-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Feb FOMC, Steady As She Goes

HIGHLIGHTS

- FOMC Minutes: Fed Staff Saw Recession This Year as Plausible, DJ

- MNI NATO: Duda Says Hungary To Sign Joint Declaration Condemning Russia

- MNI NATO: Lithuania Calls For Increased NATO Defence Capabilities In Baltics

- MNI CHINA-RUSSIA: Russia Dismisses Talk Of "Chinese Peace Plan"

- FED BULLARD: MARKETS PRICING `TOUGHER ROAD AHEAD' ON INFLATION, Bbg

- FED BULLARD SAYS HIS PROJECTION HAS RATES REACHING 5.375%, Bbg

US TSYS: Not Much of a Pause in Feb FOMC Minutes

Tsys firmer after the bell, but off session highs to near middle session range after Feb FOMC minutes revealed "a few" members wanted to hike 50bp. Yield curves off steeper levels w/ short end under pressure (2s10s -.188 at -77.623 vs. -73.312 high).- Not much of a pause gleaned from Feb minutes: "pause" came up just once in the minutes, in the context of other central banks indicating they were at or near a point where it could be appropriate to do so.

- Fed funds implied hike for Mar'23 at 29.6bp, May'23 cumulative 55.6bp (+1.8) to 5.143%, Jun'23 72.2bp (+3.3) to 5.309%, terminal climbs to 5.38% high in Aug'23.

- Tsys had bounced earlier after StL Fed Bullard interview on CNBC siphoned some hawkish positioning out of markets. StL Fed Bullard sees "tough road ahead" on inflation, rates reaching 5.375%, he states "we have a good shot at beating inflation in 2023", while mkt may be overpricing chances of recession.

- Heavy two-way trade (TYH3>3.8M) driven by quarterly futures rolls from Mar'23 to Jun'23 ahead next Tue First Notice (Jun'23 takes lead).

- Tsy futures dip briefly, still firm after $43B 5Y note auction (91282CGH8) tails: 4.109% high yield vs. 4.105% WI; 2.48x bid-to-cover vs. 2.64x the prior month.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00300 to 4.55686% (+0.00000/wk)

- 1M +0.01229 to 4.60429% (+0.01300/wk)

- 3M +0.00600 to 4.92814% (+0.01285/wk)*/**

- 6M +0.01357 to 5.27100% (+0.02800/wk)

- 12M -0.02000 to 5.61943% (-0.02343/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.92814% on 2/22/23

- Daily Effective Fed Funds Rate: 4.58% volume: $100B

- Daily Overnight Bank Funding Rate: 4.57% volume: $295B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.164T

- Broad General Collateral Rate (BGCR): 4.52%, $475B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $460B

- (rate, volume levels reflect prior session)

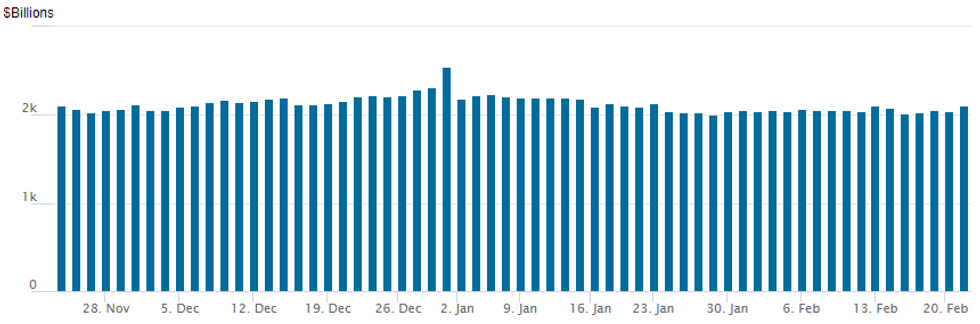

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,113.849B w/ 100 counterparties vs. prior session's $2,046.064B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better put volumes on net after SOFR saw period of upside call buying post-Bullard as underlying rallied. Put buyers returned post FOMC minutes release as underlying receded, short end under pressure.- SOFR Options:

