-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Prepared to Hike if Appropriate

- MNI FED CHAIRMAN POWELL: 'PREPARED TO RAISE RATES FURTHER IF APPROPRIATE'

- MNI PHILLY FED HARKER: CAN'T SEE RATE CUTS UNTIL NEXT YEAR AT EARLIEST

- MNI OIL: Marathon In Process Of Shutting Garyville Refinery

- UAW workers overwhelmingly vote to authorize strikes at GM, Ford, Stellantis, CNBC

- BOEING READIES 737 MAX CHINA DELIVERY RESTART AFTER FOUR YEARS, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

Tsys Off Lows, Chair Powell Tone Balanced At Jackson Hole

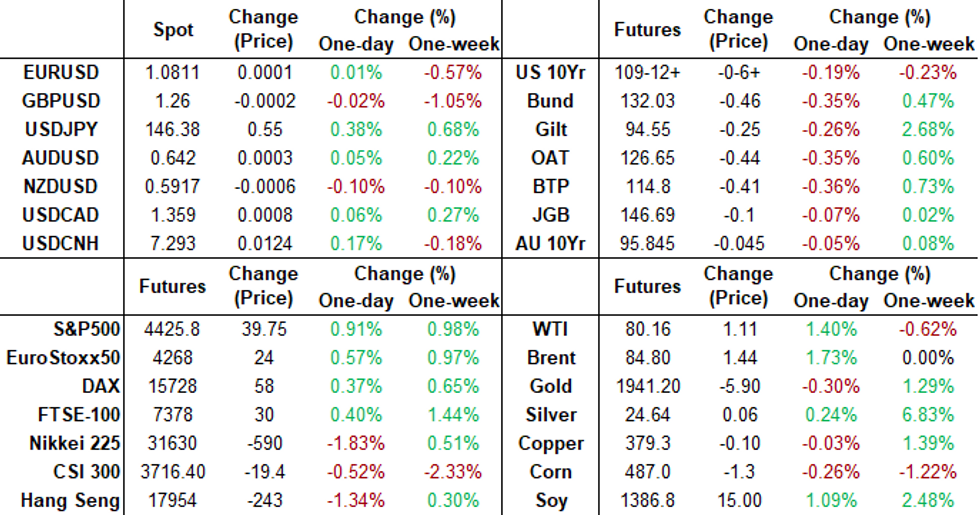

- US rates are holding mildly weaker after the bell, near the middle of the session range after early event driven volatility. Treasury futures initially trade weaker/extend lows in reaction to Fed Chairman Powell's keynote speech from Jackson Hole economic summit, and just as quickly reversed course.

- Stocks are trading firmer in late trade, headed back near early session highs as Fed Chairman Powell's speech from Jackson Hole deemed more balanced, or at the least: not as hawkish as it could have been.

- “We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective,” Powell said in his widely awaited Jackson Hole speech. “There is substantial further ground to cover to get back to price stability.”

- Powell said he’s pleased to see inflation coming down but is not yet fully convinced that price pressures are on a sustainable path downward to the Fed’s 2% target, particularly because inflation excluding food and energy prices remains more than twice that level.

- Front month 10Y futures marked 109-03.5 low (-15.5) are currently trading 109-13.5 after tapping 109-23 briefly this morning. Heavy futures volume by the close (TYU3>3.6M) due to a surge in quarterly futures rolls from Sep to Dec ahead next Thursday's First Notice. Sep'23 Treasury options expiration also added to heavy volumes.

- Slow start to the week ahead -- culminates with the latest employment data for August next Friday.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00859 to 5.32883 (+.01456/wk)

- 3M +0.01599 to 5.40389 (+0.02072/wk)

- 6M +0.02230 to 5.46731 (+0.02277/wk)

- 12M +0.03627 to 5.41166 (+0.02828/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $105B

- Daily Overnight Bank Funding Rate: 5.31% volume: $267B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.344T

- Broad General Collateral Rate (BGCR): 5.28%, $561B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $553B

- (rate, volume levels reflect prior session)

