-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - GBP Off a Cent as Brexit Can Kicked

HIGHLIGHTS:

- GBP/USD slips a cent as sources see EU/UK missing Nov 15 deadline

- Periphery spreads narrow as Lagarde suggests TLTROs and PEPP will be part of Dec policy package

- US equities post minor gains amid holiday-thinned volumes

US TSYS SUMMARY: Dec TYs Bounce Off Lows

Treasury futures struggled to find direction for most of Wednesday's session, with no data/speakers/supply, and volumes depressed due to the cash Tsy market's closure (Veterans Day holiday).

- As of noon ET, we'd seen a very light ~430k TYZ0 traded, only about ~150k of which was after 0700ET (we saw a bump in volumes in the Asia-Pac session as Tsys broke to new lows).

- After bouncing off support at 137-08, we saw front TYs move to session highs, with the USD doing likewise, in apparent contradiction to a fairly steady uptick in equities.

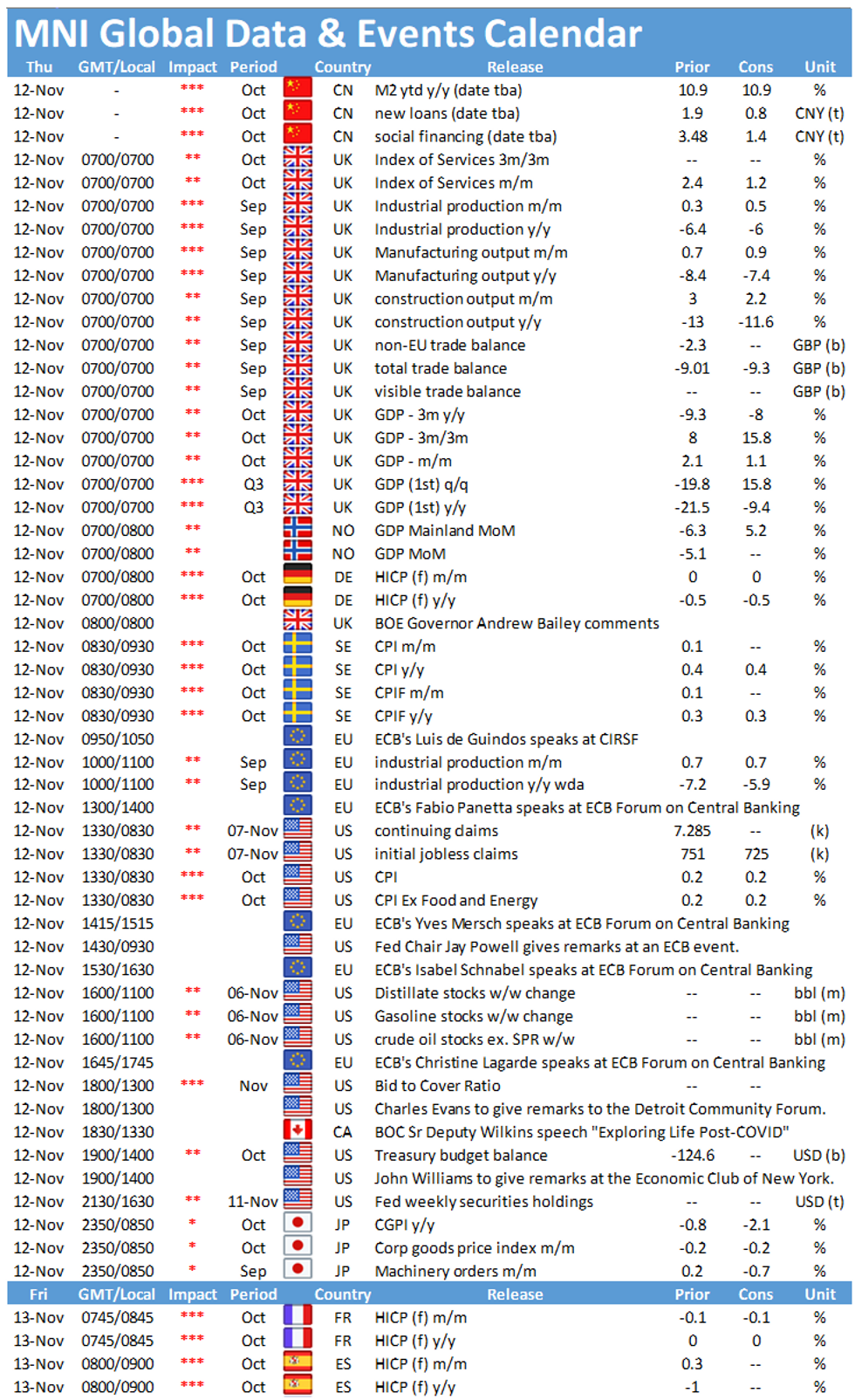

- Thursday sees a much busier schedule, with October inflation and weekly jobless claims data, Fed's Powell speaking at an ECB Forum, and 30-Yr Bond auction.

