-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: EU FI Cheaper On UK PMI Beat & German Debt Brake Suspension

HIGHLIGHTS

- Subdued US trade with Thanksgiving, with a modest sell-off in TY futures and gains in the S&P e-mini.

- Far greater focus on European matters today, with FI notably cheaper on the back of stronger than expected UK PMIs (Germany also beat but France weaker), headlines concerning the suspension of the German “debt brake” for 2023 and Dutch election results.

- That beat for UK PMIs saw GBP among the best performers, touching 1.2564 to maintain confirmation of a resumption of the uptrend with sights on 1.2589.

- Friday's docket will be headlined by German IFO, Canada retail sales and flash PMI's for the US. ECB President Lagarde is also due to speak at Euro20+, in Frankfurt.

US TSYS: TY Ebbs Lower With PMIs In Focus Tomorrow

- TYZ3 closed at 108-19 (-07) after lifting off an earlier 108-16 having been biased lower by EU FI price action. This includes the UK leading with a stronger than expected PMI (stronger Germany mostly offset by weaker France), headlines concerning the suspension of the German “debt brake” for 2023 and Dutch election results.

- It’s the turn of the US PMIs tomorrow with the November preliminary reports (mfg seen 49.9 after 50.0, services 50.3 after 50.6), in an otherwise light session post-Thanksgiving.

- Support is seen at 108-05 (50-day EMA) but the short-term trend structure remains bullish with resistance at 109-08+ (Nov 17 high).

- Volumes unsurprisingly remained low, chalking up 478k with a sizeable spread-related share.

EGBs-GILTS CASH CLOSE: Gilts Weaken Again As PMIs Surprise To Upside

Broadly stronger-than-expected flash November PMIs saw European core yields rise sharply Thursday, with Gilts underperforming.

- While German / Eurozone PMIs came in above consensus after France's below-expected numbers, the UK's comfortable beats (including an unexpectedly expansionary Services reading) was arguably the highlight and helped Gilts underperform, following Wednesday's larger-than-expected Gilt supply remit.

- Bund yields hit session highs in mid-afternoon after news emerged that the German government would indeed seek to suspend the "debt brake" for 2023 (later confirmed by the finance ministry).

- The Dutch short-end weakened on post-election result fiscal questions.

- UK yields rose by double digit basis points across the curve, moreso than Germany which saw bear steepening amid limited short-end moves.

- Periphery spreads widened modestly, with BTPs underperforming.

- Friday brings German GDP and IFO data, with a few ECB speakers including Lagarde.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1bps at 3.044%, 5-Yr is up 5.1bps at 2.596%, 10-Yr is up 5.9bps at 2.619%, and 30-Yr is up 5bps at 2.788%.

- UK: The 2-Yr yield is up 10.3bps at 4.716%, 5-Yr is up 11.1bps at 4.309%, 10-Yr is up 10.2bps at 4.257%, and 30-Yr is up 9.8bps at 4.723%.

