-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA MARKETS ANALYSIS:Fed Harker Sees Path to Soft Landing

- MNI FED'S HARKER: DON'T EXPECT RATE CUTS 'FOR A WHILE'

- MNI HARKER SAYS HE DOES NOT EXPECT 'NO LANDING' SCENARIO

- MNI Fed Harker: "I do see us on the flight path to the soft landing"

- SAUDI REAFFIRMS COMMITMENT TO OPEC+ PRECAUTIONARY MEASURES, Bbg

US TSYS Philly Fed Harker Leans Dovish

- US rates remain strong after the bell, holding to a narrow range after scaling back early session support. No obvious headline driver, US markets appear to be following German Bund's lead (trading 133.45 high, through 133.11 50D EMA resistance).

- Bonds outperformed (USU3 +31 at 122-17 cs. 123-05 high) as curves reversed Monday's steepening: 3s10Y -9.678 at -142.744, 2Y10Y -6.185 at -74.160.

- No significant reaction noted from scant data (US JUN TRADE GAP -$65.5B VS MAY -$68.3B; US JUN WHOLESALE INV -0.5%; SALES -0.7%), with more of the same Wednesday.

- Philly Fed’s Harker (’23 voter) relayed earlier the Fed doesn’t want to overdo it with Fed tightening and we’ll start cutting rates sometime probably next year helps take the edge off an intraday climb in Fed implied rates.

- Harker broadly repeated the gist from his prepared remarks earlier today although the mention of cuts comes after similar comments from Williams yesterday, even if it is still consistent with the median dot from the June SEP pencilling in 5.5-5.75% for 4Q23 going to 4.5-4.75% for 4Q24.

- Strong upsized ($42B) 3Y note sale: trades 19bp through: 4.398% high yield vs. 4.417% WI; 2.9x bid-to-cover vs. 2.88x prior month.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00343 to 5.31240 (-.00784/wk)

- 3M -0.00215 to 5.36528 (-0.00530/wk)

- 6M -0.00172 to 5.42583 (-0.00836/wk)

- 12M -0.02124 to 5.31827 (-0.04408/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $106B

- Daily Overnight Bank Funding Rate: 5.32% volume: $273B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.349T

- Broad General Collateral Rate (BGCR): 5.28%, $576B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $566B

- (rate, volume levels reflect prior session)

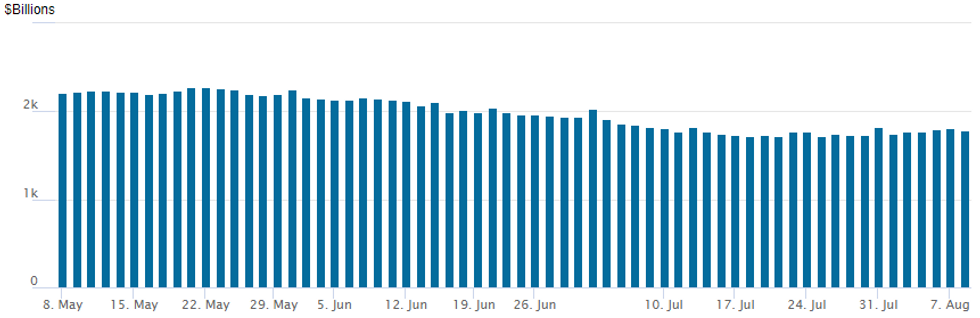

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The latest operation falls back to $1,778.351B, w/103 counterparties, compared to $1,810.583B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Solid FI option volumes Tuesday, focus on low-delta puts, put spreads carried over from overnight, some accounts taking advantage of underlying rally to buy cheaper puts. Rate hike projections through year end are mixed: Sep 20 FOMC is 12% w/ implied rate change of +3bp to 5.359%. November cumulative of +8.5bp at 5.414, December cumulative of 4.8bp at 5.377%. Fed terminal at 5.415% in Nov'23. Reminder: serial August options expire Friday.