- Block, 25,750 OQZ3 95.37/96.00 2x1 put spds, 4.0 ref 96.35

- -25,000 SFRM3 95.12 calls, 1.5

- Block, 25,000 OQM3 97.37/97.62 put spds, 0.5 ref 95.79

- 1,800 SFRJ3 94.62/94.75 1x2 call spds, 0.0 ref 94.67

- Block, 6,000 2QH3 96.50 puts, 17.5 ref 96.43

- 2,000 SFRU3 94.68/94.81/94.93 call flys ref 94.675

- Block, 3,000 SFRZ3 96.25/97.00/97.50 call flys, 3.0 vs. 94.97/0.05%

- Block, 5,000 SFRM3 94.87/95.50 call spds, 5.25 ref 94.685

- 1,000 SFRM3 94.68/94.81/94.93/95.06 put condors ref 94.68

- 10,000 OQM3 94.50 puts, 3.0 ref 95.78 to -.79

- 2,000 SFRZ3 95.12/95.25/95.50 put flys ref 94.89

- Block/screen, 5,000 SFRZ3 94.00/94.25/94.50 put flys, 3.0 ref 94.88

- 4,600 SFRZ3 94.00/94.25/94.50 put flys ref 94.88

- Block, 2,500 SFRM3 94.68/94.81/94.93/95.06 put condors, 2.75 ref 94.68

- 3,000 OQJ3 95.50 puts, 13.5 ref 95.765

- 2,000 OQM3 94.50 puts, 3.0 ref 95.79

- 1,000 SFRH4 94.62/94.87 put spds vs. 3QZ3 96.12/96.37 put spds

- Treasury Options:

- -10,000 FVH3 107.25 calls, 4.5 ref 106-29 total volume >34k

- 5,000 TUH3 102 puts vs. TUJ 101/102 put spds

- over 6,500 TYJ3 115 calls, 8 ref 111-26.5

- 2,500 USJ3 112 puts, 44 ref 125-31

- -15,000 FVJ3 107/107.25 call spds, 6.5

- 15,000 FVH3 107 calls, 9.5-10.5 ref 106-25.75 to -26.5

- 2,000 TYJ3 110 puts, 29 ref 111-19.5

EGBs-GILTS CASH CLOSE: Yields Pull Back As Hike Expectations Fade

UK and German cash yields pulled back from session highs to finish mostly lower Wednesday. Bunds outperformed, with modest bull steepening in the curve; UK yields closed mixed.

- 10Y Bund yields tested multi-year highs of 2.5744% (hitting 2.5740%) before retracing by the cash close as the Feb-33 saw a strong auction and ECB terminal pricing pulled back 6bp.

- Likewise UK 10Y yields pulled back from 6-week highs, reversing some of the post-PMI selloff, mirroring a pullback in BoE hiking expectations.

- Various catalysts for the intraday reversal included ECB's Villeroy saying that market hike pricing had gone too far, and Fed's Bullard taking some of the impetus out of the FOMC minutes later Wednesday by saying he sees a good shot at subduing inflation this year.

- Periphery EGB spreads stabilised after an early widening.

- Thursday sees Eurozone final inflation figures and commentary from BoE's Mann and ECB's de Cos.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.8bps at 2.921%, 5-Yr is down 2.1bps at 2.581%, 10-Yr is down 0.9bps at 2.52%, and 30-Yr is up 4.5bps at 2.508%.

- UK: The 2-Yr yield is up 0.4bps at 3.923%, 5-Yr is up 0.2bps at 3.562%, 10-Yr is down 1.4bps at 3.6%, and 30-Yr is down 2.1bps at 3.988%.

- Italian BTP spread up 0.3bps at 194bps / Spanish down 0.6bps at 98.4bps

EGB Options: Multiple Rate Structures

Wednesday's Europe rates / bonds options flow included:

- ERJ3 96.375/96.25/96.125 1x3x2 put fly bought for 0.5 in 9k

- ERU3 96.37/96.75cs vs 96.00p, bought the cs for -2.5 (receive) in 4k

- ERM4 97.625 call bought for 12 in 4k

- 0RK3 96.50/96.125/96.00 broken put fly, bought for 9 in 5k

- 0RH3 96.37/96.25ps, was bought for 4.75 in 4k

- SFIM3 95.50/95.75cs vs SFIM3 95.30/95.10ps, bought the cs for 3.25 in 3k

FOREX: Greenback Strength Prevails, EURUSD & AUDUSD Hit Six-Week Lows

- The greenback traded with moderate gains ahead of the FOMC minutes on Wednesday and following some initial two-way price action, the USD index is pressing to fresh session highs ahead of the APAC crossover. The USD strength comes in the face of lower yields in the US, however, is more reflective of dampened risk sentiment across global markets.