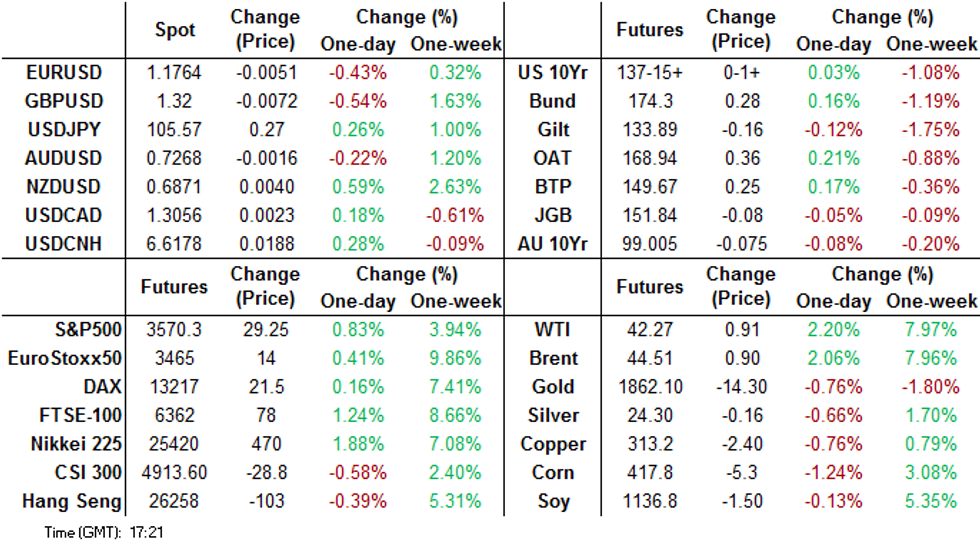

Futures levels:

- Dec 2-Yr futures (TU) down 0.375/32 at 110-10.75 (L: 110-10.625 / H: 110-11.25)

- Dec 5-Yr futures (FV) down 0.25/32 at 125-6.5 (L: 125-04.75 / H: 125-09)

- Dec 10-Yr futures (TY) up 1.5/32 at 137-15.5 (L: 137-08 / H: 137-18.5)

- Dec 30-Yr futures (US) up 9/32 at 170-9 (L: 169-16 / H: 170-13)

- Dec Ultra futures (WN) up 19/32 at 211-1 (L: 209-18 / H: 211-10)

EGBs-GILTS CASH CLOSE: Lagarde Fuels Periphery Spread Compression

Gilt and Bund yields rose sharply on the open, before falling for most of the session, then edging higher in the afternoon into the close. The UK curve steepened (w an eye on heavy long-end supply Thursday perhaps), while Germany's flattened.

- Periphery spreads narrowed sharply as ECB Pres Lagarde began introductory remarks at the Sintra conference, cued by her insistence that PEPP was effective and remained one of the ECB's main tools.

- UK linker and German Bund auctions came and went without much fanfare; no data of note.

- The Sintra conference continues tomorrow (names like Lagarde and Bailey), with prelim UK Q3 GDP leading off the data docket first thing. Italy, Ireland and the UK hold auctions.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 0.4bps at -0.715%, 5-Yr is down 1.2bps at -0.71%, 10-Yr is down 2.2bps at -0.507%, and 30-Yr is down 2.8bps at -0.073%.

- UK: The 2-Yr yield is down 0.5bps at 0.001%, 5-Yr is up 1.4bps at 0.059%, 10-Yr is up 1.2bps at 0.413%, and 30-Yr is up 2.3bps at 1.015%.

