-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Monday, December 9

MNI ASIA MARKETS ANALYSIS: Fed Wary of Cutting Too Soon

- Treasuries hold near lows after January FOMC Minutes

- FOMC expressed concern of cutting rates too soon vs. waiting too long

- Federal Reserve saw risk of inflation progress could stall

- Treasuries market session low after poor 20Y bond sale tailed 3.3bp

US TSYS Markets Roundup: Measure Twice, Cut Once

- Treasury futures drifting near late session lows after briefly paring losses as markets digested the January FOMC minutes. Focus on policy maker concern of cutting rates too soon vs. waiting too long took precedent as rates clung near lows.

- Mar'24 10Y futures currently -8.5 at 109-21.5, vs 109-18 low; initial technical support of 109-17/16+ (50.0% of Oct 19 - Dec 27 climb / Low Feb 14) earlier to 109-15 low. Resistance above at 110-17.5 (Feb 15 high). Curves mildly flatter: 2s10s -0.163 at -34.063, 10Y yield +0.0394 at 4.3147%.

- Large flattener Block posted at 1032:32ET adding to dip in the short end to intermediates: -35,000 TUH4 102-01.38, post time offer, DV01 $1,337M vs. +14,500 UXYH4 113-25.5, buy through 113-23 post time offer, DV01 $1.328M.

- Projected rate cut pricing are consolidating from this morning's levels: March 2024 chance of 25bp rate cut currently -6.8% vs. -9.6% earlier w/ cumulative of -1.7bp at 5.312%; May 2024 at -26.6% vs. -30.0% w/ cumulative -8.3bp at 5.245%; June 2024 -60.5% vs. -64.9% w/ cumulative cut -23.5bp at 5.094%. Fed terminal at 5.33% in Feb'24.

- An hour prior to the minutes, Treasury futures gapped lower after $16B 20Y bond auction (912810TZ1) drew a large tail: 4.595% high yield vs. 4.562% WI; 2.39x bid-to-cover vs. prior month's 2.53x

- Limited reaction, if any to data (MBA Mtg Apps -10.6%) nor Fed speak. Boston Fed Collins fireside chat (no text, Q&A) later this evening at 0730ET.

- Corporate earnings after the close: Nvidia, Synopsys, Etsy, APA Corp, Rivian Automotive, Ansys Inc, Lucid, Marathon Oil.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00075 to 5.32103 (+0.00518/wk)

- 3M -0.00381 to 5.32193 (+0.00791/Wk)

- 6M -0.02292 to 5.24349 (+0.01233/wk)

- 12M -0.05058 to 4.99891 (+0.02101/wk)

- Secured Overnight Financing Rate (SOFR): 5.30% (+0.00), volume: $1.610T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $673B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $664B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $104B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $280B

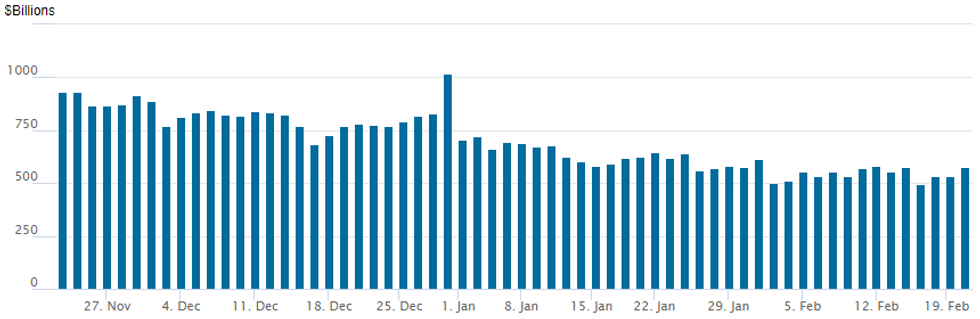

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $574.882B vs. 530.879B Tuesday; compares to $493.065B on Thursday, Feb 15 -- the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties climbs to 96 from 90 yesterday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY: Put Buys Peg Fed Rate Cut Reticence

SOFR and Treasury options continued to rotate around low-delta put, put skew plays Wednesday as well as some chunky vol sales (over 20k SFRZ4 94.75/95.25 strangles) in the lead-up to the January FOMC Minutes release. Policymakers expressed more concern with cutting rates too soon than too late.