- Italian BTP spread up 1.5bps at 177.1bps / Spanish up 1bps at 100.3bps

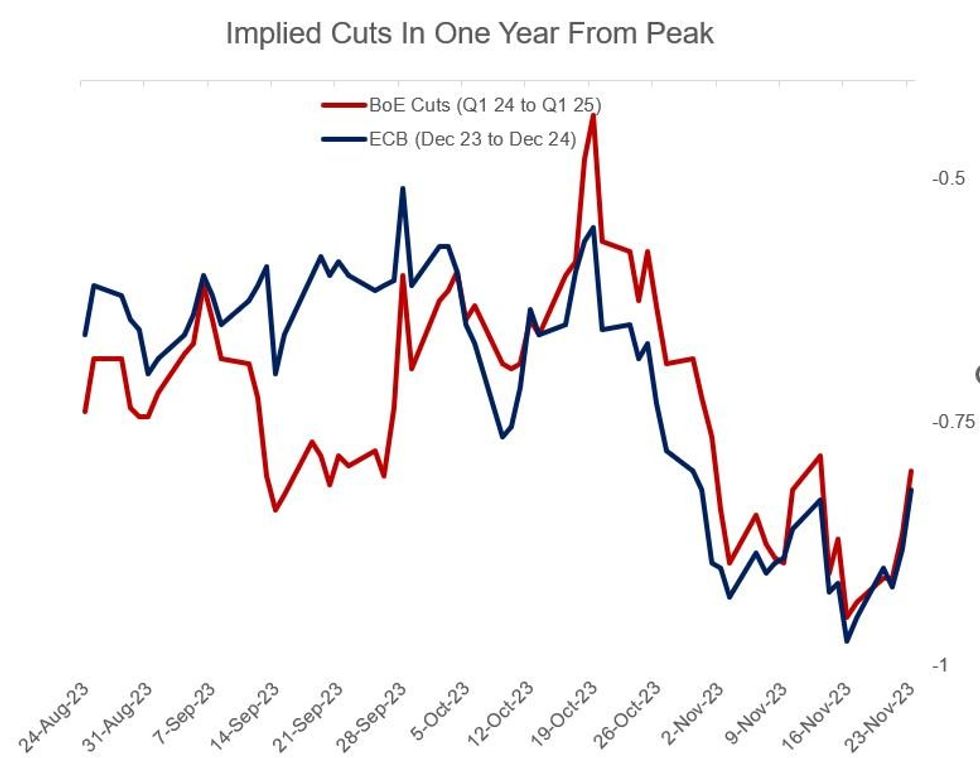

EU STIR: BoE/ECB Cut Pricing Pulls Back Lowest Levels Of Month

ECB/BoE cut pricing for the year following the respective rate peaks pulled back around 6bp Thursday, for the 2nd consecutive day, as Eurozone and UK PMI data came in above expectations.

- While the status quo of no further hikes remains for both central bank implied paths, total cuts in the year following the peak fell to 82bp for the ECB (from end-2023 to end-2024) and 80bp for the BoE (from Feb/Mar 2024 to Feb/Mar 2025).

- That is the least amount of cuts priced since late October.

- The first ECB cut remains fully priced by the June 2024 meeting, with the BoE's in August vs a near-lock in June as had been seen earlier this week.

- For the ECB, 50bp in cuts are fully priced by September 2024, with 75bp by October. For the BoE, that's 50bp in cuts from peak by December 2024, with 75bp by March 2024.

FOREX: GBP & NZD Consolidate Gains Amid Subdued Thanksgiving Trade

- GBP remains among the best performers in G10 approaching the APAC crossover, with solid November prelim PMI data largely responsible for the early strength. Both manufacturing and services PMIs came in ahead of forecast (manufacturing at 46.7 vs. Exp. 45.0, services at 50.5 vs. Exp. 49.5). GBP/USD rallied to touch 1.2564 in response. The move higher has moderated as the greenback recovered slightly throughout a subdued Thanksgiving holiday session.

- This week’s gains have resulted in a breach of 1.2506, the Nov 14 high. The break confirms a resumption of the uptrend and maintains a positive price sequence of higher highs and higher lows. Sights are on 1.2589, 50.0% of the Jul 14 - Oct 4 bear leg.

- AUD and NZD trade similarly strong, with the latter rising 0.4% on Thursday, thanks to the mild weakness across the USD. The USD Index is off yesterday's best levels after the 100-dma successfully contained prices and acted as strong resistance across Wednesday trade. Supportive China headlines also crossed, working in favour of risk assets as markets continue to bake in expectations of sizeable policy support for the property market and housing sector.

- AUD/USD continues to hold just below the 200-dma of 0.6587 - a level that held well earlier in the week. Clearance here would accelerate the bullish reversal off the October low, putting prices at levels last seen in early August.

- Friday’s docket will be headlined by German IFO, Canada retail sales and flash PMI’s for the US. ECB President Lagarde is also due to speak at Euro20+, in Frankfurt.

FX OPTIONS: Expiries for Nov24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.2bln), $1.0825(E600mln), $1.0875(E652mln), $1.0895-00(E765mln), $1.0925-30(E1.3bln)

- USD/JPY: Y146.25($500mln), Y147.25-40($1.5bln), Y148.50-65($981mln), Y149.00-20($581mln), Y150.00-10($655mln)

- AUD/NZD: N$1.0850(A$700mln)

- USD/CAD: C$1.3575($1.3bln), C$1.3755($1.6bln), C$1.3770($1.6bln)

- USD/CNY: Cny7.2300($1.0bln)

EU FI OPTIONS: Sonia Call Condor Buying Remains En Vogue Thursday

Thursday's Europe rates / bond options flow included:

- RXF4 133.50c, bought for 37 and 38 in 5k.

- RXF4 128/126ps , bought for 16 in 2k

- SFIM4 94.65/94.75/94.80/94.90c condor bought for for 1.25 in 2k

- SFIM4 94.70/94.80/94.90/95.00 call condor, bought for 1.75 in 6k

- SFIM4 94.60/94.70/94.75/94.85 c condor, bought for 1 in 4k.

US STOCKS: S&P E-Mini Holds Bulk Of Yesterday's Move Nearer Key Resistance

- ESA dipped ahead of the early close for Thanksgiving to finish near unchanged on the day at 4569.50 (+0.05%), having kept to particularly narrow ranges after pushing higher yesterday .

- It sees very slight underperformance to Nasdaq (+0.1%) and Dow Jones (0.1%) e-minis, whilst outperform the Russell 2000 (-0.1%).

- ESA unsurprisingly hasn’t troubled technical levels, after yesterday’s high of 4580.50 marked a push closer to a key resistance at 4597.50 (Sep 1 high). Support meanwhile is seen at 4501.75 (Nov 16 low).

