MNI ASIA MARKETS ANALYSIS: Fed Gov Waller Inflation Undershoot

- Treasuries look to finish higher Friday, well off midmorning lows after dovish comments from Fed Gov Waller on CNBC: policymakers would not hesitate to keep cutting aggressively if the economy weakens.

- Projected rate cuts into early 2025 bounced off early lows with another 75bp in cuts priced in by year end, 100bp by January.

- Fed Gov Bowman contrasted with Waller espousing a more measured pace toward a more neutral policy stance to "avoid unnecessarily stoking demand".

US TSYS: Fed Gov Waller Buoys Rates, Inflation Undershoot Concers

- Treasuries looked t finish near session highs Friday, bouncing off late morning lows following dovish comments from Fed Gov Waller on CNBC, consistent with the Fed going 50bp at the next meeting in November.

- Gov Waller expressed concern with inflation undershooting, not overshooting, noting firms' limited pricing power and wage inflation coming down, and that inflation is potentially on a lower path that had previously been expected.

- Fed Governor Bowman (voter) has issued a statement explaining why she dissented against the FOMC’s decision to cut the Fed Funds target range by 50bps on Wednesday. Her comments are in firm contrast to Governor Waller’s recent CNBC interview which on the flip side seemed concerned with risks of inflation undershooting.

- Projected rate cuts into early 2025 bounced off early session lows, latest vs. late Thursday levels (*) as follows: Nov'24 cumulative -37.8bp (-35.9bp), Dec'24 -75.0bp (-72.4bp), Jan'25 -108.5bp (-106.5bp).

- Dec'24 10Y Tsy futures are currently +4 at 114-27.5 vs. 114-17 low, still well off initial technical resistance at 115-23.5 (High Sep 11 and the bull trigger). Curves bull steepened, 2s10s +2.480 at 15.242, 5s30s +2.052 at 58.677.

- Looking ahead to Monday brings more Fed speak from Bostic, Goolsbee and Kashkari, data includes flash PMI data from S&P Global.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.06269 to 4.85722 (-0.22551/wk)

- 3M -0.06202 to 4.69125 (-0.24993/wk)

- 6M -0.04204 to 4.35139 (-0.22753/wk)

- 12M -0.02253 to 3.83149 (-0.16036/wk)

- Secured Overnight Financing Rate (SOFR): 4.82% (-0.51), volume: $2.378T

- Broad General Collateral Rate (BGCR): 4.81% (-0.51), volume: $844B

- Tri-Party General Collateral Rate (TGCR): 4.81% (-0.51), volume: $815B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 4.83% (-0.50), volume: $90B

- Daily Overnight Bank Funding Rate: 4.83% (-0.50), volume: $281B

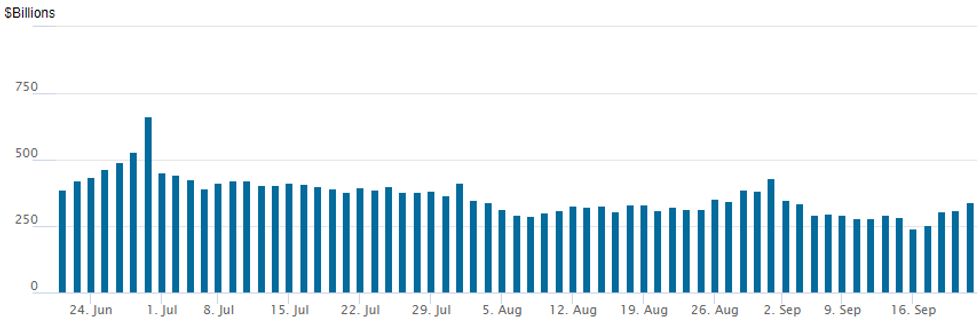

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage climbs to $339.316B this afternoon from $311.777B yesterday. This after usage fell to $239.386B Monday -- the lowest level since early May 2021. Number of counterparties climbs to 65 from 52 prior.

US SOFR/TREASURY OPTION SUMMARY

Option desks have reported better downside put & put spread buying on net Friday, carry-over after Thursday's heavy volumes as accounts looked to hedge against additional aggressive cuts by year end after the Fed cut 50bp on Wednesday. Projected rate cuts into early 2025 bounced off early session lows following Fed Gov Waller statements accepting continued rate cuts if the economy weakens, latest vs. late Thursday levels (*) as follows: Nov'24 cumulative -37.8bp (-35.9bp), Dec'24 -75.0bp (-72.4bp), Jan'25 -108.5bp (-106.5bp).