The rise in yields post-minutes saw projected rate cut pricing consolidate from this morning's levels: March 2024 chance of 25bp rate cut currently -6.8% vs. -9.6% earlier w/ cumulative of -1.7bp at 5.312%; May 2024 at -26.6% vs. -30.0% w/ cumulative -8.3bp at 5.245%; June 2024 -60.5% vs. -64.9% w/ cumulative cut -23.5bp at 5.094%. Fed terminal at 5.33% in Feb'24

- Block, 6,000 SFRZ4 94.75/2QZ4 95.50 3x2 put spds. 2.0 net

- Block, +5,000 SFRM4 94.62/94.75/94.87/95.00 put condors, 3.75 ref 94.945

- -22,000 SFRZ4 94.75/95.25 strangles, 69.0 vs. 95.585/0.44%

- Block, 5,000 SFRH5 94.62/95.12 2x1 put spds, 1.0 2-legs over

- -10,000 SFRM4 96.00/97.00 call spds 1.5

- -16,000 SFRH5 94.62/95.12 2x1 put spds, .25 ref 95.92

- +12,000 0QH4 95.93/96.43 1x2 call spds, 9.75 vs. 95.92/0.24%

- 3,500 SFRZ4 98.00/98.25/98.50/99.00 call condors ref 95.64

- 3,000 SFRK4 95.00/95.12 put spds

- 2,000 SFRK4 94.87/95.00/95.12 put trees ref 98.98

- Block 8,000 SFRM4 94.81/94.93/95.00/95.12 call condors, 3.25 ref 94.98

- 7,000 SFRH4 94.75/94.81/94.87 put flys ref 94.7155

- -4,000 SFRU4 95.00/95.12 put spds, 5.0 ref 95.315

- 4,000 SFRM4 95.00 puts ref 94.98

- +2,500 SFRM4 94.87/94.93/95.00/95.06 put condors, 1.25

- Block, +4,500 SFRM4 94.62/94.87/95.00/95.12 broken put condors, 0.75 net vs. 94.985/0.12%

- 1,500 SFRH4 97.50/98.25/99.00 call flys ref 94.7125

- -10,000 USK4 115/120 call over risk reversals, 7 vs. 117-26

- 2,300 TYK4 108/110 2x1 put spreads 13

- +4,750 TYH4 111 combo, 62 net/put over vs. 110-01/100%

- -3,000 TYH4 108.75/109.5/110.5 broken put trees, 32 vs. 109-30.5/0.50%

- +2,500 TYJ4 107.5/110 put spds vs. TYJ4 113 calls, 22 net ref 110-15.5

EGBs-GILTS CASH CLOSE: Afternoon Sell-Off Sees Curves Bear Flatten

European curves bear flattened Wednesday, with core instruments selling off toward the end of the session.

- Bunds and Gilts began the day on the back foot but had yields dipped by midday - all within prior session's ranges. But from midday London time through the cash close, yields rose steadily, with bear flattening evident as the 2Y segment underperformed.

- The short-end move came alongside a fairly sharp repricing out of rate cut expectations: 2024 ECB implied reductions were pared to 100bp from 108bp at midday; the BoE equivalent shifted to 67bp from 74bp.

- Alongside the more hawkish central bank repricing, periphery spreads closed wider to Bunds, reversing earlier tightening.

- The afternoon move couldn't be pinned on any particular development. BoE MPC's Dhingra maintaining a dovish outlook at an MNI event, and Eurozone flash consumer confidence data coming in exactly in line with expectations.

- While ECB's Wunsch noted in an interview that "it may be too early to get our hopes up" on inflation and rate cuts, those comments were not out of line with his previous views and were published well after the rate selloff had begun.