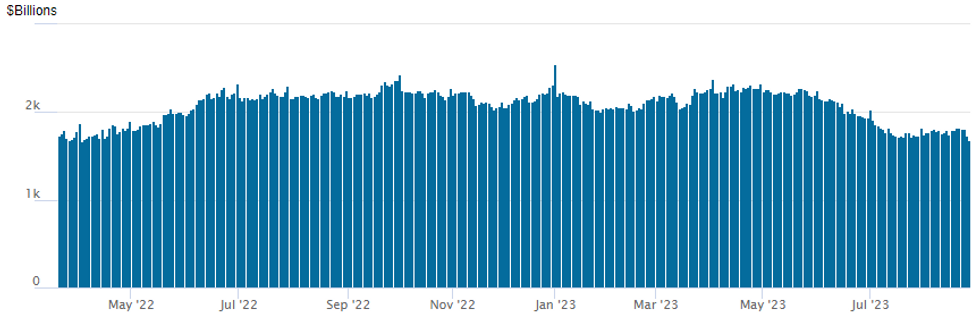

FED REVERSE REPO OPERATION: March 2022 Lows

NY Federal Reserve/MNI

Repo operation falls to $1,687.379B w/94 counterparties, the lowest since early April 2022, compared to $1,731.623B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

FI option desks reported better SOFR call structure trade on net Friday, fading weaker short end rates following Chairman Powell's balanced "stay the course" speech from Jackson Hole. Sporadic put fly buying as rate hike projections through year end are inched higher were also reported. In late trade, Sep 20 FOMC is 21% w/ implied rate change of +5.2bp to 5.381%. November cumulative of +15.7bp at 5.486, December cumulative of 15bp at 5.479%. Fed terminal climbed to 5.485% in Nov'23-Dec'23 Fed Funds.

- SOFR Options:

- +35,000 SFRZ3 94.68/94.81/94.93 call flys, 0.5 ref 94.54

- +25,000 SFRZ3 94.75/94.87 call spds 1.0 (+100k from 1-1.25 yesterday)

- Block, 20,000 SFRV3 94.25/94.43/94.62 put flys, 2.75 ref 94.51

- 3,000 SFRM4 96.00/97.00 call spds

- 2,000 SFRV3 94.25/94.50 2x1 put spds

- Block, 8,000 SFRM4 97.00/97.50 call spds 3.0 vs. 94.925/0.05%

- 4,000 SFRZ3 94.43/94.50/94.56/94.62 put condors

- Block/screen, 10,000 SFRU3 94.93 calls, .5 vs. 94.557/0.2%

- 5,000 SFRU3 94.37/94.50 put spds ref 94.5575

- 5,000 SFRZ3 94.12/94.25/94.31/94.43 put condors ref 94.54

- 4,600 SFRH4 97.87 calls, 2.5 ref 94.69

- 3,000 SFRH4 94.50 puts ref 94.685 to -.69

- 14,900 SFRH4 95.25 calls vs. SFRH4 94.5/94.75 put spds ref 94.70

- Block/screen, 5,300 SFRZ3 94.56/94.62/94.68/94.75 call condors 2.0 vs. SFRH4 94.56/94.68/94.75/94.87 call condors 2.5

- 4,000 SFRZ3 94.25/94.37/94.50 put flys ref 94.55

- Treasury Options: Mostly squaring/rolling in Sep'23 options that expire tonight.

- 8,700 TYU3 111 puts, 146-143 ref 109-08.5 to -10.5

- over 25,400 TYU3 110 calls 2-3 (8k tied to call fly earlier)

- over 4,100 FVZ3 104.75 puts, 38 ref 105-30.5 to -30.25

- 1,500 TYU3 110.25/110.5/110.75/112.25 broken call condors ref 109-07

- 4,000 TYU3 109.75/110/110.25 call flys

- 3,000 TYU3 108.5/109 put spds, 4

- 4,200 FVU3 105.75 calls, 9 ref 105-22

- 3,000 FVU3 106 puts, 22 ref 105-23.5

- over 5,000 USU3 118.5 puts ref 119-25

EGBs-GILTS CASH CLOSE: Curves Flatter To End The Week

UK and German yields reversed higher in late Friday trade in a flattening move. Periphery spreads closed slightly wider.

- Limited data flow in the morning was largely brushed aside (including a soft German IFO), with some attention on various ECB sources articles - MNI's ("ECH Mulls September Hawkish Pause, August CPI Key") pointed to the Sept 15 rate decision remaining in the balance.

- The main focus was Fed Chair Powell's Jackson Hole speech. It was hawkish but no moreso than the central bank's existing tightening bias would suggest, and the immediate reaction was a drop in yields. This reversed soon thereafter though, led by Treasuries which began to price in a slightly more hawkish Fed path.