- North of the border, the TSX is currently holding onto to a 0.2% gain after rising shortly after the close. Industrials lead gains (0.55%), primarily courtesy of Canadian National Railway up 1.2%, whilst consumer staples lag (-0.9%).

Source: Bloomberg

Source: Bloomberg

COMMODITIES: Crude Weighed By OPEC+ Discord Whilst Gold Nudges Higher

- Crude remains weaker Thursday but has recouped much of the earlier losses after a delay in the OPEC+ meeting rattled markets this week. A strong US crude stock build reported this week has also weighed on the WTI-Brent spread.

- Nigeria and Angola are the main nations pushing for higher production quotas, disrupting normal OPEC+ meeting proceedings. Both nations are aiming to boost their production in the short term.

- Nigeria’s proposed 2024 target will reduce to 1.38mn bpd – from 1.74mn bpd previously but will rise to 1.58mn bpd if three independent consultancies can confirm its capacity to produce at this level.

- An Angolan official stated the country’s intent to remain in OPEC, somewhat settling the markets Thursday.

- Outwith the difficulties faced by OPEC to assuage African nation concerns, Saudi and Russia are expected to sustain or deepen cuts into 2024 when they meet November 30.

- WTI is -1.1% at $76.24 off a low of $75.30 but having remained easily within yesterday’s wide ranges. Resistance seen at $78.55 after which lies a key short-term $79.65 (Nov 14 high).

- Brent is -0.7% at $81.42 off a low of $80.19 but having also remained easily within yesterday’s wide ranges. Key short-term resistance seen at $83.97 (Nov 14 high).

- Gold is +0.1% at $1992.25, paring earlier gains with a modest intraday recovery in the USD index. Resistance remains at the bull trigger at $2009.4 (Nov 7/Oct 27 high) having come close in the prior two sessions.

FIXES AND PRIOR SESSION REFERENCE RATES

None due to US Thanksgiving

UK Issuance Deep Dive: Autumn Statement Review and FQ4 Outlook

- In this note we outline the main measures that were announced in the Autumn Statement, revisions to the gilt remit, the wider political implications and update our expectations for which gilts will be on offer in FQ4 (January to March) following the release of the DMO’s consultation agenda.

Heavy USDCAD Expiry Could Help Extend Lift After Earlier Opening Of Key Support

- USDCAD at 1.37 trades slightly higher on the day (+0.1%) after a lacklustre session with US Thanksgiving.

- CAD underperforms all peers bar Scandis in payback after two days of outperformance.

- USDCAD earlier touched 1.3651 to clear support at 1.3674 (trendline drawn from the Jul 14 low) and open a key support at 1.3629 (Nov 6 low) but has lacked impetus to continue lower in holiday-thinned trade. A push higher meanwhile could bring 1.3777 into sights (Nov 16 high).

- Tomorrow is headlined by US PMIs and CAD retail sales but heavy option expiry for the NY cut could also bias direction. There is a large $3.4bn grouped between 1.3740-1.3770 partly offset by $1.3bn at 1.3575.

Source: Bloomberg

Source: Bloomberg

CANADA DATA: Corporate Pre-Tax Net Incomes Bounced In Q3 [1/2]

- Corporate net income before tax (NIBT) increased a seasonally adjusted 4.7% in Q3 to C$160.3bn, following two quarterly declines averaging -6.6%

- It was lifted by a 6.7% rise in financial sector NIBT. Gains here were led by “securities and commodity exchanges and portfolio management and miscellaneous financial investment activity”, whilst banks saw a 6.3% decline in NIBT owing to higher labour costs and provision for credit losses.

- Non-financial sector NIBT still increased 4%, driven by “petroleum and coal product manufacturing” and the “oil and gas extraction industry” owing to higher prices of refined petroleum products and crude oil.

- It saw overall corporate NIBT rise to an estimated 22.5% GDP in Q3. That compares to 25.2% GDP at the end of last year, although is still notably higher than pre-pandemic levels.

CANADA DATA: Elevated Corporate Incomes Could Support Investment Ahead [2/2]

- The still elevated nature of corporate pre-tax net incomes leaves scope for corporate investment as a potential (continued) growth engine.

- Real private non-residential investment has been growing strongly, up 9.2% Y/Y in Q2 to add 0.5pps to real GDP growth although it has for some time been outweighed by the drag from residential investment (-14% Y/Y and -1pps in Q2).

- Should this residential investment drag begin to fade along with the peak impulse from monetary policy tightening, overall business investment could swing to positive contributions.

- Corporate net lending suggests there is still scope for increases in corporate investment: the net lending share may not be as high as it was earlier in the emergence of the pandemic but at 1.5% GDP it still has some room to be run down - see red line in the chart.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.