- SOFR Options:

- Blocks, 10,000 SFRZ4 95.25/95.75/96.25 put flys, 6.5 net

- +8,000 SFRM4 93.00/93.75 put spds, 2.5 ref 95.31

- -5,000 SFRZ3 94.37/94.62 put spds, 9.5

- -2,500 SFRU4 95.75 straddles, 117.5

- 2,500 SFRZ3 99.25/99.75 put spds

- 4,500 3QU3 97.50 calls, 1.5 ref 96.635

- Block, 5,000 SFRZ4 93.25/94.25/95.25 put flys, 15.5 ref 96.085

- Block, 6,000 SFRV3 95.00/95.50/98.00 broken call flys, 0.75 net ref 94.66

- -19,000 SFRM4 94.00/95.00 2x1 put spds ref 95.34 to-.355

- Block, 5,000 OQU3 95.25/95.50/95.75 put flys, 6.0 vs. 95.78/0.10%

- 4,500 SFRU3 94.50 calls, 12 ref 94.605

- 3,000 SFRM4 94.00/95.00 2x1 put spds, ref 95.34

- 1,650 OQQ3 96.00/96.12/96.25 1x3x2 call flys ref 95.76

- 2,000 SFRH4 93.75/94.00/94.25 put flys

- Block, 2,000 OQZ3 95.25/96.00 3x2 put spds vs. 4,000 OQZ3 97.00 calls, 17.5 net/put spd over

- 3,000 OQZ3 95.75 puts ref 96.09

- 3,300 SFRF4 94.50 puts ref 94.955

- Block, 2,650 SFRZ5 95.00/95.50/96.00 put flys, 4.5 ref 96.55

- 1,500 OQU3 95.25/95.50/95.75 put trees, ref 95.755

- Block, 4,000 0QV3 95.62/95.87 put spds 8.5 vs. 96.08/0.15% vs.

- Block, 4,000 2QV3 96.12/96.37 put spds, 8.0 vs. 96.56/0.15%

- 2,000 2QQ3 96.25/96.50/96.75 call flys ref 96.54

- Tsy Options:

- 5,000 FVV3 107.75 puts ref 107-22.5

- 3,000 USU3 124.5 calls, 43 ref 122-17 to -19

- 2,000 TYU3 113/113.5 1x2 call spds, 9 net/2-leg over ref 111-14.5

- 5,000 TYU3 109.5/110 put spds

- over 11,700 TYU3 113 calls, 18-20 ref 111-22

- over 33,000 TYU3 109/110 put spds, 8-9 ref 111-15.5 to -18

- over 11,800 TYV 113 calls, 48-54 ref 111-31 to 112-03.5

- 2,500 TYU3 111.25 calls, 42 ref 111-14

- 1,000 USV3 114/116/117/119 put condors ref 123-03

- 1,250 USU3 119.5/123 put spds, ref 122-19

EGBs-GILTS CASH CLOSE: Bank Stock Drop Fuels Bull Flattening Rally

The German and UK curves bull flattened sharply, with Bunds outperforming Gilts in a risk-off move Tuesday.

- European bank stocks fell the most since March's turmoil (the index fell as much as 5%), amid a combination of Italy unexpectedly introducing a windfall tax on banks, and Moody's taking credit rating actions on US institutions.

- A further decline in inflation expectations in the ECB's monthly consumer survey added to the dovish tone for core FI.

- Yields bottomed out in early afternoon trade alongside a tentative stabilisation in Euro bank stocks, but the UK and German curves remained near their flattest levels of the session as the short-end underperformed the longer-end bounce.

- Periphery spreads were relatively well-behaved despite the risk-off tone, with the exception of Greece which widened for the 2nd consecutive session.

