-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Harker: Don't Cut Too Soon

- Short end Treasuries weaker on lower than expected weekly Claims, mixed flash-PMI data

- Philly Fed President Harker reiterates caution over cutting too soon

- Projected rate cuts continue to cool post data

- Chip stocks lead tech rally, new S&P Emini contract highs

Markets Roundup: Weekly Jobless Claims Lower Than Expected

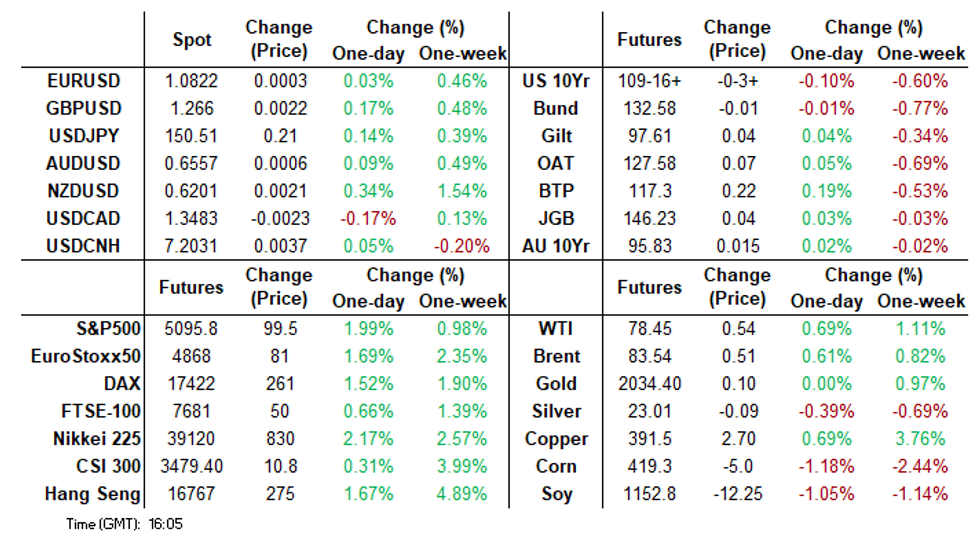

- Treasury futures holding mixed after the bell, short end to intermediates moderately weaker vs. Bonds. Treasury futures extended early lows after lower than expected Initial Jobless Claims (201k vs. 216k est) and Continuing Claims (1.862M vs. 1.885M est), Chicago Fed Nat Activity Index is lower (-0.30 vs. -0.22 est).

- Rates rebounded briefly following February flash PMI readings were mixed though on balance weaker than expected, signaling still-solid but slowing growth and potentially softer price pressures. Meanwhile, January existing home sales were roughly as expected, at 4.00mln (SAAR), vs 3.97mln expected and a 3.1% gain vs 3.88mln in December

- Well through technical support, Mar'24 10Y futures traded -10 at 109-10, technical support level at 109-05+ (Low Nov 28) to finish near 109-16.5 Thursday. Heavy volumes with TYH4 over 4.1M after the bell tied to surge in Mar'24/Jun'24 quarterly roll efforts. Curves bear flatten: 2s10s -3.329 at -38.281, 10Y yield +0.0080 at 4.3266%.

- Handful of Fed speakers still ahead: At separate events scheduled at 1700ET: Fed Gov Cook speaks at a macro-finance conference, MN Fed President Kashkari panel discussion on outlook, (Q&A, livestreamed). Later this evening, Fed Gov Waller Speaks on Economic Outlook (text, Q&A and livestreamed) at 1935ET.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00010 to 5.32093 (+0.00508/wk)

- 3M +0.00190 to 5.32383 (+0.00981/Wk)

- 6M +0.00924 to 5.25273 (+0.02157/wk)

- 12M +0.02614 to 5.02505 (+0.04715/wk)

- Secured Overnight Financing Rate (SOFR): 5.30% (+0.00), volume: $1.607T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $669B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $660B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $101B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $272B

