-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

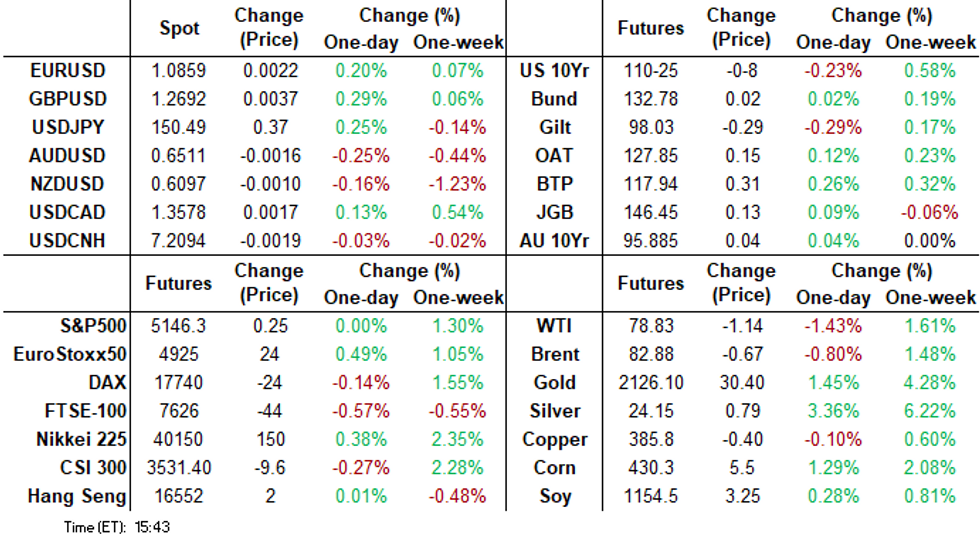

Free AccessMNI ASIA MARKETS ANALYSIS: FI Retreats Ahead Powell Testimony

- Weaker Treasuries, hold to a narrow range by the close, curves bear flatten.

- Atlanta Fed President Bostic's base case remains for two rate cuts this year

- Cautious trade ahead Fed Chairman Powell's policy testimony to Congress Wed-Thu, Jobs report Friday

US TSYS Weaker/Narrow Range Ahead Powell Policy Testimony, Employ Data

- Treasury futures holding weaker after the bell, narrow range since midmorning. No obvious headline driver as Treasury futures scaled back a portion of Friday's rally amid cautious trade ahead Fed Chairman Powell's policy testimony to Congress Wed-Thu, Jobs report Friday.

- Atlanta Federal Reserve President Raphael Bostic said his base case remains for two rate cuts this year, likely starting in the third quarter, and does not anticipate reductions at back-to-back meetings, adding he would like quantitative tightening to continue at the current pace for as long as possible.

- No data Monday, ongoing corporate bond issuance (over $21B) generated some pressure via rate-lock hedging.

- Tsy Jun'24 10Y futures mark 110-21 low (-12) are currently at 110-24.5 on the screen. 10Y yield 4.2327 high. Curves flatter flatter 2s10s -3.950 at -39.102. Initial technical support at 110-05+/109-25+ (Low Mar 1 / Low Feb 23).

- Look ahead: Tuesday data calendar includes S&P Final PMIs, ISM Services, Factory Orders.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00136 to 5.32126 (-0.00151 total last wk)

- 3M -0.00736 to 5.32376 (+0.00055 total last wk)

- 6M -0.02184 to 5.24547 (-0.00620 total last wk)

- 12M -0.04115 to 5.01539 (-0.01589 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.783T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $684B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $671B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $84B

- Daily Overnight Bank Funding Rate: 5.31% (-0.01), volume: $270B

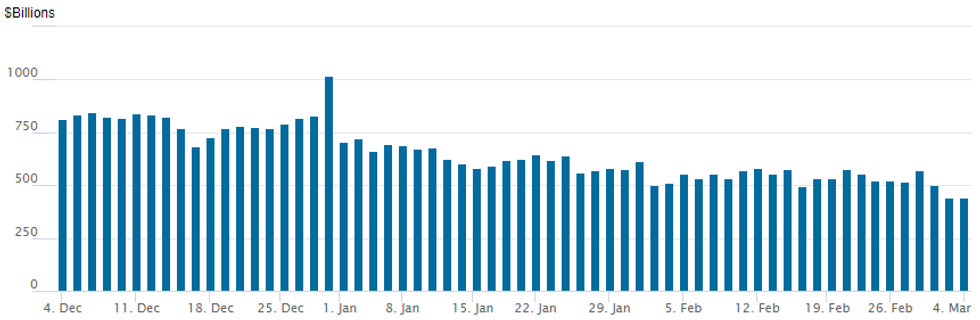

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage falls to new lowest level since May 2021: $439.793B vs. $441.265B Friday. Compares to prior low of $493.065B on February 15 -- was the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties inches back up to 75 from 73 Friday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury option trade remained mixed Monday as call buyers looking to hedge the first rate cut at the June FOMC resumed after better put buying in early trade. Overall volumes relatively modest as traders appear cautious in committing capital ahead this week's data (NFP Friday) and Fed Chairman Powell's semi-annual policy testimony to Congress on Wed-Thu.