- SOFR Options:

- +40,000 SFRU6 94.00/94.50/95.00 put flys, 1.5-1.75 ref 97.045

- +10,000 SFRX4 95.50/95.62 put spds, 0.5 ref 95.99

- +5,000 SFRZ4 96.75/97.75 call spds, 1.0 vs. 96.015/0.05%

- 5,000 SFRZ4 95.56/95.81 call spds ref 95.98 to -.985

- 4,000 SFRZ4 95.87/96.00/96.06/96.18 call condors ref 95.98 to -.985

- +5,000 SFRF5 96.37/0QF5 96.75 put spreads cab

- 10,000 0QZ4 97.00 straddles 49.0-49.5 ref 97.07

- 5,000 SFRZ4 96.75/97.50 call spds ref 96.00 to -.005

- 3,000 SFRV4 96.18/96.93/96.43 broken call trees ref 96.00

- 2,500 0QZ4 96.50/96.75 put spds ref 97.06

- 2,000 0QV4 96.81/96.93 put spds ref 97.065

- 2,000 0QV4 96.62/96.93/97.12 put flys ref 97.10

- 2,000 SFRZ4 95.50/95.62 put spds ref 96.005

- 9,000 SFRF5 96.00/96.25/96.31/96.50 put condors ref 96.605

- 2,000 SFRZ4 95.00/95.56 put spds ref 96.005

- 2,000 SFRH5 95.75/96.00 put spds ref 96.62

- Treasury Options:

- over 26,900 TYV4 115 calls, 1

- over 20,400 TYV4 114.75 puts, 4 last ref 114-25

- 2,500 TYV4 114.5 straddles, 21 ref 114-24

- 5,000 TYV4 113.75/114.75 call spds

- 5,000 TYV4 114.5/114.75 put spds, 5 ref 114-23

- 2,000 FVX4 109.5 puts, 18 ref 110-06.5

- 2,000 TYZ4 112/114.5 2x1 put spds over 118 calls ref 114-24

- 1,750 TUX4 104.5/104.75/105 call trees ref 104-09.62

- over 14,200 TYV4 115 calls, 4 ref 114-26.5

- 4,400 TYX4 116 calls, 25 ref 114-30 to -30.5

- 8,600 TYV4 114.25 puts ref 114-29.5 to -30

BONDS: EGBs-GILTS CASH CLOSE: OATs Underperform On Fiscal Concerns

Core European FI weakened slightly Friday, with OATs underperforming.

- Yields fell early in the session as equities pulled back. But they rose over most of the rest of the session, led by weakening OATs amid reports of negative fiscal developments in France.

- Yields closed off the highs on dovish comments by Fed Gov Waller just prior to the European cash close.

- BoE's Mann, a hawk, notably said that she contemplated a cut at August's meeting.

- In data, German PPI, Eurozone consumer confidence, and UK retail sales / public sector borrowing were all higher than consensus - no significant market impact however.

- The German and UK curves leaned bear steeper, but segments overall were mixed. OATs underperformed (10Y 2.1bp wider to Bunds). Periphery EGB spreads tightened modestly.

- Next week opens with flash September PMIs on Monday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.8bps at 2.23%, 5-Yr is up 1.3bps at 2.067%, 10-Yr is up 1bps at 2.208%, and 30-Yr is up 0.8bps at 2.509%.

- UK: The 2-Yr yield is up 0.5bps at 3.925%, 5-Yr is down 0.1bps at 3.744%, 10-Yr is up 1.2bps at 3.903%, and 30-Yr is up 0.9bps at 4.47%.

- Italian BTP spread down 1.2bps at 134.7bps / Spanish down 0.7bps at 78.9bps

EGB OPTIONS: Sizeable Put Spread Structures To Close A Busy Week

Friday's Europe rates/bond options flow included:

- DUX4 107.20/107.50 call spread paper paid 4.25 on 8K

- DUX4 107.00/107.30/107.70 broken c fly, bought for 4.25 in 4k

- OEZ4 120.50/121.50/122.50c ladder sold at 11 in 1.8k (ref 60, 7del).