- Italian BTP spread down 0.2bps at 124.5bps

- Spanish bond spread down 0.7bps at 66.4bps

FI OPTIONS SUMMARY: Large Sterling Downside

Today's options flow included:

- RXZ0 174.5 call, sold at 23, 21, and 20 in 3k

- RXZ0 176/175/174p fly, sold at 30 in 1.6k

- RXF1 178.5/179cs, sold at 8.5 in 2k

- RXF1 179/181cs 1x2, bought for 10 in 1k

- 3RM1 100.37/100.25/100.125 p ladder, sold at 0.75 in 2k

- LZ0 99.875/100 cs sold at 7.5 in 5k

- LH1 100 calls, sold at 2.75 in 3.75k (ref 99.97, 40 del)

- LM1 100.125/100.25cs, bought for 1.75 in 5k

- LU1 99.875/99.625 put spread sold at 2.5 in 16.5k

- 0LF1 100/100.12cs, bought for 1 in 1k

- 0LH1 100.12/100.00/99.87p fly 1x3x2, bought for -1 in 17.5

BTPS: Futura Orders Total €1bn On Day 3

Just under E1.000bn of retail orders for the Nov-28 BTP Futura, on the third day of sales -per Borsa Italiana data.

This brings the 3-day cumulative total to around E4.913bn.

FOREX: GBP/USD a Cent Off the Highs as Brexit Can Kicked

Trade in equities and currencies across US hours was muted, with US partially closed for Veterans Day (notably, fixed income markets are out until Thursday). US stock markets inched higher amid light newsflow, with the themes remaining the same.

GBP was one of the poorest performers - after making steady progress above the 1.33 handle, price action swiftly reversed as Reuters cited sources in saying UK/EU negotiators would miss their self-imposed Nov15 free trade deal deadline.

ECB's Lagarde formally kicked off the ECB central banking forum, stressing that the ECB's PEPP and TLTROs will remain the key tools going forward - suggesting that December's 'recalibration' of policy will include the two tools. The comments helped keep European spreads under pressure, thereby supporting the EUR.

Focus Thursday turns to UK GDP, Eurozone industrial production and US CPI & weekly jobless claims. Central bank speakers include BoE's Bailey, ECB's Lagarde & Fed's Powell.

FX OPTIONS: Less Dovish RBNZ Buoys Demand for NZD Calls

Despite the partial closes across the US, currency options market activity is still holding up well, albeit slightly below average for this time of day. The activity's been underpinned by USD/CNY, NZD/USD and EUR/GBP options, all of which are seeing volumes well above average.

- The less-dovish-than-expected RBNZ rate decision overnight has clearly driven the interest in upside protection today, with over $3 in calls trading for every $1 in puts so far. 0.6780, 0.6950 and 0.7050 call strikes have drawn the most interest, with markets clearly cognizant of the risks of new multi-year highs in NZD/USD.

- EUR/GBP options volumes picked up following earlier Brexit headlines. Sizeable interest in 0.89 calls followed the report, with expiries capturing the rolling-off of various Brexit deadlines (namely Nov 17th and Dec 1st). Volatility hedges also a source of interest, with trades consistent with a one-week 0.8825/0.8875 strangle crossing mid-London hours.

Expiries for Nov12 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1765(E587mln), $1.1795-05(E1.3bln), $1.1825-30(E744mln)

USD/JPY: Y103.00($1.9bln-USD puts), Y105.40-50($1.5bln), Y106.20($610mln)

EUR/GBP: Gbp0.8900-10(E539mln)

EUR/AUD: A$1.6520(E973mln)

USD/CNY: Cny6.64($900mln)

COMMODITIES: Crude Oil Hitting Best Levels Since Early September

Both WTI and Brent crude oil futures hit their best levels since early September early Wednesday, rising in spite of a moderately stronger greenback and the increased supply coming on from Libya. Countering these bearish elements are last night's API inventory numbers, which showed a considerably larger draw on reserves than expected.

Reports this morning see Libyan supply at the highest levels since January, with the back-online Sharara and Waha fields contributing to output of over 1.1mln bpd.

Libyan output running at over 1mln bpd will add pressure to OPEC+ members, who continue to float the idea of an extension to their output cut pledge in an effort to sustain crude prices.

MNI Tech flags $43.84, the Sep 2 high, with the key bull trigger resting above at $44.33, the Aug 26 high.

EQUITIES: US Stocks on Gentle Incline Amid Lower Volumes

Cash markets in the US are a touch higher, with the S&P 500 posting gains of just under 1%. NASDAQ modestly outperforms as the index bounces after underperforming following Pfizer's vaccine headlines Monday. Volumes are lower than average Wednesday, with the partial closures for Veterans Day keeping activity muted.

Tech sector outperforms, bouncing after underperforming earlier in the week. Consumer discretionary and staples aren't far behind. Worst performers Wednesday included pro-cyclical materials and energy.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.