- Wednesday's schedule is basically vacant in terms of data and central bank speakers, with Thursday's US inflation figures remaining the focus of the week.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 6.9bps at 2.918%, 5-Yr is down 10.3bps at 2.487%, 10-Yr is down 13.2bps at 2.469%, and 30-Yr is down 14.4bps at 2.55%.

- UK: The 2-Yr yield is down 0.9bps at 4.954%, 5-Yr is down 3.5bps at 4.423%, 10-Yr is down 7.6bps at 4.385%, and 30-Yr is down 7.6bps at 4.58%.

- Italian BTP spread down 0.5bps at 165.5bps / Greek up 6bps at 133.7bps

EGB Options UK Rate Call Structure Buying Features Tuesday

Tuesday's Europe rates / bond options flow included:

- ERU3 96.25/96.375cs, bought for 2.5 in over 10k

- SFIZ3 94.60/94.80/95.00c fly bought for 1.75 in 17.5k total

- SFIZ3 94.50/94.60/94.70/94.80 call condor bought for 1.25 in 10k

- DUV3 105.60/105.90/106.20 call ladder, bought for half and 1 in 5k

- RXV3 124/122ps, bought for 4.5 in 6k. Recall Yesterday and last Thursday have seen buyer of the 126/124ps.

FOREX USD Index Edges off Highs, Remains Up 0.5%

- Late comments from Philly Fed’s Harker have helped curtail the greenback advance on Tuesday, emphasising that the Fed don’t want to overdo it with tightening. However, the USD remains solidly in the green, with markets taking note of a series of negative sector news for global banks, prompting a flight to quality across the currency complex.

- Moody's cutting their rating on the US Banking sector was compounded by a fresh Italian windfall tax on banking sector profits, significantly weighing on the EuroStoxx50 Bank Index. Risk sensitive currencies such as AUD, NZD and CAD all had meaningful sell-offs across the European time zone before moderately stabilising throughout US hours.

- AUDUSD declined as much as 1.15%, briefly trading below 0.6500 for the first time since June 01, before bouncing around 30 pips ahead of the APAC crossover. The greenback advance was most noticeable against Scandi FX in G10, with both the SEK and NOK declining by over 1%.

- Similar reverberations were sent through to EMFX, with the likes of ZAR and PLN being hit the hardest. Notably, USDZAR has extended its rise in August to around 6%. However, lower yields in the US, buffered by Harker’s remarks have offered some relief for Latin American currencies, which are rebounding into Tuesday’s close.

- Underlying dollar strength worked in favour of USDCNH (+0.48%), placing the pair briefly above the first upside technical level of 7.2457 - the 76.4% retracement for the July downleg. After disappointing trade figures overnight, the data turns focus to July inflation due Wednesday, with CPI seen dropping 0.4% and PPI at -4.0%. A miss on forecast is sure to reignite speculation of further stimulus.

- Elsewhere, global markets remain firmly focused on Thursday’s US CPI data for July.

FX Expiries for Aug09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0890-05(E1.5bln), $1.0930-45(E622mln)

- USD/JPY: Y141.00($1.1bln), Y141.30-50($1.2bln), Y142.00($1.4bln), Y142.35-45($1.1bln), Y142.75($1.7bln), Y143.00($2.2bln), Y144.50($731mln), Y145.00($1.5bln)

- GBP/USD: $1.2600(Gbp675mln)

- USD/CAD: $1.3385($626mln)

Late Equity Roundup: Financials Paring Losses

- Still weaker, SPX continues to inch off four week lows tapped in late morning trade. Financial shares that had lead the sell-off have recovered slightly, replaced by Consumer Discretionary, Materials and Information Technology stocks.

- Overnight, headlines reported Italy announced a "40% levy on the extra profits of lenders for 2023". European bank weakness spilled over to US, while ratings agency Moody's lowered the credit ratings of 10 regional banks. As a result, SPDR S&P regional banking ETF, KRE, gapped from appr 49.085 high late Monday to a 46.85 low after the ETF resumed trading overnight.