- Projected rate cut pricing have receded from late Friday levels: March 2024 chance of 25bp rate cut currently -2.3% w/ cumulative of -0.6bp at 5.323%; May 2024 at -18.6% vs. -24.8% late Friday w/ cumulative -5.2bp at 5.276%; June 2024 -57.4% from -67.9% late Friday w/ cumulative cut -19.6bp at 5.133%. July'24 cumulative -33.3bp at 4.993%. Salient SOFR and Treasury option trades include:

- SOFR Options:

- Front Dec put vs. Red Dec'25 put sprd package: 2.5 net/front Dec 2.5 over

- Block, total 26,000 SFRZ4 94.75 puts vs. 95.52/0.16% vs.

- Block, total 26,000 SFRZ5 94.00/94.75 put spds, 9.0 vs. 96.325/0.08%

- +20,000 SFRM4 94.81/94.87/94.93/95.00 call condors, 1.25 ref 94.90

- -20,000 SRZ4 95.00/95.50/96.00 put flys 11.5 ref 95.51

- Block, total +10,000 SFRM4 94.81/94.93 put spds vs. SFRU4 94.87/95.00 put spds, 1.5 net/Jun over

- +4,000 SRM4 96.00 calls vs. 94.12/94.62 put spds, 0.25 net vs 94.92/0.19/%

- -3,000 SRU4 94.25/94.62 put spds 3.0 ref 95.23

- +8,000 SRM4 94.81/94.93/95.00 1x3x2 call flys 2.0 ref 94.92

- Block, 5,000 SFRM4 95.00/95.25/95.50/95.75 call condors, 4.0 ref 94.935

- 2,000 SFRZ4 94.56/94.68/94.81 put flys, ref 95.575

- Block, +2,500 SFRM4 95.75/96.37 call spds 1.25 ref 94.96

- +8,000 SFRM4 94.75/94.87 put spds vs. 95.12/95.37 call spds ref 94.94, 1.75 net/put spd over

- Block, +3,000 SFRM5 96.37/97.37 call spds, 26.5 ref 96.13

- 2,000 SFRM4 95.75/96.37 call spds ref 94.945

- Block, 2,500 SFRU4 95.75 calls, 14.5 ref 95.265

- 2,000 2QH4 96.12/96.37 put spds vs. 96.62 calls, ref 96.42

- +4,000 0QH4 95.56/95.62 put spds, 1.5 ref 95.865

- 2,000 SFRU4 94.87/95.12/95.73 broken call flys ref 95.25

- Treasury Options:

- over 6,400 FVM'24 110.5/111.25/112/112.75 call condors

- 40,000 wk2/wk3 10Y 108.5/110 put spd spds - rolling out one week for 9 net db

- 5,000 TYJ4 111/112 1x2 call spds, 4 net ref 110-23.5

- 3,000 TYK4 116 calls, 6 ref 110-29

- Block, 2,100 TYJ4 109.5/110.5 put spds vs. 112 calls, 0.0 ref 110-29.5

FOREX Cross/JPY Strengthening Towards Cycle Highs Amid Higher US Yields

- Pressure on US treasury futures has been weighing on the Japanese Yen to start the week, with markets turning their focus to a speech by Fed Chair Powell this week. USDJPY has risen 0.27% as we approach the APAC crossover, crossing back above 150.52, with the year’s highs just 40 pips away at 150.89.

- Moderate outperformance for sterling sees GBPJPY (+0.59%) edging closer to last week’s highs of 191.32, also representing the highest level for the cross since 2015.

- NZDJPY underwent a corrective pullback last week, shedding ~2% off the cycle high of 93.45 and pushing the RSI well back below the overbought technical condition. Nonetheless, the trend condition remains positive, and positioning dynamics point to continued gains in the cross.

- CFTC reports since the turn of the year show continued evidence of the NZD net position improving (coinciding with building expectations that the RBNZ policy cycle may not be at its peak), while the JPY position deteriorates.

- Elsewhere, the Swiss Franc reversed some very moderate strength in the aftermath of above-estimate CPI data. The brief EURCHF dip to 0.9572 proved short-lived, with some single currency strength assisting the reversal back above the 0.96 handle.

- Data overnight includes Tokyo CPI and China’s Caixin Services PMI. Focus then turns to US ISM Services PMI. Later in the week, centra bank decisions from Canada and the ECB are highlights, as well as the US employment report.