- Attention early Thursday will be on flash February PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 8bps at 2.854%, 5-Yr is up 8.1bps at 2.426%, 10-Yr is up 7.7bps at 2.45%, and 30-Yr is up 5.5bps at 2.59%.

- UK: The 2-Yr yield is up 7.7bps at 4.634%, 5-Yr is up 8bps at 4.143%, 10-Yr is up 6.2bps at 4.103%, and 30-Yr is up 4.3bps at 4.635%.

- Italian BTP spread up 1.3bps at 150bps / Spanish bond spread up 0.9bps at 91.8bps

EGB Options: Near-Term Downside, Longer-Term Upside In Bunds Seen Wednesday

Wednesday's Europe rates/bond options flow included:

- RXH4 132.50/132.00ps, bought for 8.5 in 15k (expiry Friday)

- RXJ4 137c, bought for 13.5 up to 14 in 5.5k

- OEM4 119.50/122.50/125.50c fly bought for 35.5 in 5k

- ERJ4 96.37/96.12ps 1x2, bought for 5.25 in 4k

- ERU4 97.00/97.25/97.37 broken c fly, bought for 4.5 in 5k

FOREX Higher US Yields and FOMC Minutes Fail To Impact Greenback

- Despite the shift higher for US yields on Wednesday, the USD index has traded in a very narrow range. With treasuries extending lows following the latest 20-year auction tailing, the greenback traded moderately into the green ahead of the FOMC minutes, however, topside momentum failed to materialise.

- Moves this afternoon have been most noticeable through USDJPY, which improved its intra-day recovery to around 50 pips, closing in on yesterday’s highs located at 150.43. A brief uptick on the FOMC minutes quickly retraced, with the pair hovering around 150.20 ahead of the APAC crossover. USDJPY bulls will focus on 1.5089, the Feb 13 high, before 151.43, the November 16 high.

- Mixed performance across G10, with most ranges remaining contained. NZDUSD remains in positive territory and extends a noteworthy run of consecutive wins. Modest outperformance is likely thanks to strong demand at the latest long end NZGB syndication (which is usually dominated by offshore investors). NZDUSD saw support and rose closer to the 0.6200 mark, as well as tipping AUD/NZD toward the YTD lows of 1.0586.

- For emerging market FX, it is worth highlighting that one-month implied volatility for USDMXN sank to near 8.5%, the lowest level since mid 2021. Furthermore, one-month implied volatility on Brazilian real options has dipped to 9.2%, the lowest since 2014, potentially highlighting the reduced levels of embedded risk premium which reports suggest should particularly pop up on foreigners’ radar.

- Focus turns to Thursday’s release of European Flash PMIs, as well as final readings for Eurozone CPI. Canadian retail sales will also cross alongside US jobless claims. US Flash PMIs and existing home sales rounds off the docket.

FX Expiries for Feb22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0730-50(E1.2bln), $1.0770-85(E1.7bln), $1.0870-80(E724mln), $1.0900-05(E1.1bln), $1.0914-30(E1.5bln)

- GBP/USD: $1.2803(Gbp703mln)

- USD/CAD: C$1.3470($509mln), C$1.3500($850mln)

- USD/CNY: Cny7.1870($826mln)

Late Equities Roundup: IT Underperforming, Waiting on NVDA Earnings

- Stocks remain weaker after extending lows following the release of January FOMC minutes -- where policymakers expressed more concern with cutting rates too soon than too late. Currently, the DJIA is down 143.3 points (-0.37%) at 38419.75, S&P E-Minis down 23.25 points (-0.47%) at 4968.25, Nasdaq down 155.3 points (-1%) at 15474.75.

- Laggers: Information Technology and Communication Services sectors underperformed in the second half, semiconductor makers weighing on the former for the second day running: Nvidia -3.78% ahead of earnings expected after the close, Intel -3.14% First Solar -2.62%. Meanwhile, media and entertainment shares weighed on the Communication Services sector: Charter Communications -2.38%, Warner Brothers -2.33%, Disney -1.97%.