- Notable weakness in the Aussie has largely been a result of the weaker wage price index data overnight, with AUDUSD (-0.70%) extending lows following the minutes as equities came under renewed pressure. The pair has gravitated to fresh six-week lows and it is worth noting the 0.85% drop for AUDNZD, which has negated much of the February rally.

- In similar vein, EURUSD’s short-term trend remains tilted lower and the pair has breached last Friday’s lows of 1.0613. Price remains below the 50-day EMA at 1.0677, and the clear break threatens an extension lower towards 1.0484, the Jan 6 low.

- The weaker risk backdrop overall has kept a lid on USDJPY strength, with the pair failing to garner any momentum above the 135 mark.

- On Thursday, there will be final readings for Eurozone inflation as well as the second release of US Q4 GDP and initial jobless claims. Focus then turns to Friday’s Core PCE Price Index data.

Late Equity Roundup: Nasdaq Outperforms SPX, DJIA Post-Minutes

Stocks paring gains in late trade, Nasdaq stocks outperforming mildly weaker SPX and Dow shares as markets still digesting Feb FOMC minutes, initially reacting negatively to "a few members wanted to hike 50bp". SPX eminis currently trading -11 (-0.27%) at 3995.5; DJIA -103.32 (-0.31%) at 33024.02; Nasdaq +1.3 (0%) at 11493.91.

- SPX leading/lagging sectors: Materials (+0.68%), Consumer Discretionary (+0.30%) and Information Technology sectors outperformed, software and services underpinning the latter (INTU +2.13%, NOW +2.00%, SNPS +1.42%, ADBE +1.15%)

- Laggers: Real Estate (-0.83%), Energy (-0.75%) and Health Care (-0.45%), pharmaceuticals and bio-techs weighing on the latter, notably Charles River Labs (CRL) -12.41%.

- Dow Industrials Leaders/Laggers: American Express (AXP) +1.90 at 175.38, Salesforce (CRM) +1.76 at 163.38, Home Depot (HD) +1.64 at 297.14, Laggers: Walmart (WMT) -4.16 aty 143.17, Caterpillar (CAT) -1.56 at 239.15, Amgen (AMGN) -1.12 at 237.12.

- Equity earnings continue after the close: Texas Pacific Land Corp (TPL, $14.29 est), Pioneer Natural Resources (PXD, $5.87 est), Etsy ($1.04 est), EBAY ($1.06 est), NVDA ($0.81 est).

COMMODITIES: Oil Slides On Demand Concerns, Gold Hit By FOMC Minutes

- Crude oil sees a more meaningful decline, based on weak demand against a backdrop of further hawkish Fed repricing seen in recent days, plus also healthy supplies despite a strong US refinery maintenance season. Russian oil output has remained stronger than expected so far following EU and G7 sanctions which came into effect on 5 Dec for crude and 5 Feb for products.

- The US-centric nature of demand concerns plus small SPR release expected this year is driving WTI lower compared to brent with the spread earlier hitting lows this month at -$6.76/bbl.

- WTI is -3.3% at $73.83 with losses potentially increased further with the clearance of support at $75.32 (Feb 17 low) to open $72.25 (Feb 6 low).

- Brent is -3.1% at $80.47, through support at $81.80 (Feb 16 low) to open $79.10 (Feb 6 low).

- Gold is -0.6% at $1824.65, sliding later in the session on renewed USD strength after the FOMC minutes, but for now remaining off support at $1819.0 (Feb 17 low).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/02/2023 | 0030/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 23/02/2023 | 0930/0930 |  | UK | BOE Mann Speech at Resolution Foundation | |

| 23/02/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 23/02/2023 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 23/02/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 23/02/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 23/02/2023 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/02/2023 | 1330/0830 | *** |  | US | GDP (2nd) |

| 23/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 23/02/2023 | 1550/1050 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/02/2023 | 1600/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 23/02/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 23/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 23/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/02/2023 | 1900/1400 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.