FX Expiries for Mar05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0760-70(E1.4bln), $1.0840-50(E2.2bln), $1.0860-65(E843mln), $1.0895(E1.1bln)

- USD/JPY: Y149.00-10($1.0bln), Y149.50($1.0bln), Y150.20-40($1.6bln), Y151.50($751mln)

- EUR/JPY: Y163.50(E1.2bln)

- AUD/USD: $0.6485-05(A$3.2bln)

- NZD/USD: $0.6050-65(N$891mln), $0.6170-80(N$1.5bln)

- USD/CAD: C$1.3530-50($1.5bln)

Late Equity Roundup: Paring Losses, Cheap Stocks, Utilities Leading

- Strength in Utility and Information Technology sector shares helped indexes pare losses in late Monday trade. Currently, DJIA is trading down 13.21 points (-0.03%) at 39075.82. S&P E-Minis up 7.75 points (0.15%) at 5154, Nasdaq up 2.2 points (0%) at 16278.24.

- Leading Gainers: Independent power and multi-source energy provides buoyed Utility sector shares in the second half: Dominion Energy +3.55%, Constellation Energy +3.0%, AES Corp +2.91%. Continued AI demand for high end semiconductors supported IT: Nvidia +6.25%, Intel +5.65%. Advanced Micro Devices +2.84%.

- Laggers: Communication Services and Consumer Discretionary sectors underperformed in late trade, interactive media and entertainment shares weighing on the former: Paramount Global -6.62%, Warner Brothers -6.17%, Charter Communications -4.8%. Meanwhile, automakers weighed on the Discretionary sector in late trade, particularly Tesla -7.74% after sales slump in China, while parts maker Aptiv -1.23%.

- The earnings cycle has largely run it's course, but there are a few notable names to still announce: Target early Tuesday, Crowdstrike Holdings late Tuesday, Foot Locker Abercrombie & Fitch, Kroger and Burlington Stores Early Wednesday.

E-MINI S&P TECHS: (H4) Northbound

- RES 4: 5193.61 3.0% Bollinger Band

- RES 3: 5172.19 2.0% 10-dma envelope

- RES 2: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 5157.75 High Mar 4

- PRICE: 5152.25 @ 1530ET Mar 4

- SUP 1: 5036.11 20-day EMA

- SUP 2: 4936.50 Low Feb 13

- SUP 3: 4921.09/4866.000 50-day EMA / Low Jan 31 and key support

- SUP 4: 4808.50 Low Jan 19

The trend condition in S&P E-Minis remains bullish and the contract traded higher last week. Price action also continues to highlight the fact that corrections remain shallow - a bullish signal. Support to watch is 5036.11, the 20-day EMA. A clear break of this average would signal potential for a deeper retracement towards 4936.50, the Feb 13 low. For bulls, sights are on 5170.86, a Fibonacci projection.

COMMODITIES Gold Surges Further In Shift Towards All-Time High, WTI Slips On Higher Supply

- Crude has fallen throughout US hours but remains within Friday’s range. High non-OPEC supplies and the difficulty for OPEC+ to adhere to its pledges is likely providing some downside after the group’s output cut extension. Warmer weather is also softening oil heating demand.

- UKMTO has received a report of an incident 91nm southeast of Aden, Yemen. A spokesperson for the Houthis said that they targeted the container ship MSC Sky II.

- Several OPEC+ countries have announced to extend the additional voluntary output cuts of 2.2mbpd from the end of March to the end of June, according to an OPEC press release.

- WTI is -1.5% at $78.76. Support is seen at $76.06 (50-day EMA) after which lies $71.49 (Feb 5 low).

- Brent is -0.9% at $82.81. Support is seen at $80.52 (50-day EMA) which which lies a key short-term $76.41 (Feb 5 low).

- Gold is +1.6% at $2116.18, continuing to surge higher after punching through the latest resistance at the round $2100. The all-time high is $2135.4 (Dec 4 high).

- Bloomberg quote TD on the yellow metal: “We still think it could go higher as well,” said Ryan McKay, senior commodity strategist at TD Securities. That’s because some discretionary macro traders are underinvested in the metal “relative to historical norms heading into a Fed cutting cycle.”

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/03/2024 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 05/03/2024 | 0030/1130 |  | AU | Balance of Payments: Current Account | |

| 05/03/2024 | 0100/0900 |  | CN | National People's Congress opens | |

| 05/03/2024 | 0745/0845 | * |  | FR | Industrial Production |

| 05/03/2024 | 0900/1000 | *** |  | IT | GDP (f) |

| 05/03/2024 | 1000/1100 | ** |  | EU | PPI |

| 05/03/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/03/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/03/2024 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/03/2024 | 1500/1000 | ** |  | US | Factory New Orders |

| 05/03/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 05/03/2024 | 1700/1200 |  | US | Fed Governor Michael Barr | |

| 05/03/2024 | 2030/1530 |  | US | Fed Governor Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.