- The UK curve twist flattened, with Germany's bear flattening.

- Attention turns to ECB's Lagarde who speaks at Jackson Hole after the market close (2100CET). Next week's focus will be Eurozone CPIs which will help shape the hold vs hike debate at the September ECB meeting.

- BoE's Broadbent will participate in a Jackson Hole panel Saturday on the topic of "Globalization at an Inflection Point." UK markets will be closed on Monday for a holiday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.7bps at 3.035%, 5-Yr is up 7.5bps at 2.587%, 10-Yr is up 4.8bps at 2.561%, and 30-Yr is up 4.4bps at 2.662%.

- UK: The 2-Yr yield is up 4.9bps at 5.022%, 5-Yr is up 4.2bps at 4.516%, 10-Yr is up 1.5bps at 4.441%, and 30-Yr is down 0.8bps at 4.639%.

- Italian BTP spread up 2bps at 168bps / Spanish up 0.2bps at 102.9bps

EGB Options: Mixed Rates Trade Pre-Jackson Hole

Friday's Europe rates / bond options included:

- DUU3 105.2/105.1/105p fly sold at 4 in 2.5k

- ERV3 96.00p, bought for 4.25 in 4.6k

- ERV3 96.12/96.25/96.62 broken c fly, bought for 2.75 in 3.5k

- ERU3 96.12/96.00ps 1x2, sold at 2.25 in 4.5k total.

- ERU4 98/99/99.50 broken call fly, bought for 5.5 in 5k

FOREX USDJPY Prints Fresh 2023 Highs At 146.63

- Despite some volatility in the aftermath of Fed Chair Powell’s Jackson Hole speech on Friday, the USD index remains close to unchanged on Friday, as we approach the week’s close. Slightly higher front-end yields in the US have placed some moderate downward pressure on the Japanese yen, prompting USDJPY to post a fresh yearly high at 146.63.

- With Jerome Powell providing little surprising information for markets, the USD completed a volatile spin cycle before general strength saw the DXY move to fresh trend highs just below 104.50. USDJPY briefly pierced a key short-term resistance level between 146.56/59, representing the August highs and the high dating back to November 10, 2022 before the lower than expected US October CPI data. However, with momentum waning ahead of the weekend, the pair settled back around 146.30.

- Overall, the uptrend in USDJPY remains intact and the latest pullback appears to have been a correction. Moving average studies are in a bull mode condition, highlighting an uptrend. The focus above will be on 147.49, a Fibonacci projection. Support to watch moves up to 144.39, the 20-day EMA.

- The Euro faced selling pressure through Asia-Pac hours and across the European open, resulting in a break below the key 200-dma support of 1.0804 (last broken below in Jun'21). EUR/USD then tested the base of the bull channel drawn off the March lows at 1.0769, before reverting to the 1.0800 mark ahead of this afternoon’s main event. In similar vein, a test of session lows following Powell’s speech was once again well supported and the pair slowly edged back above the 1.0800 handle once more ahead of the close.

- It is worth noting there is a UK bank holiday on Monday and the key data point next week will be the release of US non-farm payrolls on Friday.

FX Expiries for Aug28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0745-50(E609mln), $1.0790-00(E1.5bln), $1.0825(E833mln), $1.0850(E632mln), $1.0900(E1.5bln)

- USD/JPY: Y146.50($701mln), Y147.00($656mln)

- EUR/GBP: Gbp0.8555-65(E591mln)optio

- AUD/USD: $0.6410-25(A$2.6bln)

- USD/CNY: Cny7.1500($1.4bln), Cny7.2500($1.6bln), Cny7.3000($2.0bln)

Late Equity Roundup: Energy, Autos Outperforming

- Stocks are trading firmer in late trade, headed back near early session highs as Fed Chairman Powell's speech from Jackson Hole deemed more balanced, or at the least: not as hawkish as it could have been.

- Currently, S&P E-Mini futures are up S&P E-Mini Future up 35.75 points (0.82%) at 4421.5, DJIA up 285.69 points (0.84%) at 34388.12, Nasdaq up 138.8 points (1%) at 13601.42.

- Leading gainers: Energy, Consumer Discretionary and Industrials led in late trade, the former underpinned by a rebound in crude from late session reversal (WTI +.98 at 80.03): Valero +4.1%, Devon Energy +3.85%, Exon Mobil +2.15%. Autos buoyed discretional sector: Tesla +3.45%, Ford +1.8%, while parts makers Aptiv gained 1.8%, BorgWarner +1.4%.