- Currently, DJIA shares are down DJIA down 150.52 points (-0.42%) at 35321.79, S&P E-Mini futures down 21 points (-0.46%) at 4516.25, Nasdaq down 120.2 points (-0.9%) at 13872.58.

- Laggers: Container makers weighed on Materials sector: Sealed Air -7.55% after beating earnings est late Monday while the stock underperformed it's peers; Ball Corp -2.2%, Amcor -2.1%. The Consumer Discretionary sector was weighed down by online retailers: Etsy -2.9%, Amazon -1.95%, Best Buy -1.45%. Meanwhile, chip makers weighed on IT: AMD -3.1%, Micron and Monolithic Power both -2.45% while Analog Devices slipped over 2%.

- Leading gainers: Health Care, Energy and Utility sectors continued to outperform. Pharmaceuticals and Biotech shares buoyed Health Care and outpaced weaker equipment and service providers: Eli Lily up a whopping 14% after beating earnings/sales estimates on strong performance of an obesity medication. Energy shares rebounded as crude bounced off midday lows (WTI +1.0 at 82.94 vs. 79.98 low), APA +2.6%, Volero +2.0% Marathon +1.75%.

E-MINI S&P TECHS: (U3) Sights Are On The 50-Day EMA

- RES 4: 4704.27 3.0% 10-dma envelope

- RES 3: 4675.96 Bull channel top drawn from the Mar 13 low

- RES 2: 4670.58 2.00 proj of the Jun 26 - 20 - Jul 7 price swing

- RES 1: 4593.50/4634.50 High Aug 2 / Jul 27

- PRICE: 4508.50 @ 14:23 BST Aug 8

- SUP 1: 4493.75 Low Aug 4

- SUP 2: 4457.21 50-day EMA

- SUP 3: 4429.37 Bull channel base drawn from the Mar 13 low

- SUP 4: 4411.25 Low Jul 10

Bearish conditions in the E-mini S&P contract remain intact. Last week’s sell-off reinforced a bearish threat and resulted in a break of support at the 20-day EMA. The recent failure at the top of the bull channel also highlights a bearish development and the risk of an extension lower near-term. Further downside would open 4457.21, the 50-day EMA. First key resistance is at 4634.50, the Jul 27 high.

COMMODITIES A Day Of Two Halves For Crude, Gold Sees One Directional Decline

- Crude oil has seen two clear trends today, first sliding with risk off after Moody’s US bank downgrades and softer China data including oil imports falling 19% from June levels to a six-month low.

- The subsequent turnaround has been helped by a stabilisation and then increase in equities and the USD index falling back from the day’s highs, whilst some attribute the more recent bid in crude to Zelenskiy saying Ukraine is to pick targets if Russia blocks ports.

- In other oil news, a western section of the Druzhba pipeline has been fully repaired after a leak and flows were restored on Monday evening. Saudi Arabia’s Council of Ministers today reaffirmed the Kingdom’s committed to strengthen the precautionary efforts of OPEC+ countries aimed at supporting the stability of oil markets, including the extension of the voluntary crude oil output cut of 1mbpd into September according to SPA.

- WTI is +1.1% at $82.88 off a low of $79.90, moving back closer to resistane at $83.59 (Nov 7, 2022 high). The day’s most active strikes in the front CLU3 have by far been $80/bbl puts, followed by $85/bbl calls in above half the volume.

- Brent is +1.0% at $86.17 off a low of $83.32, coming close to yesterday’s high of $86.73 after which lies the pyschological $90/bbl.

- Gold is -0.6% at $1924.98 as USD strength provides a strong headwind to build on yesterday’s drop for the yellow metal.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/08/2023 | 0130/0930 | *** |  | CN | CPI |

| 09/08/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/08/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/08/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/08/2023 | 1230/0830 | * |  | CA | Building Permits |

| 09/08/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 09/08/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.