- RXZ4 135.00/136.50/138.00c ladder sold at 17 in 2k (ref 41, 3del).

- RXZ4 136.50/138.50cs bought for 34 in 1k.

- RX (27th Sep) 132p, bought for 2 in 3k (weekly)

- ERX4 96.87/96.75 put spread vs. ERZ4 96.87/96.75 put spread, paper paid 1.5 on 20K, buying the Nov. 30K of that structure lifted over the past 2 sessions.

- ERX4/ERZ4 96.87/96.75ps spread, bought the Nov for 1.5 in 10k

- ERZ4 97.00/97.125/97.25c fly, sold at 2.25 in 10k

- ERF5/ERG5 97.25p calendar spread, bought for 1.5 in 5k total

- SFIX4 96.65/96.55/96.35p fly bought for 1.25 in 2k

FOREX: USDJPY Rises 1% on Cautious BOJ, Set to Close Around 144.00

- As expectations shifted towards the Fed potentially cutting by 50bps, lower core yields helped USDJPY trade below 140.00 on Monday, a new 14-month low for the pair. However, the ongoing positive sentiment for equities and a lack of momentum on the break of this psychological point prompted a firm recovery across the week. This culminated with the Bank of Japan decision on Friday, where Governor Ueda said the BOJ will be patient when adjusting policy. Accordingly, USDJPY rose back to a weekly high of 144.49 and trades around 144.00 as we approach the close.

- The dollar index trades moderately in the green Friday, however is half a percent lower on the week, broadly reflective of the FOMC’s bold 50bp rate cut, and an extension of the broader bearish technical trend seen across much of July and August. Bolstering this theme, positive sentiment in equity markets continues to weigh on the greenback.

- EURUSD has risen roughly 0.9% this week, on the back of the softer US dollar and the single currency’s large weighting within the dollar index. While the ECB have left all options on the table, markets are tilting heavily towards the central bank only cutting at a quarterly pace. This caution is underpinning the renewed bid for EURUSD, alongside the positive sentiment for risk overall. 1.1202, the Aug 26 high and the technical bull trigger are yet to be tested.

- A busy week for the pound where inflation data and the Bank of England decision were in focus. There was a marginally hawkish outcome with the MPC vote split and an ongoing cautious approach to the easing cycle has been underpinning GBP this week, which remains the best performing currency against the dollar this year. Stronger than expected retail sales data on Friday saw GBPUSD rise to 1.3340, a fresh trend high, and the highest level since March 2022.

- Eurozone PMI's kick off next week's economic calendar.

US STOCKS: Late Equities Roundup: Taking Profits Ahead Weekend, Energy Soars

- Stocks are trading modestly weaker late Friday, off lows on narrow session ranges, however, following surprisingly dovish comments from Fed Gov Waller on CNBC. Not surprisingly, profit taking weighed the day after S&P Eminis and the Dow climbed to new all time highs (5796.00 and 42,152.06 respectively) while Friday's triple witching index rebalancing elicited little reaction in the first half.

- In late trade, the DJIA trades down 21.32 points (-0.05%) at 42000.83, S&P E-Minis down 23 points (-0.4%) at 5754.5, Nasdaq down 74.3 points (-0.4%) at 17936.64.

- Utilities and Communication Services outperformed in the second half, energy companies supporting the former. Notably, Constellation Energy surged over 21% after announcing a restart of Three Mile Island reactors to supply energy for Microsoft data centers.

- Next up was Vistra +14.4% after acquiring full equity interest in Vistra Vision after purchasing four nuclear power plants earlier in the year. A distant third, NRG Energy gained 5.07% on the day.

- Meanwhile, Verizon +0.75%, Meta +0.59% and AT&T +0.49% led gainers in the Communication Services sector.

- On the flipside, Industrials and Materials sectors underperformed, air freight & transportation shares weighed on the former: Fedex falling over 14% after missing earnings expectations and poor outlook. Old Dominion -5.57%, JB Hunt Transportation -2.98%. Packaging and container shares weighed on the Materials sector: Smurfit WestRock -3.55%, International Paper -2.34%, Ball Corp -1.46% later in the second half.