- Laggers: Communication Services and Materials sectors continued to unwind early-midweek gains: Warner Brothers -3.1%, Meta -2.6, Paramount -1.15%. Metals and mining shares weighed on Materials: Newmont Corp -1.45%, Freeport McMoRan -.25%.

- Technicals: Thursday's sell-off in the E-mini S&P contract reinforces a bearish theme and signals the end of the recent corrective bounce between Aug 18 - 24. The focus turns to support at 4350.00, the Aug 18 low and bear trigger. A break would confirm a resumption of the current bear cycle. On the upside, resistance to watch is 4499.37, the base of a bull channel that was breached last week. The channel is drawn from the Mar 13 low.

E-MINI S&P TECHS: (U3) Former Bull Channel Base Provides Resistance

- RES 4: 4593.50/4634.50 High Aug 2 / Jul 27 and key resistance

- RES 3: 4560.75 High Aug 4

- RES 2: 4517.75 High Aug 15

- RES 1: 4499.37 Former bull channel base drawn from Mar 13

- PRICE: 4425.50 @ 1515 ET Aug 25

- SUP 1: 4350.00 Low Aug 18 and a bear trigger

- SUP 2: 4344.28 38.2% retracement of the Mar 13 - Jul 27 bull cycle

- SUP 3: 4305.75 Low Jun 8

- SUP 4: 4254.62 50.0% retracement of the Mar 13 - Jul 27 bull cycle

A sharp sell-off yesterday in the E-mini S&P contract reinforces a bearish theme and signals the end of the recent corrective bounce between Aug 18 - 24. The focus turns to support at 4350.00, the Aug 18 low and bear trigger. A break would confirm a resumption of the current bear cycle. On the upside, resistance to watch is 4499.37, the base of a bull channel that was breached last week. The channel is drawn from the Mar 13 low.

COMMODITIES Crude Reveres Swift Decline But Can’t Prevent Weekly Loss

- Crude oil reversed a sharp decline in the second half of the session, leaving it back with gains seen through London trade as tightness in global supply continues to provide some support.

- The sharp decline could have been linked to Marathon shutting its Garyville refinery (even if news of the fire was report hours before) and the Brent-WTI spread has drifted wider to $4.69, but speed of the retracement suggests potentially some positioning adjustments at play as well.

- Most recently, Baker Hughes data showed the US rig count falling to a fresh eighteen-month low, down 10 to 632 (oil 8, gas 2) for its 16th weekly decline in 17 weeks.

- Earlier, Turkey is looking to broker a deal with the central Iraqi government and the Kurdistan Regional Government (KRG) to restart exports via the Ceyhan pipeline, according to Bloomberg.

- Iran and the US seem to have produced an informal arrangement on oil flows despite no return yet to their lapsed nuclear agreement according to Bloomberg.

- Deep OPEC production cuts and strong product demand are supportive of tighter balances and stronger prices in the second half of the year according to a Morgan Stanley client note.

- WTI is +1.0% at $79.84 and remained above support at $77.48 (50-day EMA) despite its intraday slide. Resistance is seen at $81.75 (Aug 21 high).

- Brent is +1.4% at $84.54, holding above support at $81.75 (50-day EMA) whilst resistance remains at $85.86 (Aug 21 high).

- Gold is -0.2% at $1913.12 although is recovering as the USD gives back some its earlier gains. The trend outlook remains bearish with support at $1897.7 (Aug 23 low) although breach of resistance at the 20-day EMA this week sees resistance at $1931.4 (50-day EMA).

- Weekly moves: WTI -1.7%, Brent -0.3%, Gold +1.3%, US nat gas -0.5%, EU TTF nat gas -4.5%.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/08/2023 | 0130/1130 | ** |  | AU | Retail Trade |

| 28/08/2023 | 0800/1000 | ** |  | EU | M3 |

| 28/08/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 29/08/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 29/08/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 29/08/2023 | 0600/0800 | *** |  | SE | GDP |

| 29/08/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/08/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 29/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/08/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 29/08/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 29/08/2023 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 29/08/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 29/08/2023 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 29/08/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 29/08/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 29/08/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 29/08/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 29/08/2023 | 1430/1530 |  | UK | DMO Quarterly Investor/GEMM Consultation Meetings |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.