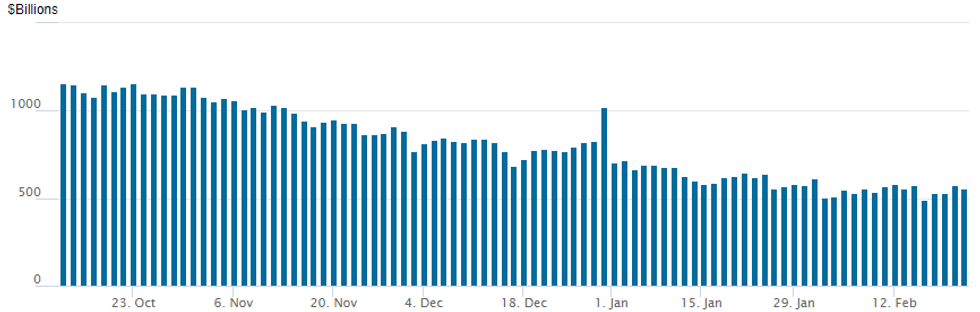

FED Reverse Repo Operation

- RRP usage recedes to $553.245B vs. 574.882B Wednesday; compares to $493.065B on Thursday, Feb 15 -- the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties falls back to 86 from 96 yesterday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury option flow appeared more mixed Thursday compared to the more one-way low delta put buying over the last several sessions. Heavy volumes saw continued low delta volume, to be sure, but also a pick-up in upside calls looking to fade the decline in the latest rate cut projections.

Underlying futures held weaker in the short end to intermediates as this morning's lower than expected weekly claims underscored policymakers concern over cutting rates too soon than too late as reiterated by Philly Fed Harker late Thursday.

Projected rate cut pricing remains soft compared to this morning's levels: March 2024 chance of 25bp rate cut currently -5.8% vs. -6.8% this morning w/ cumulative of -1.4bp at 5.314%; May 2024 at -23.5% vs. -27.7% earlier w/ cumulative -7.3bp at 5.255%; June 2024 -55.3% vs. -61.5% earlier w/ cumulative cut -21.1bp at 5.117%. Fed terminal at 5.33% in Feb'24.

- SOFR Options:

- Block, 30,000 SFRU4 95.25/95.43 call spds 5.75 on splits ref 95.19

- Block, 8,000 SFRH4 94.75 puts, 6.0 vs. 94.705/0.74%

- Block, 6,000 SFRH5 94.62/95.12 2x1 put spds, 1.5 net 2-legs over

- Block, 20,000 SFRU4 95.00/95.50/95.75/96.25 call condors, 13.0-12.5

- Block, 20,000 SFRJ4 94.62/94.75/94.81/94.93 put condors 5.0-4.0

- +5,000 SFRM4 94.81/94.93/95.00/95.12 call condors 3.25 ref 94.91

- +5,000 0QJ4 95.75 puts 11.5 vs. 96.01/0.30%

- +5,000 SRM4 95.00/95.25 call spds 5.5 vs. 9493/0.17%

- -10,000 0QH4 95.75/96.25 2x1 put spds 21.25 ref 95.80

- +5,000 SRJ4 95.25/95.75 call spds 1.75

- +5,000 0QH4 95.68/95.87 2x1 put spds 1x2 2.0 ref 95.78

- +2,000 SRM4 95.37/95.50/95.62 1x3x2 call flys .75

- +2,000 SFRM4 94.75/94.87/95.00 put fly w/

- +2,000 SFRM4 94.62/94.81/95.00 put fly strip, 5.5 total db

- -3,000 SRM4 94.93 straddles, 31.5 ref 9491.5

- -6,000 0QH4 95.62/96.25 2x1 put spds 32.0 vs. 95.78/0.20%

- -2,500 SRM4 94.75 puts 7.5 ref 9491.5

- +2,500 0QH4 95.31/95.43/95.56/95.68 put condors 2.5 vs. 95.80/0.05%

- +4,000 SRM4 94.93/95.12 put spds 12.25 over 95.50/95.68 call spd

- +5,000 SFRM4 95.25/95.50 call spds, 2.5

- Block, 5,000 SFRJ4 95.25/95.75 calls, 1.75 ref 94.915, 2k more in pit

- -10,000 SFRK4 95.06/95.18 call spds, 2.5 vs. 94.925/0.10%

- +10,000 SFRM4 95.50/96.00/96.50 call flys, 1.25

- +4,000 SFRK4 94.75 puts, 5.5 vs. 94.905/0.10%

- Treasury Options:

- +15,200 TYJ4 108.5 puts, 23 vs. 110-01/0.25%

- -5,000 TYJ4 110 straddles 1-50 in smaller lots

- Block, -10,400 TYH 107.5/109 put spds vs. +13,500 TYM4 107.5/109 put spds

- 15,000 TYH4 109/TYM4 108 put spds

- +4,000 TYJ4 111.5 calls 26 vs. 109-24/0.30%

EGBs-GILTS CASH CLOSE: Flattening Resumes As Short End Sinks

The German and UK curves resumed Thursday where they left off late Wednesday by flattening further, led by a short-end selloff.

- Downside in the session was initially seen following French PMI beats on both the Services and Manufacturing measures, though the German readings were more mixed with Manufacturing weaker than expected. UK PMIs were better than expected but unintuitively, Gilts rallied in the aftermath. The UK and Eurozone composites were both above expectations.

- Otherwise developments were limited: the accounts of the January ECB meeting brought no surprises, while the US PMIs were weak on balance they showed relatively steady growth.

- The short-end weakness was again led by central bank cut repricing. After 8bp of 2024 ECB cuts were priced out Wednesday, another 8bp was priced out Thursday, with 92bp of reductions now seen. For the BoE, 4bp was priced out today, bringing the 2-day retracement to 13bp at 63bp.

- The UK and German curves twist flattened on the day, with Bunds modestly underperforming Gilts. Periphery spreads tightened, led by BTPs, with elevated risk appetite evidenced by ongoing strength in equities.

- German data features early Friday, including the IFO survey; we also get ECB inflation expectations and multiple speakers including de Cos and Schnabel.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.1bps at 2.905%, 5-Yr is up 2.2bps at 2.448%, 10-Yr is down 1bps at 2.44%, and 30-Yr is down 3.3bps at 2.557%.

- UK: The 2-Yr yield is down 3.2bps at 4.602%, 5-Yr is up 1bps at 4.153%, 10-Yr is up 0.2bps at 4.105%, and 30-Yr is down 0.5bps at 4.63%.

- Italian BTP spread down 2.5bps at 147.5bps / Spanish down 1.3bps at 90.5bps

EGB Options More Bund Downside Eyed As Large Short-Term Profit Booked Thursday

Thursday's Europe rates/bond options flow included:

- RX 131/130ps, bought for 12 in 2k (weekly downside)

- RXH4 132.50/132.00ps sold at 26.5 in 15k (was bought Wednesday for 8.5)

- RXJ4 129.5/128ps, bought for 15.5 in 10.6k

- ERK4 96.50/96.62/96.75/96.87c condor vs 96.00p, bought the condor for 1.5 in 20k

FOREX: Greenback On Firmer Footing As US Yields Move Higher

- The USD index trades closed to unchanged on Thursday, having recovered from an initial 0.5% sell-off earlier in the session. The more optimistic backdrop for equities had initially placed pressure on the greenback, however, the move higher for US yields supported the greenback bounce.

- The most notable reversal has been seen in EURUSD, following some mixed PMI data in early European hours. Generally, the data fared better than expected, with the Eurozone and French figures topping forecast, and countering modest weakness in Germany manufacturing. EURUSD traded as highs as 1.0888 before a consistent grind back towards the 1.08 handle ensued.

- G10 FX implied vols extend recent lows, with EUR/JPY 6m implied nearing on 8 vol points and the lowest level since Feb'22. With lower vols tied to JPY weakness over the past 12 months, EUR/JPY has extended the YTD rally, putting the cross within range of key resistance at the bull trigger of the cycle high from late 2023 at 164.30.

- Indeed, USDJPY remained buoyant on Thursday and likely was supported by the higher core yields. Highs of 150.69 bring the pair ever closer to resistance at 1.5089, the Feb 13 high, before 151.43, the November 16 high.