- Leading gainers: Energy and Utilities sectors continued to outperform, oil and gas shares buoyed the former: EQT Corp surged +11.18% (apparently as gas producers look to defer production), Coterra Energy +6.01%, ConocoPhillips +2.90%. Multi energy providers supported the Utilities sector: Exelon +3.94, Ameren Corp +2%, Dominion Energy +1.79%.

- Looking ahead: Corporate earnings after the close: Nvidia, Synopsys, Etsy, APA Corp, Rivian Automotive, Ansys Inc, Lucid, Marathon Oil.

E-MINI S&P TECHS: (H4) BULLISH TREND STRUCTURE

- RES 4: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 5110.50 2.00 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5100.00 Round number resistance

- RES 1: 5066.50 High Feb 12 and the bull trigger

- PRICE: 4966.0 @ 1500 ET Feb 21

- SUP 1: 4957.27 20-day EMA

- SUP 2: 4866.000/4845.11 Low Jan 31 / 50-day EMA

- SUP 3: 4702.00 Low Jan 5

- SUP 4: 4594.00 Low Nov 30

The trend condition in S&P E-Minis is unchanged and remains bullish. The pullback from Monday’s 5066.50 high is considered corrective and support to watch lies at 4957.27, the 20-day EMA. A clear break of this average would suggest potential for a deeper retracement, possibly towards the 4866.00 key support, the Jan 31 low. The trigger for a resumption of gains is 5066.50, the Feb 12 high

COMMODITIES WTI Futures Rise 1% As Market Continues To Weigh Middle-East Tensions

- WTI has climbed to new intraday highs, continuing the steady rise since European afternoon trading. The market is weighing Middle East tensions and supply risks against concerns that the US rate cut outlook could be slower than previously anticipated. WTI APR 24 is up 1.1% at 77.89$/bbl.

- Gains off the Feb 5 low still appear corrective at these levels. Key short-term resistance has been defined at $78.52, the Feb 16 high. Clearance of this level would be a bullish development.

- Natural gas jumped on the day to its highest closing level since Feb. 12, driven by news of planned output cuts from producers in 2024. US Natgas MAR 24 is up 12.5% at 1.77$/mmbtu. Producers such as Chesapeak, Antero, and Comstock, are set to scale back their natural gas drilling operations.

- A subdued session for the US dollar has translated into a very marginal adjustment for spot gold, which hovers mid-range around $2026/oz. Technically significant levels on the topside remain much further out. The yellow metal needs to clear resistance at $2065.5, the Feb 1 high, to reinstate a bullish theme.

- Copper futures rose 0.32%, extending the run of consecutive daily advances to four. Price action also sees the recovery from the February lows extend to 5.68%.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/02/2024 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 22/02/2024 | 0630/0630 |  | UK | BOE's Greene, Kroll South Africa breakfast | |

| 22/02/2024 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 22/02/2024 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 22/02/2024 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 22/02/2024 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 22/02/2024 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 22/02/2024 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 22/02/2024 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 22/02/2024 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 22/02/2024 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 22/02/2024 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 22/02/2024 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 22/02/2024 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 22/02/2024 | 1000/1100 | *** |  | EU | HICP (f) |

| 22/02/2024 | 1100/0600 | *** |  | TR | Turkey Benchmark Rate |

| 22/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 22/02/2024 | 1330/0830 | ** |  | CA | Retail Trade |

| 22/02/2024 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/02/2024 | 1445/0945 | *** |  | US | S&P Global Services Index (flash) |

| 22/02/2024 | 1500/1000 | *** |  | US | NAR existing home sales |

| 22/02/2024 | 1500/1000 | * |  | US | Services Revenues |

| 22/02/2024 | 1500/1000 |  | US | Fed Vice Chair Philip Jefferson | |

| 22/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 22/02/2024 | 1600/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/02/2024 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 22/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 22/02/2024 | 2015/1515 |  | US | Philly Fed's Pat Harker | |

| 22/02/2024 | 2200/1700 |  | US | Minneapolis Fed's Neel Kashkari | |

| 22/02/2024 | 2200/1700 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.