Japan. A 10bps hike from 0.1% is more than 50% priced by markets, but a hot CPI print for Tokyo could help bed in this pricing further. The ECB's inflation expectations survey is also due, ahead of June personal income/spending and PCE price index numbers from the US.

Late Equities Roundup: Aerospace, Energy Sectors Buoy Broader Mkt

- Stocks rebounded from Wednesday's sharp sell-off, firmer but off early session highs late in the session. Currently, the DJIA is up 329.87 points (0.83%) at 40183.72, S&P E-Minis up 15 points (0.27%) at 5487.25, Nasdaq up 40.7 points (0.2%) at 17381.96.

- Industrial and Energy sectors outperformed in late trade, aerospace and construction related companies buoyed the former: RTX Corp +9.98%, Masco +7.88%, Northrop Grumman and Dover Corp both +6.38%. Oil & Gas and servicer related companies supported the Energy sector: Valero +5.29%, Halliburton +3.88% while APA Corp gained 3.38%.

- On the flipside, Communication Services and Utility sectors underperformed in late trade, interactive media and entertainment continued to weigh on the former: Warner Brothers -5.37%, Alphabet, formerly Google trades -2.24%, Meta -0.81%. Meanwhile, independent energy providers weighed on the Utility sector: Vistra -3.22%, Constellation Energy -2.76%, Public Service Enterprise -2.34%.

- Reminder, Thursday afternoon earnings announcements expected from: Baker Hughes, Weyerhaeuser, Mohawk Industries, Dexcom, Digital Realty Trust, L3Harris, Skechers, Arthur J Gallagher, Norfolk Southern, LPL Financial Holdings, Texas Roadhouse, Fortune Brands Innovations and Juniper Networks.

- Early Friday earnings announcement are expected by: Centene Corp, Aon PLC, Avantor, Charter Communications, 3M Co, T Rowe Price, Colgate-Palmolive, Bristol-Myers Squibb, Newell Brands and Franklin Resources.

COMMODITIES Crude Regains Ground, Gold Pulls Back Further From Highs

- WTI has broken through yesterday’s high, regaining all the previously lost ground to be back to July 23 levels.

- WTI Sep 24 is up 0.7% at $78.1/bbl.

- For WTI futures, vol band based support undercuts from here at $76.52, ahead of key support at the June 4 low of $72.23. Initial key resistance to watch is $83.58, the July 5 high.

- Gold has fallen by 1.6% to $2,358/oz on Thursday, pushing spot below the 20-day EMA support to new pullback lows.

- The move brings the yellow metal to its lowest level since July 9, following solid US data which have reduced the odds of an imminent Fed rate cut.

- Spot has also pierced the 50-day EMA at $2,359.7, with next support at $2,286.9, the June 7 low.

- Meanwhile, silver is down by 3.7% to $27.8/oz today.

- Silver has slipped through further supports, taking out the weekly lows and extending the negative response to the break of the 50-day EMA. $28.573, the Jun 26 low, has given way, opening $26.018 as the next key level.

- In contrast, copper has edged up by 0.3% to $412/lb, the first gain in nine sessions.

- Key support to watch lies at $402.35, the March 27 low.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/07/2024 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 26/07/2024 | 0600/0800 | ** |  | SE | Unemployment |

| 26/07/2024 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/07/2024 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/07/2024 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/07/2024 | 0800/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 26/07/2024 | - |  | EU | ECB's Cipollone at Rio de Janeiro G20 FinMin/CB conf | |

| 26/07/2024 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 26/07/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 26/07/2024 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 26/07/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.