- Higher equities continue to keep NZD as one of the best performing majors, extending its impressive run in recent days. NZDUSD now stands 2.5% above the Feb 14 lows, breaching the 50-day moving average in the process and breaching 0.6200 for the first time since Jan 16.

- New Zealand retail sales kick off the Friday docket, while Japan will be out for a national holiday. German final GDP and IFO sentiment data will cross in Europe, in an otherwise quiet data day to end the week.

FX Expiries for Feb23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0815-30(E1.5bln)

- USD/JPY: Y146.90-00($944mln), Y149.10-15($625mln), Y150.00($752mln)

Late Equity Roundup: Chip Stocks Lead Tech-Driven Rally

- Stocks remain strong late Thursday, IT sector helping SPX Eminis mark new contract highs (5107.75). Currently, S&P E-Minis are up 107.75 points (2.16%) at 5104.5, Nasdaq up 478.8 points (3.1%) at 16059.66, DJIA up 477.79 points (1.24%) at 39091.12.

- Leading Gainers: Information Technology and Consumer Discretionary sectors outperformed, semiconductor makers bounced back from midweek selling after Nvidia beat earnings late Wednesday on the back of continued AI demand: Nvidia +15.89%, Advanced Micro Devices +11.18%, Broadcom +6.32% and Applied Materials +5.45%.

- Meanwhile, broadline retailers buoyed the Consumer Discretionary sector: Amazon +3.45%, CarMax +2.66%, Home Depo +1.84%.

- Laggers: Utilities and Energy sectors retreated from midweek gains, multi energy providers supported the Utilities sector: AES Corp -2.9%, Dominion Energy -1.871%, DTE Energy -1.57%. Oil and gas services weighed on the latter: APA -3.96%, Kinder Morgan -1.23%, Diamond Back Energy -1.77%.

- Looking ahead: Corporate earnings after the close: EOG Resources, Copart Inc, BioMarin Pharmaceuticals, Insulet Corp, Intuit Inc, Carvana, Floor & Decor Holdings.

COMMODITIES WTI Crude Futures Set To Post Highest Close Since November

- WTI has softened from its intraday highs but remains on track for its highest close since early November. A lower-than-expected build in US crude stocks and Red Sea tensions have supported prices. WTI (APR 24) is up 0.8% at 78.57$/bbl.

- Houthi Leader Says Group Is Looking To 'Escalate' Red Sea Operations: Following earlier reports regarding an attack on a vessel in the Gulf of Aden.

- Key short-term resistance has been pierced at $78.52, the Feb 16 high - and a sustained clearance of this level would be a bullish development.

- For precious metals, the initial greenback weakness saw spot gold rise to $2035/oz before moderating into the close and remaining close to unchanged on the session.

- Investors are currently dramatically under positioned for a Fed cutting cycle and "we still expect gold prices to rally quite notably into the second quarter of this year", said a commodity strategist at TD Securities.

- Gold traded lower into mid-month, but is building well off lows and today pierced the 50-dma of $2031.71. Clearance here and above the Feb 1 high of $2065.50 would be required to reinstate a bullish theme, with the mid-month weakness proving corrective in nature.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/02/2024 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 22/02/2024 | 0035/1935 |  | US | Fed Governor Christopher Waller | |

| 23/02/2024 | 0700/0800 | *** |  | DE | GDP (f) |

| 23/02/2024 | 0800/0900 |  | EU | ECB's Lagarde and Cipollone in Eurogroup meeting | |

| 23/02/2024 | 0800/0900 |  | EU | ECB's Lagarde, de Guindos, and Cipollone in ECONFIN meeting | |

| 23/02/2024 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 23/02/2024 | 0900/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 23/02/2024 | 0920/1020 |  | EU | ECB's Schnabel lecture on Inflation fight at Bocconi | |

| 23/02/2024 | 1300/1400 |  | EU | ECB's Schnabel speech at Forum Analysis | |

| 23/02/2024 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/02/2024 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 23/02/2024 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 23/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.