EQUITY TECHS: E-MINI S&P: (Z4) Fresh All-Time High

- RES 4: 5868.50 1.00 proj of the Apr 19 - Jul 16 - Aug 5 price swing

- RES 3: 5818.12 0.50 proj of the Sep 6 - 17 - 8 minor price swing

- RES 2: 5800.00 Round number resistance

- RES 1: 5797.50 High Sep 19

- PRICE: 5758.50 @ 1502 ET Sep 20

- SUP 1: 5638.14 20-day EMA

- SUP 2: 5602.68 50-day EMA / 5424.75 Low Aug 13

- SUP 3: 5500.00 Round number support

- SUP 4: 5451.25 Low Sep 6 and a bear trigger

A bull cycle in S&P E-Minis remains in play and Thursday’s gains reinforce the current bullish condition. The contract has traded through a key and major resistance at 5785.00, the Jul 16 high and a bull trigger. A clear break of this hurdle would confirm a resumption of the long-term uptrend. Sights are on the 5800.00 handle next. First key support is 5602.68, the 50-day EMA. Initial support lies at 5638.14, the 20-day EMA.

COMMODITIES: Gold Rises To Fresh Record High, Crude Rises On Week

- Spot gold rose to a new all-time high of $2,625.8/oz on Friday, aided by dovish comments from the Fed’s Waller, before paring gains later in the session.

- The yellow metal is currently up 1.3% at $2,620/oz.

- Analysts at Quantix Commodities say that although a near-term pull-back in prices is possible, given extreme positioning, the beginning of a Fed easing cycle will undoubtedly be bullish for gold.

- From a technical perspective, having pierced initial resistance at $2,613.3 today, next resistance is seen at $2,642.7, the 2.236 projection of the Jul 25 - Aug 2 - Aug 5 price swing.

- Silver has also risen 1.2% today, to $31.2/oz, its highest level since July 17.

- The break of key short-term resistance at $30.192, the Aug 26 high, signals scope for an extension towards $31.754, the Jul 11 high.

- Crude markets have eased back on the day but are set for a net weekly gain of over 4%. Support follows an improved risk sentiment amid expectations that the Fed is confident of a soft landing for the US economy.

- WTI Oct 24 is down marginally at $71.9/bbl.

- The possibility of a further escalation of tensions in the Middle East hangs over the oil market following comments from the Israeli Defence Minister suggesting a ‘new phase’ in the war is imminent.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 23/09/2024 | 2300/0900 | *** |  | Judo Bank Flash Australia PMI |

| 23/09/2024 | 0645/0845 |  | ECB's Elderson at Real Estate summit | |

| 23/09/2024 | 0715/0915 | ** |  | S&P Global Services PMI (p) |

| 23/09/2024 | 0715/0915 | ** |  | S&P Global Manufacturing PMI (p) |

| 23/09/2024 | 0730/0930 | ** |  | S&P Global Services PMI (p) |

| 23/09/2024 | 0730/0930 | ** |  | S&P Global Manufacturing PMI (p) |

| 23/09/2024 | 0800/1000 | ** |  | S&P Global Services PMI (p) |

| 23/09/2024 | 0800/1000 | ** |  | S&P Global Manufacturing PMI (p) |

| 23/09/2024 | 0800/1000 | ** |  | S&P Global Composite PMI (p) |

| 23/09/2024 | 0830/0930 | *** |  | S&P Global Manufacturing PMI flash |

| 23/09/2024 | 0830/0930 | *** |  | S&P Global Services PMI flash |

| 23/09/2024 | 0830/0930 | *** |  | S&P Global Composite PMI flash |

| 23/09/2024 | 1000/1100 | ** |  | CBI Industrial Trends |

| 23/09/2024 | 1200/0800 |  | Atlanta Fed's Raphael Bostic | |

| 23/09/2024 | 1300/1500 |  | ECB's Cipollone statement on digital euro at Hearing | |

| 23/09/2024 | 1345/0945 | *** |  | S&P Global Manufacturing Index (Flash) |

| 23/09/2024 | 1345/0945 | *** |  | S&P Global Services Index (flash) |

| 23/09/2024 | 1415/1015 |  | Chicago Fed's Austan Goolsbee | |

| 23/09/2024 | 1530/1730 |  | ECB's Cipollone in panel discussion at House of the euros | |

| 23/09/2024 | 1530/1130 | * |  | US Treasury Auction Result for 26 Week Bill |

| 23/09/2024 | 1530/1130 | * |  | US Treasury Auction Result for 13 Week Bill |